Keeping Up With Buildoors - ep 4

Spotlight 💡: @tapioca_dao - The un-shilled buildoor

Building the first omni-chain money market and a STABLE stablecoin.

OPTIONS AIRDROP CONFIRMED!

The omni-chain Aave? 🤔🧵⬇️

#DeFi #lending #web3 #Crypto

Spotlight 💡: @tapioca_dao - The un-shilled buildoor

Building the first omni-chain money market and a STABLE stablecoin.

OPTIONS AIRDROP CONFIRMED!

The omni-chain Aave? 🤔🧵⬇️

#DeFi #lending #web3 #Crypto

⚠️ Disclaimer: This is a long a** thread and nothing here is FA, as with other 'keeping up with buildoors' series.

✍️ Guidelines:

💎 what is Tapioca

💎 how the protocol works

💎 current stage of development

💎 tokenomics

💎 bullish points to note

💎 getting positioned

💎 personal opinion

💎 what is Tapioca

💎 how the protocol works

💎 current stage of development

💎 tokenomics

💎 bullish points to note

💎 getting positioned

💎 personal opinion

In the world of finance today, the availability of money is what has made trading and money circulation easy for businesses, institutions, and average traders at large.

And a huge part of this is made possible through lending and borrowing.

And a huge part of this is made possible through lending and borrowing.

Lending and borrowing has always been a key part of finance; from TradFi (Banks etc) and now to DeFi, as it allows for growth in the overall supply of money/liquidity.

Say for instance; I want to make use of USD but only have GOLD which i don’t want to sell atm. I can then...

Say for instance; I want to make use of USD but only have GOLD which i don’t want to sell atm. I can then...

choose to deposit my GOLD as collateral, then borrow the amount of USD I need, relative to my collateral worth.

You get?🙂

In DeFi today, there are lots of protocols serving as decentralised banks to ensure the growth of DeFi such as Aave, MakerDAO, Granary finance etc but...

You get?🙂

In DeFi today, there are lots of protocols serving as decentralised banks to ensure the growth of DeFi such as Aave, MakerDAO, Granary finance etc but...

there’s been a limiting factor - their separate individuality, hereby causing liquidity fragmentation and the need for constant bridging across blockchains.

Wen have a DeFi Central Bank??🫤

Wen have a DeFi Central Bank??🫤

💎 Tapioca

TapiocaDAO is a DAO building the first ‘DeFi Central Bank’ using the layerzero tech that’ll allow for lending, leveraging, and borrowing of crypto assets across multiple chains without the need for bridging.

Also, add earning of real yield to that ⬆️

TapiocaDAO is a DAO building the first ‘DeFi Central Bank’ using the layerzero tech that’ll allow for lending, leveraging, and borrowing of crypto assets across multiple chains without the need for bridging.

Also, add earning of real yield to that ⬆️

💎 How Tapioca works - the tech

Tapioca uses the layerzero messaging network to power its omnichain infrastructure.

Asides this, it employs several core techs to efficiently run the market.

Let’s simplify this tech! 👇

Tapioca uses the layerzero messaging network to power its omnichain infrastructure.

Asides this, it employs several core techs to efficiently run the market.

Let’s simplify this tech! 👇

- Singularity

This is an isolated omnichain lending, leveraging, & borrowing engine licensed to Tapioca by @boring_crypto.

This engine allows for users to lend and borrow assets from individual markets rather than from a pool of assets.

i.e you can lend/borrow directly just...

This is an isolated omnichain lending, leveraging, & borrowing engine licensed to Tapioca by @boring_crypto.

This engine allows for users to lend and borrow assets from individual markets rather than from a pool of assets.

i.e you can lend/borrow directly just...

from the ETH/USDT market, minimizing your risk to just that of ETH & USDT; rather than from a market pool of many assets like most existing protocols do.

This ‘isolative’ feature also allows for users to leverage up to 5x on their asset on Tapioca, without having to lend &

This ‘isolative’ feature also allows for users to leverage up to 5x on their asset on Tapioca, without having to lend &

borrow across different lending protocols.🫡

- YieldBox

This is a token vault (still by @boring_crypto - chad 🫡) with yield bearing strategies that utilizes idle funds from Singularity engine to generate yield safely from other protocols, while still in the vault.

- YieldBox

This is a token vault (still by @boring_crypto - chad 🫡) with yield bearing strategies that utilizes idle funds from Singularity engine to generate yield safely from other protocols, while still in the vault.

You can relate this to how your web2 banks invest your deposits to earn more.

- Time Weighted Average Magnitude Lock - twAML

This is a novel DeFi economic system by Tapioca to sustain the economic-tokenomic growth of Tapioca dynamically.

Yes, I know that definition is short

- Time Weighted Average Magnitude Lock - twAML

This is a novel DeFi economic system by Tapioca to sustain the economic-tokenomic growth of Tapioca dynamically.

Yes, I know that definition is short

and obviously has a deeper meaning…

In the simplest form; the twAML machine allows to control Tapioca’s token distribution and also create a democratized governance system and fee-sharing mechanism.

Trust me, there’s a lot more to twAML - maybe I’ll write specifically on this

In the simplest form; the twAML machine allows to control Tapioca’s token distribution and also create a democratized governance system and fee-sharing mechanism.

Trust me, there’s a lot more to twAML - maybe I’ll write specifically on this

…you can read more on twAML here 👉 docs.tapioca.xyz/tapioca/core-t…

- Pearlayer & Oracles

Pearlayer is Tapioca’s security mechanism to verify that every cross-chain message is not compromised.

Tapioca uses chainlink and Uniswap v3 TWAP price feeds.

- Pearlayer & Oracles

Pearlayer is Tapioca’s security mechanism to verify that every cross-chain message is not compromised.

Tapioca uses chainlink and Uniswap v3 TWAP price feeds.

💎 Current stage of development

Currently, product is in Beta testing Phase, with Tapioca website arguably one of the best #DeFi websites 👀

Try the dApp 👉 tapioca.xyz

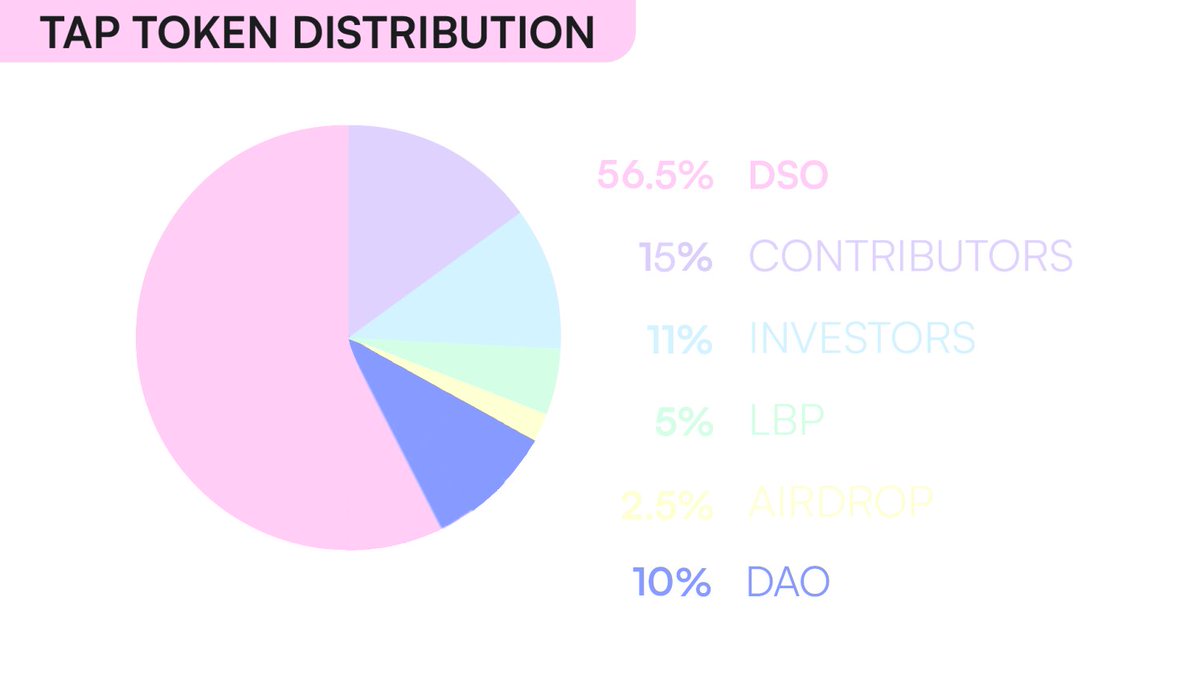

💎 Tokenomics

Tapioca will have an utility token, $TAP, with a product stablecoin, $USD0.

