1/30

#BookRecommendation

#BookSummary

#Investing

A book that must be read by all direct equity investors but will be appreciated & understood by a few, that too only after witnessing an entire cycle play out in markets.

Few of my takeaways from this 💎 by Howard Marks.

👇🏽

#BookRecommendation

#BookSummary

#Investing

A book that must be read by all direct equity investors but will be appreciated & understood by a few, that too only after witnessing an entire cycle play out in markets.

Few of my takeaways from this 💎 by Howard Marks.

👇🏽

2/30

To consistently beat the market,

You either need a ton of luck or superior insight & awareness of psychology.

Because investing is at least as much of an art as it is a science, it is essential that one's investment approach be intuitive & adaptive always.

To consistently beat the market,

You either need a ton of luck or superior insight & awareness of psychology.

Because investing is at least as much of an art as it is a science, it is essential that one's investment approach be intuitive & adaptive always.

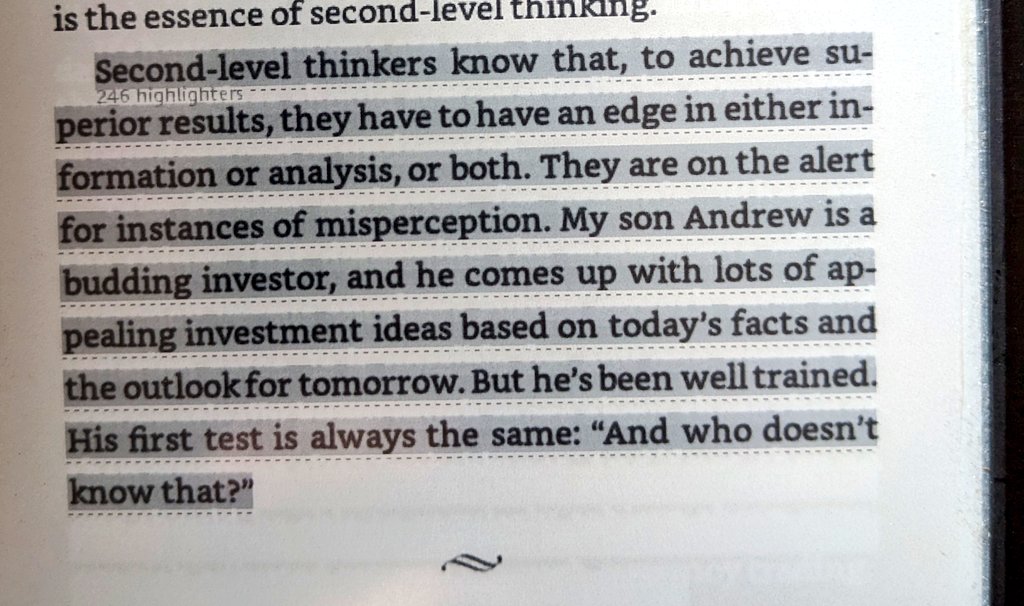

3/30

All investors can't beat the market, since collectively, they are the market.

Stellar returns majorly come from correct non consensus forecasts.

Here Second Level Thinking matters immensely.

And the number of people capable of it is tiny.

What is Second Level Thinking ?

All investors can't beat the market, since collectively, they are the market.

Stellar returns majorly come from correct non consensus forecasts.

Here Second Level Thinking matters immensely.

And the number of people capable of it is tiny.

What is Second Level Thinking ?

4/30

The Efficient Market Hypothesis sounds good but isn't applicable 100% given how it links Returns & Risk.

Once in a while things go well & riskier investments deliver high returns & lull people into believing that Higher Risk entails Higher Returns.

But this isn't true.

The Efficient Market Hypothesis sounds good but isn't applicable 100% given how it links Returns & Risk.

Once in a while things go well & riskier investments deliver high returns & lull people into believing that Higher Risk entails Higher Returns.

But this isn't true.

5/30

The emphasis in Value Investing is on tangible factors. Intangibles are given less weightage.

Earnings , Cash Flow, Dividends,Hard Assets & Enterprise Value are looked at & businesses are bought cheap on these basis.

Or take the concept of net - net investing.

👇🏽

The emphasis in Value Investing is on tangible factors. Intangibles are given less weightage.

Earnings , Cash Flow, Dividends,Hard Assets & Enterprise Value are looked at & businesses are bought cheap on these basis.

Or take the concept of net - net investing.

👇🏽

6/30

The emphasis on Growth Investing is to identify companies with bright futures.

The emphasis is on future potential as it is believed that the value will grow fast enough in future to produce substantial appreciation.

