👉🧐Contrarian indicator = hedge fund equity market exposure which is now exceptionally low ... as during 2008 Lehman, 2012 EuroZone Sovereign Debt Crisis, 2020 Covid crash & now with higher rates, recession likelihood ... Thoughts? Food for thought ?

$SPY #SPX #Stocks #Equities

$SPY #SPX #Stocks #Equities

Complementary another contrarian metric & view:

👉CEO Business Confidence Expectations for the Economy & S&P 500

Thoughts ?

$SPY #SPX #Stocks #Equities

👉CEO Business Confidence Expectations for the Economy & S&P 500

Thoughts ?

$SPY #SPX #Stocks #Equities

Another contrarian sentiment metric, Europe edition

👉economic expectations/sentiment is about 2007-2009 Lehman implosion levels and worse than 2012 EuroZone Sovereign Debt Crisis ...

👉economic expectations/sentiment is about 2007-2009 Lehman implosion levels and worse than 2012 EuroZone Sovereign Debt Crisis ...

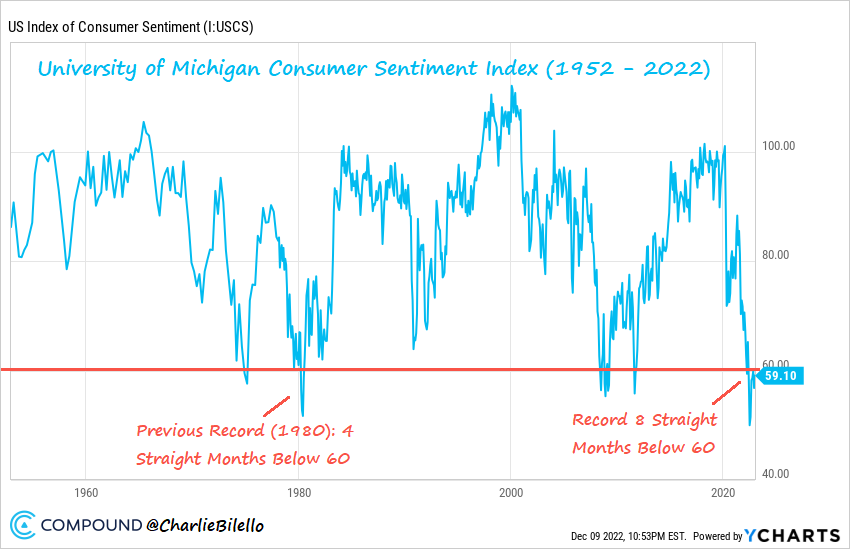

US Consumer Sentiment still very low after it even dipped below 2007-2009 Lehman GFC

👉Longest run of extreme negative sentiment since 1952 (prior record was 4 straight months during 1980 recession)

Contrarian indicator also?

$SPY #SPX #Stocks #Equities #InterestRates #FED

👉Longest run of extreme negative sentiment since 1952 (prior record was 4 straight months during 1980 recession)

Contrarian indicator also?

$SPY #SPX #Stocks #Equities #InterestRates #FED

• • •

Missing some Tweet in this thread? You can try to

force a refresh