#Huobi seems to be melting down in real time, possibly along with His Excellency #JustinSun's fortune...

Shut down all intra-employee IMs etc, maybe fired a bunch of people. Employees now angry (or Sun is ruggin') @HuobiGlobal @justinsuntron

Shut down all intra-employee IMs etc, maybe fired a bunch of people. Employees now angry (or Sun is ruggin') @HuobiGlobal @justinsuntron

https://twitter.com/BitRunX/status/1610839176454483974

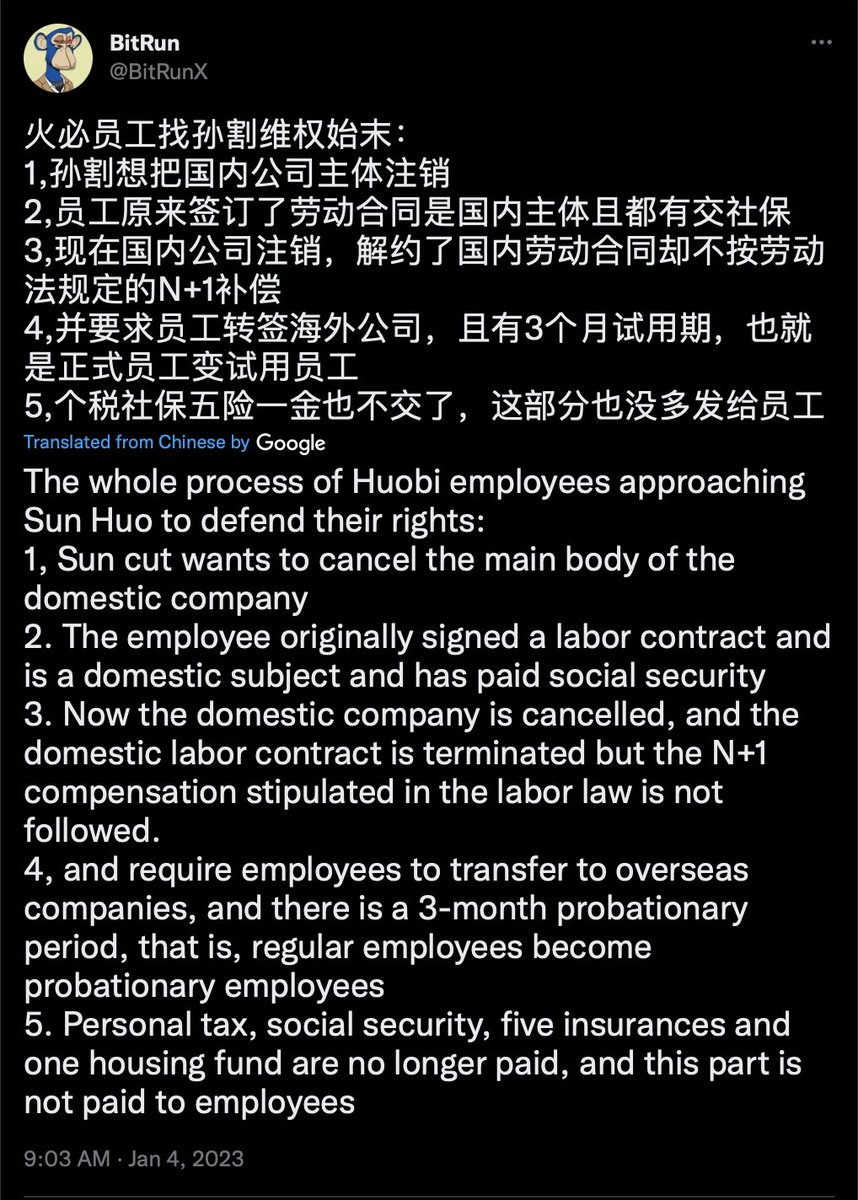

@HuobiGlobal @justinsuntron Apparently #JustinSun tried to dissolve the company (which would presumably leave all the employees unemployed).

