🚨 BREAKING: Massive Announcement at #FOMC Meeting Today 🔥

What #Bitcoin and #Crypto Traders MUST Know 🚀

A thread 🧵

What #Bitcoin and #Crypto Traders MUST Know 🚀

A thread 🧵

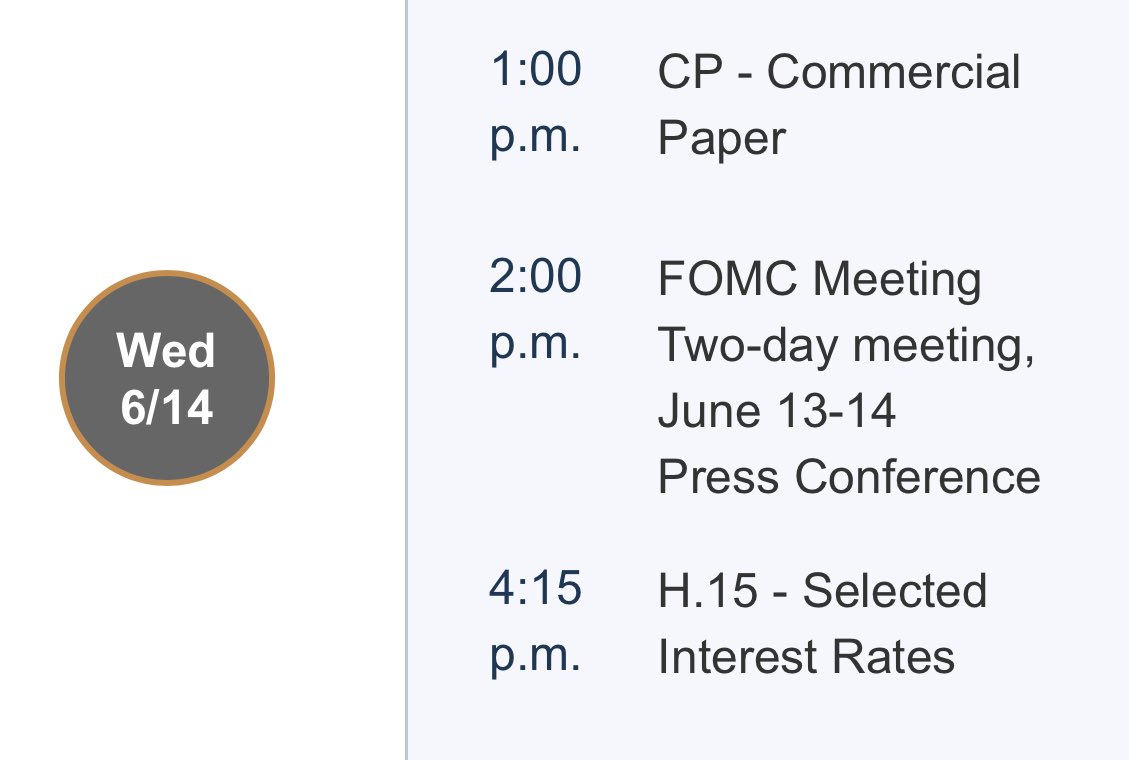

1/ The highly anticipated #FOMC meeting is underway, and it's set to rock the market!

👉 Here's what you need to know 👇

👉 Here's what you need to know 👇

2/ The Fed's interest rate decision is about to be released at 2:00 pm EST, followed by a press conference at 2:30 pm EST.

👉 The outcome could have a monumental impact on the #crypto space!

👉 The outcome could have a monumental impact on the #crypto space!

3/ The odds are in favor of NO change in interest rates, with a whopping 95.3% probability according to the CME FedWatch tool.

👉 This breather could provide the Fed more time to observe the effects of their battle against inflation.

👉 This breather could provide the Fed more time to observe the effects of their battle against inflation.

4/ Major banks like Goldman Sachs, J.P. Morgan, and Morgan Stanley all expect a pause, aligning with market sentiment.

👉 However, Citi stands alone, predicting another 25 basis point rate hike.

👉 However, Citi stands alone, predicting another 25 basis point rate hike.

https://twitter.com/tedtalksmacro/status/1668913996232007680

5/ Keep an eye on the new "dot plot" projection, revealing the Fed members' future interest rate path.

👉 Any correction to the upside may send equities tumbling and the dollar index soaring.

👉 The #crypto market could follow this trend!

👉 Any correction to the upside may send equities tumbling and the dollar index soaring.

👉 The #crypto market could follow this trend!

6/ Bond markets are predicting both a rate hike and a rate cut by the end of 2023.

👉 Michael Contopoulos of Richard Bernstein Advisors suggests it's a binary scenario: either the Fed doesn't cut, or growth falters drastically, forcing them to make significant moves.

👉 Michael Contopoulos of Richard Bernstein Advisors suggests it's a binary scenario: either the Fed doesn't cut, or growth falters drastically, forcing them to make significant moves.

7/ The possibility of a pause doesn't rule out future rate hikes.

👉 As the Bank of Canada demonstrated, the Fed could follow a similar path.

👉 The market is currently pricing in another quarter-point hike in July, indicating more volatility ahead.

👉 As the Bank of Canada demonstrated, the Fed could follow a similar path.

👉 The market is currently pricing in another quarter-point hike in July, indicating more volatility ahead.

8/ The dot plot's revisions will determine the trajectory of equities, #Bitcoin, and #crypto.

👉 Downward adjustments could ignite a new bullish surge, while upward revisions ("higher for longer") might turn bearish.

👉 Downward adjustments could ignite a new bullish surge, while upward revisions ("higher for longer") might turn bearish.

9/ #Bitcoin's price is currently hovering around the crucial support zone of $22,785 to $23,595.

👉 Over 1.34 million wallets hold 450,000 #BTC in this range.

👉 On the flip side, a resistance level from $26,000 to $28,250 awaits, with 5.18 million wallets involved!

👉 Over 1.34 million wallets hold 450,000 #BTC in this range.

👉 On the flip side, a resistance level from $26,000 to $28,250 awaits, with 5.18 million wallets involved!

10/ As we wait for the interest rate decision, #BTC remains relatively calm.

👉 However, a breakout is brewing, and the #FOMC meeting could trigger a fresh wave of volatility

👉 Stay tuned and be ready to capitalize on the market's next move!

👉 However, a breakout is brewing, and the #FOMC meeting could trigger a fresh wave of volatility

👉 Stay tuned and be ready to capitalize on the market's next move!

👉 Remember, always do your research and make informed decisions.

👉 The #crypto market is full of surprises, and today's #FOMC meeting could bring some game-changing moments.

👉 The #crypto market is full of surprises, and today's #FOMC meeting could bring some game-changing moments.

Liked the thread! Don’t forget to retweet the first tweet and follow for more 🔥👇

https://twitter.com/cryptokingkeyur/status/1668966615961210880

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter