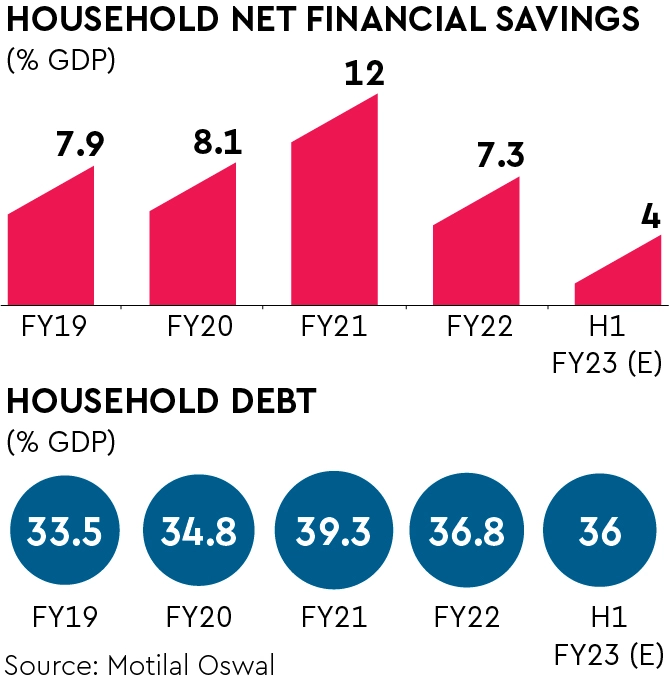

Nobody is bullish which is why I think that we could have a unexpected Rally baring a black swan event

Global Central Bank LIQUIDITY is on the rise... this next 6 months is called #GOLDILOCKS..... Falling Inflation, Bond Markets expecting Fed to Pivot, Very tight Labor Markets in the US ...

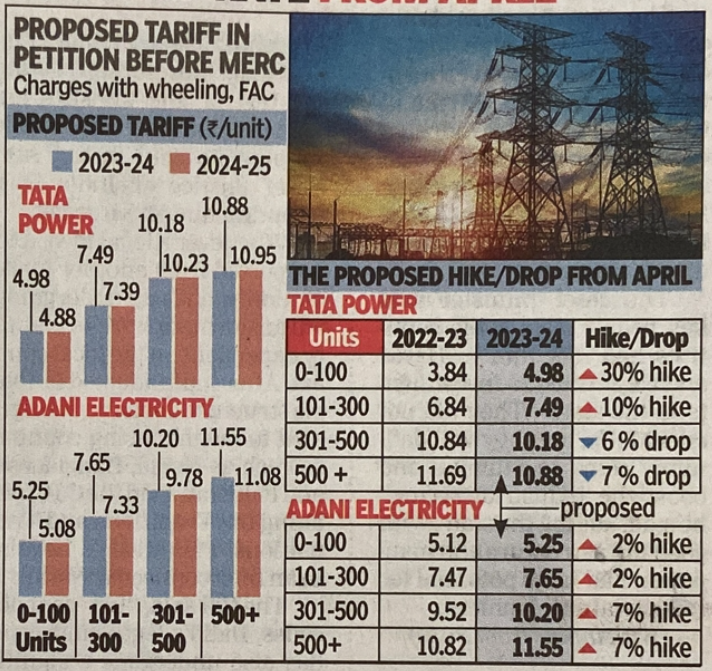

Check this chart

Check this chart

https://twitter.com/trevornoren/status/1616110796475629568

• • •

Missing some Tweet in this thread? You can try to

force a refresh