Remember just yesterday it was reported that #JustinSun had tried to pay #Huobi employees in $USDT and/or $USDC... #Tether (h/t @crasl7 for non machine translation)

Remember just yesterday it was reported that #JustinSun had tried to pay #Huobi employees in $USDT and/or $USDC... #Tether (h/t @crasl7 for non machine translation)

Random Twitter user sharing rumors that there are concerns this will spread to #TRON and its companies from Pulse (which @crasl7 looked into and called "Chinese language LinkedIn")

👇I'll throw out there that when the #HooExchange CEO rug pulled his employees not paying them for months, for one day the employees poured onto twitter sock puppet accounts and started dishing... everything was deleted a day later.

Hoo screenshots here: cryptadamus.substack.com/p/the-crypto-b…

Hoo screenshots here: cryptadamus.substack.com/p/the-crypto-b…

Here's another coincidence: Just yesterday DOJ moved to seize money (~$90mm but don't quote me) in #Silvergate bank. Some of that money was reportedly #FTX's.

But guess who else banks at $SI?

And guess who couldn't meet payroll in fiat yesterday? #Huobi

But guess who else banks at $SI?

And guess who couldn't meet payroll in fiat yesterday? #Huobi

https://twitter.com/AureliusValue/status/1608512294128062469

Important detail: #Huobi have been selling $BONK and $PI lately which tbh seem like total scams

But then the dev team that makes $PI pointed out that $PI isn't even minted yet so whatever #JustinSun was selling was just like, an IOU or something

But then the dev team that makes $PI pointed out that $PI isn't even minted yet so whatever #JustinSun was selling was just like, an IOU or something

https://twitter.com/hulkberry_vc/status/1611162710359547904

Folks I was the only English speaker who watched the #HooExchange rug pull in real time. What I see right now is the exact same pattern:

Low follower Chinese tweets getting increasingly accusatory... Until the Chinese government seized Hoo's servers.

#Huobi #JustinSun #TRON

Low follower Chinese tweets getting increasingly accusatory... Until the Chinese government seized Hoo's servers.

#Huobi #JustinSun #TRON

Translations of (probably employee sock puppet) tweets are... ominous:

"I think the best way is to cooperate with #SBF

Reason: You both need what the other has"

Remember #SBF & #JustinSun worked together on #Tether / $USDT...

#Huobi #JustinSun @justinsuntron #FTX #FTXScam

"I think the best way is to cooperate with #SBF

Reason: You both need what the other has"

Remember #SBF & #JustinSun worked together on #Tether / $USDT...

#Huobi #JustinSun @justinsuntron #FTX #FTXScam

Based on my experience watching #RexyWang rug his employees I can advise those who want to observe this implosion in real time to go to this 🧵 by #JustinSun.

start translating low follower Chinese language tweets.

the angry ones are #Huobi employees.

start translating low follower Chinese language tweets.

the angry ones are #Huobi employees.

https://twitter.com/justinsuntron/status/1610910777040580611

"[The Grenadian diplomat] who controls the [view of] the past controls the future."

- George Orwell

#Tron #JustinSun #Tronscan @justinsuntron #Huobi @HuobiGlobal #FTXScam

- George Orwell

#Tron #JustinSun #Tronscan @justinsuntron #Huobi @HuobiGlobal #FTXScam

https://twitter.com/Cryptadamist/status/1610138783667683330

👇 Link to the long thing I wrote about the events of the #HooExchange meltdown as I stayed up all night watching what had been crypto shilling zombie bots hurl insults of incredibly eloquence at #RexyWang.

#JustinSun @huobiglobal @justinsuntron #Huobi

cryptadamus.substack.com/i/64706275/the…

#JustinSun @huobiglobal @justinsuntron #Huobi

cryptadamus.substack.com/i/64706275/the…

@CoinDesk reporting on the situation. Apparently #JustinSun denied there were any problems but just look 👆🧵 at the employee sock puppets crowding his threads with tweets of financial desperation. #Huobi @HuobiGlobal

coindesk.com/markets/2023/0…

coindesk.com/markets/2023/0…

BTW Chinese speakers don't really use tweet app much so #JustinSun's employees complaining here about not getting paid etc. is prolly tip of the ice berg.

The real action will be on Telegram. If any Chinese readers feel like jumping in the #Huobi TG channels... @HuobiGlobal

The real action will be on Telegram. If any Chinese readers feel like jumping in the #Huobi TG channels... @HuobiGlobal

@BitRunX seems careful about what is confirmed v. rumored but seems confirmed #Huobi's outflow was 3.5% of its reserves in 24H.

at the #FTX panic rate (v. roughly ~2x/day) reserves hit $0 in ~4 days.

faster if the reserves are not full. #JustinSun #Tron

at the #FTX panic rate (v. roughly ~2x/day) reserves hit $0 in ~4 days.

faster if the reserves are not full. #JustinSun #Tron

https://twitter.com/BitRunX/status/1611073060316254208

🧵 Seems like a good to remind everyone that we have entered #TheWarOfTheWhales, where it is prophesied that bro will turn upon brothren.

#SBF/#FTX was first to be thrown off the boat

Either #CryptoCom or #JustinSun seems to be next

#LordCZ? last.

👇Ω👇

cryptadamus.substack.com/p/the-by-now-a…

#SBF/#FTX was first to be thrown off the boat

Either #CryptoCom or #JustinSun seems to be next

#LordCZ? last.

👇Ω👇

cryptadamus.substack.com/p/the-by-now-a…

🧵A little #JustinSun history:

2018: #TronNetwork is founded

2019: @justinsuntron joins #Tether

2020-2021: $USDT mkt cap goes from $3B to $80B (see 👇)

2021 Dec: Justin Sun becomes #Grenadian diplomat

2022: Sun buys #Huobi

More detailed timeline:👇Ω👇

cryptadamus.substack.com/p/the-tetherer…

2018: #TronNetwork is founded

2019: @justinsuntron joins #Tether

2020-2021: $USDT mkt cap goes from $3B to $80B (see 👇)

2021 Dec: Justin Sun becomes #Grenadian diplomat

2022: Sun buys #Huobi

More detailed timeline:👇Ω👇

cryptadamus.substack.com/p/the-tetherer…

@justinsuntron 🧵 So here's a really interesting thing I have never shared that I put together:

If you go look at the blockchains $USDT appears on, you find that more $USDT was minted and then burned on #Tron than on #Ethereum.

Like, a whole lot more.

#JustinSun #Tether #Huobi @JustinSunTron

If you go look at the blockchains $USDT appears on, you find that more $USDT was minted and then burned on #Tron than on #Ethereum.

Like, a whole lot more.

#JustinSun #Tether #Huobi @JustinSunTron

🧵You may ask yourself "what's the connection to #FTX & why Chinese accounts ominously telling #JustinSun to 'cooperate' with #SBF?"

Well, first you need to know that #SBF was the biggest customer of $USDT... and almost the ONLY customer of $USDT on #Tron

datafinnovation.medium.com/usdt-on-tron-f…

Well, first you need to know that #SBF was the biggest customer of $USDT... and almost the ONLY customer of $USDT on #Tron

datafinnovation.medium.com/usdt-on-tron-f…

🧵h/t @DataFinnovation on that 👆. True story: I am 🙏🏽 to #JustinSun/#Tron for bringing us together

Anyways you may wonder where, exactly, did all the money for #SBF to buy $40bn $USDT come from and why is it all on the sketchy Tronchain?

Well.

👇Ω👇

Anyways you may wonder where, exactly, did all the money for #SBF to buy $40bn $USDT come from and why is it all on the sketchy Tronchain?

Well.

👇Ω👇

https://twitter.com/Cryptadamist/status/1600012333450817538

🧵Here's some pics for those too lazy to click through to the @FinancialTimes's amazing reporting by @primroseriordan/@ThomasHHChan on #FTX/#SBF

Serious shout out to #FT who, I have learned, are the only biz reporters in the world who engage in the lost art of "Journalism".

Serious shout out to #FT who, I have learned, are the only biz reporters in the world who engage in the lost art of "Journalism".

🧵So: #FTX, through its subsidiary @GenesisBlock, was basically taking suitcases full of cash from... the kind of people who move cash around in suitcases.

FT reporting says #SBF traded $BTC for this cash, but was it *all* $BTC for cash?

Seems unlikely.

occrp.org/en/daily/16826…

FT reporting says #SBF traded $BTC for this cash, but was it *all* $BTC for cash?

Seems unlikely.

occrp.org/en/daily/16826…

@genesisblock 🧵Another question: Once cash was onboarded to #FTX/#Tether where, exactly, did it go? Was #Tether just printing $USDT from thin air?

Turns out they did not mint $USDT from air.

