1/ This November was the toughest for crypto fundraising in two years.

Total financing dropped by 84% year-over-year: $850M vs. $5.25B in Nov 2019.

A thread on crypto fundraising 🧵

Total financing dropped by 84% year-over-year: $850M vs. $5.25B in Nov 2019.

A thread on crypto fundraising 🧵

2/ First of all,

@WuBlockchain reported that there were 65 public raises in November, down 55% compared to the same period last year.

Web3 and Infrastructure fields saw the most deals with #DeFi accounting for only 11 of the deals.

@WuBlockchain reported that there were 65 public raises in November, down 55% compared to the same period last year.

Web3 and Infrastructure fields saw the most deals with #DeFi accounting for only 11 of the deals.

3/ In dollar terms, the Year-over-Year drop is even worse.

Financing dropped by 84%, from $5.25B to $840M last month.

Both the number of funds raised and the amount raised in November were the lowest in nearly two years—according to @WuBlockchain data.

Financing dropped by 84%, from $5.25B to $840M last month.

Both the number of funds raised and the amount raised in November were the lowest in nearly two years—according to @WuBlockchain data.

4/In fact, November 2021 was the all-time-high month for crypto fundraising on record.

@DefiLlama puts the dollar amount raised at $7B.

Interestingly, the amount raised in private sales coincided with the ATH price for BTC at 69K BTC.

@DefiLlama puts the dollar amount raised at $7B.

Interestingly, the amount raised in private sales coincided with the ATH price for BTC at 69K BTC.

5/ The chart below shows #BTC price vs amount raised.

It's clear that fundraising correlates with BTC.

On a side note, it’s crazy how much $EOS raised in 2018 (and how little they built).

Thanks to EOS, June 2018 is the second-best month for fundraising in crypto history.

It's clear that fundraising correlates with BTC.

On a side note, it’s crazy how much $EOS raised in 2018 (and how little they built).

Thanks to EOS, June 2018 is the second-best month for fundraising in crypto history.

6/ In total, $83.4B has been raised since 2014.

These are the top 5 notable raises due to value destruction:

• EOS - $4.2B

• FTX - $2.1B

• Terra's LFG - $1B

• Celsius - $814M

• BlockFi - $949M

Only $17.3M was raised during #ETH ICO.

(Credit to @CharlieXYZ_ for chart)

These are the top 5 notable raises due to value destruction:

• EOS - $4.2B

• FTX - $2.1B

• Terra's LFG - $1B

• Celsius - $814M

• BlockFi - $949M

Only $17.3M was raised during #ETH ICO.

(Credit to @CharlieXYZ_ for chart)

7/ Out of the total funding, 33.4% went to #CeFi companies, followed by infrastructure (27.1%) and Web3 (17.2%).

DeFi has attracted $6.49B in total since 2017, which is less than #NFT projects raised since 2018.

What's worse: 865 funding rounds for #DeFi versus 596 for NFTs.

DeFi has attracted $6.49B in total since 2017, which is less than #NFT projects raised since 2018.

What's worse: 865 funding rounds for #DeFi versus 596 for NFTs.

8/ Arranged by round type, Series B attracted the most cash ($11.5B), with FTX as the largest recipient at $900M.

Series A companies raised $10.5B, with MoonPay receiving $555M.

Surprisingly, Seed rounds came in 3rd with a total of $8.1B. Yuga Labs’ raise was worth $450M.

Series A companies raised $10.5B, with MoonPay receiving $555M.

Surprisingly, Seed rounds came in 3rd with a total of $8.1B. Yuga Labs’ raise was worth $450M.

9/ Compared to other sectors, #DeFi projects managed to raise less cash per round.

With the largest raises ever going to:

1. Lithosphere network: $400M

2. BitDAO: $230M

3. Capricorn: $200

4. Unizen: $200M

5. 1inch: $175M

and Uniswap - $165M for Series B.

With the largest raises ever going to:

1. Lithosphere network: $400M

2. BitDAO: $230M

3. Capricorn: $200

4. Unizen: $200M

5. 1inch: $175M

and Uniswap - $165M for Series B.

