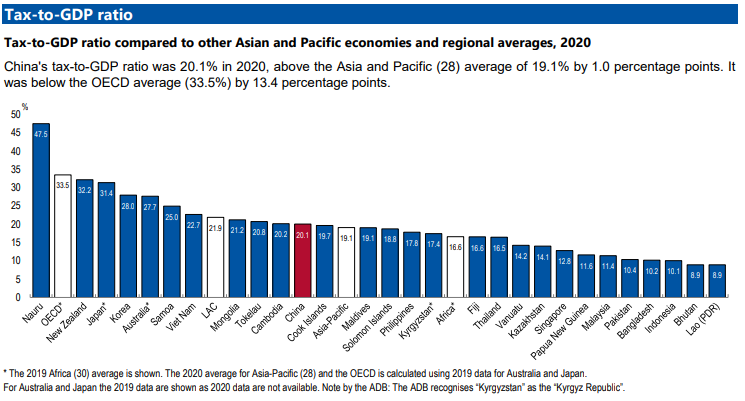

#UncommonSense ..... India has already become an #OVER #TAXED #ECONOMY on the #Consumer considering how such few people pay Income tax, poor people pay GST while Corporates pay very litte.

Combined Center & State Tax to GDP over 18%!! Compare that to China (Next tweet)

Combined Center & State Tax to GDP over 18%!! Compare that to China (Next tweet)

KEY difference b/n India and China is that, in China, 1/4th of the 20% tax goes towards Social Security Contributions (EPF, PF, Insurance, ELSS etc) which in India is termed as Savings and NOT Tax.

Effectively China Tax2GDP is 15% vs 18% in India.

Another Diff (Next Twt)

Effectively China Tax2GDP is 15% vs 18% in India.

Another Diff (Next Twt)

Another key Difference in China is that Personal Income tax (including Capital Gains) is just 1.1% of GDP while Corporate Income Tax (including CG) is 4.2% of GDP (400% of Personal Income Tax Collections).

In India Personal Income tax is => Corporate Income Tax Collections

In India Personal Income tax is => Corporate Income Tax Collections

Which is one of the big reasons why it's becoming OBVIOUS that India is turning out to be a HIGH TAX ECONOMY for hard working INDIVIDUALS while Corporates (and smart Businessmen) benefit with lower taxes.

Like China, Tide needs to turn to Tax Corporates More than Individuals

Like China, Tide needs to turn to Tax Corporates More than Individuals

If you found this interesting, please comment and also #RETWEET

• • •

Missing some Tweet in this thread? You can try to

force a refresh