Ultimately it's a matter of WHEN and IF.

However,

👇🏽

The emphasis on Growth Investing is to identify companies with bright futures.

The emphasis is on future potential as it is believed that the value will grow fast enough in future to produce substantial appreciation.

Ultimately it's a matter of WHEN and IF.

However,

👇🏽

7/30

*A very important fact*

"It's hard to consistently do the right thing as an investor.

But it's impossible to consistently do the right thing at the right time."

Remind yourself this each time you start feeling like a genius stock picker who can time the markets to T.

*A very important fact*

"It's hard to consistently do the right thing as an investor.

But it's impossible to consistently do the right thing at the right time."

Remind yourself this each time you start feeling like a genius stock picker who can time the markets to T.

8/30

"An accurate opinion on valuation, loosely held ,will be of limited help.

An incorrect opinion on valuation, strongly held , is far worse."

Valuation matters.

But what we do with our opinion (right or wrong ) matters more !

Intrigued ?

👇🏽

"An accurate opinion on valuation, loosely held ,will be of limited help.

An incorrect opinion on valuation, strongly held , is far worse."

Valuation matters.

But what we do with our opinion (right or wrong ) matters more !

Intrigued ?

👇🏽

9/30

Something worth reminding ourselves often.

"No asset is so good that it can't become a bad investment if bought at too high a price.

Then there are few assets so bad that they can't be a good investment when bought cheap enough."

Something worth reminding ourselves often.

"No asset is so good that it can't become a bad investment if bought at too high a price.

Then there are few assets so bad that they can't be a good investment when bought cheap enough."

10/30

Investing is a popularity contest & the most dangerous thing is to buy something at the peak of its popularity.

At that point all favourable facts & opinions are already factored into its price & no new buyers are left.

Rings any bells ?? 🤔 😉

Investing is a popularity contest & the most dangerous thing is to buy something at the peak of its popularity.

At that point all favourable facts & opinions are already factored into its price & no new buyers are left.

Rings any bells ?? 🤔 😉

11/30

Understand RISK.

Recognise WHEN the risk is high.

Learn to CONTROL risk.

Volatility isn't Risk.

So what could be Risk then ?

Risk is the potential for loss when things go wrong .

👇🏽

🔸Falling short of one's goal

🔸Underperformance

🔸Career Risk

🔸Illiquidity

Understand RISK.

Recognise WHEN the risk is high.

Learn to CONTROL risk.

Volatility isn't Risk.

So what could be Risk then ?

Risk is the potential for loss when things go wrong .

👇🏽

🔸Falling short of one's goal

🔸Underperformance

🔸Career Risk

🔸Illiquidity

12/30

People vastly over estimate their ability to recognise risk & under estimate what it takes to avoid it.

Thus,they accept risk unknowingly & in doing so contribute to its creation.

The rewards for incremental risk shrink as more people take it, for the market isn't static.

People vastly over estimate their ability to recognise risk & under estimate what it takes to avoid it.

Thus,they accept risk unknowingly & in doing so contribute to its creation.

The rewards for incremental risk shrink as more people take it, for the market isn't static.

13/30

Outstanding investors are distinguished in the least as much for their ability to control Risk as they are for generating return.

Their records are remarkable because of decades of consistency & absence of disasters, and not just high returns.

Outstanding investors are distinguished in the least as much for their ability to control Risk as they are for generating return.

Their records are remarkable because of decades of consistency & absence of disasters, and not just high returns.

14/30

Extreme volatility & loss surface infrequently.

With passing time as the investors confidence increases,

temptation increases to relax rules & increase leverage.

And this is often done just before RISK rears its head.

⌛💣💣💥💥

As Taleb states in Fooled by Randomness

Extreme volatility & loss surface infrequently.

With passing time as the investors confidence increases,

temptation increases to relax rules & increase leverage.

And this is often done just before RISK rears its head.

⌛💣💣💥💥

As Taleb states in Fooled by Randomness

15/30

Rule 1 : Most things will be cyclical

Rule 2 : Some of the greatest opportunities for Gain and Loss come, when other people forget Rule 1.

Investors will overvalue companies when they are doing well & undervalue then when things get difficult : Opportunity 101.

Rule 1 : Most things will be cyclical

Rule 2 : Some of the greatest opportunities for Gain and Loss come, when other people forget Rule 1.

Investors will overvalue companies when they are doing well & undervalue then when things get difficult : Opportunity 101.

