Thread on #Bitcoin Dominance and how it relates to #Altcoins. $BTC dominance is super important to understand and I'll also go into alt/btc pairs and why they are selling off.

$BTC.D #Ethereum $ETH $ETHBTC

$BTC.D #Ethereum $ETH $ETHBTC

This thread is partially inspired by a recent one I made in regards to why altcoins aren't moving right now despite BTC going super strong. Check this one out first.

https://twitter.com/AltcoinSherpa/status/1637799040204111872

To start, what is $BTC dominance?

Bitcoin dominance is the total share of BTC marketcap / total crypto marketcap.

So if $BTC MC is 2 trillion and the total #Crypto MC is 4 trillion, BTC.D is 50%

Bitcoin dominance is the total share of BTC marketcap / total crypto marketcap.

So if $BTC MC is 2 trillion and the total #Crypto MC is 4 trillion, BTC.D is 50%

As an altcoin trader/investor (everyone), you want bitcoin dominance to go down.

This means that more $ is flowing to altcoins and alt/btc pairs are going UP (more on this later).

We haven't seen a true altszn since 2021, where everything collectively mooned hard.

This means that more $ is flowing to altcoins and alt/btc pairs are going UP (more on this later).

We haven't seen a true altszn since 2021, where everything collectively mooned hard.

BTC.D chart itself isn't as helpful as it once was; mostly due to dexes and how anyone can spin up tokens + before it was just the cexes that listed them. Plus getting the calculation is probably suspect. But it's still useful IMO.

Different scenarios:

-BTC bull market and btc strong = btc.d UP

-BTC bull market and btc consolidate = btc.d DOWN

-BTC bear market and btc down = btc. DOWN

-BTC bear market and btc consolidate = btc.d DOWN

-BTC bull market and btc strong = btc.d UP

-BTC bull market and btc consolidate = btc.d DOWN

-BTC bear market and btc down = btc. DOWN

-BTC bear market and btc consolidate = btc.d DOWN

There are very few times when alts take the spotlight and these are oftentimes the best time to make $ as a trader. market is fully volatile and up big time and everyone is happy and printing $. I believe we're in the btc bullish cycle for now.

What is an alt/btc pair?

Alt/btc is literally just the altcoin price / bitcoin price.

So if $ETH is worth $100 and $BTC is worth $200, ETHBTC is .50

You can take any altcoin and divide it by bitcoin price and that's your alt/btc value.

Alt/btc is literally just the altcoin price / bitcoin price.

So if $ETH is worth $100 and $BTC is worth $200, ETHBTC is .50

You can take any altcoin and divide it by bitcoin price and that's your alt/btc value.

Alt/btc going down = you would have been better off holding bitcoin.

Alt/btc going up = your altcoin is outperforming bitcoin.

Oftentimes these two charts look very different.

Alt/btc going up = your altcoin is outperforming bitcoin.

Oftentimes these two charts look very different.

It's rare that an altcoin outperforms bitcoin over a long period of time. Alts typically dump or bleed the majority of the time vs. btc but will go through small periods where they rip and greatly outperform. $XRP is a good example of that.

It's why I emphasize that you should never really have long term holds other than BTC or ETH. Long term, altcoins will greatly underperform btc and it's really hard to find the outliers that have true staying power. Chart defi blue chips or other stuff vs. ETH or BTC and its ugly

You might have seen a lot of traders on twitter talk about how they have a lot of #BTC exposure.

That's because btc.d is likely to go up if BTC goes on a big run.

If $BTC runs to 30-45k, BTC.D should go up. and the btc.d chart itself looks very strong.

That's because btc.d is likely to go up if BTC goes on a big run.

If $BTC runs to 30-45k, BTC.D should go up. and the btc.d chart itself looks very strong.

If this scenario happens, then alt/btc goes down and alt/usd probably chop around+consolidate.

Just because btc is ripping does not mean your alts are necessarily going to follow. Check $DOT and $DOTBTC back in the last big run up. The BTC pair died while the USD pair chopped

Just because btc is ripping does not mean your alts are necessarily going to follow. Check $DOT and $DOTBTC back in the last big run up. The BTC pair died while the USD pair chopped

As long as BTC is super strong, alts are not going to really rip. Remember, it's when btc consolidates when alts have a chance to move.

