I have no sympathies for #Scammers who were duping people with lakhs and crores of screenshots.

At first, I along with friends of mine were in awe of how they were generating this much return. For almost, 2 years I worked a lot and tried to break the code.

Do read and retweet.

At first, I along with friends of mine were in awe of how they were generating this much return. For almost, 2 years I worked a lot and tried to break the code.

Do read and retweet.

A lot of ideas were worked upon on Amibroker may it be ITM Selling of Option, Option Doublers in 2 - 3 days, Intraday Option Buying, Future Holygrail and what not. In the process we were able to make Option Chain on Amibroker, calculate option greeks on Amibroker and what not.

But no definite system was built.

If we cracked up Option Buying or burst moves, it was difficult to ascertain position-sizing. For eg. position sizing average size, doesn't make the profit so lucrative. And if the position-size is big, loss could be 70% in 3 trades.

If we cracked up Option Buying or burst moves, it was difficult to ascertain position-sizing. For eg. position sizing average size, doesn't make the profit so lucrative. And if the position-size is big, loss could be 70% in 3 trades.

If we cracked up Future trading, there was no way around the phase when losses will accumulate. Not to mention, higher the profits, higher the capital should be.

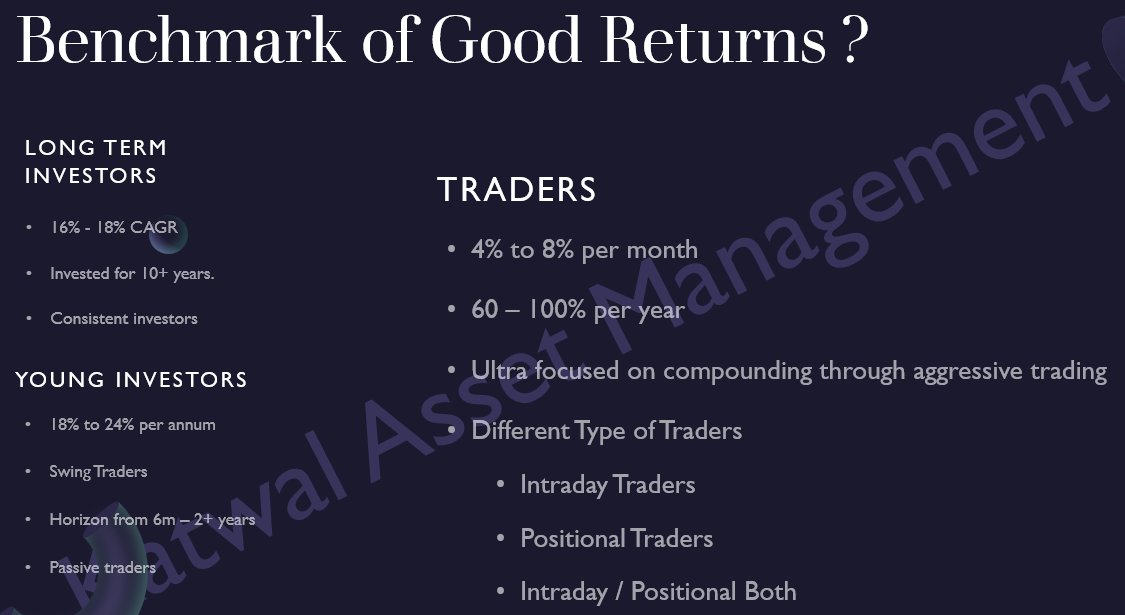

Then we thought whether it is at all possible to explore this much return with Indicators or system ....

Then we thought whether it is at all possible to explore this much return with Indicators or system ....

...or discretionary trading was answer. But then discretionary trading has its own limits. You are on a winning streak with small capital and suddenly the market structure will change and force you to lose out a big chunk of what you profited.

Back to square 1...

Back to square 1...

One needs a military discipline while trading discretionary and not to say that a rock solid psychology which doesn't come when you are trading for a living. One wrong gut move and all your trading chips can be gone. You will be out from the markets.

Need strong family backing

Need strong family backing

or trading fund which doesn't threaten your bread and butter can only give you that kind of balls. Like a different primary business. That's why I said, its very easy to talk about risk management, following your system when primary bread and butter is not dependent on trading...

...like a hotel, rented properties, service channels bringing in ₹₹₹₹

But these scamsters were always profitable. Like 80, 100, 120 lakh with down days to remain modest as 3-4 lakh. Then they had time for live trading, youtube live, seminars, Dubai and what not...

But these scamsters were always profitable. Like 80, 100, 120 lakh with down days to remain modest as 3-4 lakh. Then they had time for live trading, youtube live, seminars, Dubai and what not...

So, with common sense we knew what was possible and what was not. We did not give up our search for perfect systems.

But all this #Fake Screenshot does have an impact on our psycyhe. After being in market for 13 years, what is it that we are doing wrong. And it was depressing.

But all this #Fake Screenshot does have an impact on our psycyhe. After being in market for 13 years, what is it that we are doing wrong. And it was depressing.

Without big m2m's the growth on twitter was slow. People wanted to see the big shot m2m's. But one thing was clear not to get into anything fake. I was asked to nudge followers to put appreciations which I refused like many do by threatening to stop channels and I refused...

.... one thing is very simple, if we do something fake to gather followers, we are snowballing a ton of shit bag that will eventually burst on our head and will ruin all the reputation that have built over time. So we kept going. Not worrying about followers experimenting.

Truly, this whole fake screenshot m2m and finfluencers now crying for being fake is just KARMA they accrued in the form of Big Shit Bag now dropping over their own head. And whats bad, they haven't lost their followers. I mean it will drop from 500k to 480k or 160k to 140k but...

...after a pause of 6 month it will be again 600k or 200k. People will again get fooled and scam will go on. India has 140 crore population and even today its not 0.01% of population affected by the scam.

Only solution is to use your own common sense when following some one.

Only solution is to use your own common sense when following some one.

And question how they were earning so much profit?

1. Capital was too big.

2. Capital was never there else no body cares for a workshop or retailers.

3. Screenshot were fake.

4. If they were original, there have to be negative days which were hidden,

Its that simple.

1. Capital was too big.

2. Capital was never there else no body cares for a workshop or retailers.

3. Screenshot were fake.

4. If they were original, there have to be negative days which were hidden,

Its that simple.

• • •

Missing some Tweet in this thread? You can try to

force a refresh