@LynAldenContact suggests Taylor Rule implies 10.2% FFR citing @stlouisfed FRED (#Fed).

Is 10.2% really what Taylor rule suggests the FFR should be currently at?

A thread.

1/13

Is 10.2% really what Taylor rule suggests the FFR should be currently at?

A thread.

1/13

https://twitter.com/LynAldenContact/status/1627026513077108737

Taylor Rule:

FFR = R* + 0.5 (GDP est - potential GDP) + 0.5 (inflation est - 2)

R* - natural interest rate (estimates vary from 2-2.5%); IOW FFR which is neither expansive nor restrictive

#Fed's Dec projections:

GDP est - 0.5%

Potential GDP - 1.8%

Inflation est - 3.1%

2/13

FFR = R* + 0.5 (GDP est - potential GDP) + 0.5 (inflation est - 2)

R* - natural interest rate (estimates vary from 2-2.5%); IOW FFR which is neither expansive nor restrictive

#Fed's Dec projections:

GDP est - 0.5%

Potential GDP - 1.8%

Inflation est - 3.1%

2/13

Assuming higher bound of the R* estimates, and #Fed's Dec SEP projections Taylor rule implies:

FFR = 2.4%

This is about 220 bps BELOW the current FFR!

And almost 800 bps BELOW that 10.2% @LynAldenContact quoted.

3/13

FFR = 2.4%

This is about 220 bps BELOW the current FFR!

And almost 800 bps BELOW that 10.2% @LynAldenContact quoted.

3/13

Those who follow me regularly know I've been calling for the #Fed to pause hikes back in Sep.

FFR before the Sep meeting was 2.25%-2.5% which is exactly what the #Fed's projection now suggest using the Taylor Rule.

Now the obvious Q is are the #Fed's projections correct?

4/13

FFR before the Sep meeting was 2.25%-2.5% which is exactly what the #Fed's projection now suggest using the Taylor Rule.

Now the obvious Q is are the #Fed's projections correct?

4/13

At July's meeting #Fed Chair Powell talked about R* of 2.25%.

Some have suggested R* is (a bit) higher than that.

I think there is a probability R* actually moved lower in the meantime given they hiked in Sep and beyond with #disinflation, overdoing it by 225 bps.

5/13

Some have suggested R* is (a bit) higher than that.

I think there is a probability R* actually moved lower in the meantime given they hiked in Sep and beyond with #disinflation, overdoing it by 225 bps.

5/13

For the sake of this analysis, let's assume R* is at 2.25%, and take latest prints of both #GDP and #inflation.

There is a high probability #GDP will be lower in 2023 and even the #Fed agrees with that.

So 2022 #GDP of 2.1% is likely an overestimate but I'll use it here.

6/13

There is a high probability #GDP will be lower in 2023 and even the #Fed agrees with that.

So 2022 #GDP of 2.1% is likely an overestimate but I'll use it here.

6/13

Also potential #GDP is likely higher than just 1.8% suggested by the #Fed's projections from Dec.

Average post WWII-era #GDP (1947-2022) was much higher at 3.1% which will be my potential #GDP figure.

7/13

Average post WWII-era #GDP (1947-2022) was much higher at 3.1% which will be my potential #GDP figure.

