#Team42, Darius joined Paul Barron last week to discuss inflation, the jobs market, crypto outlook, and much more.

In case you missed it, here are 7 takeaways that will SIGNIFICANTLY help your portfolio over the next 6 months:

In case you missed it, here are 7 takeaways that will SIGNIFICANTLY help your portfolio over the next 6 months:

1) Although inflation is moving in the right direction, we still have some work to do.

Given the stock market's (relatively) high current valuation and the bond market pricing in a quick Fed pivot, the inflation numbers we are currently at are scary.

Given the stock market's (relatively) high current valuation and the bond market pricing in a quick Fed pivot, the inflation numbers we are currently at are scary.

2) “The Fed has been explicit about waiting to see slack emerge in the labor market.”

Two significant labor metrics, Job Openings / Unemployed Workers & the Employment Cost index are 2x their pre-covid levels.

The Fed won’t pivot to rate cuts & QE until they see change.

Two significant labor metrics, Job Openings / Unemployed Workers & the Employment Cost index are 2x their pre-covid levels.

The Fed won’t pivot to rate cuts & QE until they see change.

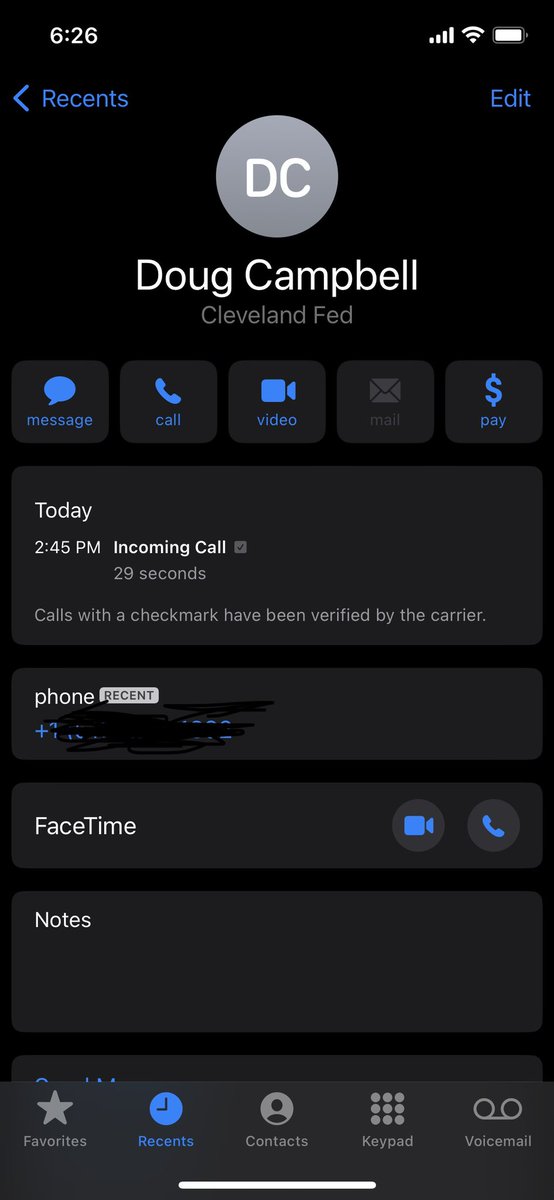

3) The Fed doesn’t have enough data yet to determine the damage we will see in regional bank lending.

Pausing is how they can buy themselves time & assess those effects.

Given its change in guidance at the May FOMC, we believe the Fed has already implemented the pause pivot.

Pausing is how they can buy themselves time & assess those effects.

Given its change in guidance at the May FOMC, we believe the Fed has already implemented the pause pivot.

4) “Inflation tends to peak at or in recessions. It’s a very late cycle indicator, like the labor market itself.”

We're currently experiencing an unusual inflation cycle - a lot of inflation was pandemic and fiscal stimulus-related.

We're currently experiencing an unusual inflation cycle - a lot of inflation was pandemic and fiscal stimulus-related.

Pandemic and fiscal stimulus-related inflation aside, we still have structural ~4% core inflation.

We're going to need a recession to get that structural inflation back to where the Fed wants it to be.

We're going to need a recession to get that structural inflation back to where the Fed wants it to be.

5) What’s the outlook on Crypto?

Pre-halving years are extremely volatile for Bitcoin; there are usually several large drawdowns throughout the year.

On top of that, global liquidity isn’t ubiquitously improving anymore (and it will likely worsen throughout Q3).

Pre-halving years are extremely volatile for Bitcoin; there are usually several large drawdowns throughout the year.

On top of that, global liquidity isn’t ubiquitously improving anymore (and it will likely worsen throughout Q3).

The liquidity narrative that propelled BTC from $16k to $30k made sense; liquidity was improving back then.

But, it's not anymore.

Bitcoin needs more liquidity to go higher.

Realistically, that likely won’t happen until next year.

But, it's not anymore.

Bitcoin needs more liquidity to go higher.

Realistically, that likely won’t happen until next year.

6) Will there be opportunities to find outperforming, single stocks?

Absolutely.

When the yield curve is inverted, we're typically in the late stages of the economic cycle.

Absolutely.

When the yield curve is inverted, we're typically in the late stages of the economic cycle.

When you’re in the late stages, you usually see good companies continue to grow, while other firms increasingly fall by the wayside.

It becomes a stock pickers market.

It becomes a stock pickers market.

7) How long will the recession last?

The recession will most likely happen in Q4 or Q1 of next year.

But, there’s a lot of time before then; we can easily see a short squeeze at some point.

The recession will most likely happen in Q4 or Q1 of next year.

But, there’s a lot of time before then; we can easily see a short squeeze at some point.

So, be patient.

Remember, these are the times when great wealth is made.

Remember, these are the times when great wealth is made.

That's a wrap!

If you found this thread helpful:

1. Go to 42macro.com/macro-bundle to unlock actionable, hedge-fund caliber investment insights

2. RT this thread and follow @42Macro and @42MacroWeather

3. Have a great day!

If you found this thread helpful:

1. Go to 42macro.com/macro-bundle to unlock actionable, hedge-fund caliber investment insights

2. RT this thread and follow @42Macro and @42MacroWeather

3. Have a great day!

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter