Look, the tabloid responses are easy. And no-one likes the pain caused by rate rises. But here's the thing:

1. Inflation, left to spiral, will destroy our standard of living.

2. Higher rates, temporarily, beat higher prices, permanently

3. Of course it's painful.

1/n

1. Inflation, left to spiral, will destroy our standard of living.

2. Higher rates, temporarily, beat higher prices, permanently

3. Of course it's painful.

1/n

4. It's also unfair that the burden falls where it does

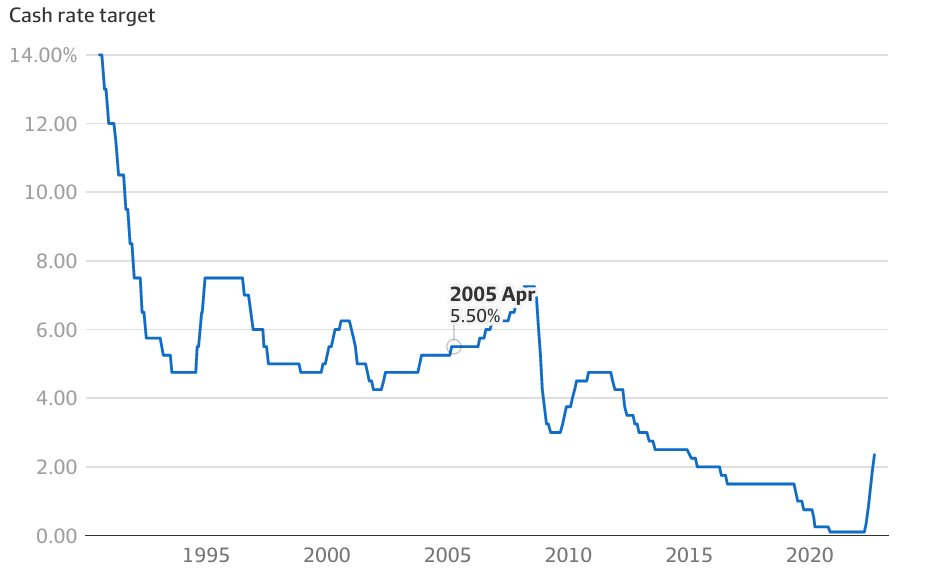

5. The RBA has few other options: either high inflation or high rates

6. The choice is easy (see 1. and 2. above)

2/n

5. The RBA has few other options: either high inflation or high rates

6. The choice is easy (see 1. and 2. above)

2/n

7. 'Avoiding pain' for households is a seductive idea, but it's a non-starter -- the pain is either higher prices or higher rates. There's no Door #3.

8. Parliaments can do more. They should do more. But in the meantime, the RBA has no other options.

3/n

8. Parliaments can do more. They should do more. But in the meantime, the RBA has no other options.

3/n

9. The time for Parliament to do more was last year, and 5 years ago and 10 years ago. The second best time is now (but they'll squib it, mostly due to politics).

10. The RBA has clearly told us what they'll do, and why. But we keep spending. Don't blame the RBA

4/n

10. The RBA has clearly told us what they'll do, and why. But we keep spending. Don't blame the RBA

4/n

11. The final rate rise, whenever it comes, will be one (or more) too many, almost by definition. That's just life. Perfection doesn't exist.

12. The best thing for the economy is for the Opposition (of whatever stripe) to join a unity ticket for better economic policy

5/n

12. The best thing for the economy is for the Opposition (of whatever stripe) to join a unity ticket for better economic policy

5/n

13. Pigs might fly.

That's it. That's the lot.

But remember, the RBA can choose higher prices or higher rates. There's no magic alternative universe.

6/6

#rba #interestrates #ausbiz

That's it. That's the lot.

But remember, the RBA can choose higher prices or higher rates. There's no magic alternative universe.

6/6

#rba #interestrates #ausbiz

• • •

Missing some Tweet in this thread? You can try to

force a refresh