Imajin:

You just set up your Prime Account: 4x #AVAX long, 4x #BTC long, all gently farming with @yieldyak_ and @vector_fi.

You feel happy. Bullish...

And then the SEC decides everything was a security all along, crashing prices.

Time to restart it all?

No anon, watch this🧵

You just set up your Prime Account: 4x #AVAX long, 4x #BTC long, all gently farming with @yieldyak_ and @vector_fi.

You feel happy. Bullish...

And then the SEC decides everything was a security all along, crashing prices.

Time to restart it all?

No anon, watch this🧵

There are two ways to get back control over your health and exposure.

✅Direct deposits

✅Debt swaps

Let's dive in both

✅Direct deposits

✅Debt swaps

Let's dive in both

Direct deposits

While DeltaPrime might feel like a CEX at times, it is not. Everything is fully transparent, and your Prime Account is YOUR Prime Account.

Next to the added security this brings, this also lets you send funds from any wallet, straight into your account.

While DeltaPrime might feel like a CEX at times, it is not. Everything is fully transparent, and your Prime Account is YOUR Prime Account.

Next to the added security this brings, this also lets you send funds from any wallet, straight into your account.

Direct deposits

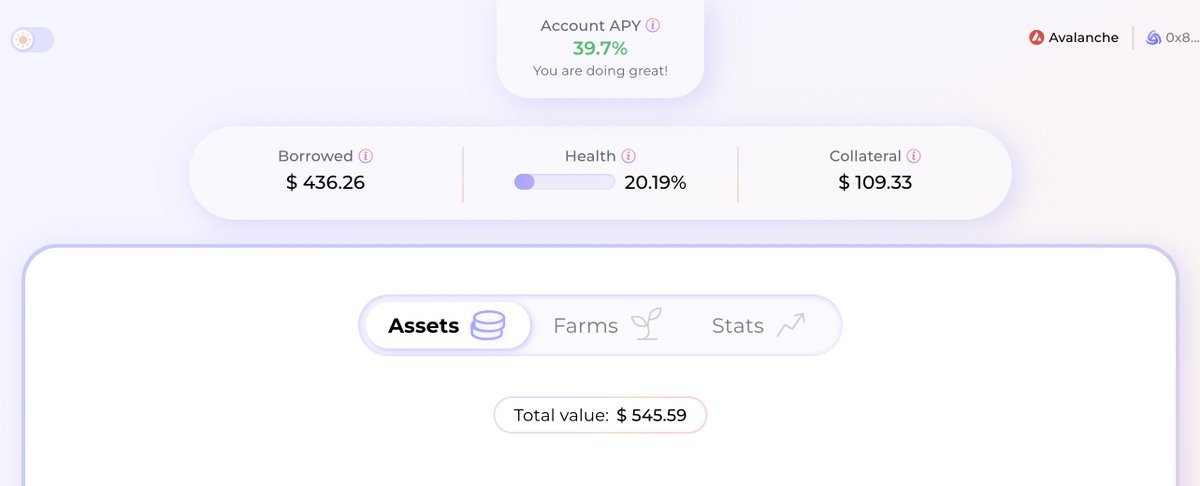

Why would you want that? Because sometimes you check your Prime Account just in time to see a liquidation incoming.

And sending in funds from any wallet, might make the difference between health and liquidation.

Neat.

Why would you want that? Because sometimes you check your Prime Account just in time to see a liquidation incoming.

And sending in funds from any wallet, might make the difference between health and liquidation.

Neat.

Debt swaps

With the immediate threat neutralized, it might be time for a more delta-neutral portfolio, until the dust settles.

Usually that would mean:

1⃣ Unstake AVAX & BTC

2⃣ Swap to USDC

3⃣ Repay USDC

4⃣ Borrow AVAX & BTC

5⃣ Restake AVAX & BTC

Delta-neutral, but tedious.

With the immediate threat neutralized, it might be time for a more delta-neutral portfolio, until the dust settles.

Usually that would mean:

1⃣ Unstake AVAX & BTC

2⃣ Swap to USDC

3⃣ Repay USDC

4⃣ Borrow AVAX & BTC

5⃣ Restake AVAX & BTC

Delta-neutral, but tedious.

Debt swaps

Recently the Debt-swap was introduced, allowing you to swap your borrowed value (read: exposure) with 2 simple clicks. Turning the 5-step plan into a 1-step plan:

1⃣Swap debt

From max exposure, to delta neutral and back, without touching your farmed assets🫡

Recently the Debt-swap was introduced, allowing you to swap your borrowed value (read: exposure) with 2 simple clicks. Turning the 5-step plan into a 1-step plan:

1⃣Swap debt

From max exposure, to delta neutral and back, without touching your farmed assets🫡

With the direct deposits, as well as the debt swap, you have full control of keeping your health at your desired level.

The only thing left for full control is a feature that would notify you of health changes.

But for that, it's back to the buidl🛠️

👇

The only thing left for full control is a feature that would notify you of health changes.

But for that, it's back to the buidl🛠️

👇

Note: with those two features you have almost* full control.

Elon, where is that edit button?

Elon, where is that edit button?

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter