Detailed review of West Ham's financial results for the 2021/22 season is in my Substack blog, but a few highlights to follow #WHUFC

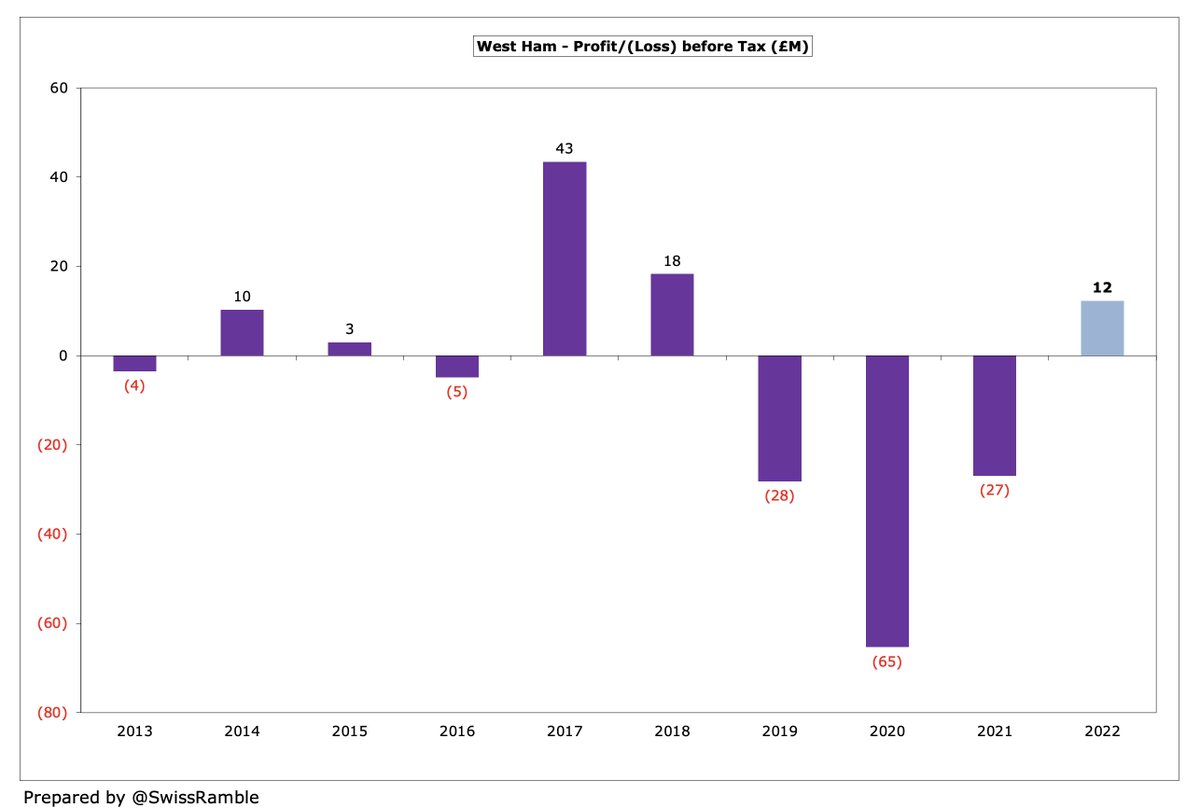

#WHUFC swung from a £27m pre-tax loss to £12m profit, a £39m improvement.

#WHUFC revenue rose £60m (31%) from £193m to a club record £253m.

Club record £41m match day revenue for #WHUFC after playing games behind closed doors the previous season.

Club record £164m broadcasting revenue for #WHUFC boosted by reaching the Europa League semi-final.

Club record £48m commercial revenue for #WHUFC

#WHUFC had the 3rd highest transfer spend in Europe last summer.

Thanks to a £125m capital injection from new investor Daniel Kretinsky, #WHUFC gross debt reduced from £109m to just £56m, as previous shareholder loans were repaid in full.

#WHUFC vice-chairman Karren Brady’s remuneration rose 68% from £1.3m to £2.2m, including a one-off £1.0m bonus “in respect of the new investment”. 4th highest in the Premier League.

Sullivan and Gold were paid £4.6m interest as part of the loan settlement. The #WHUFC owners are not paid a salary or dividend, but they have trousered £23.3m interest over the years.

• • •

Missing some Tweet in this thread? You can try to

force a refresh