1/ I saw a post from @Route2FI on @CantoPublic which has been pumping hard. #CANTO #NOTE

How come this #Cosmos chain is at $120 mil TVL & #Kuji is at only $7 mil?

@TeamKujira has been building hard, but Canto is better?

I found the answer. See next, a thread. 🧵

How come this #Cosmos chain is at $120 mil TVL & #Kuji is at only $7 mil?

@TeamKujira has been building hard, but Canto is better?

I found the answer. See next, a thread. 🧵

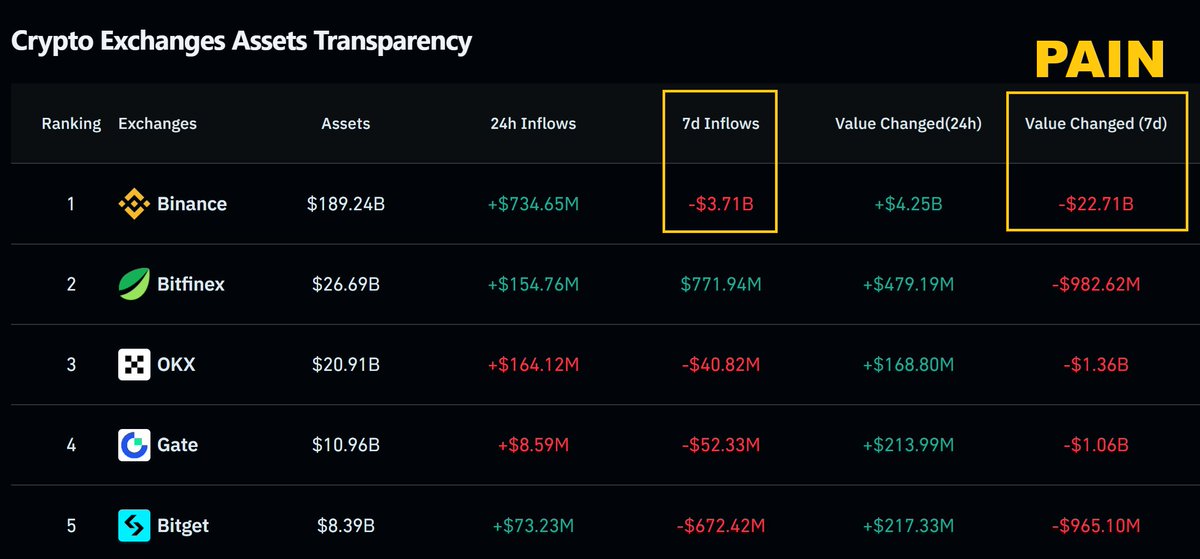

2/ #CANTO (native token) & #NOTE (its stable) represent 72% of the chain's volume & about $46 mil in value.

But what worries me more is that you can issue Notes with Canto!

Pump Canto price, borrow more Notes. Fly wheel. 🚀

Sounds familiar? #Luna & #UST anyone? 🙃

Next 👇

But what worries me more is that you can issue Notes with Canto!

Pump Canto price, borrow more Notes. Fly wheel. 🚀

Sounds familiar? #Luna & #UST anyone? 🙃

Next 👇

3/ If you check the price of NOTE it's over peg by 3 cents on the dollar, see pic

Demand is high - of course! You can borrow more Notes so long Canto price is pumping.

Guess what happens when Canto price crashes? Liquidations.

Not pretty.

More on that overstated TVL next. 👇

Demand is high - of course! You can borrow more Notes so long Canto price is pumping.

Guess what happens when Canto price crashes? Liquidations.

Not pretty.

More on that overstated TVL next. 👇

4/ $42 mil in #USDC and #USDT are on Canto chain.

Presumably that is used to borrow Notes. Hence, that $42 mil is stuck as collateral for Notes.

It's a great way to double count $42 mil in TVL since Notes in circulations are just USDC & USDT with another label.

Risks next 👇

Presumably that is used to borrow Notes. Hence, that $42 mil is stuck as collateral for Notes.

It's a great way to double count $42 mil in TVL since Notes in circulations are just USDC & USDT with another label.

Risks next 👇

5/ Imagine you deposit 100 USDC on Canto and borrow 97 NOTES (remember the peg is 1 USDC for 0.97 Note).

Everything goes well for a while.

✅ Canto price explodes = Notes in circulation explode

Then the crash happens (see #Luna pic).

