I did a first THREAD to present the @pendle_fi protocol to achieve level 2 comprehension.

I complete this THREAD (to level 4) by finishing the presentation of this wonderful protocol !

Let's dive into it !

THREAD PART 2 🧵🧵🧵

I complete this THREAD (to level 4) by finishing the presentation of this wonderful protocol !

Let's dive into it !

THREAD PART 2 🧵🧵🧵

In the last THREAD I talked about:

- #Yield Tokenisation

- PT (Principal #Token) Strategy

In this THREAD we’ll talk about :

- YT (Yield Token) Strategy

- Yield Trading

- #Yield Tokenisation

- PT (Principal #Token) Strategy

In this THREAD we’ll talk about :

- YT (Yield Token) Strategy

- Yield Trading

On the same principle of the previous THREAD, I will try to be as simple as possible and will put a lot of examples to facilitate understanding.

Let’s GO !! 🔥🔥

Let’s GO !! 🔥🔥

Yield Tokens (YT) are traded on the @pendle_fi AMM in the same pool as Principal Tokens (PT).

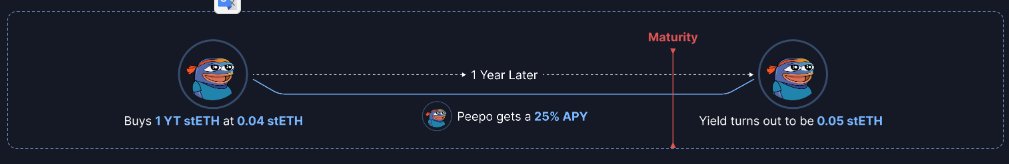

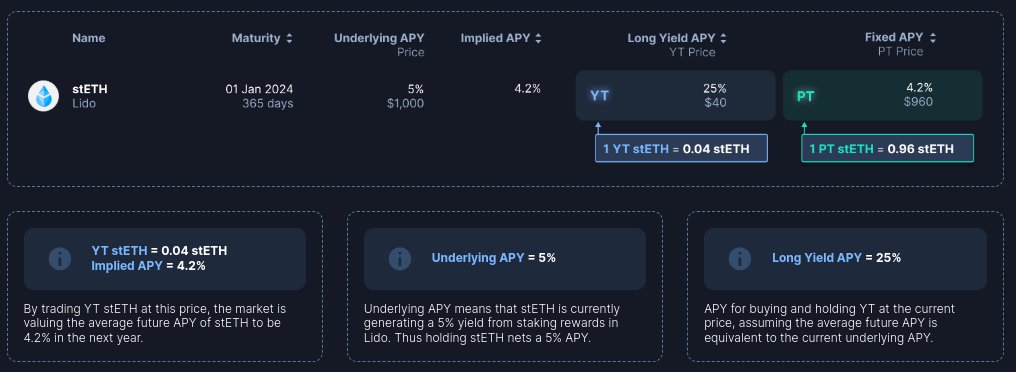

Let's say 1 YT $stETH is trading at 0.04 $stETH, with a maturity in 1 year.

Holding 1 YT $stETH gives you the right to receive the yield on 1 $stETH until maturity.

Let's say 1 YT $stETH is trading at 0.04 $stETH, with a maturity in 1 year.

Holding 1 YT $stETH gives you the right to receive the yield on 1 $stETH until maturity.

Peepo thinks that 1 $stETH will generate more than 0.04 stETH yield in 1 year (equivalent to 4% APY), and chooses to buy 1 YT $stETH.

Suppose that Peepo would have kept 0.04 $stETH, after 1 year he would therefore have 0.04 $stETH + 0.002 $stETH (assumes 5% @LidoFinance staking).

By buying 1 YT $stETH Peepo ends up with 0.05 stETH, so he is more profitable.

Buying and holding YT = longing yield

By buying 1 YT $stETH Peepo ends up with 0.05 stETH, so he is more profitable.

Buying and holding YT = longing yield

When should you long yield and buy YT?

If you think the average future APY will be higher than the current Implied APY (the APY that the market is implying), then longing yield is a sound strategy.

If you think the average future APY will be higher than the current Implied APY (the APY that the market is implying), then longing yield is a sound strategy.

It is important that you understand these two points:

- If Implied APY is low compared to Underlying APY, then you are more likely to profit from buying YT.

- If Implied APY is high compared to Underlying APY, then you are less likely to profit from buying YT.

- If Implied APY is low compared to Underlying APY, then you are more likely to profit from buying YT.

- If Implied APY is high compared to Underlying APY, then you are less likely to profit from buying YT.

