Most recent unrolls from @ThreadReaderApp

Mar 9

Read 6 tweets

This is a great example of confession through projection. I am totally flabbergasted.

There are 58 Muslim countries and one tiny Jewish one and it is the size of New Jersey.

1)

There are 58 Muslim countries and one tiny Jewish one and it is the size of New Jersey.

1)

Tucker does not believe that the indigenous Jews of Eretz Yisrael should be able to live in peace in their homeland. He obviously does not believe in G-d, the power of prayer, or the Bible. But Tucker Carlson did claim to be attacked by a demon in his bed...

2)

2)

who left scratch marks on him. Anyone who has read the Torah knows witchcraft is strictly forbidden within Judaism.

See.

1. Book of Exodus 22:18:

“You shall not allow a sorceress to live.”

3)

See.

1. Book of Exodus 22:18:

“You shall not allow a sorceress to live.”

3)

Mar 9

Read 4 tweets

9 mars 1940

François Mitterrand, homme de lettres, projet de colloque (15 et 16 octobre 2026).

Homme de lettres au sens propre : lettres à Anne (1962-1995) et aussi à Marie-Louise (1938-1942).

Lettre du 9 mars 1940 🧵⬇️

via @fabulafabula.org/actualites/128…

François Mitterrand, homme de lettres, projet de colloque (15 et 16 octobre 2026).

Homme de lettres au sens propre : lettres à Anne (1962-1995) et aussi à Marie-Louise (1938-1942).

Lettre du 9 mars 1940 🧵⬇️

via @fabulafabula.org/actualites/128…

Mar 9

Read 15 tweets

PhillyFashWatch Exposed

Paul Minton of Philadelphia, Pennsylvania, and Scotlyn Schmitt have been uncovered as operating the Antifa doxxing account PhillyFashWatch on X and its associated website.

Paul Minton of Philadelphia, Pennsylvania, and Scotlyn Schmitt have been uncovered as operating the Antifa doxxing account PhillyFashWatch on X and its associated website.

Very interestingly, they've collaborated with other Antifa doxxing pages such as ByWayofPlymouth a Boston based antifa account.

Under promise of anonymity, we received information from a source claiming to be “Antifa”, but complaining about the involvement of both Paul Minton and Scotlyn Schmitt in Antifascist circles.

Mar 9

Read 17 tweets

MY VIEW ON THE IRAN WAR

Most people seem to think nothing important is happening. They are still posting about baseball and influencers, and don't understand why I would drop everything to argue against this war. In this thread I'll share my view for my readers.

Most people seem to think nothing important is happening. They are still posting about baseball and influencers, and don't understand why I would drop everything to argue against this war. In this thread I'll share my view for my readers.

First of all, this war was started by the US and Israel without justification. National interest aside, it is morally wrong to go starting wars without justification. The stain of this unnecessary violence will haunt America for years to come.

The war rhetoric coming out of the Department of Defense is highly disturbing, and in some cases nakedly evil.

Renaming the DoD the Department of War is a red flag in itself. Promoting real violence with video game clips is psychotic. I could go on, but I won't....

Renaming the DoD the Department of War is a red flag in itself. Promoting real violence with video game clips is psychotic. I could go on, but I won't....

Mar 9

Read 25 tweets

After 10 days of war between Iran 🇮🇷 and the USA/Israel 🇺🇸🇮🇱, the economical situation is worsening

Here is a new MAP UPDATE with the military situation, the economical situation, some analysis and some prospects :

🧵THREAD🧵1/25 ⬇️

Here is a new MAP UPDATE with the military situation, the economical situation, some analysis and some prospects :

🧵THREAD🧵1/25 ⬇️

The war has been going on for now more than 10 days and the repercussion are felt worldwide.

Iran held despite constant strikes which obliterated its navy and airforce and still continues to launch important drone and missile strikes across the region.

Iran held despite constant strikes which obliterated its navy and airforce and still continues to launch important drone and missile strikes across the region.

Mar 9

Read 31 tweets

AYAĞI ZİLLİ GENÇ.!.

Bir kasaba Papazı etrafın rahatlıkla görülebildiği yüksek kilise bahçesinde oturuyordu. Uzaktan temiz giyimli eli yüzü düzgün bir gencin kiliseye doğru geldiğini gördü. Genç yürüyüşüne asalet katan ağır adımlarla yürüyordu.

Bir kasaba Papazı etrafın rahatlıkla görülebildiği yüksek kilise bahçesinde oturuyordu. Uzaktan temiz giyimli eli yüzü düzgün bir gencin kiliseye doğru geldiğini gördü. Genç yürüyüşüne asalet katan ağır adımlarla yürüyordu.

Genç yaklaştıkça Papaz ilginç bir ayrıntı fark etti. Genç yürüdükçe garip bir zil sesi geliyordu. Bir an içinden “acaba hayalleniyor muyum?” diye geçirdi ve bir daha dikkat kesildi. Evet, genç yürüdükçe etraftan zil sesleri yükseliyordu.

Genç kilise bahçesine girip Papaz’a yaklaştı.

- Selam Papaz Efendi.

- Selam delikanlı.

- Ben günah çıkartmak için geldim.

- Selam Papaz Efendi.

- Selam delikanlı.

- Ben günah çıkartmak için geldim.

Mar 9

Read 11 tweets

He arribat al punt que penso que a Catalunya el Govern Espanyol, amb col·laboració amb els seus d'aquí i d'allà, està fent un gegantí experiment social per veure fins a quin punt una societat pot aguantar i quins són els seus límits:

1. Un 70% dels inspectors fiscals de l'Estat

1. Un 70% dels inspectors fiscals de l'Estat

300% més inspectors que Madrid i 700% més que a Andalusia.

2. Una pressió fiscal inaguantable a les ex classes mitjanes cada vegada més empobrides, amb els col·laboradors criminalitzant la propietat i l'estalvi.

3. Uns serveis públics que només paguen els primers, però d'ús

2. Una pressió fiscal inaguantable a les ex classes mitjanes cada vegada més empobrides, amb els col·laboradors criminalitzant la propietat i l'estalvi.

3. Uns serveis públics que només paguen els primers, però d'ús

per tothom que passa per aquí, siguis expat milionari o un immigrant subvencionat que acaba d'arribar i ni cotitza ni ho farà mai.

4. Impost de successions i plusvàlues desorbitades, no fos cas que algú malgrat tot hagués aconseguit deixar en morir un mínim patrimoni a la família

4. Impost de successions i plusvàlues desorbitades, no fos cas que algú malgrat tot hagués aconseguit deixar en morir un mínim patrimoni a la família

Mar 9

Read 6 tweets

🚨 O contra-ataque do STF: Ministros articulam esvaziar o poder da PF em meio ao escândalo do Banco Master

Segundo Andréia Sadi, acuada pelo avanço das investigações sobre seus próprios membros, a Suprema Corte discute uma manobra para enquadrar a corporação.

Entenda os bastidores atualizados da crise institucional! 👇🏼

Segundo Andréia Sadi, acuada pelo avanço das investigações sobre seus próprios membros, a Suprema Corte discute uma manobra para enquadrar a corporação.

Entenda os bastidores atualizados da crise institucional! 👇🏼

1️⃣ O alvo: A autonomia da PF

Com as apurações financeiras esbarrando na família de Dias Toffoli e os contratos revelados ligados a Alexandre de Moraes, o discurso mudou, segundo a jornalista da Globo.

Nos bastidores do STF, a avaliação agora é de que a Polícia Federal "concentra poder demais" sob a atual gestão.

Com as apurações financeiras esbarrando na família de Dias Toffoli e os contratos revelados ligados a Alexandre de Moraes, o discurso mudou, segundo a jornalista da Globo.

Nos bastidores do STF, a avaliação agora é de que a Polícia Federal "concentra poder demais" sob a atual gestão.

2️⃣ A manobra política

Para frear a PF, a tese que ganha força na Corte é a criação ou o fortalecimento de um Ministério da Segurança Pública.

O objetivo não é apenas mudar o organograma da força, mas o "personagrama": trocar as chefias que hoje comandam investigações sensíveis.

Para frear a PF, a tese que ganha força na Corte é a criação ou o fortalecimento de um Ministério da Segurança Pública.

O objetivo não é apenas mudar o organograma da força, mas o "personagrama": trocar as chefias que hoje comandam investigações sensíveis.

Mar 9

Read 16 tweets

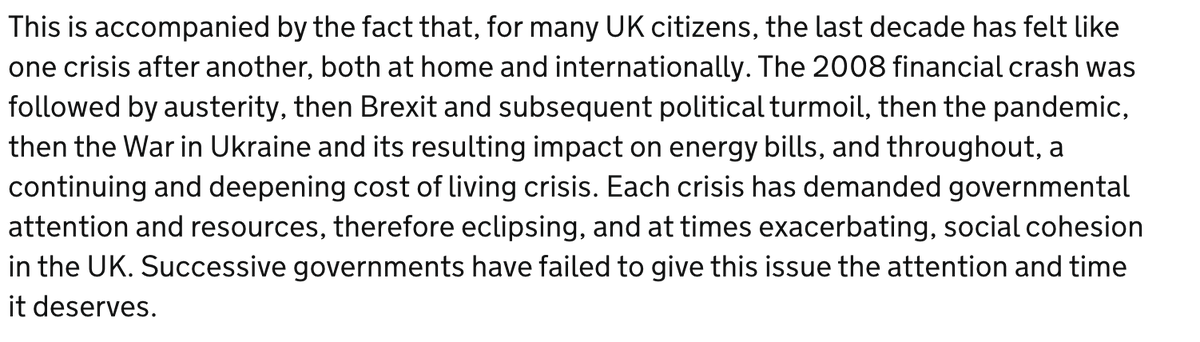

🧵Will get lost in geo-political turmoil & its domestic impacts, but the Govt's cohesion plan is imo well pithced & quite bold avoiding usual 'kumbaya' and placing more emphasis on responsibilities/ expectations necessary for a cohesive society than is normal in this type of work

Mar 9

Read 7 tweets

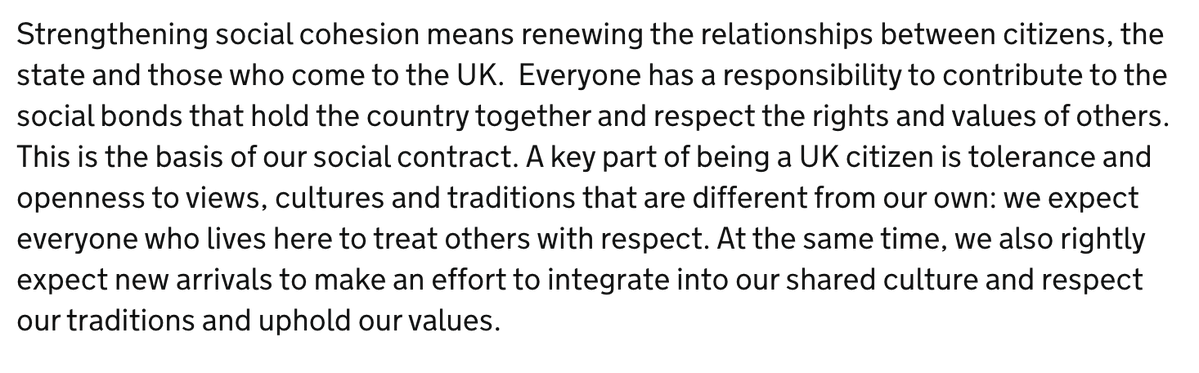

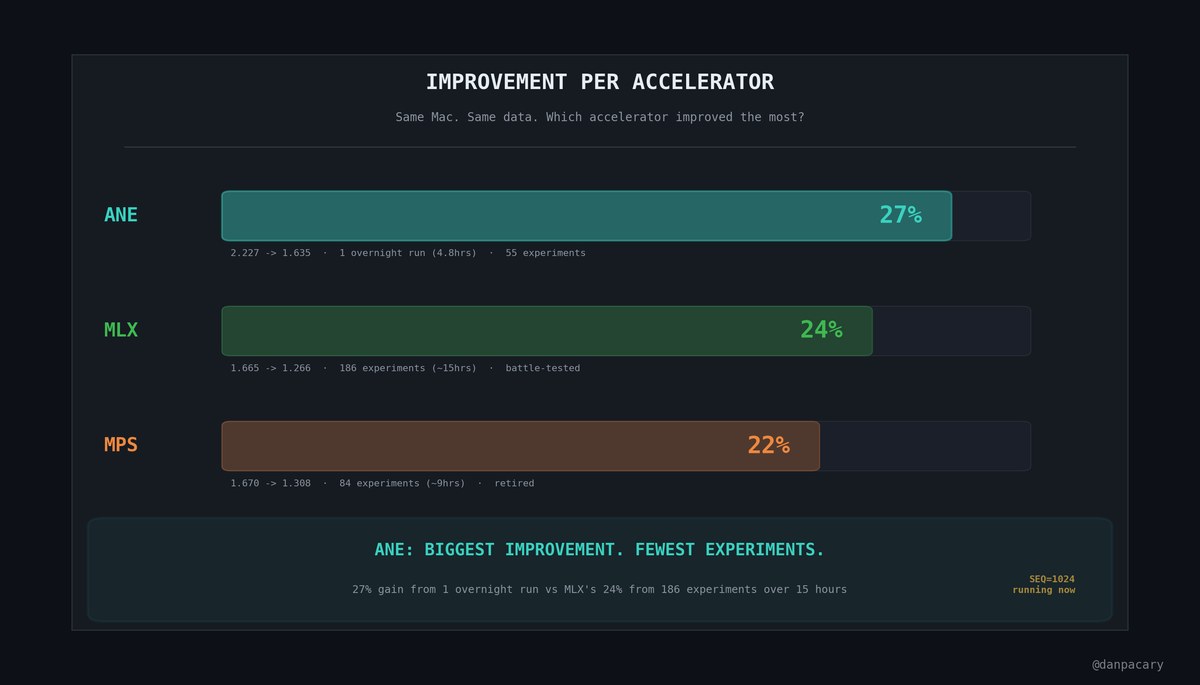

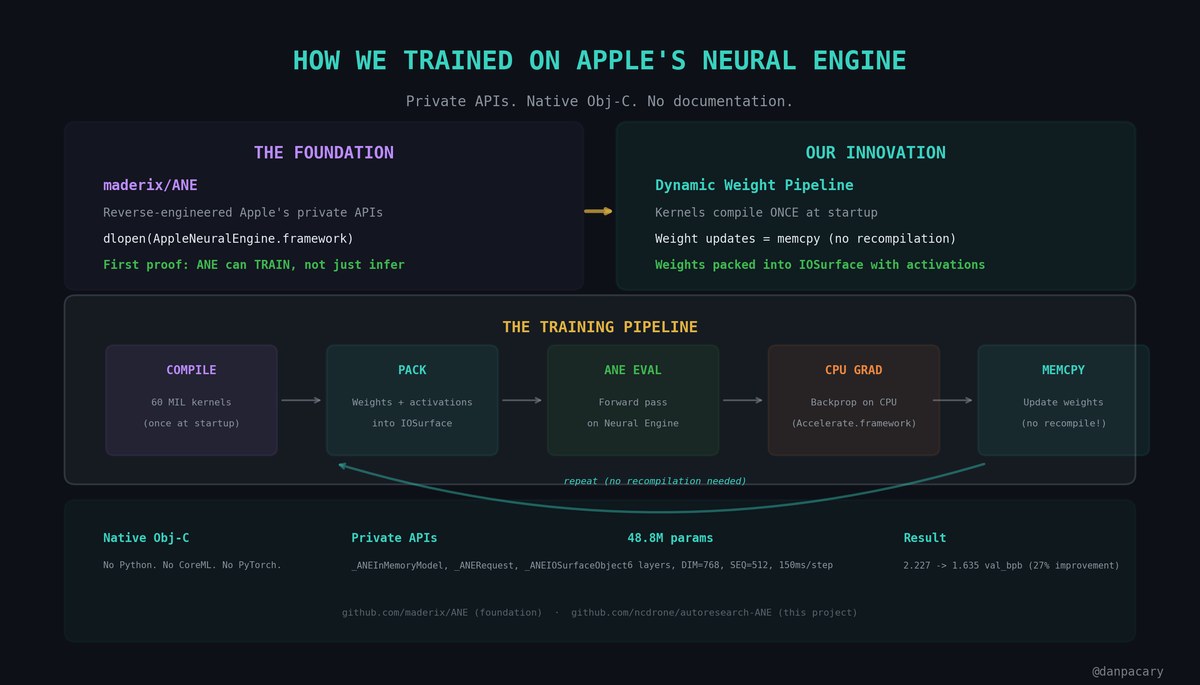

I hijacked Apple's Neural Engine -- the chip built for Siri and photo filters.

