First, we'll take a look at the #Bitcoin Dominance chart.

The #BTC.D is a metric that measures Bitcoin's market share compared to other cryptocurrencies.

If BTC.D is high, it suggests that Bitcoin is dominating the market & investors may be focusing on it more than alts.

(2/x)

The #BTC.D is a metric that measures Bitcoin's market share compared to other cryptocurrencies.

If BTC.D is high, it suggests that Bitcoin is dominating the market & investors may be focusing on it more than alts.

(2/x)

Conversely if BTC.D is low, it suggests that other cryptocurrencies may be gaining more attention and market share.

(3/x)

(3/x)

The Bitcoin dominance chart is unique in that it can act as both a leading and lagging indicator of an altseason, depending on the timeframe/method being used for analysis.

(4/x)

(4/x)

As a leading indicator, changes in the BTC.D chart can be used to predict a potential altseason or capitulation.

Ex. As the BTC.D reaches a macro resistance/support level, a reversal pattern could unfold, increasing the likelihood of an impeding altseason/capitulation.

(5/x)

Ex. As the BTC.D reaches a macro resistance/support level, a reversal pattern could unfold, increasing the likelihood of an impeding altseason/capitulation.

(5/x)

As a lagging indicator, the BTC.D chart can be used to confirm/invalidate an altseason.

Ex. If #altcoins have already started to perform well, the Bitcoin Dominance chart may reflect this by trending downward, in a lag, as investors diversify away from Bitcoin.

(6/x)

Ex. If #altcoins have already started to perform well, the Bitcoin Dominance chart may reflect this by trending downward, in a lag, as investors diversify away from Bitcoin.

(6/x)

With that out of the way, how is the BTC.D chart looking like now?

The 1W chart illustrates a tower top taking form, a strong bearish reversal pattern.

(7/x)

The 1W chart illustrates a tower top taking form, a strong bearish reversal pattern.

(7/x)

BTC.D is also at macro resistance, a level where it got rejected, consecutively, several times before.

So since the BTC.D is at macro resistance and a tower top is in formation, wouldn't that imply a high probability for an altseason?

Well, there's more...

(8/x)

So since the BTC.D is at macro resistance and a tower top is in formation, wouldn't that imply a high probability for an altseason?

Well, there's more...

(8/x)

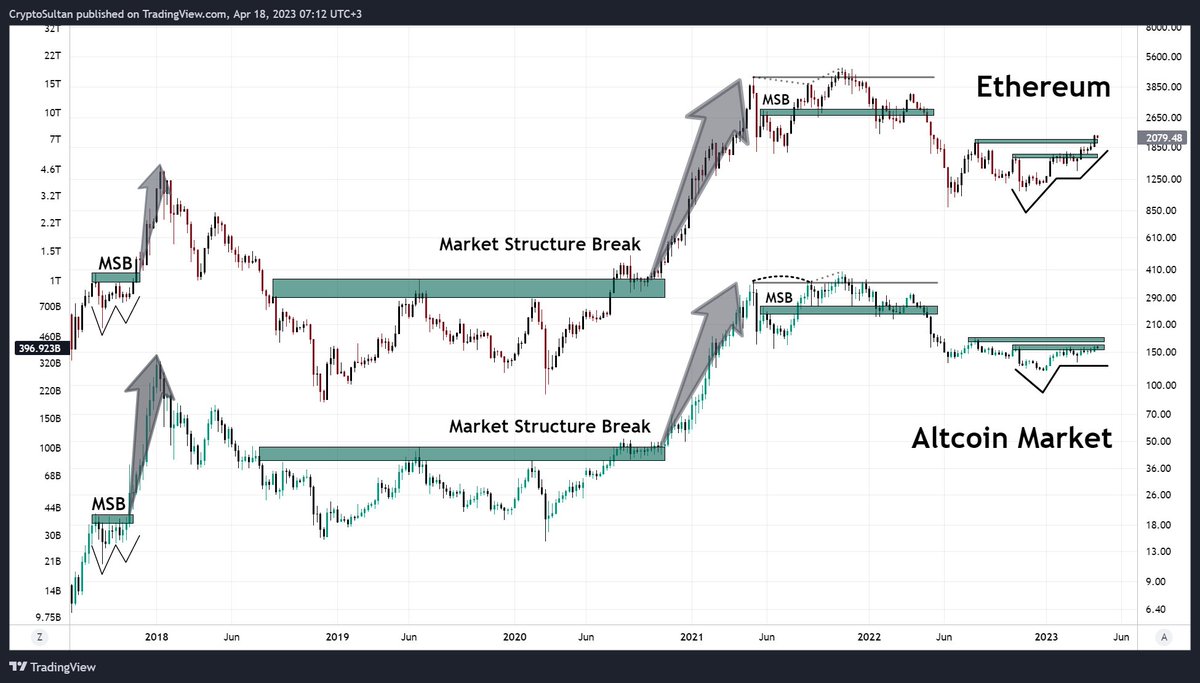

The #Ethereum vs Altcoins chart (total3) shows a major lag in performance by the altcoin market.

Regardless of #ETH's consecutive bullish structural breaks, the Alt Market remains stagnant, just as it's been for the past 3 months.

(9/x)

Regardless of #ETH's consecutive bullish structural breaks, the Alt Market remains stagnant, just as it's been for the past 3 months.

(9/x)

To understand the significance of a lagging Alt Market, we would have to look at previous altcoin seasons/price action, and compare them with $ETH.

(10/x)

(10/x)

The Alt Market has a tendency to follow Ethereum, even structurally so, and perform similar/better bullish structure breaks.

These breaks tend to be followed by significant markup phases.

Today however, the Alt Market lost its structural adjacency to Ethereum.

(11/x)

These breaks tend to be followed by significant markup phases.

Today however, the Alt Market lost its structural adjacency to Ethereum.

(11/x)

What does this mean for altcoins?

In essence, this indicates a rather significant loss of trust in altcoins by market participants.

Investors are staying clear of altcoins.

This is uncharted territory for the Alt Market.

(12/x)

In essence, this indicates a rather significant loss of trust in altcoins by market participants.

Investors are staying clear of altcoins.

This is uncharted territory for the Alt Market.

(12/x)

As for the #altseason, the best case scenario would be a multi-week rally, a rather weak one too, into a selloff.

This is the best possible outcome I see unfolding.

That said, I'm completely out of altcoins and not looking to enter any time soon.

Risk>Reward

(13/x)

This is the best possible outcome I see unfolding.

That said, I'm completely out of altcoins and not looking to enter any time soon.

Risk>Reward

(13/x)

Hopefully, this thread helped you gain a deeper insight into the current state of altcoins and what it means for the altcoin season.

(14/14)

(14/14)

RT appreciated.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter