1) $324M of $3.9B of $TSLA OI was FSD recognition.

Most didn't model. +1.5% GM impact. And there goes EPS beat vs "company compiled" consensus.

Inventory $12.8B vs $10.3B Q3 and $5.8B Q4 '21. Big jump Q/Q and huge jump Y/Y in days.

Many ...

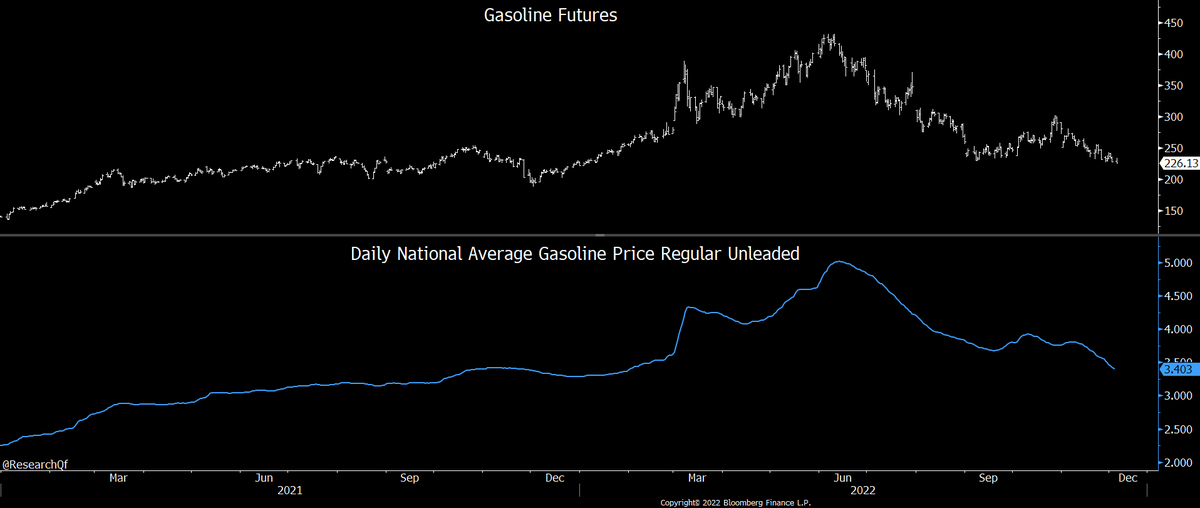

$SPY $QQQ $TLT $GLD #Commodities

Most didn't model. +1.5% GM impact. And there goes EPS beat vs "company compiled" consensus.

Inventory $12.8B vs $10.3B Q3 and $5.8B Q4 '21. Big jump Q/Q and huge jump Y/Y in days.

Many ...

$SPY $QQQ $TLT $GLD #Commodities

2) more details ... forward comments usually don't matter much. Especially if Elon says bullish things (just calibrate his past comments).

If he concedes any downside metrics? Pay attention.

Independent analysis with incoming data by far most relevant.

If he concedes any downside metrics? Pay attention.

Independent analysis with incoming data by far most relevant.

https://twitter.com/ResearchQf/status/1613907794754736128

3) Non-GAAP EPS $1.19 (includes FSD) vs "company compiled" cons $1.10 and Bberg cons $1.12.

Ex-FSD just meets company compiled and misses Bloomberg.

Taxes only $276M so several ¢. Ex-lower taxes misses both.

Not too important.

Where do margins and volumes meet going forward?

Ex-FSD just meets company compiled and misses Bloomberg.

Taxes only $276M so several ¢. Ex-lower taxes misses both.

Not too important.

Where do margins and volumes meet going forward?

5) A note on A/R vs A/P. I know A/R was +$760M Q/Q. But A/P has been up so much more than A/R over time that this could go on only for so long.

A/R +$1.07B vs A/P +$3.3B last 3 years. Could easily begin reversing in which case one might argue FCF has been even more overstated.

A/R +$1.07B vs A/P +$3.3B last 3 years. Could easily begin reversing in which case one might argue FCF has been even more overstated.

• • •

Missing some Tweet in this thread? You can try to

force a refresh