🧵#RepoMarket Explainer and the impact on the #crypto market

In this thread, I'll break down the repo market in simple terms so that anyone can understand it. Plus, I'll explain its importance for #crypto 👇

* Don't forget to like and commend if you learned something

In this thread, I'll break down the repo market in simple terms so that anyone can understand it. Plus, I'll explain its importance for #crypto 👇

* Don't forget to like and commend if you learned something

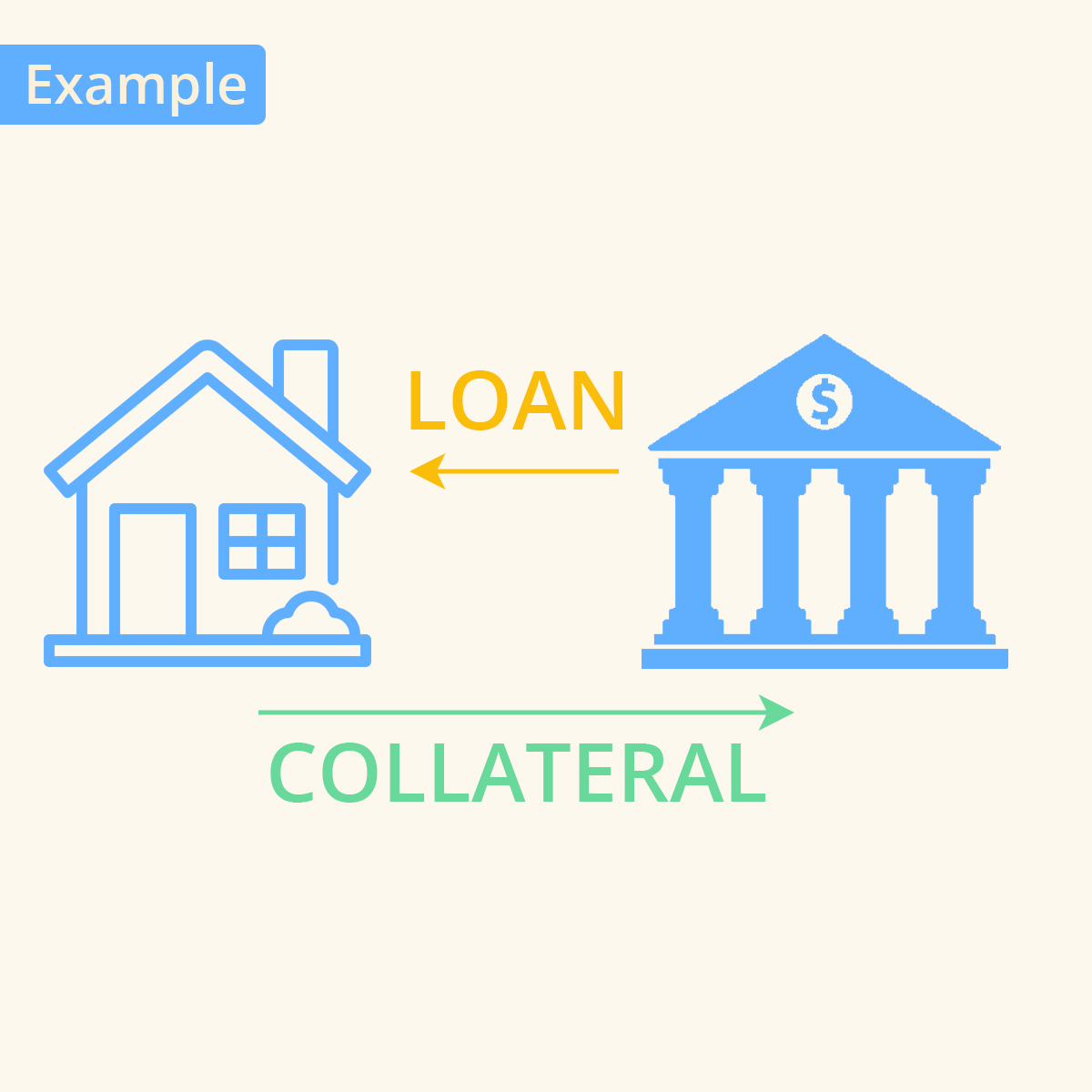

Imagine you need a short-term loan, and you have valuable items to use as collateral. You give the items to a friend, and they lend you the money. After a short period, you return the money plus some interest and get your items back. 🔄

The repo market works similarly. Financial institutions like banks and hedge funds exchange assets, usually government bonds for cash, with an agreement to repurchase the assets at a later date (hence the name "repurchase agreement" or "repo"). ⏳

The repo market is crucial for short-term liquidity – it helps banks and financial institutions meet their daily cash needs. It's like the financial world's ATM, with billions of dollars changing hands every day! 💸

There are two main parties in a repo transaction:

1️⃣ Cash borrower (gives assets as collateral)

2️⃣ Cash lender (provides cash)

The cash lender charges interest on the loan, called the "repo rate." 📈

1️⃣ Cash borrower (gives assets as collateral)

2️⃣ Cash lender (provides cash)

The cash lender charges interest on the loan, called the "repo rate." 📈

Repos can be either bilateral, directly between two parties or cleared through a central counterparty, which minimizes the risk of default. This makes the repo market safer for everyone involved 🛡️

The repo market is sensitive to interest rates and other economic factors. If the repo rate spikes, it can signal a lack of confidence in the financial system or a shortage of cash. Central banks, like the Federal Reserve, monitor and intervene when necessary. 👀

Remember the 2008 financial crisis? The repo market played a role in it. The market froze, causing a liquidity crunch.

In conclusion, the repo market is a vital part of the financial system. It facilitates short-term loans between financial institutions, helping them manage their daily cash needs. It's like a financial dance that keeps the economy moving! 💃🕺

Now, let's talk about the repo market's importance for the crypto market. With the spike in the repo rate, we are seeing that cash lenders are getting it more and more difficult.

Now the US Government stepped in and is helping banks from going bankrupted. With this, they are started printing money again, and lots of it.

But what will this mean for crypto?

With cash becoming more and more worthless, people are starting to search for alternatives, and one of these alternatives is #Bitcoin.

With cash becoming more and more worthless, people are starting to search for alternatives, and one of these alternatives is #Bitcoin.

That's it for my #RepoMarketExplainer! I hope this helped you understand the repo market better and its significance for the crypto market. If you have any questions, leave a comment below and don't forget like the first tweet in this thread!

• • •

Missing some Tweet in this thread? You can try to

force a refresh