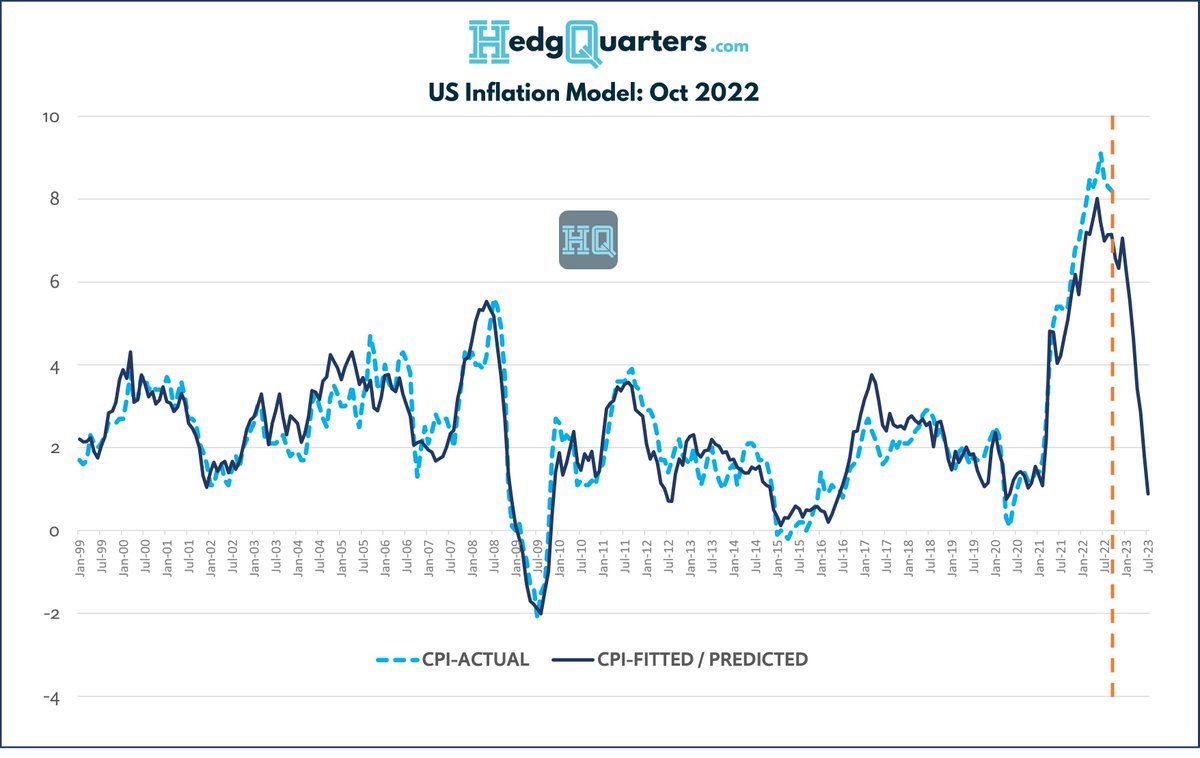

Have #Fed rate hikes led to the slowdown in #inflation we've seen so far?

That's the conventional wisdom anyway. BUT, the San Francisco Fed's own index actually says "NO"!

Why & implications. A thread...

#macro #Stocks #SPX $QQQ

1/8

That's the conventional wisdom anyway. BUT, the San Francisco Fed's own index actually says "NO"!

Why & implications. A thread...

#macro #Stocks #SPX $QQQ

1/8

2/8

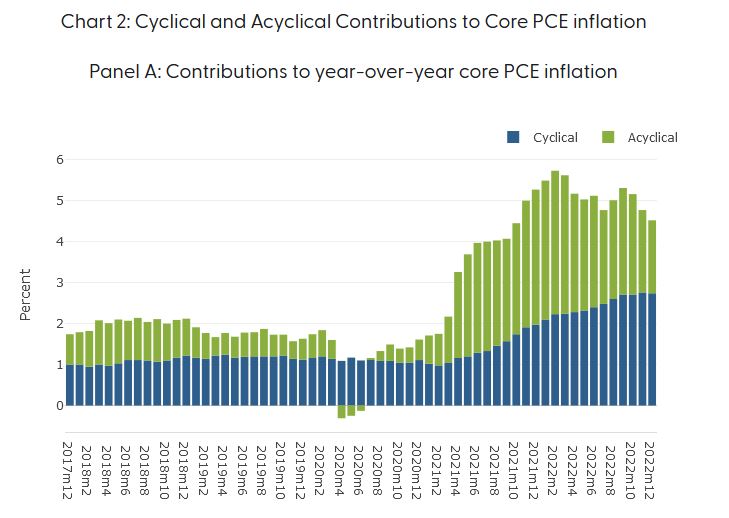

This chart (YoY before & MoM below) breaks out Core PCE #inflation into cyclical & Acyclical components

Cyclical are those influenced by the eco cycle, Acyclical are those that have had a statistically insignificant relationship w/ past cycles

Cyclical inflation...

This chart (YoY before & MoM below) breaks out Core PCE #inflation into cyclical & Acyclical components

Cyclical are those influenced by the eco cycle, Acyclical are those that have had a statistically insignificant relationship w/ past cycles

Cyclical inflation...

3/8

hasn't declined yet - at least on YoY basis with MoM measures only recently starting to cool. The real cooling so far has been in the Acyclical parts!

This is because, if you look at what heated up first and to the greatest extent in the first chart, it was typically...

hasn't declined yet - at least on YoY basis with MoM measures only recently starting to cool. The real cooling so far has been in the Acyclical parts!

This is because, if you look at what heated up first and to the greatest extent in the first chart, it was typically...

4/8 non-cyclical price drivers that accelerated in '21. As world economies reopened synchronously, shortages in production were felt everywhere & prices that are typically more stable rose rapidly

Cyclical prices followed with a lag - an unusual cycle that is still surprising

Cyclical prices followed with a lag - an unusual cycle that is still surprising

5/8 As production has caught up with demand, those Acyclical components that are well elevated vs prior cycles have cooled first. Supply chain normalization

Cyclical prices are only just now starting to see the lagged effect of hikes after 12mths.

This is rate lags in action

Cyclical prices are only just now starting to see the lagged effect of hikes after 12mths.

This is rate lags in action

6/8 Remember as well as you look at this chart again, that this is CORE PCE inflation with Food and energy removed.

So rate hikes that have already been conducted will likely start to influence cyclical components from here. But with the China re-opening, just like the green...

So rate hikes that have already been conducted will likely start to influence cyclical components from here. But with the China re-opening, just like the green...

7/8 bars rebounded in Aug/Sep '22, will we see another temporary hump in Acyclical prices again in '23?

With everyone just watching oil & commods mainly, this is something off the radar screen to watch for that can slow the glide path down this year!

Link following:

With everyone just watching oil & commods mainly, this is something off the radar screen to watch for that can slow the glide path down this year!

Link following:

• • •

Missing some Tweet in this thread? You can try to

force a refresh