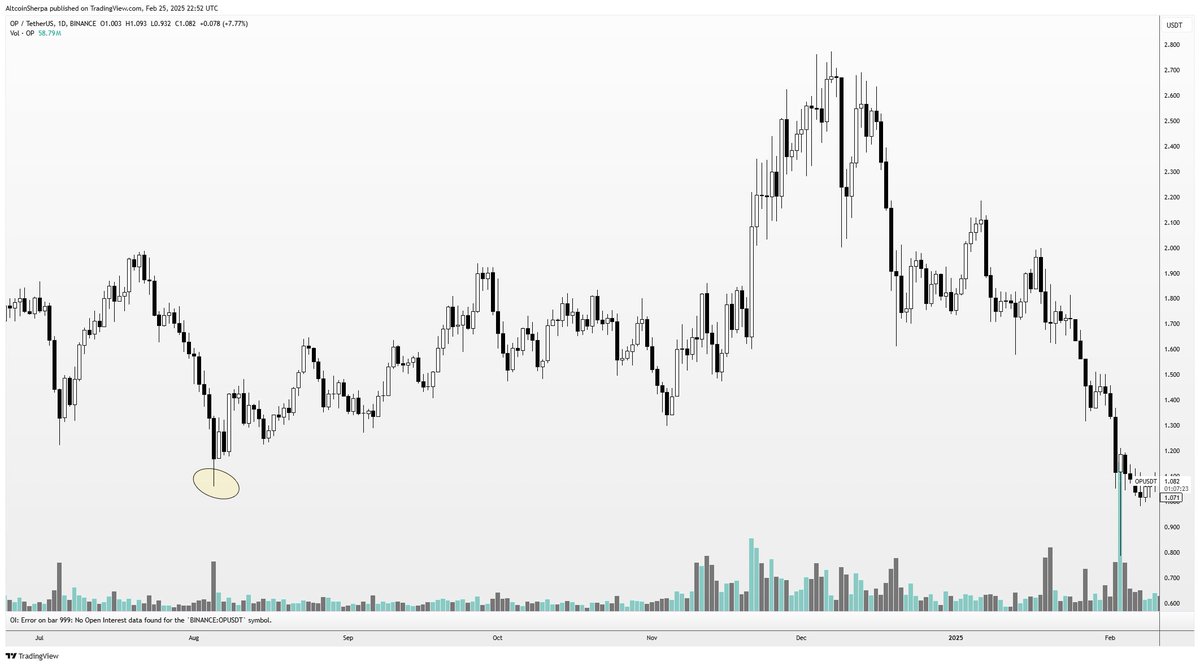

I'm guessing alt/btc pairs still die and sell off for a bit.

$MATIC $SOL $DYDX $LDO

I'm guessing alt/btc pairs still die and sell off for a bit.

$MATIC $SOL $DYDX $LDO

$ETHBTC is usually a good macro indicator in regards to altcoins. And it used to go through fairly predictable cycles, where you saw some pumps/dumps in a fairly consistent manner. I used to flip $ETH to $BTC and vice versa back then using these market cycles.

So, what's the current landscape?

BTC just exited a 9 month range and looks to be on the verge of making the next leg up.

If this happens then alts will not do much. And it makes sense; many alts already went 2-4x+ from the bottom. They likely need time to cool and chop.

BTC just exited a 9 month range and looks to be on the verge of making the next leg up.

If this happens then alts will not do much. And it makes sense; many alts already went 2-4x+ from the bottom. They likely need time to cool and chop.

But when btc starts to chill out, we all know what happens next...

Altseason

Alts full flying and sending and alt/btc pairs doing well.

(To be determined if its going to be like 2021 Jan or pvp like summer 2021 and beyond).

My guess is the latter to be honest.

Altseason

Alts full flying and sending and alt/btc pairs doing well.

(To be determined if its going to be like 2021 Jan or pvp like summer 2021 and beyond).

My guess is the latter to be honest.

My advice to you is to chill out and to relax. You're probably like everyone else and have full exposure to shitcoins and waiting on them to pop.

I'm guessing that alts dont do well for several weeks/months as a whole.

If you want to be active, there are a few ways...

I'm guessing that alts dont do well for several weeks/months as a whole.

If you want to be active, there are a few ways...

1) you can just have BTC and buy a lot of eth at .05. Rotate your BTC there and eth SHOULD outperform btc for a bit and then you can rotate back to btc or cash, depending.

My guess is that eth will eventually outperform btc hard and you can make a lot more btc during this time.

My guess is that eth will eventually outperform btc hard and you can make a lot more btc during this time.

2) Play $ARB ecosystem. ARB itself should take most of the shitcoin volume/liquidity and anything that isn't being traded there should be directed at bitcoin. Nobody is going to buy your shitcoins right now.

https://twitter.com/AltcoinSherpa/status/1637141086702391296

Stay safe and be careful. Don't expect full marketwide pumps for your shitcoins for a bit. But just be patient and wait because good times will come when btc has a chance to cool and consolidate. Good luck.

I miswrote this. It should be:

-BTC bull market and btc strong = btc.d UP

-BTC bull market and btc consolidate = btc.d DOWN

-BTC bear market and btc down = btc.d UP

-BTC bear market and btc consolidate = btc.d UP

-BTC bull market and btc strong = btc.d UP

-BTC bull market and btc consolidate = btc.d DOWN

-BTC bear market and btc down = btc.d UP

-BTC bear market and btc consolidate = btc.d UP

• • •

Missing some Tweet in this thread? You can try to

force a refresh