16/30

A Reality Check

*Awareness of the Pendulum*

Being aware of the swing & Reversion to Mean

🔸Greed vs Fear

🔸Willingness to view things through an 🔸Optimistic or Pessimistic Lens

🔸Faith in future Developments

🔸Credulousness vs Skepticism

🔸Risk Tolerance vs Aversion

A Reality Check

*Awareness of the Pendulum*

Being aware of the swing & Reversion to Mean

🔸Greed vs Fear

🔸Willingness to view things through an 🔸Optimistic or Pessimistic Lens

🔸Faith in future Developments

🔸Credulousness vs Skepticism

🔸Risk Tolerance vs Aversion

17/30

The combination of Greed & Optimism repeatedly leads people to pursue strategies they hope will produce high returns without high risk, hold things after they have become highly priced in the hope that there's still some appreciation left !

Hindsight shows otherwise.

The combination of Greed & Optimism repeatedly leads people to pursue strategies they hope will produce high returns without high risk, hold things after they have become highly priced in the hope that there's still some appreciation left !

Hindsight shows otherwise.

18/30

*Capitulation*

A regular feature of investor behaviour late in cycles. Investors hold onto their convictions as long as they can, but when psychological pressures become irresistible, they surrender & jump on the bandwagon.

*Capitulation*

A regular feature of investor behaviour late in cycles. Investors hold onto their convictions as long as they can, but when psychological pressures become irresistible, they surrender & jump on the bandwagon.

19/30

If you're alert to the pendulum like swing of markets it's possible to recognise the opportunities that occasionally are there for plucking.

Knowing Contrarianism is one thing.

Implementing it is another. 🤷🏻♀️

Ultimately, implementation matters.

If you're alert to the pendulum like swing of markets it's possible to recognise the opportunities that occasionally are there for plucking.

Knowing Contrarianism is one thing.

Implementing it is another. 🤷🏻♀️

Ultimately, implementation matters.

20/30

Skepticism calls for Pessimism when Optimism is excessive.

But it also calls for Optimism when Pessimism is excessive.

But the herd applies optimism at the top & pessimism at the bottom.

That's where the problem lies and so does the opportunity !

Skepticism calls for Pessimism when Optimism is excessive.

But it also calls for Optimism when Pessimism is excessive.

But the herd applies optimism at the top & pessimism at the bottom.

That's where the problem lies and so does the opportunity !

21/30

You simply cannot create investment opportunities when they're not there.

The dumbest thing you can do is insist on perpetuating high returns and in the process give back all your profits.

You just have to wait for the pendulum to swing .

Patience is the key.

You simply cannot create investment opportunities when they're not there.

The dumbest thing you can do is insist on perpetuating high returns and in the process give back all your profits.

You just have to wait for the pendulum to swing .

Patience is the key.

22/30

One way to be right sometimes is to always be Bullish or Bearish.

If you hold a fixed view long enough,you may be right sooner or later.... 🤷🏻♀️

Afterall,

"It ain't what you don't know that gets you into trouble.

It's what you thought for sure that just ain't so."

One way to be right sometimes is to always be Bullish or Bearish.

If you hold a fixed view long enough,you may be right sooner or later.... 🤷🏻♀️

Afterall,

"It ain't what you don't know that gets you into trouble.

It's what you thought for sure that just ain't so."

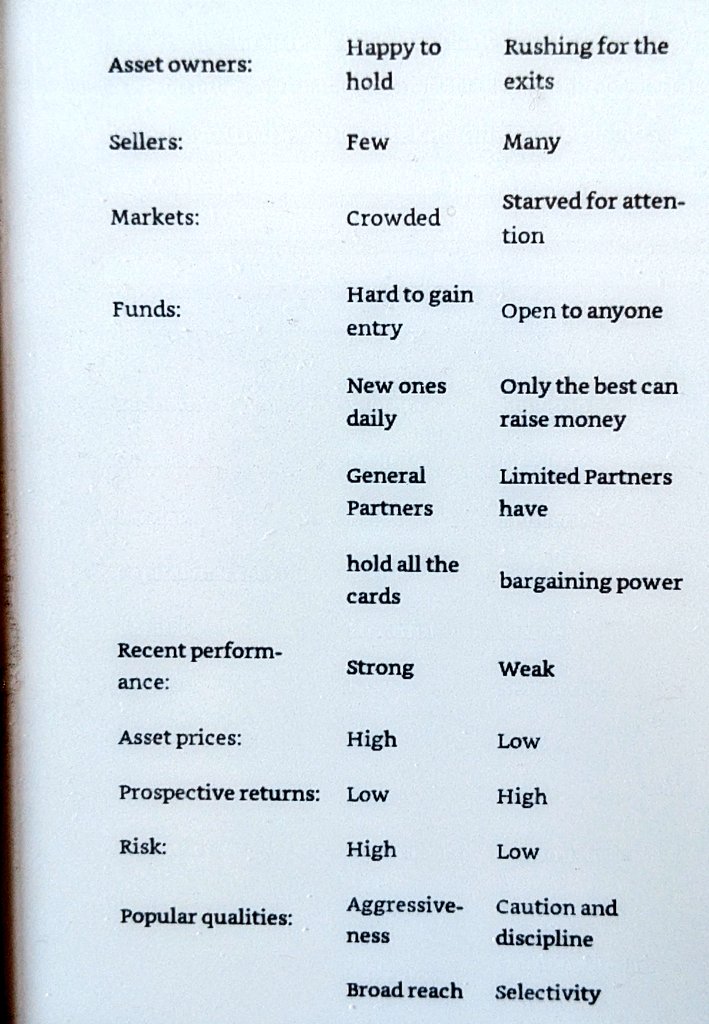

23/30

As difficult as it is to know the future, it's really not that hard to understand the present.

If we are alert & perceptive, we can gauge the behaviour of those around us & from that judge what we should do.

A simple checklist for guidance

👇🏽

As difficult as it is to know the future, it's really not that hard to understand the present.

If we are alert & perceptive, we can gauge the behaviour of those around us & from that judge what we should do.

A simple checklist for guidance

👇🏽

24/30

The most important thing is : APPRECIATING THE ROLE OF LUCK.

Randomness/ Luck plays a huge part in life's results.

Every once in a while someone takes a risky bet that pays off & ends up looking like a genuis.

But we should recognise that it's due to LUCK, NOT SKILL.

The most important thing is : APPRECIATING THE ROLE OF LUCK.

Randomness/ Luck plays a huge part in life's results.

Every once in a while someone takes a risky bet that pays off & ends up looking like a genuis.

But we should recognise that it's due to LUCK, NOT SKILL.

25/30

Operating a high risk portfolio is like performing on the wire without a net.

The payoff for success may be high & bring "oohs" and "aahs" .

But any slips will kill you.

Emphasis must be put on diversifying, avoiding loss & continuous due diligence along with MOS.

Operating a high risk portfolio is like performing on the wire without a net.

The payoff for success may be high & bring "oohs" and "aahs" .

But any slips will kill you.

Emphasis must be put on diversifying, avoiding loss & continuous due diligence along with MOS.

26/30

Failure of imagination- The inability to understand in advance the full breadth of the range of possible outcomes.

Asset Correlation matters - How one asset will react to a change in another.

Understanding & anticipating the power of correlation is an important aspect.

Failure of imagination- The inability to understand in advance the full breadth of the range of possible outcomes.

Asset Correlation matters - How one asset will react to a change in another.

Understanding & anticipating the power of correlation is an important aspect.

27/30

It's not just your return that matters, but also what risk you took to get it.

In a bad yr defensive investor lose less than aggressive investors.

In a good yr aggressive investors make more than defensive ones.

Investment Asymmetry matters here which requires Skill.

👇🏽

It's not just your return that matters, but also what risk you took to get it.

In a bad yr defensive investor lose less than aggressive investors.

In a good yr aggressive investors make more than defensive ones.

Investment Asymmetry matters here which requires Skill.

👇🏽

28/30

Economies & Markets cycle up & down.

Whichever direction they're going at the moment, most people assume that they'll go that way forever.

This thinking is a source of great danger since it sends valuation to extremes & ignites bubbles that most find hard to resist.

Economies & Markets cycle up & down.

Whichever direction they're going at the moment, most people assume that they'll go that way forever.

This thinking is a source of great danger since it sends valuation to extremes & ignites bubbles that most find hard to resist.

29/30

While aggressive investing can produce exciting results when it goes right, especially in good times.

It's unlikely to generate gains as reliably as defensive investing.

If we avoid losers, winners will take care of themselves.

Risk control lies at the core of it all.

While aggressive investing can produce exciting results when it goes right, especially in good times.

It's unlikely to generate gains as reliably as defensive investing.

If we avoid losers, winners will take care of themselves.

Risk control lies at the core of it all.

30/30

Most investors focus too much on macro whilst ignoring micro factors at play.

They assume the world runs on orderly processes that can be mastered & predicted.

They ignore the Randomness of things.

Remember, the most important thing is...

Pulling It All Together.

*End*

Most investors focus too much on macro whilst ignoring micro factors at play.

They assume the world runs on orderly processes that can be mastered & predicted.

They ignore the Randomness of things.

Remember, the most important thing is...

Pulling It All Together.

*End*

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter