Tokenomics For Dummies 🧠🪙

Always see/hear Tokenomics & instantly get confused?

Being able to read Tokenomics will make a HUGE difference in your #Crypto success.

Read this 3-minute thread & become a better investor today! 👇

#DeFi #NFT

Always see/hear Tokenomics & instantly get confused?

Being able to read Tokenomics will make a HUGE difference in your #Crypto success.

Read this 3-minute thread & become a better investor today! 👇

#DeFi #NFT

Tokenomics are arguably the most important part of any project.

The word is the combination of

Token

+

Economics

They define the individual economy of how any project will function. Understanding them will give you a wide understanding of how the project can/will develop.

The word is the combination of

Token

+

Economics

They define the individual economy of how any project will function. Understanding them will give you a wide understanding of how the project can/will develop.

1. The Token Price

Repeat after me... A low token price does not equal a valuable opportunity.

We, humans, tend to use our cognitive bias to low numbers = scarcity = value. But the opposite is usually true in Tokenomics.

A very low price usually equals a very high supply.

Repeat after me... A low token price does not equal a valuable opportunity.

We, humans, tend to use our cognitive bias to low numbers = scarcity = value. But the opposite is usually true in Tokenomics.

A very low price usually equals a very high supply.

2. Token Supply

9 times out of 10 a project will have two different metrics when it comes to the token supply.

Max/Fully Diluted Supply

+

Circulating supply

9 times out of 10 a project will have two different metrics when it comes to the token supply.

Max/Fully Diluted Supply

+

Circulating supply

Max Supply is pretty self-explanatory. This is the total amount of tokens that have been minted.

Circulating supply is the total amount of tokens that are currently active in use/circulation.

Tokens are held out of circulating supply for a variety of reasons...

Circulating supply is the total amount of tokens that are currently active in use/circulation.

Tokens are held out of circulating supply for a variety of reasons...

- Staking or reward tokens

- Staked tokens can be removed from the circulating supply

- Locked Team & Advisor tokens

- Vested(locked) tokens from presale & seed rounds

- Tokens to fund future development

- Potentially future malicious intent(dumping)

More on some of these below

- Staked tokens can be removed from the circulating supply

- Locked Team & Advisor tokens

- Vested(locked) tokens from presale & seed rounds

- Tokens to fund future development

- Potentially future malicious intent(dumping)

More on some of these below

3. Market Cap

The Market Cap is the current valuation of the project. This is calculated as follows.

Token price

x

Circulating supply

= Market Cap

Going back to earlier, this is why you cant base value on token price alone.

For example...

The Market Cap is the current valuation of the project. This is calculated as follows.

Token price

x

Circulating supply

= Market Cap

Going back to earlier, this is why you cant base value on token price alone.

For example...

Token Price = $100

Max Supply = 500,000

MC = $50m

In this scenario, if you judged the project solely based on its token price you could be missing an undervalued gem.

With a total supply of only 500,000 tokens, it doesn't take many tokens to be purchased to move the price.

Max Supply = 500,000

MC = $50m

In this scenario, if you judged the project solely based on its token price you could be missing an undervalued gem.

With a total supply of only 500,000 tokens, it doesn't take many tokens to be purchased to move the price.

4. Economics Policy

It's very important to understand the project's economic policy.

Things like

- Is there a max supply? Or can they keep minting new tokens?

- If so, do these tokens have solid #utility or purpose?

- Do they have token burns in place to counteract inflation?

It's very important to understand the project's economic policy.

Things like

- Is there a max supply? Or can they keep minting new tokens?

- If so, do these tokens have solid #utility or purpose?

- Do they have token burns in place to counteract inflation?

If a project can continue to mint an unlimited amount of tokens without an obvious utility for them, then proceed with caution.

A continual amount of new tokens added into the circulating supply is inflation, and this will continue to dump the price.

Burns can counter-act this.

A continual amount of new tokens added into the circulating supply is inflation, and this will continue to dump the price.

Burns can counter-act this.