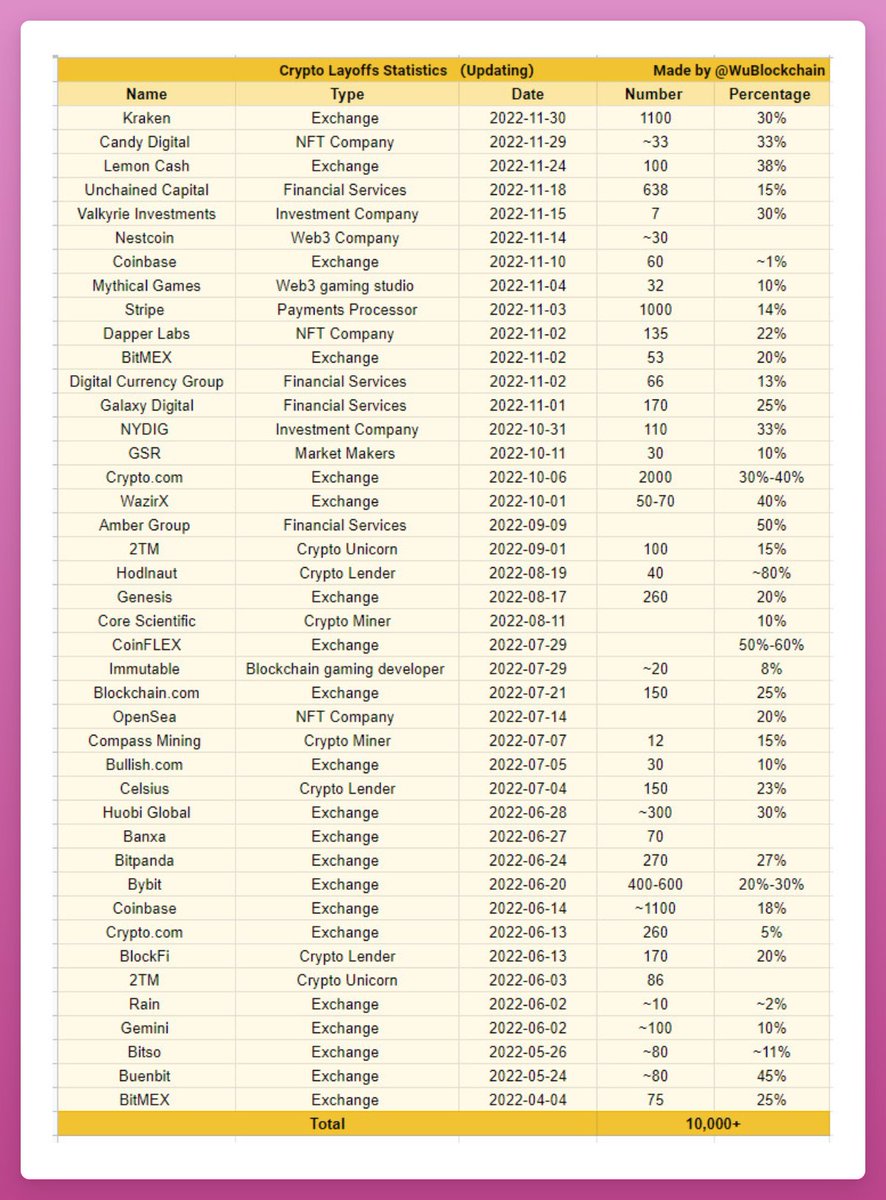

10/ The data is clear: cash is abundant during bull markets and dries up when crypto prices drop.

Now we're at the low point in terms of the number of funding rounds and amount raised.

Projects can't raise much cash, and companies are laying people off.

Now we're at the low point in terms of the number of funding rounds and amount raised.

Projects can't raise much cash, and companies are laying people off.

11/ Every month I share the most interesting early stage projects that raise money.

Early stage projects that raise during bear markets have a good chance to come out strong into the bull run.

November was tough, but you can learn about the top 3 October projects here:

Early stage projects that raise during bear markets have a good chance to come out strong into the bull run.

November was tough, but you can learn about the top 3 October projects here:

https://twitter.com/DefiIgnas/status/1588446482197147648

12/ Like/Retweet the first tweet below if you can.

Follow me @DefiIgnas for more.

Follow me @DefiIgnas for more.

https://twitter.com/DefiIgnas/status/1599671335260540928

• • •

Missing some Tweet in this thread? You can try to

force a refresh