🧵1/Ω

It should surprise no one that @Bullish, an offshore exchange backed by the #EOS scammers at Block.One, uses $SI for banking.

It should surprise no one that @Bullish, an offshore exchange backed by the #EOS scammers at Block.One, uses $SI for banking.

🧵2/Ω

Nor would it surprise anyone to know that as of Nov. 24th a little over 1/6th of $SI (16.73%) was owned by #B1 CEO #BrendanBlumer and @B1 itself.

b1.com/press/b1-acqui…

Nor would it surprise anyone to know that as of Nov. 24th a little over 1/6th of $SI (16.73%) was owned by #B1 CEO #BrendanBlumer and @B1 itself.

b1.com/press/b1-acqui…

🧵3/Ω

The #EOS situation is complicated but suffice it to say it is dodgy even by crypto standards. Bros cashed out $4bn selling a coin to retail in an ICO and then never delivered the product. Got fined only ~$24mm by #SEC... good take, right?

@EOS even admits it's a failure.

The #EOS situation is complicated but suffice it to say it is dodgy even by crypto standards. Bros cashed out $4bn selling a coin to retail in an ICO and then never delivered the product. Got fined only ~$24mm by #SEC... good take, right?

@EOS even admits it's a failure.

🧵4/Ω

@EOS litigation continues. A settlement was reached that had #EOS paying $27.5mm. Great deal right? They would pay ~$51mm in total fines and settlement on a $4bn scam.

Unfortunately for the bros a judge rejected the settlement as grossly unfair.

forbes.com/sites/emilymas…

@EOS litigation continues. A settlement was reached that had #EOS paying $27.5mm. Great deal right? They would pay ~$51mm in total fines and settlement on a $4bn scam.

Unfortunately for the bros a judge rejected the settlement as grossly unfair.

forbes.com/sites/emilymas…

🧵 5/Ω

All of which is why it is interesting that these are the folks that think they should own 1/6th of #Silvergate bank, piling in at the most inopportune of times post #FTXplosion. Is there something special about that 1/6th number? $SI @AureliusValue @AlderLaneEggs.

All of which is why it is interesting that these are the folks that think they should own 1/6th of #Silvergate bank, piling in at the most inopportune of times post #FTXplosion. Is there something special about that 1/6th number? $SI @AureliusValue @AlderLaneEggs.

🧵6/Ω

And why is it that #B1's exchange @bullish, which chain data indicates might be actually one of the biggest crypto exchanges in the world, is banking with $SI? Americans are not allowed to trade on @Bullish so who are all these non-American customers? @eliant_capital

And why is it that #B1's exchange @bullish, which chain data indicates might be actually one of the biggest crypto exchanges in the world, is banking with $SI? Americans are not allowed to trade on @Bullish so who are all these non-American customers? @eliant_capital

🧵7/Ω

Because when you put it together it means one of the largest crypto exchanges in the world by chain activity - #Bullish - is banking with a bank, #Silvergate, that was *at least* 1/6th owned by the same people that a) own bullish and b) scammed retail for $4bn.

Because when you put it together it means one of the largest crypto exchanges in the world by chain activity - #Bullish - is banking with a bank, #Silvergate, that was *at least* 1/6th owned by the same people that a) own bullish and b) scammed retail for $4bn.

🧵8/Ω

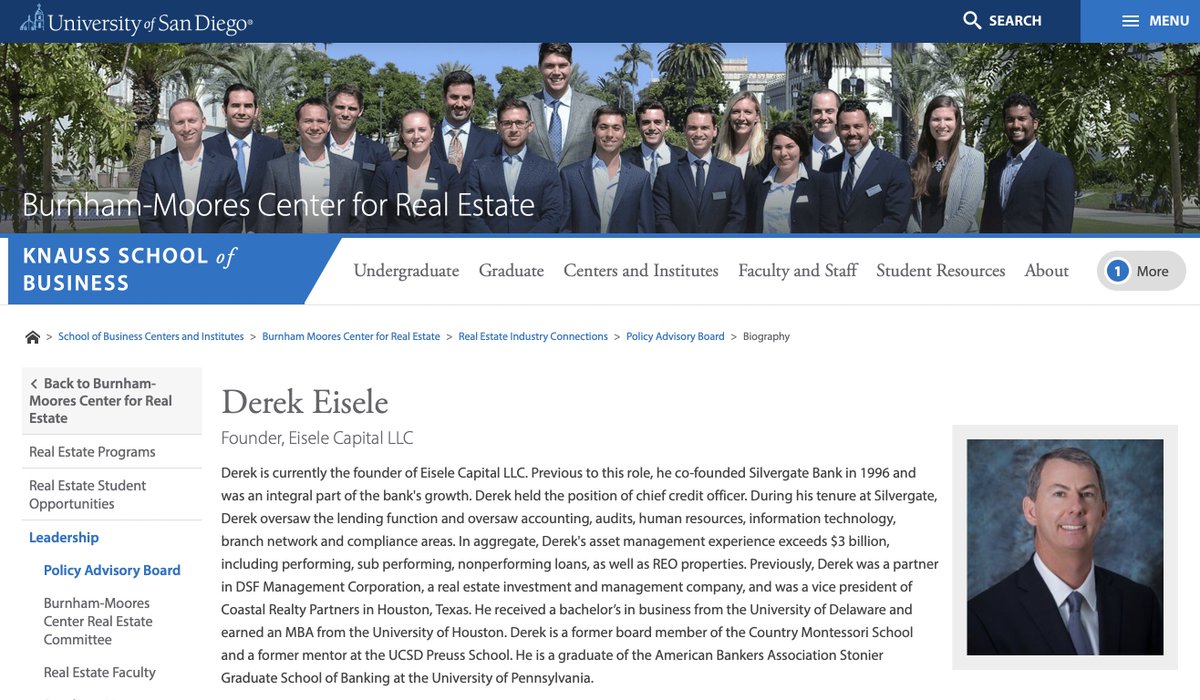

Assuming they have not sold their stake between them #BrendanBlumer and #B1 have enough shares to materially impact the C level positions at $SI.

In fact they're up the range where they could possibly do things like, say, eject a founder.

Assuming they have not sold their stake between them #BrendanBlumer and #B1 have enough shares to materially impact the C level positions at $SI.

In fact they're up the range where they could possibly do things like, say, eject a founder.

https://twitter.com/Cryptadamist/status/1614123580387885056

🧵9/Ω

Note also that there is a "SEN Transfer" deposit option on the screenshot at the top of this 🧵, at least for those who can use it. 👆

SEN is $SI's not-yet-fully-bank-permissible alternative to SWIFT/ACH/etc.

Most know SEN by its true name: #TheWheelOfDoom.

Note also that there is a "SEN Transfer" deposit option on the screenshot at the top of this 🧵, at least for those who can use it. 👆

SEN is $SI's not-yet-fully-bank-permissible alternative to SWIFT/ACH/etc.

Most know SEN by its true name: #TheWheelOfDoom.

🧵10/Ω

Guess who else makes an appearance in the #EOS/#B1/#BrendanBlumer saga? Everyone's favorite stablecoin, interestingly right around the time His Excellency joined the team.

Guess who else makes an appearance in the #EOS/#B1/#BrendanBlumer saga? Everyone's favorite stablecoin, interestingly right around the time His Excellency joined the team.

https://twitter.com/Bitfinexed/status/1614356939533651968

🧵11/𝛀

More juice on #B1, #BrendanBlumer, and a company called #NorthernData. cc @AureliusValue @AlderLaneEggs.

More juice on #B1, #BrendanBlumer, and a company called #NorthernData. cc @AureliusValue @AlderLaneEggs.

https://twitter.com/NingiResearch/status/1614362823823327232

🧵13/Ω

More to read about #NorthernData, $RIOT, #EOS, #BrendanBlumer, and links to #Wirecard etc.

medianista.com/chad_harris_ri…

@AureliusValue @eliant_capital @paulgb @AlderLaneEggs

More to read about #NorthernData, $RIOT, #EOS, #BrendanBlumer, and links to #Wirecard etc.

medianista.com/chad_harris_ri…

@AureliusValue @eliant_capital @paulgb @AlderLaneEggs

Correction here: @Bullish is one of the biggest exchange by *self-reported* trading volume, NOT by chain activity.

https://twitter.com/Cryptadamist/status/1614351925759168513

@B1 correction here: I saw it reported as two separate beneficiaries totalling 16.7% a few places but turns out that is incorrect. h/t @MimedxGroupie:

https://mobile.twitter.com/Cryptadamist/status/1614727551905144832

• • •

Missing some Tweet in this thread? You can try to

force a refresh