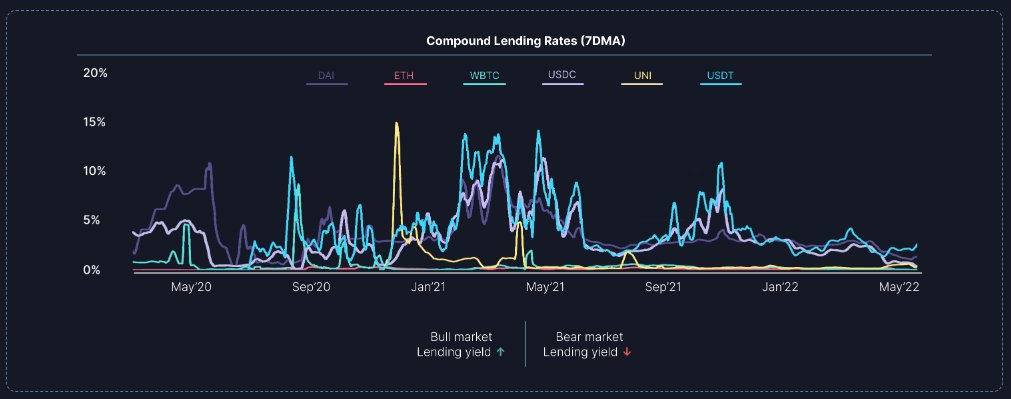

So the important point is to be able to predict the future APY? But how to do that?

It’s not easy because many other factors can influence the future yield, such as market sentiment or changes to the yield generating mechanism of the underlying protocol.

It’s not easy because many other factors can influence the future yield, such as market sentiment or changes to the yield generating mechanism of the underlying protocol.

In a bull market, there are more requests, so borrowers pay more fees and therefore lenders earn more (higher APY).

In the bear market it is the opposite, the borrowers pay less fees because fewer requests and therefore the lenders earn less fees (lower APY).

In the bear market it is the opposite, the borrowers pay less fees because fewer requests and therefore the lenders earn less fees (lower APY).

Let's see a complete example to make it easier to understand.

Let's say that there is a $stETH pool in Pendle with a maturity of 1 year. That means the holder of YT $stETH has the right to collect stETH yield for the next 1 year.

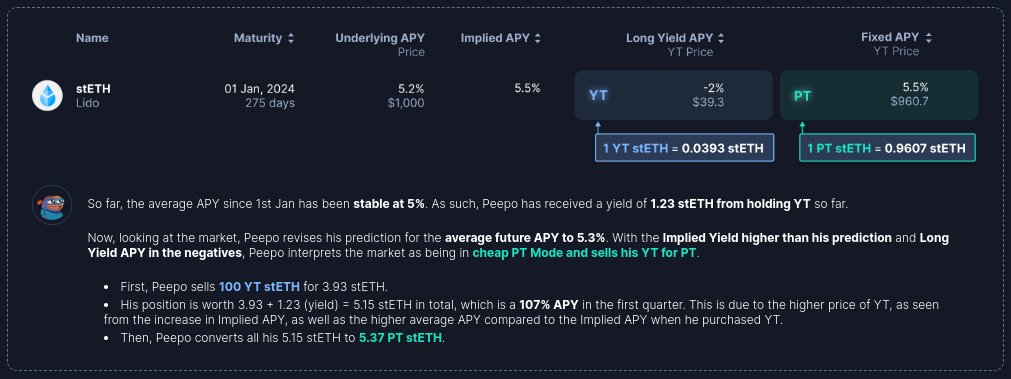

Peepo sees the following information :

Let's say that there is a $stETH pool in Pendle with a maturity of 1 year. That means the holder of YT $stETH has the right to collect stETH yield for the next 1 year.

Peepo sees the following information :

Peepo predicts that the average future APY of $stETH will remain above 5%, meaning that the current Implied APY of 4.2% is a bargain.

Peepo chooses to buy 100 YT $stETH (= 4 $stETH), knowing that if the average future APY remains at the current underlying APY (which is a possible assumption), he will receive 5 $stETH worth of yield, netting a 25% APY.

Compared to simply holding $stETH, which would receive the displayed 5.5% APY, Peepo receives more than 6x of that APY by holding YT stETH instead.

However, it is important to note that, as with most investments, higher rewards comes with higher risks.

In this example, let's say that this year Lido would have given 3% APY instead of 5% then Peepo would have generated 3 $stETH, so he would have lost 1 $stETH.