What happens next? 👇

Everything goes well for a while.

✅ Canto price explodes = Notes in circulation explode

Then the crash happens (see #Luna pic).

What happens next? 👇

6/ All those Notes in circulation backed by Canto are worthless.

So what happens?

Note peg falls to the fair value backed by... USDC & USDT. The peg has reversed.

100 Notes borrowed can only redeem you maybe $80 or less in USDC.

With that, the Canto TVL also crashes.

Next 👇

So what happens?

Note peg falls to the fair value backed by... USDC & USDT. The peg has reversed.

100 Notes borrowed can only redeem you maybe $80 or less in USDC.

With that, the Canto TVL also crashes.

Next 👇

7/ I don't have all the data as the information on the main site of Canto is particularly opaque.

The best part? There are no fees to transact on Canto.

Yes - really. Why?

Maybe to incentivize liquidity/volume? See #2.

In other words, pump Note market cap.

Juicy next 👇

The best part? There are no fees to transact on Canto.

Yes - really. Why?

Maybe to incentivize liquidity/volume? See #2.

In other words, pump Note market cap.

Juicy next 👇

8/ Good thing that there are an infinite number of Notes ready to be borrowed.

No joke, I don't even know how to call a number with so many zeroes (pictured).

While I find Canto's vision intriguing (see next), my findings show you may be taking more risk than necessary here.

No joke, I don't even know how to call a number with so many zeroes (pictured).

While I find Canto's vision intriguing (see next), my findings show you may be taking more risk than necessary here.

9/ We can all agree with the ethos of a "Free Public Infrastructure" for #DeFi (pic).

But we can also all agree that there is no such thing as a free lunch.

Don't be naïve. If the lunch is free, then you are the lunch, or rather, your USDC & USDT on Canto. 😱

Moreover... 👇

But we can also all agree that there is no such thing as a free lunch.

Don't be naïve. If the lunch is free, then you are the lunch, or rather, your USDC & USDT on Canto. 😱

Moreover... 👇

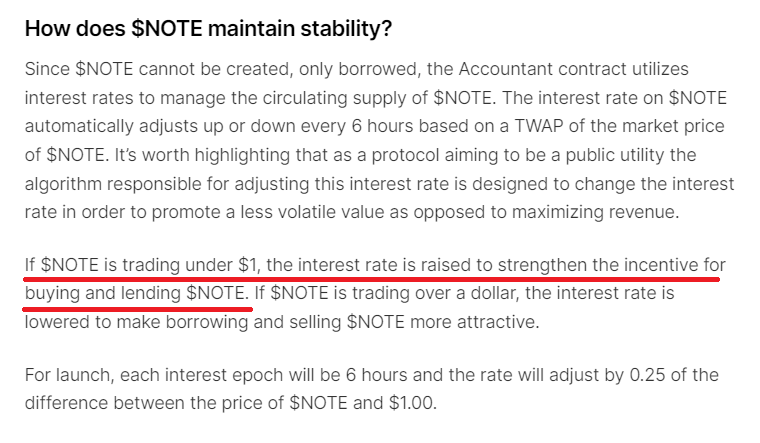

If the Note peg falls under 1, the solution to solve that is to print more Notes = inflation! See pic 🤣

The questions then is, who wants to buy Notes when the peg is crashing?

It's all about trust in this market and that can vanish in seconds. See #Luna.

Lastly. 👇

The questions then is, who wants to buy Notes when the peg is crashing?

It's all about trust in this market and that can vanish in seconds. See #Luna.

Lastly. 👇

11/ If you liked this thread, #retweet the first post to get more of this content in the future!

Stay in touch + follow @DU09BTC:

✅ Discord

✅ YouTube

✅ TradingView

✅ Newsletter

✅ Patrons & Donations

My best content is one click away. 👇

linktr.ee/duonine

Stay in touch + follow @DU09BTC:

✅ Discord

✅ YouTube

✅ TradingView

✅ Newsletter

✅ Patrons & Donations

My best content is one click away. 👇

linktr.ee/duonine

P.S. #Note is NOT a stable coin. There is no obligation for its peg to be at $1. 🤣

Picture is straight from the devs. 👇

At least they are transparent to inform you to expect to lose your money.

Good luck out there.

Picture is straight from the devs. 👇

At least they are transparent to inform you to expect to lose your money.

Good luck out there.

• • •

Missing some Tweet in this thread? You can try to

force a refresh