Reverse-engineered the private APIs and trained a full LLM on it.

Zero fan noise. Zero GPU. Just the Neural Engine doing what nobody thought it could.

Your Mac has one too.

Reverse-engineered the private APIs and trained a full LLM on it.

Zero fan noise. Zero GPU. Just the Neural Engine doing what nobody thought it could.

Your Mac has one too.

Apple's Neural Engine is in every Apple Silicon Mac. But Apple never documented it for training -- only inference.

We ported native ANE code from maderix (.github.com/maderix/ANE) who reverse-engineered the private APIs. Direct hardware access. Obj-C. No CoreML.

Then built a dynamic weight pipeline: kernels compile once, weight updates are just memcpy.

We ported native ANE code from maderix (.github.com/maderix/ANE) who reverse-engineered the private APIs. Direct hardware access. Obj-C. No CoreML.

Then built a dynamic weight pipeline: kernels compile once, weight updates are just memcpy.

Mar 9

Read 16 tweets

There are certain misconceptions about the Kowloon Walled City, the so-called anarchic and festering slum of British Hong Kong. Some include that housing quality and space was almost non-existent or that they were at least far inferior to less spontaneous public housing programmes; that poverty was significantly higher, that quality of life was far worse and that the area lacked governance (not to be equated with a state in this case). These are for the most part, misleading.

Please note: although I'm pretty decent in Cantonese as it is one of my primary languages (我嘅廣東話一般般啦) I am mostly using Colonial-era Romanisation of certain location names. So don't take offence if you are one of the few people to be offended by that.

Despite the fact that government interests favouring the demolition of the walled City were at play, a report found no structurally defective or unsafe buildings 17 years after the Walled City's construction. This was after considering potential factors such as collapse, a lack of structural integrity, fire, disease outbreak, or a plane mis-approximating its approach to Kai Tak Airport (one of the most challenging approaches in the world, mind you). It seems as if the buildings being packed together actually contributed to their structural integrity.

However, many public rental buildings were found to be structurally unsound, such that 27 housing blocks were demolished and 411 required heavy costs and maintenance to survive. This was due to the shoddiness of public housing projects, which I shall cover in due course.

However, many public rental buildings were found to be structurally unsound, such that 27 housing blocks were demolished and 411 required heavy costs and maintenance to survive. This was due to the shoddiness of public housing projects, which I shall cover in due course.

Mar 9

Read 10 tweets

जयश्रीराम🚩

Meet जी है दी Cut वो का Mu ल्ली IT Cell,

१.

Make Them Drink "वराह" मूत्र।

When All Cut वाS Proudly K!ll & Eat Our "गऊ माता"

Half Of Time Just To Mock & Provoke सनातनधर्म🚩

तब कहां घुस जाता है पीड़ित कार्ड।

ऊंट का तो पीते ही हो।

"वराह"जी का भी पीलो क्या दिक्कत है।

⤵️

Meet जी है दी Cut वो का Mu ल्ली IT Cell,

१.

Make Them Drink "वराह" मूत्र।

When All Cut वाS Proudly K!ll & Eat Our "गऊ माता"

Half Of Time Just To Mock & Provoke सनातनधर्म🚩

तब कहां घुस जाता है पीड़ित कार्ड।

ऊंट का तो पीते ही हो।

"वराह"जी का भी पीलो क्या दिक्कत है।

⤵️

२.

जी है दी Cut WasS & Mu ल्लाS

Should Not Live In *Delhi। *भारतवर्ष।

Send Them To फ़कीर स्तान। १९४७।

I Want खून का बदला खून। "Qisas"।

समझ गए कि और समझाऊं।

ऐसे,

जी है दी वहछी द रिं De Cut वे Mu ल्लाS

को तो कहीं भी रहने का अधिकार नहीं है।

१९४७ वाली Jin ना की बात याद आगई।

⤵️

जी है दी Cut WasS & Mu ल्लाS

Should Not Live In *Delhi। *भारतवर्ष।

Send Them To फ़कीर स्तान। १९४७।

I Want खून का बदला खून। "Qisas"।

समझ गए कि और समझाऊं।

ऐसे,

जी है दी वहछी द रिं De Cut वे Mu ल्लाS

को तो कहीं भी रहने का अधिकार नहीं है।

१९४७ वाली Jin ना की बात याद आगई।

⤵️

३.

She Is Speaking Ur भाषा Of Justice।

"संविधान के ऊपर शरिया"

According To शRiaS

"Qisas" (Retaliation) :

For D Deliberate Taking Of life,

The Primary Punishment Is "Qisas",

Which Means The Family Of The Victim Has The Right To Demand The Death Penalty For The "KILLERS".

समझा।⤵️

She Is Speaking Ur भाषा Of Justice।

"संविधान के ऊपर शरिया"

According To शRiaS

"Qisas" (Retaliation) :

For D Deliberate Taking Of life,

The Primary Punishment Is "Qisas",

Which Means The Family Of The Victim Has The Right To Demand The Death Penalty For The "KILLERS".

समझा।⤵️

Mar 9

Read 13 tweets

The very serious situation in 🇧🇷, a 🧵.

1/ Mr. Trump @POTUS is set to designate 🇧🇷 ‘s PCC (First Capital Command) and Comando Vermelho (Red Command) as Foreign #Terrorist Organizations. A massive move.

1/ Mr. Trump @POTUS is set to designate 🇧🇷 ‘s PCC (First Capital Command) and Comando Vermelho (Red Command) as Foreign #Terrorist Organizations. A massive move.

2/ This designation allows the US to freeze global assets and target the financial networks of these #brutal #cartels directly.

3/ The caviar #socialist is reportedly furious, claiming it violates "sovereignty." Critics ( and I agree a hundred percent) say he's just terrified of US eyes on 🇧🇷’s internal #corruption.

Mar 9

Read 13 tweets

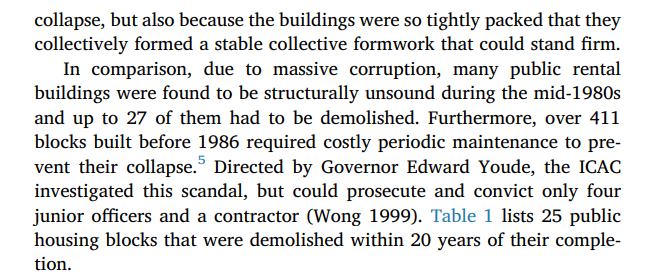

On va décortiquer un pattern rhétorique récurrent dans les beefs en ligne : la fausse « démonstration par l’absurde » utilisée comme bouclier après DARVO.

Thread (🧵)

Thread (🧵)

Exemple fictif : après critique sur des méthodes manipulatrices, réponse du style « je n’étais pas disposé à donner des éléments, mais en essayant de me cacher, vous avez créé un effet Streisand énorme donc vos accusations ont toujours été absurdes, rester loin de nous»

Rappel : la vraie démonstration par l’absurde montre qu’une prémisse mène à une contradiction logique évidente.

Ici, c’est détourné en : « Si vos critiques étaient justes, je n’aurais pas eu autant de bruit en essayant de rester discret → absurdité → vous êtes faux ».

Ici, c’est détourné en : « Si vos critiques étaient justes, je n’aurais pas eu autant de bruit en essayant de rester discret → absurdité → vous êtes faux ».

Mar 9

Read 18 tweets

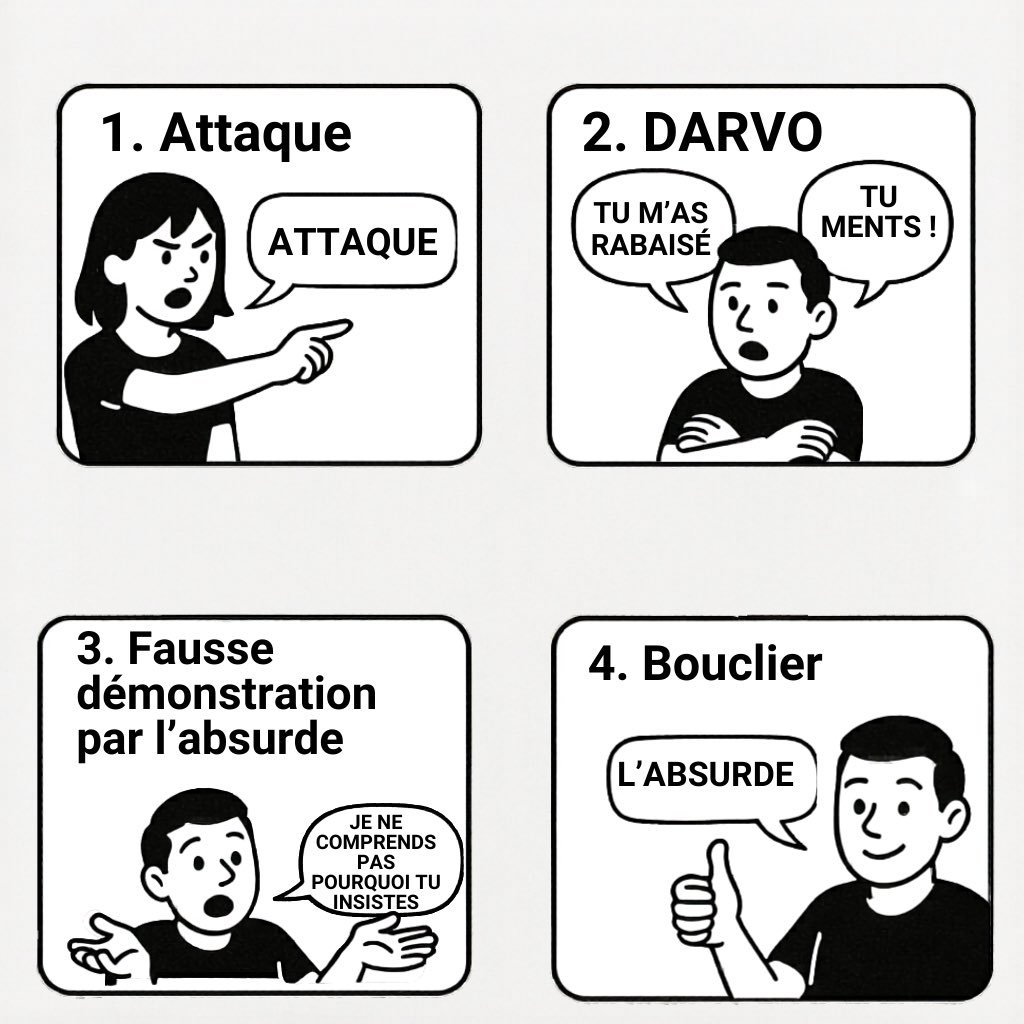

You cut the sugar. You took the antifungals. You did the "Candida cleanse."

And it worked... for a while. Then everything came back.

This is the part nobody explains to you.

Here's why Candida overgrowth resists almost everything people throw at it ↓

And it worked... for a while. Then everything came back.

This is the part nobody explains to you.

Here's why Candida overgrowth resists almost everything people throw at it ↓

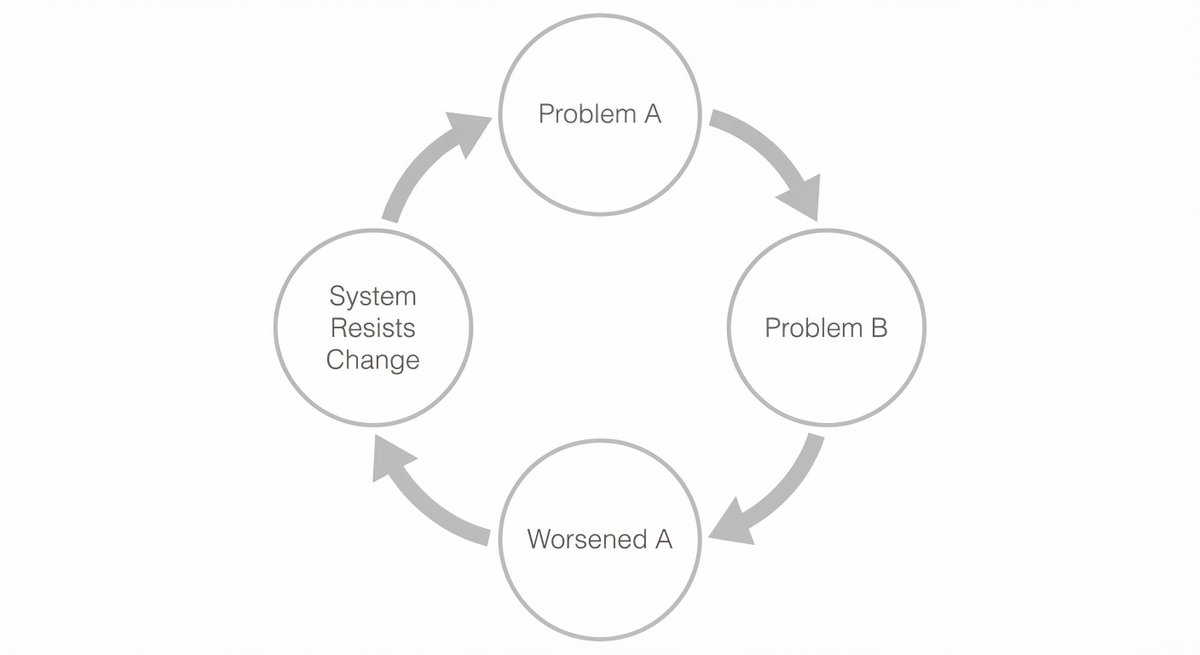

Most people think of Candida overgrowth as a simple infection. Something got out of control, so you kill it, and then you move on.

The problem with that line of thinking is that Candida overgrowth is a SYSTEMS problem. Your body has MULTIPLE overlapping defense systems that are supposed to keep this organism in check at all times. Your gut pH, your microbial community, your bile acids, your mucosal barrier, your immune surveillance, your hormones, your nutritional status.

Overgrowth happens when enough of those systems break down at the same time that the internal environment shifts toward a state where Candida can thrive.

The problem with that line of thinking is that Candida overgrowth is a SYSTEMS problem. Your body has MULTIPLE overlapping defense systems that are supposed to keep this organism in check at all times. Your gut pH, your microbial community, your bile acids, your mucosal barrier, your immune surveillance, your hormones, your nutritional status.

Overgrowth happens when enough of those systems break down at the same time that the internal environment shifts toward a state where Candida can thrive.

And here's where it gets really important.

Once that shift happens, the dysfunction starts FEEDING ITSELF through something called feedback loops.

A feedback loop is when the output of one problem becomes the input for another problem, which then circles back and amplifies the original problem. When enough of these loops are active at the same time, they create a system that actively resists intervention.

This is why temporary improvement followed by relapse is one of the most common patterns people report with chronic Candida issues.

Once that shift happens, the dysfunction starts FEEDING ITSELF through something called feedback loops.

A feedback loop is when the output of one problem becomes the input for another problem, which then circles back and amplifies the original problem. When enough of these loops are active at the same time, they create a system that actively resists intervention.

This is why temporary improvement followed by relapse is one of the most common patterns people report with chronic Candida issues.

Mar 9

Read 5 tweets

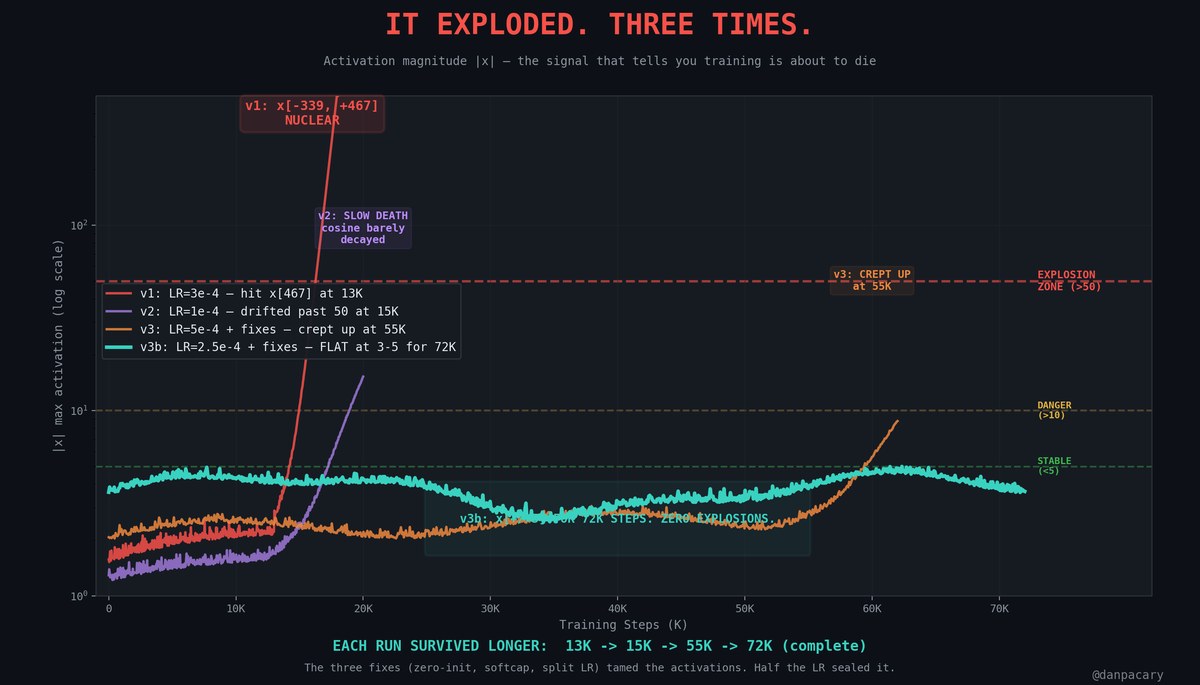

Tak, jestem małostkowy ale mam satysfakcję gdy rzeczywistość weryfikuje błędne tezy.

Nie tak dawno od szefa BBN usłyszeliśmy "Europa nie ma potencjału".

Dziś widzimy jak "brak potencjału" nazywany też francuskim lotniskowcem idzie pełną parą w rejon konfliktu. 1/

Nie tak dawno od szefa BBN usłyszeliśmy "Europa nie ma potencjału".

Dziś widzimy jak "brak potencjału" nazywany też francuskim lotniskowcem idzie pełną parą w rejon konfliktu. 1/

Mar 9

Read 10 tweets

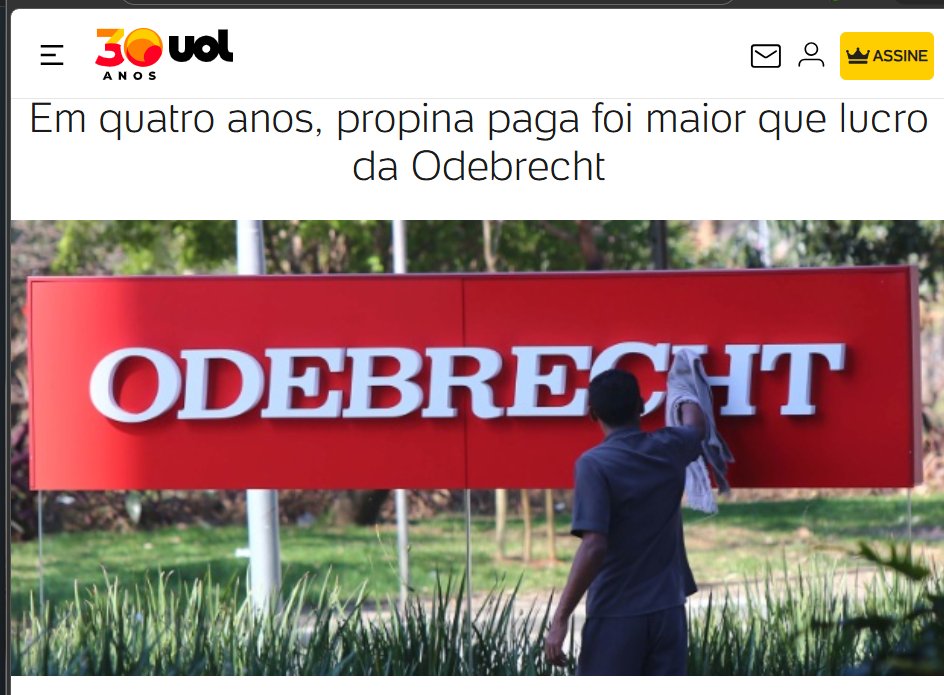

#1 Um dos erros da Lava Jato foi acreditar que investigava casos colossais de corrupção apenas. O que eles tinham em mãos era uma engenharia de fluxo de financeiro na qual as obras eram meios que justificavam as movimentações. A corrupção era método e parte do negócio. Parte...

#2 Isso aqui faz sentido para alguém? Esse volume de dinheiro chamado de "propina" não se encaixa em nenhuma lógica. Não há como a corrupção superar os ganhos formais negócio. O que existiu foi um esquema transnacional de lavagem e movimentação de ativos em escala estatal.

#3 Qual é a oportunidade que a @policiafederal tem e a imprensa também? Não olhem o caso do Master como fraude no sistema financeiro ou corrupção. Está cada vez mais evidente que não se trata disso. Vorcaro sequer deve estar no topo da hierarquia. Tem cheiro que ele era um provedor de serviços como lavagem e canais de fluxo de ativos.

Mar 9

Read 20 tweets

שוב יום מעייף של ניסיונות להדוף מגיבי "אז מה אתה מציע?". אני מרכז כאן כמה טקסטים והפניות שמסבירים למה זו שאלה קנטרנית (במכוון או לא במכוון) ולמה היא מראש ממוסגרת בהנחות שאסור לקבל.

זה יהיה ארוך.

זה יהיה ארוך.

כל עוד השואל מניח את הנחות המסגרת, אין טעם לדיון. ממילא דיוני טוויטר נועדים לכישלון כמעט תמיד, ודאי שתחת מטחי טילים, ודאי וודאי כאשר הנחות המוצא כל כך מקוטבות. מה שנתפס בתגובות שלי כהתחמקות או קוצר רוח הוא פשוט גישה פרגמטית למה שאפשר ואי אפשר להשיג כאן,

ואני מאד ממוקד מטרה בכתיבה שלי כאן, לא מבזבז קלוריות על ויכוחי סרק.

Mar 9

Read 7 tweets

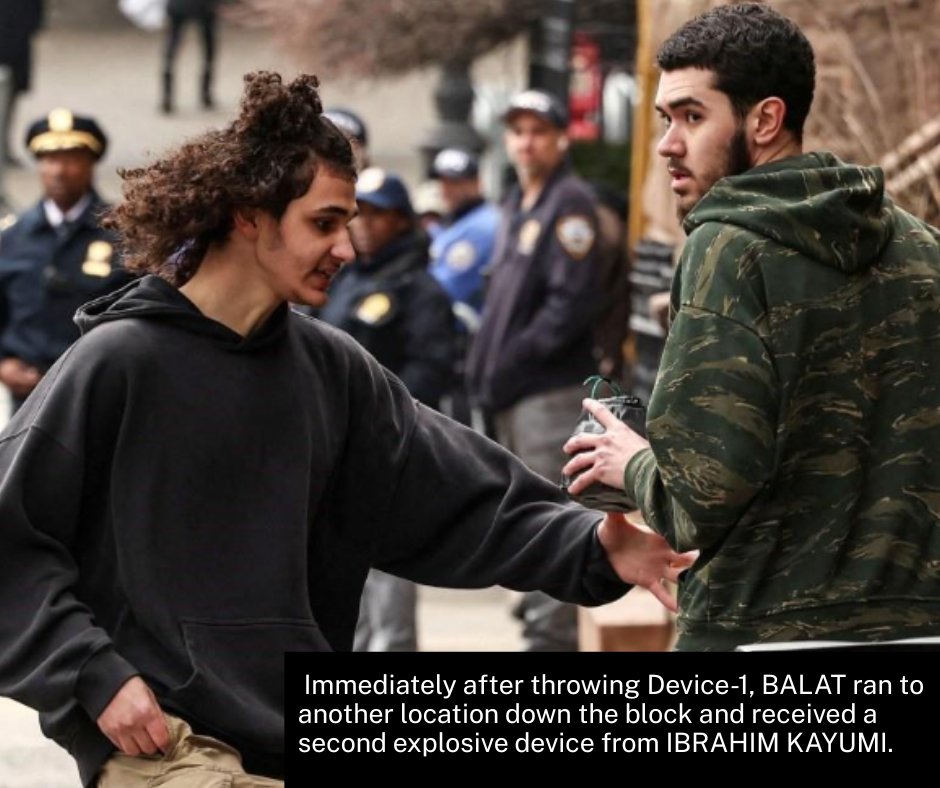

🚨TWO ISIS SUPPORTERS CHARGED WITH ATTEMPTING TO DETONATE EXPLOSIVE DEVICES DURING PROTESTS OUTSIDE GRACIE MANSION

Avowed ISIS supporters Emir Balat and Ibrahim Kayumi attempted to detonate two devices containing shrapnel and highly volatile explosive material during a protest and counter-protest outside the Mayor of New York's residence.

Great work @SDNYnews @NYPDnews @FBINewYork!

🔗: justice.gov/opa/pr/two-isi…

Avowed ISIS supporters Emir Balat and Ibrahim Kayumi attempted to detonate two devices containing shrapnel and highly volatile explosive material during a protest and counter-protest outside the Mayor of New York's residence.

Great work @SDNYnews @NYPDnews @FBINewYork!

🔗: justice.gov/opa/pr/two-isi…

Mar 9

Read 4 tweets

The problem with this thought is the Iranian drones being fired now are the uber sophisticated Russian-guilt Geran using radio mesh and cell phone sim card link video-navigation.

1/3

1/3

They are flying lower and more sophisticated trajectories taking advantage of radar shadows from oil infrastructure in the Gulf to prevent the generation of good intercept tracks.

Gun armed ships and attack helicopters low amongst oil rigs are the best play here.

2/3

Gun armed ships and attack helicopters low amongst oil rigs are the best play here.

2/3

It is only a matter of time until Geran/Shaheed FPV motherships are being fired by the IRGC at Gulf Oil infrastructure using Gulf Cell phone networks as video data links.

3/3

3/3