Your NPS pension amount depends on 2 factors:

>The amount you invest in buying an annuity (pension) plan

>The type of pension plan you pick

So far, you had the option to buy only one annuity plan.

But new rules will allow you to buy multiple plans.

A 🧵 on how this will help

>The amount you invest in buying an annuity (pension) plan

>The type of pension plan you pick

So far, you had the option to buy only one annuity plan.

But new rules will allow you to buy multiple plans.

A 🧵 on how this will help

First, the basics.

NPS matures when you turn 60.

You can withdraw up to 60% tax-free.

With the remaining 40%, you must buy an annuity plan, where you invest money with an Annuity Service Provider or ASP (an insurance company).

In return, it promises you a lifelong pension.

NPS matures when you turn 60.

You can withdraw up to 60% tax-free.

With the remaining 40%, you must buy an annuity plan, where you invest money with an Annuity Service Provider or ASP (an insurance company).

In return, it promises you a lifelong pension.

So far, buying more than one annuity plan wasn’t possible.

But now, it can be done.

As per the new rules, if an NPS subscriber has more than Rs 10 lakh to buy annuity plans, he can invest Rs 5 lakh each in two annuities.

One more thing.

But now, it can be done.

As per the new rules, if an NPS subscriber has more than Rs 10 lakh to buy annuity plans, he can invest Rs 5 lakh each in two annuities.

One more thing.

Currently, there are 14 ASPs that include big names like LIC and SBI Life.

As per new rules, you must buy all your annuity plans from the same ASP.

If you get one annuity plan from LIC, another plan cannot be from #SBI Life.

As per new rules, you must buy all your annuity plans from the same ASP.

If you get one annuity plan from LIC, another plan cannot be from #SBI Life.

Will all these new changes be helpful?

To some extent, yes.

The option to buy multiple annuity plans certainly gives #investors a chance to diversify across different types of annuity plans.

But first, let’s understand some common annuity plans in detail.

To some extent, yes.

The option to buy multiple annuity plans certainly gives #investors a chance to diversify across different types of annuity plans.

But first, let’s understand some common annuity plans in detail.

One of the most common types of annuity plans is ‘Annuity for life with ROP’.

In this, the NPS subscriber gets a pension till death & then the premium is returned to the nominee.

Another option is ‘Annuity for life without ROP’.

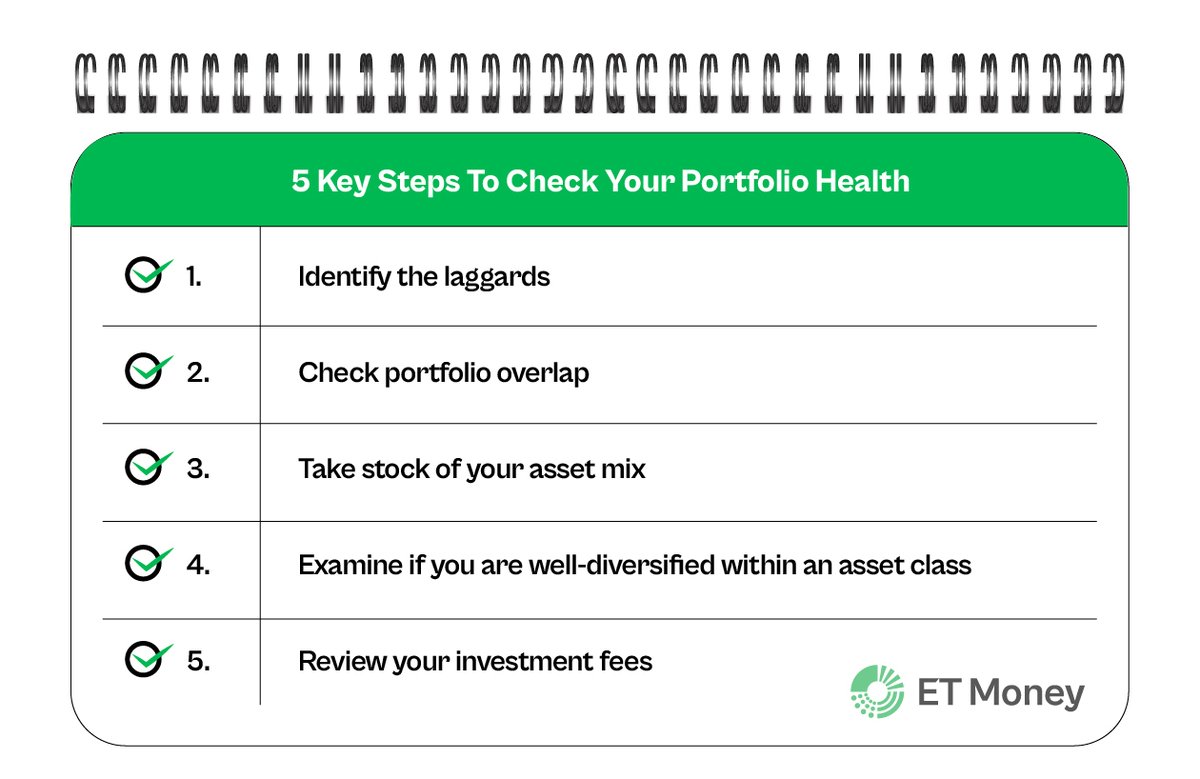

Check some common plans. (see image)

In this, the NPS subscriber gets a pension till death & then the premium is returned to the nominee.

Another option is ‘Annuity for life without ROP’.

Check some common plans. (see image)

The more beneficial an option sounds, the lower its returns can be.

Here’s an example.

LIC’s annuity for life with ROP offers 6.29% interest at this point.

But its annuity for life without ROP offers 6.67%.

Here’s an example.

LIC’s annuity for life with ROP offers 6.29% interest at this point.

But its annuity for life without ROP offers 6.67%.

How will the new rules help?

Now, you have more flexibility.

A portion of your corpus may go to annuity plans with higher interest (but without returning the premium).

Another portion of the corpus can be to leave a small legacy behind to legal heirs.

Now, you have more flexibility.

A portion of your corpus may go to annuity plans with higher interest (but without returning the premium).

Another portion of the corpus can be to leave a small legacy behind to legal heirs.

To sum it up, the new rules do provide flexibility to NPS subscribers.

But there are certain limitations.

One, it has to be from one ASP so this limits the flexibility.

But there are certain limitations.

One, it has to be from one ASP so this limits the flexibility.

Two, an annuity plan has to be purchased for the entire 40% in one go.

This can lower the annuity income, depending on the interest rate scenario at the time of purchase.

What do you think about this rule?

Let’s know in the comment section.

This can lower the annuity income, depending on the interest rate scenario at the time of purchase.

What do you think about this rule?

Let’s know in the comment section.

We put a lot of effort into creating such informative threads.

So, if you find this useful, show some love. ❤️

Please like, share, and retweet the first tweet.

So, if you find this useful, show some love. ❤️

Please like, share, and retweet the first tweet.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter