#FlashBack Thread.

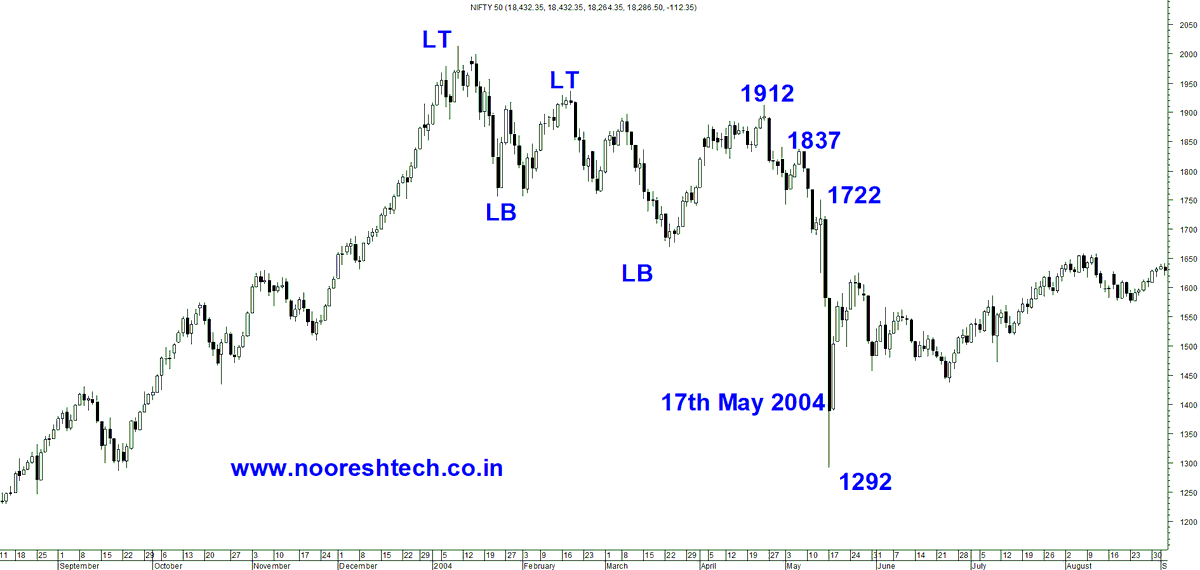

17th May 2004 - #BlackMonday LowerCircuit Day.

Started learning Technicals from @nsfidai just a week or two before this event.

Remember him and his friend discussing how markets are heading lower irrespective of results.

Let's see what happened.

17th May 2004 - #BlackMonday LowerCircuit Day.

Started learning Technicals from @nsfidai just a week or two before this event.

Remember him and his friend discussing how markets are heading lower irrespective of results.

Let's see what happened.

#IndianElections & the Impact.

#Nifty fell almost 20% in a single day. Closed 12-13 % lower.

Down 32% from April to May. Peak to Bottom.

On Close 24% fall.

#BJP lost elections.

Remember the "India is Shining " Campaign.

Learnt Lower Top Lower Bottom Pattern

#Nifty fell almost 20% in a single day. Closed 12-13 % lower.

Down 32% from April to May. Peak to Bottom.

On Close 24% fall.

#BJP lost elections.

Remember the "India is Shining " Campaign.

Learnt Lower Top Lower Bottom Pattern

#Global Impact of Indian Elections.

#US Markets fell by 6-7% in April-May 2004.

Was down 1% on 17th May 2004.

#US Markets fell by 6-7% in April-May 2004.

Was down 1% on 17th May 2004.

#Conclusion -

#IndianElections impact the whole world.

#Demonetization led to a Global Rally in 2017

(Global mkts up 25% in 2017.)

Or accept #GlobalMarkets are interrelated but Magnitudes could be different.

#IndianElections impact the whole world.

#Demonetization led to a Global Rally in 2017

(Global mkts up 25% in 2017.)

Or accept #GlobalMarkets are interrelated but Magnitudes could be different.

Learning from 2004 was to focus and give more weight to #GlobalTrends during major Local events like #IndianElections #Budget #Demonetization.

This helped us in the 2009/2014/2019 elections and #Budget 2016 and other such events.

This helped us in the 2009/2014/2019 elections and #Budget 2016 and other such events.

2009 - #India was lagging, caught up with #UpperCircuits.

2014- #India caught up too.

#Budget2016 #LTCG rumor. World had already bounced. #Nifty bottomed on budget day.

( Search IIF Meet Video on my youtube )

Levered Long for me in 2014 was a game-changer personally.

2014- #India caught up too.

#Budget2016 #LTCG rumor. World had already bounced. #Nifty bottomed on budget day.

( Search IIF Meet Video on my youtube )

Levered Long for me in 2014 was a game-changer personally.

Interesting to see we are at 10x of #Nifty since then. Just add a zero to the Chart and suddenly #Volatility #TradinRange seems way lower nowadays :)

The above charts are from a Report done in #MarchApril of 2014.

Search #IndianElections on our Blog to read the older Note

The above charts are from a Report done in #MarchApril of 2014.

Search #IndianElections on our Blog to read the older Note

• • •

Missing some Tweet in this thread? You can try to

force a refresh