Thread on #Altcoin cycles and what to expect during this time of the year.

#Bitcoin #BTC $BTC $BTC.D $ETH #Ethereum $ETHBTC

#Bitcoin #BTC $BTC $BTC.D $ETH #Ethereum $ETHBTC

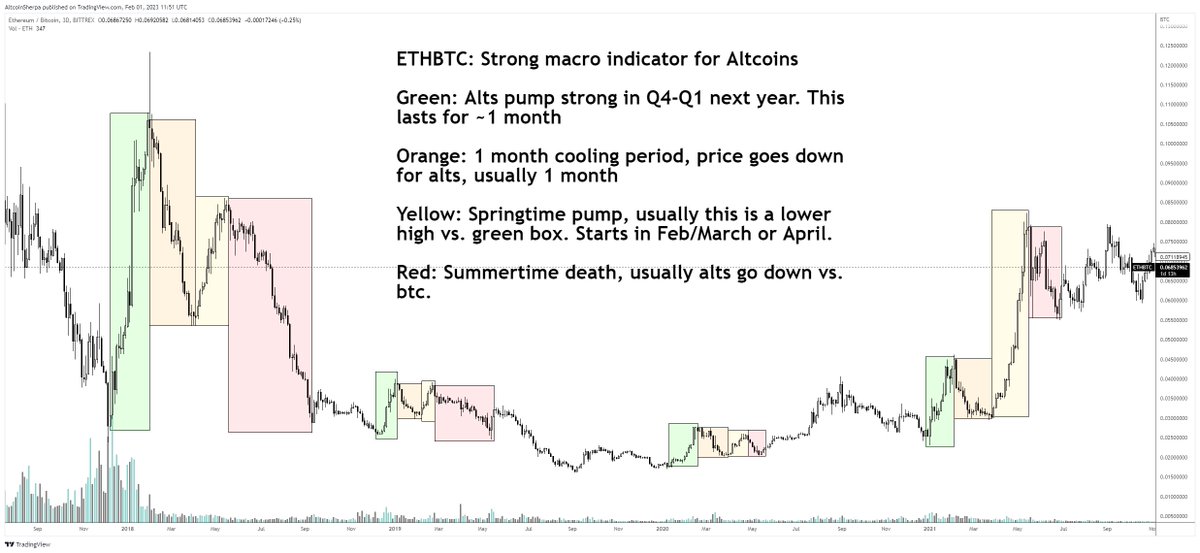

Some notes are on this chart. I'm using $ETHBTC as the macro indicator for altcoins right now; it usually is a good sign of how altcoins are doing (vs. bitcoin).

The cycle is usually this:

1) Dec/Jan- Alts start to move hard

2) Feb/March- Alts dump for a month and/or consolidate

3) March/April- Alts start to move again for another pump, usually less than #1

4) Alts retrace and start to die down in the summer

1) Dec/Jan- Alts start to move hard

2) Feb/March- Alts dump for a month and/or consolidate

3) March/April- Alts start to move again for another pump, usually less than #1

4) Alts retrace and start to die down in the summer

I've done lots of threads on BTC.D and you can see that #Bitcoin dominance goes down during these times of the year. BTC.D going down means that alt/btc is going UP. If you're an alt trader (everyone), this is what you like to see.

Since 2021 though, we haven't really seen a collective pump for alts. It was sector by sector and liquidity has been very fragmented. Narrative driven trading was important.

https://twitter.com/AltcoinSherpa/status/1612444362402631681

Now, what are some reasons why $ETHBTC might not be as good of an indicator going forward?

- $ETH could just outperform btc over the next few years and therefore wouldn't be a good representative of the altcoin market

-ETH has done well the last several months and outperformed

- $ETH could just outperform btc over the next few years and therefore wouldn't be a good representative of the altcoin market

-ETH has done well the last several months and outperformed

...bitcoin and therefore probably won't see the same pumping that other altcoins do (relatively speaking).

So going forward, maybe it's not the best but it's still interesting to note.

So going forward, maybe it's not the best but it's still interesting to note.

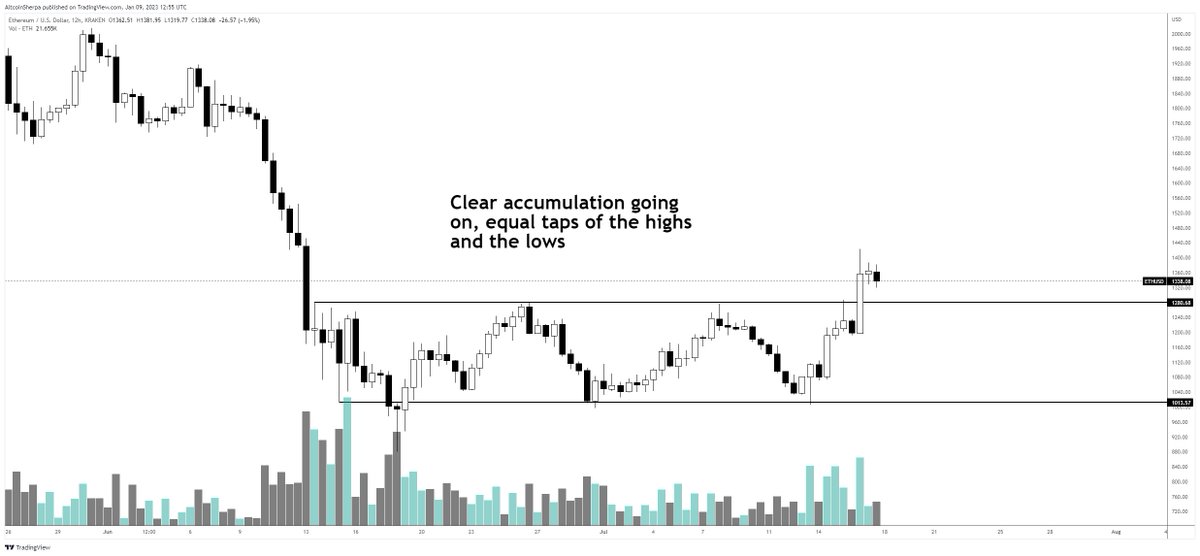

So, where are we currently at? I think we're in the first part of that first pump. Even though BTC.D is up, there are a large amount of altcoins that are performing very very well. AI coins, ETH derivs, metaverse, etc are all doing great. Most coins are up 2x+ from the lows.

But liquidity is still fragmented and $ is not going to go everywhere. I think it's really important to choose which token you are going to trade/invest in. Don't hold a $TOMO long while other shitcoins pop 4x.

So if we're in the first part of the cycle, we should probably be expecting a cooling period soon. Note, this is alt/btc I'm mostly talking about, or the fact that btc is probably going to outperform the majority of altcoins. Sure, there are going to be many that outperform btc..

but you have to find those altcoins overall.

Cooling period would likely entail altcoins chopping/consolidating for a month and chilling out. Then we see a second run in March or April and then unsure after that.

Cooling period would likely entail altcoins chopping/consolidating for a month and chilling out. Then we see a second run in March or April and then unsure after that.

Why are there some reasons why this entire thesis/idea might be wrong?

-Different macro environment

-So many rekt alts compared to 2 years ago that they'll just continue up

-Lots of leverage wiped from system, not as many sellers left

-Much more Alt/USD pairs than before

-Different macro environment

-So many rekt alts compared to 2 years ago that they'll just continue up

-Lots of leverage wiped from system, not as many sellers left

-Much more Alt/USD pairs than before

Overall, my current plan is to continue to actively trade altcoins and will adjust as the charts do- if we see a steep pullback then I'll assume everything is going to cool for a while. With that said, there are still going to be lagging alts that haven't gone yet

If we do see a cooling period, I'm not going to assume it's all over....if they form large lows on a macro level and chop for a few weeks, that's actually quite healthy and I will assume a springtime pump is going to come at that time. I will be looking for laggers + narratives.

Always have a plan, though. It's also possible that macro shits the bed and then we see a huge run down later and it's just over for a while. I'm perfectly open to that idea and will just sell everything in that case and go back into chill mode for a while. Good luck.

• • •

Missing some Tweet in this thread? You can try to

force a refresh