Stocks crashing after your entry?

Try these 5 conformation rules for trading entries.

A Thread🧵

A like and a retweet would help :)

#trading #TRADINGTIPS #tradingstrategy #StockMarket #stocks #TradingSignals #stockmarkets

@kuttrapali26 @Curious_Indian_ @JayneshKasliwal

Try these 5 conformation rules for trading entries.

A Thread🧵

A like and a retweet would help :)

#trading #TRADINGTIPS #tradingstrategy #StockMarket #stocks #TradingSignals #stockmarkets

@kuttrapali26 @Curious_Indian_ @JayneshKasliwal

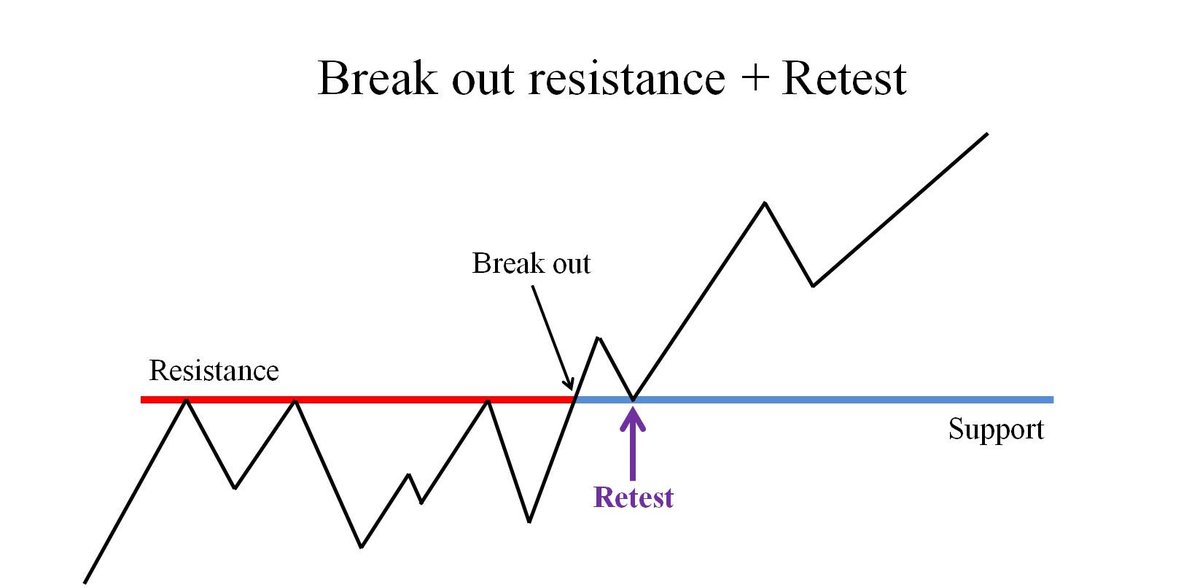

1) Retest

Whenever a stock trails back to the resistance after a breakout and bounces off treating it as a support towards the target then it is known as retest. retest might not happen all the time but when it does moves are strong. A full thread on retest is pinned on my feed.

Whenever a stock trails back to the resistance after a breakout and bounces off treating it as a support towards the target then it is known as retest. retest might not happen all the time but when it does moves are strong. A full thread on retest is pinned on my feed.

2) Volumes

A spike in volumes on a Breakout in your direction of trade is considered one of the best things for your trade. But if volumes are below average volumes, then you need to be careful as very few Breakout trades succeed with volumes lower than average volumes

A spike in volumes on a Breakout in your direction of trade is considered one of the best things for your trade. But if volumes are below average volumes, then you need to be careful as very few Breakout trades succeed with volumes lower than average volumes

3) Look for Support and Resistance levels

There is a very high probability that stock might reverse from a support or a resistance level. So before entering in a trade look if there is no major support or resistance in the midway. If using strategy avoid stocks on these levels.

There is a very high probability that stock might reverse from a support or a resistance level. So before entering in a trade look if there is no major support or resistance in the midway. If using strategy avoid stocks on these levels.

4) Ema crossover

Although Exponential moving average is a lagging indicator but if we use price action with it, they can be the best combos for entries. you can use 50 and 200 EMA's for detecting a strong trend.

Although Exponential moving average is a lagging indicator but if we use price action with it, they can be the best combos for entries. you can use 50 and 200 EMA's for detecting a strong trend.

5) Strong Candle

Breakout candle should be strong and with a small wick. If Breakout candle gives breakout but traces back forming a big wick, then that is a big red flag for your trade. Look at below examples for strong and weak candle.

Breakout candle should be strong and with a small wick. If Breakout candle gives breakout but traces back forming a big wick, then that is a big red flag for your trade. Look at below examples for strong and weak candle.

So here were some rules which can help you improve your trading. Please like, retweet and follow for more of such good content. Do comment at what topic do you want me to make another thread.

• • •

Missing some Tweet in this thread? You can try to

force a refresh