🐻♉️↗️↘️↔️⚠️🚩🔺🔻🧮 💰

Macro Review 🧵

01/15/2023

1/11

Core #CPI running at +3.1% SAAR confirmed #Goldilocks for Q422 and catalyzed a 🚀 in equities, metals, and hydrocarbons

#Core CPI - 3-month SAAR

Dec - 3.1%

Nov - 4.2%

Oct - 5.7%

Chart: #CoreCPI 5.7% 🔻

Macro Review 🧵

01/15/2023

1/11

Core #CPI running at +3.1% SAAR confirmed #Goldilocks for Q422 and catalyzed a 🚀 in equities, metals, and hydrocarbons

#Core CPI - 3-month SAAR

Dec - 3.1%

Nov - 4.2%

Oct - 5.7%

Chart: #CoreCPI 5.7% 🔻

1a/11

Despite all the recession talk - including my own, the @AtlantaFed #NowCast is projecting Q4 growth of +4.1%, an acceleration.

Growth 🔺 + Inflation 🔻 = #Quad1 #Goldilocks

Chart:

Despite all the recession talk - including my own, the @AtlantaFed #NowCast is projecting Q4 growth of +4.1%, an acceleration.

Growth 🔺 + Inflation 🔻 = #Quad1 #Goldilocks

Chart:

https://twitter.com/AtlantaFed/status/1612873854694658051?s=20&t=yjGQQ6rAdazN3jS13PT73g

2/11

While #Quad1 #Goldilocks may be good for risk assets, it’s decidedly poor for the $USD, which continued ↘️ and took out the 50% retracement level of 102.12

Chart: $USD -1.64% (w) -9.94% 3M = T = Trend

While #Quad1 #Goldilocks may be good for risk assets, it’s decidedly poor for the $USD, which continued ↘️ and took out the 50% retracement level of 102.12

Chart: $USD -1.64% (w) -9.94% 3M = T = Trend

3a/11

With a -0.76 correlation to the $USD over (T) duration, $GOLD +2.78% continued to 🚀 and is now +18.7% off the October lows and VERY OVERBOUGHT

Chart: $GOLD +5.23% YTD

With a -0.76 correlation to the $USD over (T) duration, $GOLD +2.78% continued to 🚀 and is now +18.7% off the October lows and VERY OVERBOUGHT

Chart: $GOLD +5.23% YTD

3b/11

Dr. $COPPER turned decidedly ♉️ the week ending 11/11/22 and has been🚦bullish Trend ever since, front running China re-opening announcement by over a month.

Chart: $COPPER +7.8% (w) +23.9% (T)

Dr. $COPPER turned decidedly ♉️ the week ending 11/11/22 and has been🚦bullish Trend ever since, front running China re-opening announcement by over a month.

Chart: $COPPER +7.8% (w) +23.9% (T)

4/11

Declines in energy costs in December nearly offset the rise in shelter costs in the #CPI report. The commensurate real wages ↗️ put pressure on hydrocarbons this week = sowing the seeds #Goldilocks early demise

Chart: $GASO +13.39% (w) -3.67% (T)

Declines in energy costs in December nearly offset the rise in shelter costs in the #CPI report. The commensurate real wages ↗️ put pressure on hydrocarbons this week = sowing the seeds #Goldilocks early demise

Chart: $GASO +13.39% (w) -3.67% (T)

4a/11

📌 Importantly, I want to note that oil 🌊 has fallen to multi-month lows as speculators have been shaken from the market.

Time to get long energy 🛢 folks.

Chart: $OVX 38.19 at the lowest level in a year.

📌 Importantly, I want to note that oil 🌊 has fallen to multi-month lows as speculators have been shaken from the market.

Time to get long energy 🛢 folks.

Chart: $OVX 38.19 at the lowest level in a year.

5/11

While the "the food index increased +10.4% over the last year” in the December #CPI report, grains have been decidedly subdued since peak inflation in June.

Chart: $DBA -0.15% (w) -2.64% (T) could be the next to join the ♉️ party

While the "the food index increased +10.4% over the last year” in the December #CPI report, grains have been decidedly subdued since peak inflation in June.

Chart: $DBA -0.15% (w) -2.64% (T) could be the next to join the ♉️ party

6/11

With event risk behind us, the $VIX 🔻 to 18.35, a 1-year low and supporting equity prices as both realized and implied vol fall.

Chart: $VIX 18.35 has some calling for long zee puts, but I’m not so sure

With event risk behind us, the $VIX 🔻 to 18.35, a 1-year low and supporting equity prices as both realized and implied vol fall.

Chart: $VIX 18.35 has some calling for long zee puts, but I’m not so sure

6d/11

With real wages rising, consumers ostensibly have more 💰 in their pockets to spend.

Accordingly, consumer discretionary led US Sectors ↗️ while Staples -1.37% on the week.

Chart: $XLY +5.78% (w) +3.27% (T)

With real wages rising, consumers ostensibly have more 💰 in their pockets to spend.

Accordingly, consumer discretionary led US Sectors ↗️ while Staples -1.37% on the week.