7/13

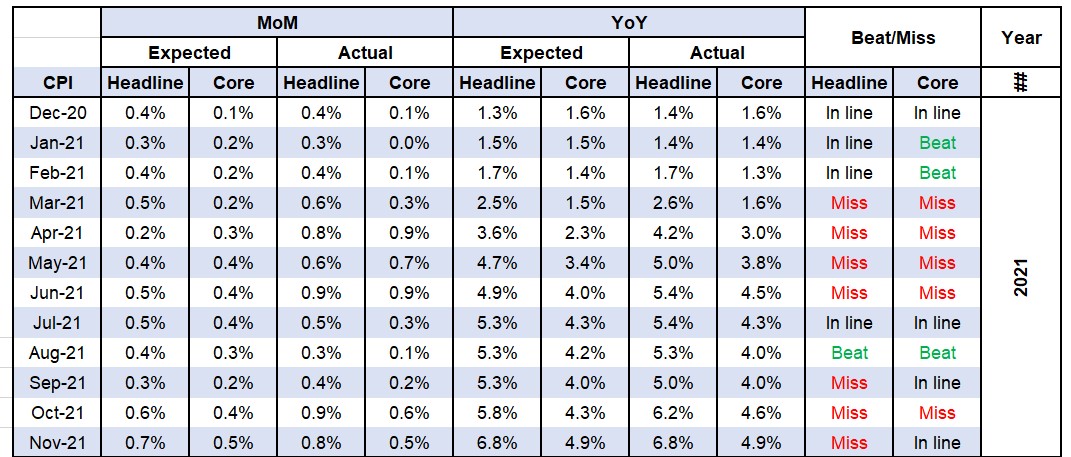

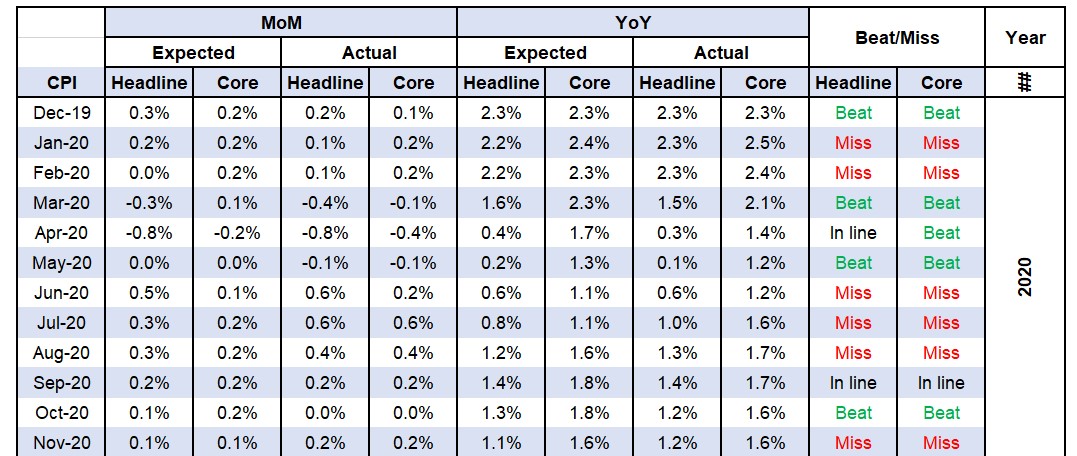

For #inflation I'll use the raw #CPI data (unadjusted 3MMA, annualized) which is currently at 1.6% in Jan.

8/13

https://twitter.com/MBjegovic/status/1625591926790492160?s=20

8/13

Since the #Fed doesn't target 2% #CPI, I'll use the (unadjusted) #CPI LT avg so Taylor Rule will be:

FFR = R* + 0.5 (2022 GDP - potential GDP) + 0.5 (Jan CPI - 3.3)

With all the mentioned inputs we get to FFR of only 0.9% using the Taylor Rule.

9/13

FFR = R* + 0.5 (2022 GDP - potential GDP) + 0.5 (Jan CPI - 3.3)

With all the mentioned inputs we get to FFR of only 0.9% using the Taylor Rule.

https://twitter.com/MBjegovic/status/1625591930494099456?s=20

9/13

To recap, with the #Fed's latest (Dec) projections FFR should be at 2.4% using the Taylor Rule.

With latest inputs FFR using the Taylor Rule should be even lower at 0.9%!

So 10.2% quoted by @LynAldenContact is an incorrect Taylor Rule number.

10/13

With latest inputs FFR using the Taylor Rule should be even lower at 0.9%!

So 10.2% quoted by @LynAldenContact is an incorrect Taylor Rule number.

10/13

Now we come to the crucial Q - how will the #Fed react to the latest #inflation developments?

When will they pause and finally cut rates?

Much of this will, of course, depend on the #inflation going forward.

So where is #inflation going in 2023?

11/13

When will they pause and finally cut rates?

Much of this will, of course, depend on the #inflation going forward.

So where is #inflation going in 2023?

11/13

These threads take a lot of time and effort to write.

If you like the content, please love and retweet to help me spread the message.

12/13

If you like the content, please love and retweet to help me spread the message.

12/13

I made an overview of #inflation moving forward and what will the #Fed do about it in my latest workshop.

If interested in getting a recording, message me.

13/13

If interested in getting a recording, message me.

https://twitter.com/MBjegovic/status/1623467108527906816?s=20

13/13

*Correction:

FFR = R* + Jan CPI + 0.5 (2022 GDP - potential GDP) + 0.5 (Jan CPI - 3.3)

which gives 2.5% FFR using the Taylor Rule.

This is still a lot lower than where 4.5%-4.75% currently, and a whole lot lower than the originally mentioned 10.2%.

H/T @powpowpaws

FFR = R* + Jan CPI + 0.5 (2022 GDP - potential GDP) + 0.5 (Jan CPI - 3.3)

which gives 2.5% FFR using the Taylor Rule.

This is still a lot lower than where 4.5%-4.75% currently, and a whole lot lower than the originally mentioned 10.2%.

H/T @powpowpaws

*Correction

FFR = R* + current inflation + 0.5 (GDP est - potential GDP) + 0.5 (inflation est - 2)

Using #Fed's preferred measure (PCE) current #inflation is 2.1% (3MMA annualized in Dec).

FFR = R* + current inflation + 0.5 (GDP est - potential GDP) + 0.5 (inflation est - 2)

Using #Fed's preferred measure (PCE) current #inflation is 2.1% (3MMA annualized in Dec).

@LynAldenContact *Correction:

Assuming higher bound of the R* estimates, the current PCE and the #Fed's Dec SEP projections Taylor rule implies:

FFR = 4.5%

which is exactly where the current FFR is and almost 600 bps BELOW the 10.2% originally.

Assuming higher bound of the R* estimates, the current PCE and the #Fed's Dec SEP projections Taylor rule implies:

FFR = 4.5%

which is exactly where the current FFR is and almost 600 bps BELOW the 10.2% originally.

@LynAldenContact *Correction

Taylor Rule using the Fed's estimates is 4.5% while the latest inputs give FFR of only 2.5%.

Taylor Rule using the Fed's estimates is 4.5% while the latest inputs give FFR of only 2.5%.

• • •

Missing some Tweet in this thread? You can try to

force a refresh