#Tether is (or at least was) mostly backed.

Let's turn to @DataFinnovation

datafinnovation.medium.com/usdt-us-banks-…

Turns out they did not mint $USDT from air.

#Tether is (or at least was) mostly backed.

Let's turn to @DataFinnovation

datafinnovation.medium.com/usdt-us-banks-…

@genesisblock @DataFinnovation 🧵The gold standard for money launderers is to get their $USD into a bank connected to the American financial system. That's basically all banks that aren't in Iran, North Korea, or (now) Russia. But what's even better...

is to get your money into an actual American bank. #Huobi

is to get your money into an actual American bank. #Huobi

🧵We saw 👆 why a seized $90mm from #FTX accounts at $SI/#Silvergate might include #Huobi's payroll cash.

But $SI is a bank with only $7bn in deposits (was $15bn til #FTXplosion).

$USDT mkt cap is ~$65bn so $USDT backing not in $SI. Where is it?

But $SI is a bank with only $7bn in deposits (was $15bn til #FTXplosion).

$USDT mkt cap is ~$65bn so $USDT backing not in $SI. Where is it?

🧵There's another bank besides $SI.

A bank that provides banking services to #FTX.

To #Binance and #CZ

To #JustinSun/#Tron, and (probably) #Huobi

To #FTX and #SBF

And to #Tether.

If you compare that bank's non interest bearings deposits to $USDT over time

This is what you get:

A bank that provides banking services to #FTX.

To #Binance and #CZ

To #JustinSun/#Tron, and (probably) #Huobi

To #FTX and #SBF

And to #Tether.

If you compare that bank's non interest bearings deposits to $USDT over time

This is what you get:

🧵 Having trouble believing it? Here's His Excellency #JustinSun himself to explain it to you:

https://twitter.com/trondao/status/1539504381178957824

🧵 Of course this is interesting. $SBNY is a NY bank. $USDT backing should probably not be in a New York bank... bc #Tether's settlement of felony charges from @NewYorkStateAG involved paying a fine for its fraud...

And agreeing to leave.

👇Ω👇

ag.ny.gov/press-release/…

And agreeing to leave.

👇Ω👇

ag.ny.gov/press-release/…

🧵But it's not hard to see how it happened. Inspired by @DataFinnovation's analysis we went out and scoured the earth for old #SEC filings, press releases, etc about the relationships between #FTX, #SBF, $SBNY, #Binance, and #JustinSun.

We found... a lot.

cryptadamus.substack.com/p/signature-ba…

We found... a lot.

cryptadamus.substack.com/p/signature-ba…

🧵And that's all I got for now... but stay tuned, because there's more coming in Part II.

I leave you with a little light reading about how even w/out this thread you should probably regard #Huobi, #JustinSun, and the blockchains he controls w/suspicion.

theverge.com/c/22947663/jus…

I leave you with a little light reading about how even w/out this thread you should probably regard #Huobi, #JustinSun, and the blockchains he controls w/suspicion.

theverge.com/c/22947663/jus…

(For a cherry on top here's my tweet from 72 hours ago when @justinsuntron decided to start the #Huobi Doomsday clock.)

https://twitter.com/Cryptadamist/status/1610167573680619520

final thought: if you or anyone you know has info about #JustinSun's financial crimes (or anyone's) contact @Lioness_Stories

you should know the US govt pays *SUBSTANTIAL* rewards for info that leads to asset recovery, up to 30%. People have gotten hundreds of millions $USD.

you should know the US govt pays *SUBSTANTIAL* rewards for info that leads to asset recovery, up to 30%. People have gotten hundreds of millions $USD.

@justinsuntron, you and @cz_binance should just keep your heads down and build. Build right up until the minute the police drag you away... forever.

You know they're closing in.

You even know when.

You just haven't put it together yet.

Think hard...

You know they're closing in.

You even know when.

You just haven't put it together yet.

Think hard...

https://twitter.com/justinsuntron/status/1611254535699435521

Some (epic) color on #JustinSun/@HuobiGlobal's $PI token scam from the eastern hemisphere.

https://twitter.com/Cryptadamist/status/1611262250186055682

I'll just leave this here:

https://twitter.com/Cryptadamist/status/1611262250186055682

• • •

Missing some Tweet in this thread? You can try to

force a refresh