Chart: $XLY +5.78% (w) +3.27% (T)

7/11

A weak $USD has also catalyzed ♉️ moves in international indices over the past 3 months with both Europe and the Pac Rim showing outsized 💪

Chart: $DAX +3.26% (w) and +22.7% off the October lows

A weak $USD has also catalyzed ♉️ moves in international indices over the past 3 months with both Europe and the Pac Rim showing outsized 💪

Chart: $DAX +3.26% (w) and +22.7% off the October lows

8a/11

In bond land, the yield curve remains deeply inverted as the short-end has been 📌 by the Fed and bonds have rallied on slowing inflation and the prospect of #recession in the year ahead

Chart: 10Y3M to -118 bps

In bond land, the yield curve remains deeply inverted as the short-end has been 📌 by the Fed and bonds have rallied on slowing inflation and the prospect of #recession in the year ahead

Chart: 10Y3M to -118 bps

9/11

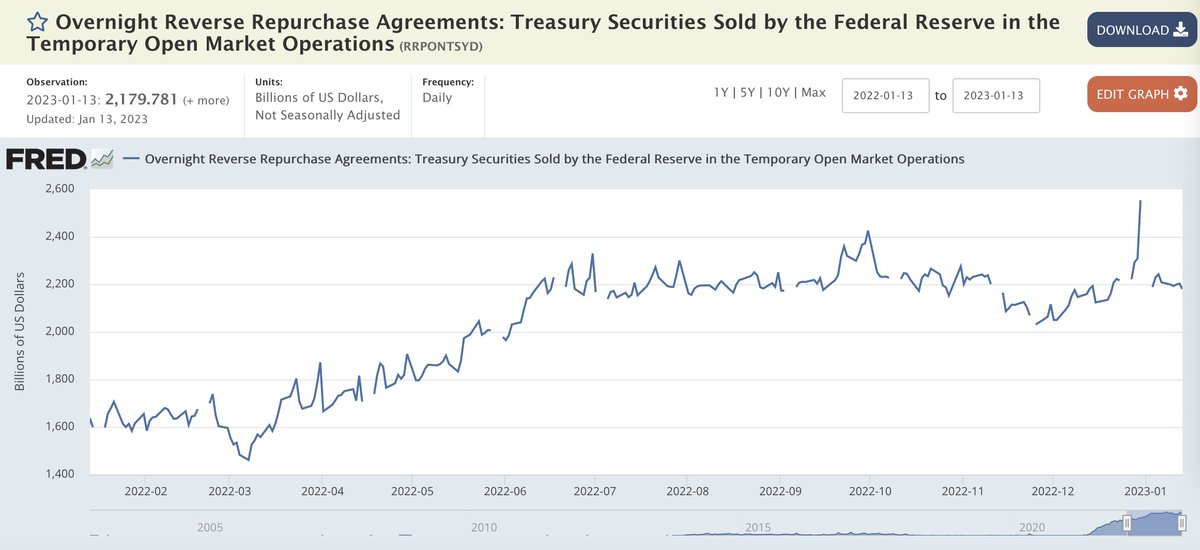

Supporting all of this ♉️ 🚀, 374B has come out of reverse repo (money markets) and into risk assets since the end of December 🔥

It only takes 50-100B to move markets each day

Chart: Overnight reverse repo

Supporting all of this ♉️ 🚀, 374B has come out of reverse repo (money markets) and into risk assets since the end of December 🔥

It only takes 50-100B to move markets each day

Chart: Overnight reverse repo

10a/11

The big question for investors is how long can this #Quad1 #Goldilocks ♉️ last - especially as it runs into a 🦅 #FOMC on 02/01/23, one day after the Employment Cost Index (ECI) for Q422 is released.

Remember, this Fed is focused on wages aka "services ex-shelter"

The big question for investors is how long can this #Quad1 #Goldilocks ♉️ last - especially as it runs into a 🦅 #FOMC on 02/01/23, one day after the Employment Cost Index (ECI) for Q422 is released.

Remember, this Fed is focused on wages aka "services ex-shelter"

10b/11

I’m inclined to agree with @BobEUnlimited that this #Goldilocks is transitory and that it will sow its own seeds of destruction as moribund commodities spring to life and as real wage gains spur a resilient consumer, pushing #inflation ↗️

blog.unlimitedfunds.com/transitory-gol…

I’m inclined to agree with @BobEUnlimited that this #Goldilocks is transitory and that it will sow its own seeds of destruction as moribund commodities spring to life and as real wage gains spur a resilient consumer, pushing #inflation ↗️

blog.unlimitedfunds.com/transitory-gol…

10c/11

In the meantime, we will run a Goldilocks play 📗 in combination with our recession play 📕

Image: #Goldilocks play 📗

In the meantime, we will run a Goldilocks play 📗 in combination with our recession play 📕

Image: #Goldilocks play 📗

11/11

Despite extremely overbought conditions in equities, expect positive vanna and charm 🌊 into #OPEX 🥐 as well as more #TGA spend as Janet front runs Congress & reverse repo 💦 as chasers chase the 200-day #FOMO

Note $SPX resistance at 4075-4100 and have a super 💰 week!

Despite extremely overbought conditions in equities, expect positive vanna and charm 🌊 into #OPEX 🥐 as well as more #TGA spend as Janet front runs Congress & reverse repo 💦 as chasers chase the 200-day #FOMO

Note $SPX resistance at 4075-4100 and have a super 💰 week!

• • •

Missing some Tweet in this thread? You can try to

force a refresh