Currently, product is in Beta testing Phase, with Tapioca website arguably one of the best #DeFi websites 👀

Try the dApp 👉 tapioca.xyz

💎 Tokenomics

Tapioca will have an utility token, $TAP, with a product stablecoin, $USD0.

$TAP supply: 100mil

Other variations of $TAP will exist in twTAP and oTAP

twTAP - given to users for locking $TAP

- For governance

- Bribes

- Receives 100% protocol revenue and 50% vault manager fees

oTAP - call option contract offering weekly discount to lendoors.

Other variations of $TAP will exist in twTAP and oTAP

twTAP - given to users for locking $TAP

- For governance

- Bribes

- Receives 100% protocol revenue and 50% vault manager fees

oTAP - call option contract offering weekly discount to lendoors.

- Buy $TAP at 5-50% discount price OTC from the DAO

$USD0 - decentralized, multi-collateral, over-collateralized, non-algorithmic, and censorship-resistant USD-pegged omnichain stablecoin.

$USD0 - decentralized, multi-collateral, over-collateralized, non-algorithmic, and censorship-resistant USD-pegged omnichain stablecoin.

💎 Some bullish points to note

- Arguably the most educative and active #DeFi community filled with chads, not to mention lead devs are gigabrains - @twMattt, @0xRektora

- Elite product design

- Novel tokenomics design - no liquidity mining; new $TAP tokens is only released...

- Arguably the most educative and active #DeFi community filled with chads, not to mention lead devs are gigabrains - @twMattt, @0xRektora

- Elite product design

- Novel tokenomics design - no liquidity mining; new $TAP tokens is only released...

from the DAO via oTAP call execution

- Top #DeFi accounts keep tab on them like @blocmatesdotcom, @BarryFried1, @ChadCaff, @wassiecapital, @alpha_pls

...and so many others.

💎 Getting positioned

Protocol & token launch (LBP) is tentatively set for April.

- Top #DeFi accounts keep tab on them like @blocmatesdotcom, @BarryFried1, @ChadCaff, @wassiecapital, @alpha_pls

...and so many others.

💎 Getting positioned

Protocol & token launch (LBP) is tentatively set for April.

And there’ll be an AIRDROP, but not like the type you know…🤔

aoTAP will be airdropped to 4 different categories in different phases; LBP contributors, Guild members, Pearl NFT holders, and (twTAP lockers + cassava role holders).

This drop is not completely free as it is a...

aoTAP will be airdropped to 4 different categories in different phases; LBP contributors, Guild members, Pearl NFT holders, and (twTAP lockers + cassava role holders).

This drop is not completely free as it is a...

call option to be able to buy $TAP at a discount price, rather than just having airdroppers dump the token for free money

You give value to get value. 💆

It’s late to obtain some of the top roles now, but you can still get the ‘cassava’ role by attending the TapTalk held in...

You give value to get value. 💆

It’s late to obtain some of the top roles now, but you can still get the ‘cassava’ role by attending the TapTalk held in...

the Discord every Tuesday and also, the LBP will be open to everyone.

Airdrop full details 👉 docs.tapioca.xyz/tapioca/launch…

💎 Personal opinion

TapiocaDAO offers to the DeFi space value, not first in it’s niche, but first in it’s approach to tackle the problems faced by other...

Airdrop full details 👉 docs.tapioca.xyz/tapioca/launch…

💎 Personal opinion

TapiocaDAO offers to the DeFi space value, not first in it’s niche, but first in it’s approach to tackle the problems faced by other...

lending protocols and tokenomics design in entirety.

I think they’re on path to join set the next standards for DeFi and tokenomics design.

I keep a huge tab on TapiocaDAO, and i think you should too.

.

.

.

Feel free to drop your thoughts and ask any question in the comments⬇️

I think they’re on path to join set the next standards for DeFi and tokenomics design.

I keep a huge tab on TapiocaDAO, and i think you should too.

.

.

.

Feel free to drop your thoughts and ask any question in the comments⬇️

If you liked and learnt something from this thread, please like and retweet for others too 🙏.

https://twitter.com/Prince_omobee/status/1640728562306039808?s=20

I don't know why all the images are coming out white tho🤔...but you can find them in the docs

docs.tapioca.xyz

docs.tapioca.xyz

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter