Why I am bullish on $ETHx & $SD

Currently, #ETH staking is very centralized ~50% is with the top 3 entities (not good) 👎🏼

This could bring risk like massive slashing events and censorship of transactions

However, @staderlabs attends to fix this dilemma. 🧵👇🏼

Currently, #ETH staking is very centralized ~50% is with the top 3 entities (not good) 👎🏼

This could bring risk like massive slashing events and censorship of transactions

However, @staderlabs attends to fix this dilemma. 🧵👇🏼

Before we start, please retweet the first tweet.

It helps spread the message and cost you $0.00

Enough talking.

Let’s go….👇🏼

It helps spread the message and cost you $0.00

Enough talking.

Let’s go….👇🏼

1/

Out of the 50% of ETH Staked

The two most preferred ways of staking $ETH is:

*Liquid staking (36.6%)

*Centralized Exchanges (23.2%)

SOURCE: dune.com/hildobby/eth2-…

Out of the 50% of ETH Staked

The two most preferred ways of staking $ETH is:

*Liquid staking (36.6%)

*Centralized Exchanges (23.2%)

SOURCE: dune.com/hildobby/eth2-…

2/

Time of this thread #Ethereum MC is $223,011,948,843.

Only 8,511,133 $ETH is being liquid staked (~15.81B)

That alone shows how much potential for a solid team to enter the market could take a sliver out of it to be profitable.

defillama.com/lsd

Time of this thread #Ethereum MC is $223,011,948,843.

Only 8,511,133 $ETH is being liquid staked (~15.81B)

That alone shows how much potential for a solid team to enter the market could take a sliver out of it to be profitable.

defillama.com/lsd

3/

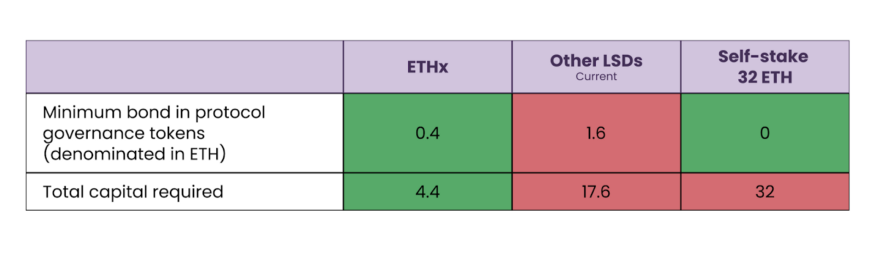

How does @staderlabs_eth plan on differentiate themselves from the competition?

First and foremost,

-Reduce capital barriers to entry for permissionless node operators

❌The competition charges ~ 32 $ETH 😵💫

Stader is only 4 ETH and 0.4 ETH worth of $SD per validator. 👍🏼

How does @staderlabs_eth plan on differentiate themselves from the competition?

First and foremost,

-Reduce capital barriers to entry for permissionless node operators

❌The competition charges ~ 32 $ETH 😵💫

Stader is only 4 ETH and 0.4 ETH worth of $SD per validator. 👍🏼

4/

*This will allow more people to run a node at a reasonable price which promotes more of a scalable/decentralization staking model for $ETHx.📈

Second,

-Stader will allow node operators to regulate exposure to Stader’s $SD token based on their convictions and risk appetite.

*This will allow more people to run a node at a reasonable price which promotes more of a scalable/decentralization staking model for $ETHx.📈

Second,

-Stader will allow node operators to regulate exposure to Stader’s $SD token based on their convictions and risk appetite.

5/

Third,

Align interests between Node operators and #Stader with skin in the game, ability to shape the protocol through governance.

Stader is focusing on the community at large and has worked hard to come up with a tokenomic model with long term viability in 2 phases.

Third,

Align interests between Node operators and #Stader with skin in the game, ability to shape the protocol through governance.

Stader is focusing on the community at large and has worked hard to come up with a tokenomic model with long term viability in 2 phases.

6/

Phase 1:

Node operators can start with a minimum of just 0.4 ETH worth of SD to run a node with Stader.

This is 75% lower than the requirements of other similar protocols and keeps the total capital required to run a validator with Stader to just 4.4 $ETH

Phase 1:

Node operators can start with a minimum of just 0.4 ETH worth of SD to run a node with Stader.

This is 75% lower than the requirements of other similar protocols and keeps the total capital required to run a validator with Stader to just 4.4 $ETH

7/

Phase 2:

Profitability of Node operator

Given the 4 ETH requirement on $ETHx provides higher leverage, ETH denominated profits for node operators would be 35% higher than solo-staking at 8.1%

*Also, Stader plans on running a special incentive promotion for even more yield

Phase 2:

Profitability of Node operator

Given the 4 ETH requirement on $ETHx provides higher leverage, ETH denominated profits for node operators would be 35% higher than solo-staking at 8.1%

*Also, Stader plans on running a special incentive promotion for even more yield

8/

But what if you are like, I don't run a node I just want to invest?

Well $ETHx adds utility to the $SD token in 3 ways:

-Protocol fees to SD stakers:

1. Stader charges a % of user’s staking rewards as fees. A significant share of these fee revenues will be redirected to SD

But what if you are like, I don't run a node I just want to invest?

Well $ETHx adds utility to the $SD token in 3 ways:

-Protocol fees to SD stakers:

1. Stader charges a % of user’s staking rewards as fees. A significant share of these fee revenues will be redirected to SD

9/

2. On #Ethereum, 5% of users’ staking rewards will be charged as protocol fee and again, a % share will be redirected to SD stakers

3. $SD bond requirement for running nodes locks supply and brings a vibrant node operator community to participate in SD and governance.

2. On #Ethereum, 5% of users’ staking rewards will be charged as protocol fee and again, a % share will be redirected to SD stakers

3. $SD bond requirement for running nodes locks supply and brings a vibrant node operator community to participate in SD and governance.

10/

$SD Lending should also help drive demand which will launch during Phase 2

SD lenders can earn up to 2% additional yield in $ETH for lending their SD token

Stader will attract node operators throughout both phases which will only drive the demand for $ETHx and $SD 📈

$SD Lending should also help drive demand which will launch during Phase 2

SD lenders can earn up to 2% additional yield in $ETH for lending their SD token

Stader will attract node operators throughout both phases which will only drive the demand for $ETHx and $SD 📈

If you found value in this thread:

Follow me @CosmosHOSS

Also, please considering to Like +RT the first post

🫶🏼

Follow me @CosmosHOSS

Also, please considering to Like +RT the first post

🫶🏼

• • •

Missing some Tweet in this thread? You can try to

force a refresh