🧵DeFi History Simplified🧵

a) Definition

b) How it was born and how it developed.

c) Its Ups and Downs from Summer ‘20 till May ‘21

d) DeFi 2.0

e) The next wave and what we’re building

A thread by @0xNurstar , our content partner here at ZD Labs!

Image: @finematics

a) Definition

b) How it was born and how it developed.

c) Its Ups and Downs from Summer ‘20 till May ‘21

d) DeFi 2.0

e) The next wave and what we’re building

A thread by @0xNurstar , our content partner here at ZD Labs!

Image: @finematics

2/ What is #DeFi - WiKipedia Definition

"Decentralized finance (often stylized as #DeFi) offers financial instruments without relying on intermediaries such as brokerages, exchanges, or banks by using smart contracts on a #blockchain ."

"Decentralized finance (often stylized as #DeFi) offers financial instruments without relying on intermediaries such as brokerages, exchanges, or banks by using smart contracts on a #blockchain ."

3/DeFi, "Debutante" of the Crypto Bull Run 20'/21'

DeFi unexpectedly played a Main Role in the last #BullMarket , especially at both Early and Final stages with DeFi Summer '20 on one hand, and the Rise/Fall of DeFi 2.0 feat. "Terra Disaster" on the other one.

DeFi unexpectedly played a Main Role in the last #BullMarket , especially at both Early and Final stages with DeFi Summer '20 on one hand, and the Rise/Fall of DeFi 2.0 feat. "Terra Disaster" on the other one.

4/DeFi Summer, when it all started.

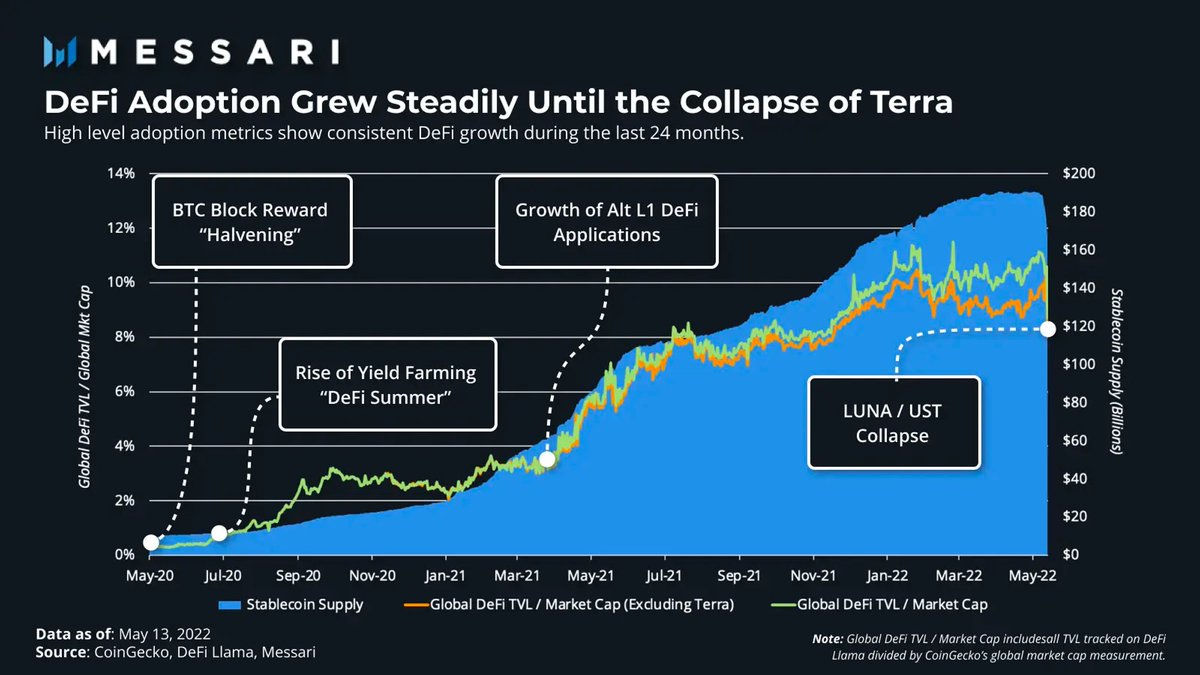

It was June ‘20, the Crypto Market was on a shy Recovery after the Covid-Driven Meltdown in March and the #Bitcoin Halving in May, when @compoundfinance started its Liquidity Reward program by giving $COMP in exchange for liquidity provisions.

It was June ‘20, the Crypto Market was on a shy Recovery after the Covid-Driven Meltdown in March and the #Bitcoin Halving in May, when @compoundfinance started its Liquidity Reward program by giving $COMP in exchange for liquidity provisions.

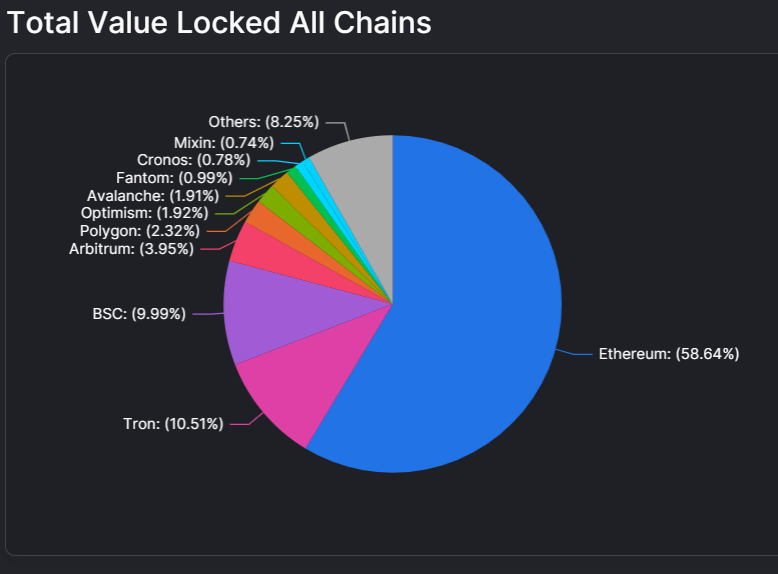

5/ “Yield Farming” was born and many other DeFi Protocols arose such as @iearnfinance . As a result, DeFi Pioneers such as @MakerDAO , @Uniswap , @AaveAave saw a big increase in their activities. DeFi on #Ethereum reached 9B TVL in Oct 20' starting with 500M in Jan.

6/ Although most DeFi-related Tokens had a slight correction during Sept ‘20, by then DeFi had officially become one of the most prominent Narratives in the Crypto Space.

