Everyone is talking about @RamsesExchange !

What is it and why does it make noise ??

Let’s dive into it !

THREAD 🧵🧵🧵

What is it and why does it make noise ??

Let’s dive into it !

THREAD 🧵🧵🧵

What is @RamsesExchange ?

RAMSES is a ve(3,3) DEX.

If you don’t know what is a ve(3, 3) I encourage you to read this article from @AndreCronje_dev :

andrecronje.medium.com/ve-3-3-44466ea…

RAMSES is a ve(3,3) DEX.

If you don’t know what is a ve(3, 3) I encourage you to read this article from @AndreCronje_dev :

andrecronje.medium.com/ve-3-3-44466ea…

The important point here is that the $veRAM holder are protected against Token inflation.

Example: If inflation increases by 10% then your position ( $veRAM ) also increases by 10%.

$veRAM is the vested token $RAM, the token of the protocol.

Example: If inflation increases by 10% then your position ( $veRAM ) also increases by 10%.

$veRAM is the vested token $RAM, the token of the protocol.

Like all ve(3, 3) DEX @RamsesExchange propose several features:

- Swaps

- Voting

- Bribing

- Vesting (veNFT)

- LP staking

- Swaps

- Voting

- Bribing

- Vesting (veNFT)

- LP staking

Just like @CamelotDEX , @RamsesExchange offers a Dual AMM:

- Volatile swaps: x*y = k (Uniswap V2)

- Stables swaps : x3y + y3x > k (Curve)

- Volatile swaps: x*y = k (Uniswap V2)

- Stables swaps : x3y + y3x > k (Curve)

The main purpose of the $veRAM NFT is to direct emissions to LP token pairs.

This is achieved through voting for the pair. Emissions are distributed proportionally to the total percentage of votes in the epoch.

This is achieved through voting for the pair. Emissions are distributed proportionally to the total percentage of votes in the epoch.

A core feature of the ve(3,3) DEX model is bribing. There are two types of bribes within the system:

- Users/Protocols can bribe voters to direct emissions to specific token pairs, and in return receive a proportional distribution of the bribes.

- Users/Protocols can bribe voters to direct emissions to specific token pairs, and in return receive a proportional distribution of the bribes.

- Gauge Bribes - Similarly to emissions, tokens can be bribed directly to LP stakers to incentivize liquidity growth of the targeted pair. This is mainly useful for protocols who want to bootstrap liquidity efficiently on the @RamsesExchange AMM.

You can stake your $RAM to get $veRAM and earn fees generated by the protocol.

100 % of fees goes to $veRAM holders !

Liquidity providers do not earn swap fees !

Instead, staking gauges are implemented to incentivize users to provide LP tokens to earn attractive APRs.

100 % of fees goes to $veRAM holders !

Liquidity providers do not earn swap fees !

Instead, staking gauges are implemented to incentivize users to provide LP tokens to earn attractive APRs.

The Ramses Bazaar :

@RamsesExchange Bazaar is the RAMSES's Native veNFT Marketplace.

The RAMSES Bazaar will be an easy way for users to list, trade, and purchase $veRAM positions denominated in $ETH. It will be the first big DEX doing that !

@RamsesExchange Bazaar is the RAMSES's Native veNFT Marketplace.

The RAMSES Bazaar will be an easy way for users to list, trade, and purchase $veRAM positions denominated in $ETH. It will be the first big DEX doing that !

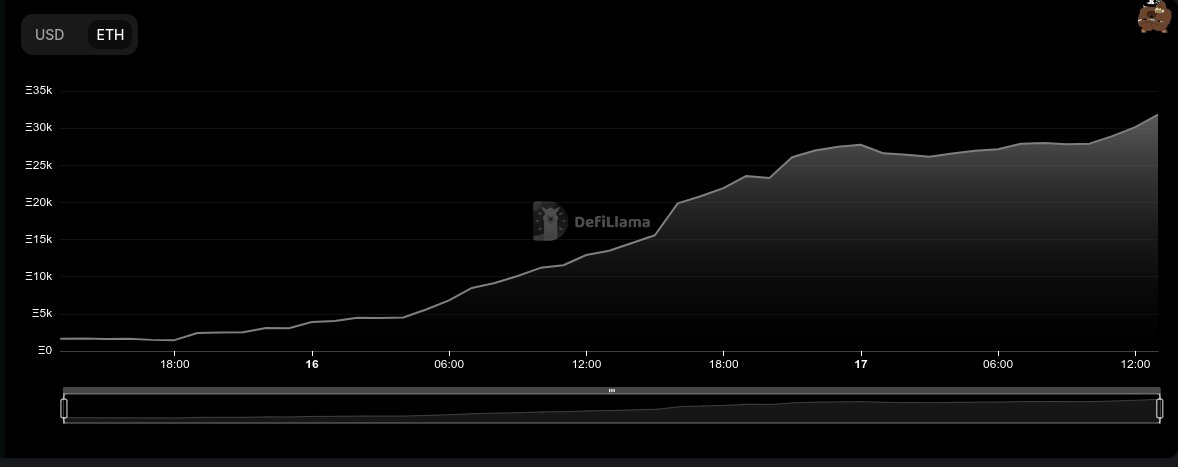

TVL is at $50M as of this writing.

Within days it became #Arbitrum 12th largest protocol ! It's just amazing !

Within days it became #Arbitrum 12th largest protocol ! It's just amazing !

Personally, I can't wait to see how this protocol will evolve, I'm very optimistic.

Especially since the timing is perfect as it will most likely benefit from the upcoming Arbitrum #airdrop.

Especially since the timing is perfect as it will most likely benefit from the upcoming Arbitrum #airdrop.

Please note, I am optimistic about the protocol because I find it very fair and very innovative, but that does not mean that the Token will go to the moon !

Dilution is still very important so be careful or if you want to hold for the long term, switch to $veRAM because you are protected against dilution.

Especially with their next marketplace, it will most likely be easy to sell the $veNFT tokens which for me is more likely to increase in value than the $RAM token.

I hope you enjoyed it, don't hesitate to let me know in the comments, without forgetting to like and RT the first tweet of the thread!

Be strong 💪

#Cryptocurency #DEX #Ramses #Arbitrum #RealYield #Tokenomics #blockchain #project #fees #earning

Be strong 💪

#Cryptocurency #DEX #Ramses #Arbitrum #RealYield #Tokenomics #blockchain #project #fees #earning

• • •

Missing some Tweet in this thread? You can try to

force a refresh