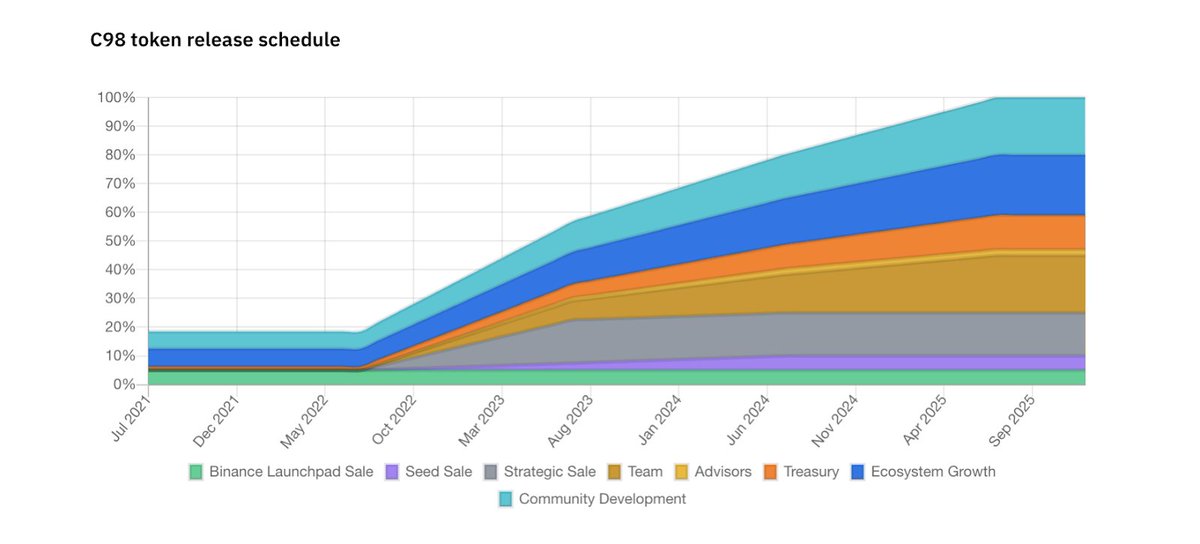

5. Token Distribution

Every project will have a Token distribution section in its White-paper. This will advise you exactly how many tokens & for which purpose.

Things to watch out for are

- Large team holdings

- More than 25% in one wallet

- Overly large rewards pool

Every project will have a Token distribution section in its White-paper. This will advise you exactly how many tokens & for which purpose.

Things to watch out for are

- Large team holdings

- More than 25% in one wallet

- Overly large rewards pool

6. Presale Rounds

Typically a project will conduct several rounds of token sales before launch.

- Seed funding

- Private sale

- Presale rounds

These rounds are all bought at different prices. Understanding this & the next tweet is very important.

Typically a project will conduct several rounds of token sales before launch.

- Seed funding

- Private sale

- Presale rounds

These rounds are all bought at different prices. Understanding this & the next tweet is very important.

7. Vesting Schedules

Vesting is a posh word for unlocking. If a token has a vesting schedule it means that not all of the tokens that were purchased will be available to sell straight away. They will unlock at different intervals.

Vesting is a posh word for unlocking. If a token has a vesting schedule it means that not all of the tokens that were purchased will be available to sell straight away. They will unlock at different intervals.

Understanding distribution and vesting are very important because you can roughly predict sell pressure.

Let's say a VC firm invested in a project in the seed round at $1 with a 24-month vesting period. After 24 months if the price is $5, they're going to sell. At least a chunk.

Let's say a VC firm invested in a project in the seed round at $1 with a 24-month vesting period. After 24 months if the price is $5, they're going to sell. At least a chunk.

8. Token Utility

The more utility a token has the less likely it is to be sold, increasing its value. Utilities to look out for are...

- Gas fees

- In-project payments

- Facilitating bandwidth

- Use in 3rd party apps

- Staking options

- Token burns

- Outside of project payments

The more utility a token has the less likely it is to be sold, increasing its value. Utilities to look out for are...

- Gas fees

- In-project payments

- Facilitating bandwidth

- Use in 3rd party apps

- Staking options

- Token burns

- Outside of project payments

And that's a wrap, guys!

I hope that provided some insight into the world of Tokenomics and how important they are in the research process of investing your money!

If you value this content, please RT the first tweet I have added below again here 👇

I hope that provided some insight into the world of Tokenomics and how important they are in the research process of investing your money!

If you value this content, please RT the first tweet I have added below again here 👇

• • •

Missing some Tweet in this thread? You can try to

force a refresh