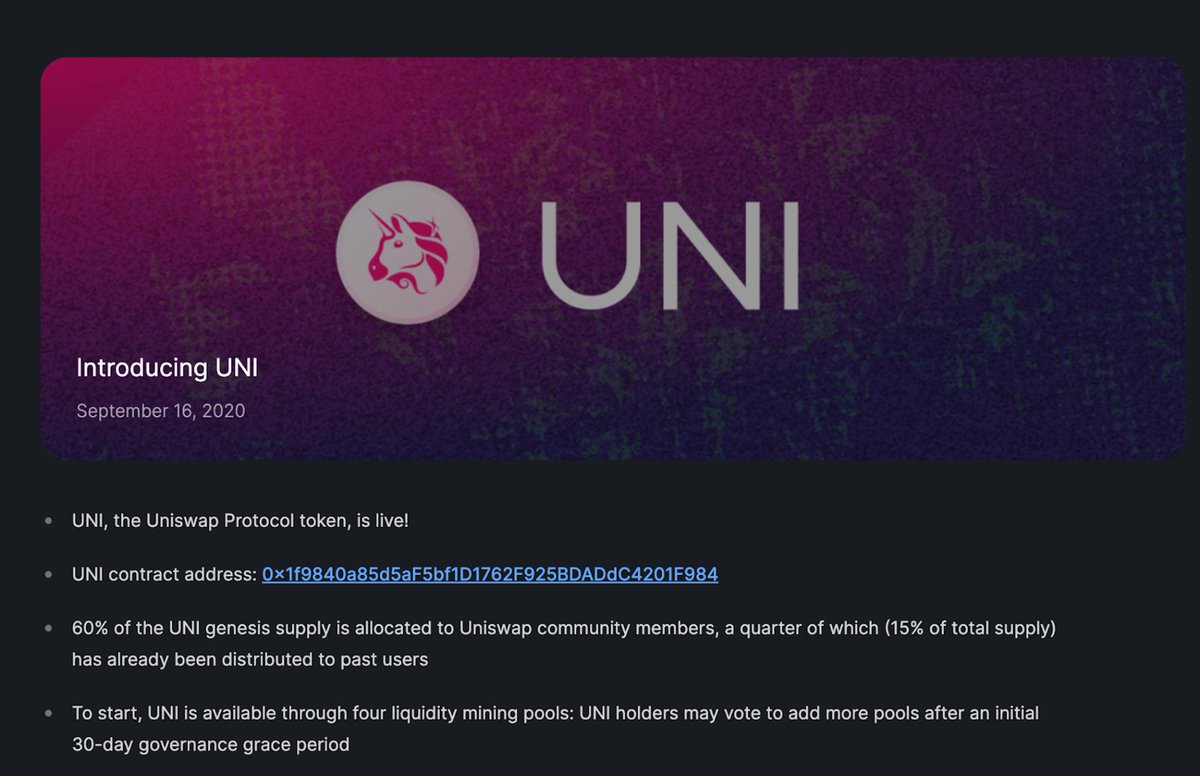

7/ On top of that, @Uniswap kicked off the “Airdrop Season” which would characterize the following 7 months together with the overall Bull Run in terms of prices and the NFT and Metaverse Hypes in terms of additional Narratives besides DeFi.

8/ During the last 20’ quarter, DeFi was a thing but so were the hacking exploits in many protocols. Some of the first big ones happened on bZx with 8M, Harvest Finance 24M and on Pickle Finance 30M.

9/ Malicious Hackers from all over the World yielded the opportunity of having such young and light-audited Smart Contracts storing Millions in value. Spring-Summer 2021 was even worse in terms of DeFi Exploits.

[cryptosec.info/defi-hacks/](https://t.co/UJsJLU2J1d)

[cryptosec.info/defi-hacks/](https://t.co/UJsJLU2J1d)

10/ In May 21’ the whole #Crypto Market had a first rough and fast correction which was mitigated by the many narratives around that seemed to hint at this one as a natural and healthy correction in a secular #BullMarket .

11/ In fact, in Mid-Summer ‘21 things resumed to go up and up again, with all the different narratives coming back stronger than ever. But this time something grew alongside DeFi, it was DeFi 2.0.

[cointelegraph.com/defi-101/defi2…](https://t.co/3dw7HZv0DF)

[cointelegraph.com/defi-101/defi2…](https://t.co/3dw7HZv0DF)

12/ DeFi 2.0 was characterized by projects such as @OlympusDAO , @MIM_Spell and @KlimaDAO that focused on “Capital Efficiency” by proposing Algorithmic Reserve Currencies where the project would buy back its own #Token .

coinmarketcap.com/alexandria/art…

coinmarketcap.com/alexandria/art…

13/ The Hype around DeFi 2.0 was so big that even the Terra Ecosystem adopted such algorithmic principles for their UST algorithmic #StableCoin .

14/ However, the whole Crypto Market peaked in Mid-November ‘21 once again due to overall “Euphoria Stage”. Things were looking too good to be true and Bears became knocking on the door once again.

15/ During the Downside Journey, some DeFi 2.0 principles turned out to be unsustainable and most of its Project Leaders got in trouble for their irresponsibility. Between Feb & May ‘22 DeFi 2.0 was completely washed out in terms of both price and reputation.

16/ In the meanwhile, at the time of writing, a Brutal #bearmarket is still in full swing and many scandals, Bankrupts and Contagions have been hitting the whole space hard, very hard. However, there’s still hope in crypto, specially through DeFi.

17/ With the birth and Vibrant Development of L2s on top of #Ethereum , DeFi seems to keep on boiling the same principles and Vibe that we all experienced during Summer ‘20. Scaling Solutions will allow us to experiment with new and better Financial Primitives.

18/ I hope you enjoyed our thread on the History of DeFi. If so, please like our page and become part of our Community.

We’re working to disrupt the DeFi Space with our Interoperable Liquidity Protocol. Stay tuned! 🌊🧬

We’re working to disrupt the DeFi Space with our Interoperable Liquidity Protocol. Stay tuned! 🌊🧬

• • •

Missing some Tweet in this thread? You can try to

force a refresh