In this example, let's say that this year Lido would have given 3% APY instead of 5% then Peepo would have generated 3 $stETH, so he would have lost 1 $stETH.

Even when you buy YT at a positive Long Yield APY when Implied APY < Underlying APY, the average future APY could drop lower than the Implied APY of your trade and you will have a loss.

So be very carreful, because your P/L will depend on yield sustaining, increasing or decreasin

So be very carreful, because your P/L will depend on yield sustaining, increasing or decreasin

If you understood everything I said above and everything I said in this THREAD:

so you are now at level 3.

Let's start level 4! 🔥🔥🔥

https://twitter.com/ed_Nuward/status/1637217113248079872?s=20

so you are now at level 3.

Let's start level 4! 🔥🔥🔥

So you have two possibilities depending on the evolution of the Yield:

- short Yield (hold PT)

- long Yield (hold YT)

- short Yield (hold PT)

- long Yield (hold YT)

Since yields in DeFi are constantly fluctuating, Implied APY on Pendle markets also fluctuates.

As Implied APY fluctuates, the market will swing between two modes:

As Implied APY fluctuates, the market will swing between two modes:

To identify the strategy to adopt, it is therefore essential to estimate an average future Yield, based on this estimate we can choose which strategy to adopt.

Let’s see a big exemple :

Suppose it is 1 Jan 2023, and there is an $stETH market on Pendle with a 1 year maturity period (1 Jan 2024).

On 1 Jan 2023 (1 year till maturity):

Suppose it is 1 Jan 2023, and there is an $stETH market on Pendle with a 1 year maturity period (1 Jan 2024).

On 1 Jan 2023 (1 year till maturity):

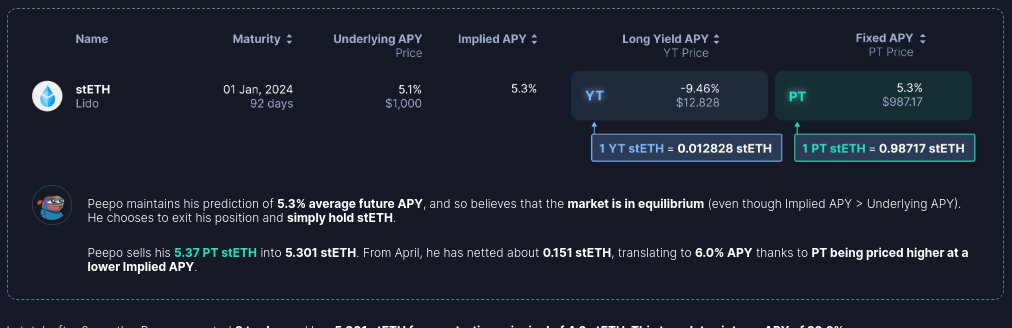

In total, after 9 months, Peepo executed 3 trades and has 5.301 $stETH from a starting principal of 4.3 $stETH. This translates into an APY of 32.2%.

In this example Peepo came out a winner but he could also very well have come out a loser if he hadn't made the right decisions.

In this example Peepo came out a winner but he could also very well have come out a loser if he hadn't made the right decisions.

If you understood everything I wrote above then you are at level 4.

I hope this THREAD has been clear, I will discuss in a future THREAD more details on the protocol (fees, revenue, Lps, …) and in particular the tokenomics.

I hope this THREAD has been clear, I will discuss in a future THREAD more details on the protocol (fees, revenue, Lps, …) and in particular the tokenomics.

I invite you to complete this THREAD with these THREADS from the master: @DeFi_Made_Here

https://twitter.com/DeFi_Made_Here/status/1628771658361196544?s=20

https://twitter.com/DeFi_Made_Here/status/1630939275662446592?s=20

https://twitter.com/DeFi_Made_Here/status/1636773703244562441?s=20

@Crypt0Ricard0 j’espère que tu n’auras pas de traduction à faire cette fois ci ;)

Thanks to @Chinchillah_ who gives me good advices when I bother him in DM :p

Thanks to @Chinchillah_ who gives me good advices when I bother him in DM :p

I hope you enjoyed it, don't hesitate to let me know in the comments, without forgetting to like and RT the first tweet of the thread!

Be strong 💪

#Cryptocurency #DEX #pendle #Arbitrum #RealYield #yield #blockchain #project #fees #earning

Be strong 💪

#Cryptocurency #DEX #pendle #Arbitrum #RealYield #yield #blockchain #project #fees #earning

https://twitter.com/ed_Nuward/status/1637389609544962048?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh