Continuous delay in Merger Proceeding by Creditors

SEBI’s Shirpur Gold Refinery Order on Fund siphoning

Now,

SEBI asked resignation of Punit Goenka, MD CEO of Zee as well Mr. Chandra of Essel Group.

Let’s take a deep dive into this interim order and understand!

#Zeel

SEBI’s Shirpur Gold Refinery Order on Fund siphoning

Now,

SEBI asked resignation of Punit Goenka, MD CEO of Zee as well Mr. Chandra of Essel Group.

Let’s take a deep dive into this interim order and understand!

#Zeel

Background

Resignation of 2 Independent Director - Sunil Kumar and Neharika Vohra in Nov’19 on misappropriation of FD of Zee by Yes Bank for squaring off loan of other Essel grp entities

Resignation of 2 Independent Director - Sunil Kumar and Neharika Vohra in Nov’19 on misappropriation of FD of Zee by Yes Bank for squaring off loan of other Essel grp entities

Mr Subash Chandra, then chairman of Zeel/Essel grp provided LoC to yes bank on 200 Cr Loan o/s in Essel Green Mobility Limited. as per LoC, he accepted that Essel group companies incl Zee will have FD of 200 Cr that can be used in event of default

Now, this LoC is known to only few person in mgt and even Board of zee.

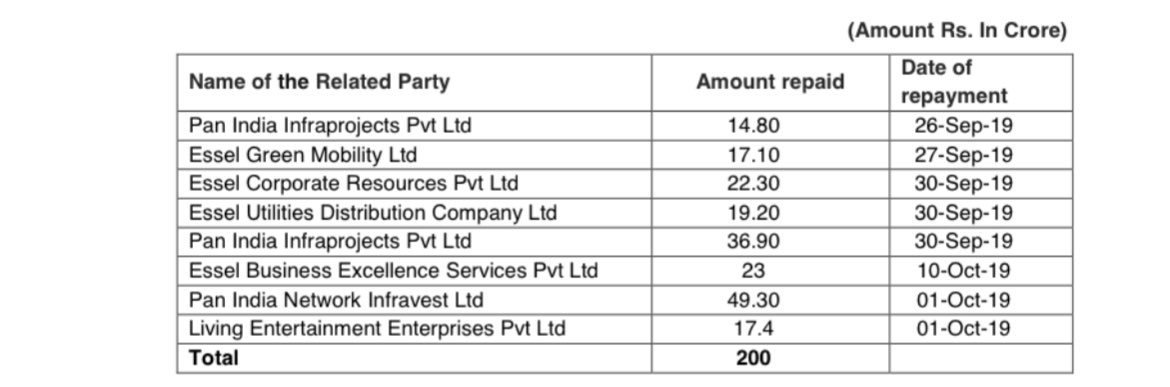

Post that, Yes Bank adjusted the FD of Zee and then from these following 7 entities - Zee recovered, which is also mentioned as associate in Annual report of Zee

Post that, Yes Bank adjusted the FD of Zee and then from these following 7 entities - Zee recovered, which is also mentioned as associate in Annual report of Zee

Now when Zee FD of 200 Cr appropriated by Yes Bank.

Zee submitted SEBI that funds of Zee FD returned by associate in full as detailed below 👇

Zee submitted SEBI that funds of Zee FD returned by associate in full as detailed below 👇

When SEBI investigated abt this 200 Cr, found 200 Cr followed circuitous route where money originated from Zee or other listed Essel grp entity and tiff to Zee via multiple layered transaction.

Example of one of these -

Example of one of these -

Noted that Subhash Chandra and Punit Goenka were direct beneficiaries of Fund diversion.

Post that Promoter shareholding also dropped from 41.62% to 3.99% over the period.

This is just “INTERIM Order”,Investigation is still underway.

Post that Promoter shareholding also dropped from 41.62% to 3.99% over the period.

This is just “INTERIM Order”,Investigation is still underway.

Final Direction by SEBI

- Cease to hold position of Director or KMP in any listed Co or it’s subsidiary untill further order

- Place order before board within 7 d from receipt

Order shall take effect IMMEDIATELY

- Cease to hold position of Director or KMP in any listed Co or it’s subsidiary untill further order

- Place order before board within 7 d from receipt

Order shall take effect IMMEDIATELY

Zee NCLT case Proceeding-

Hearing on 16-Jun

Previous Hearing - NCLT asked exchanges to review NOC given to Sony Merger after Shirpur Order

which Zee appealed in NCLAT

NCLAT set aside order and asked NCLT to hear Zee Opinion on shirpur Gold.

Hearing on 16-Jun

Previous Hearing - NCLT asked exchanges to review NOC given to Sony Merger after Shirpur Order

which Zee appealed in NCLAT

NCLAT set aside order and asked NCLT to hear Zee Opinion on shirpur Gold.

SEBI order against ZEE Entertainment has jolted the impending Merger between ZEE & Sony

A thread 🧵 on case Shirpur Gold Refinery - Fund Diversion

#ZeeSony #zeeentertainment #sebi #redflag #corporategovernance

A thread 🧵 on case Shirpur Gold Refinery - Fund Diversion

#ZeeSony #zeeentertainment #sebi #redflag #corporategovernance

https://twitter.com/BeatTheStreet10/status/1657048744351653889?t=xdycWX9UrQ5RuCAzOZYjhA&s=19

If you find this thread helpful, retweet the First tweet!

#Zee #Zeel #ZeeEntertainment #redflag #CorporateGovernance

#Zee #Zeel #ZeeEntertainment #redflag #CorporateGovernance

https://twitter.com/beatthestreet10/status/1668318966555504640

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter