Is #Base merely ordinary exchange chains for Coinbase?

1)

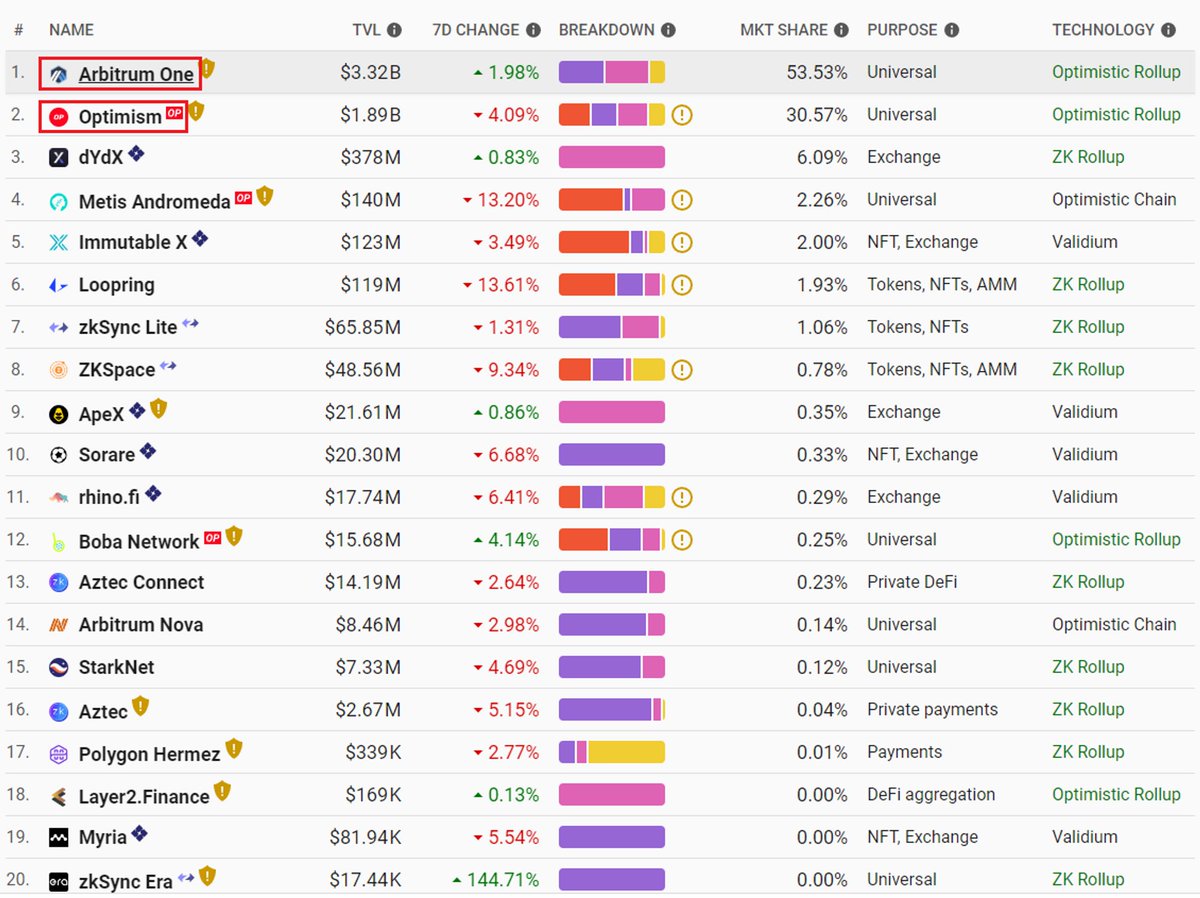

The L2 project for Ethereum is one of the hottest topics right now. L2 projects started to emerge as a solution to overcome Ethereum's issue with its scalability limit and the high gas cost that resulted from it.

1)

The L2 project for Ethereum is one of the hottest topics right now. L2 projects started to emerge as a solution to overcome Ethereum's issue with its scalability limit and the high gas cost that resulted from it.

2)

With Ethereum's help, L2 has begun to steadily advance. The temporary Ethereum gas cost explosion is still present, but the current Tx of L2 is steadily increasing, reversing the average TPS, and demonstrating the outcome of sharing the burden of Ethereum's Tx processing.

With Ethereum's help, L2 has begun to steadily advance. The temporary Ethereum gas cost explosion is still present, but the current Tx of L2 is steadily increasing, reversing the average TPS, and demonstrating the outcome of sharing the burden of Ethereum's Tx processing.

3)

In this instance, Coinbase introduced an L2, #Base. Coinbase adopted a distinctive strategy.

They facilitated Web 3.0 onboarding of users focused on Coinbase customers within the Ethereum ecosystem by acknowledging Ethereum and using the #OPstack to quickly build an L2.

In this instance, Coinbase introduced an L2, #Base. Coinbase adopted a distinctive strategy.

They facilitated Web 3.0 onboarding of users focused on Coinbase customers within the Ethereum ecosystem by acknowledging Ethereum and using the #OPstack to quickly build an L2.

4)

Despite it was stated that no coins would be issued, the contentious debate over whether the tokens were securities may have indirectly influenced Coinbase's decision to move to L2.

(A native token is not always necessary for L2)

Despite it was stated that no coins would be issued, the contentious debate over whether the tokens were securities may have indirectly influenced Coinbase's decision to move to L2.

(A native token is not always necessary for L2)

5)

As a result, #Optimism, the technical basis of the OP stack, will have a wider application, strengthening Ethereum's position.

The involvement of new competitors will cause the competition among L2 projects to seriously increase.

As a result, #Optimism, the technical basis of the OP stack, will have a wider application, strengthening Ethereum's position.

The involvement of new competitors will cause the competition among L2 projects to seriously increase.

6)

On the other hand, because a suitable ecosystem has not been established, some chains will be relatively unselected.

Cases like the "Boba network," which deviate slightly from the L2 revival flow as a whole, were ones that we were able to observe.

On the other hand, because a suitable ecosystem has not been established, some chains will be relatively unselected.

Cases like the "Boba network," which deviate slightly from the L2 revival flow as a whole, were ones that we were able to observe.

7)

The future of #Base is not doomed in that regard.

In order to advance the ecosystem, Coinbase is announcing the 'Base Ecosystem Fund'.

The community is already growing quickly. All competitors who take a different route than L2 will have a lot of difficulty because of it.

The future of #Base is not doomed in that regard.

In order to advance the ecosystem, Coinbase is announcing the 'Base Ecosystem Fund'.

The community is already growing quickly. All competitors who take a different route than L2 will have a lot of difficulty because of it.

• • •

Missing some Tweet in this thread? You can try to

force a refresh