How to get URL link on X (Twitter) App

#Ouroboros Genesis is an upcoming Cardano upgrade that solves issues and protects against attacks in a #decentralized setting, with unique features not found in other PoS #blockchain 's.

#Ouroboros Genesis is an upcoming Cardano upgrade that solves issues and protects against attacks in a #decentralized setting, with unique features not found in other PoS #blockchain 's.

What does MiCA have to say specifically about stablecoins? MiCA is a meaty framework and bundles its stablecoin language into two subcategories: E-Money Tokens (EMTs) and Asset-Referenced Tokens (ARTs).

What does MiCA have to say specifically about stablecoins? MiCA is a meaty framework and bundles its stablecoin language into two subcategories: E-Money Tokens (EMTs) and Asset-Referenced Tokens (ARTs).https://twitter.com/theblock__/status/1631631708368822275The Uniswap committee will evaluate eight bridges and three bridge-agnostic solutions.

that Kwon and others “engaged in a scheme to deceive and mislead investors … in the U.S. and abroad.” Indeed, the SEC’s findings paint a much clearer picture of the entire Terra system as a fraud, one just as elaborate and calculated as Sam Bankman-Fried’s FTX,

that Kwon and others “engaged in a scheme to deceive and mislead investors … in the U.S. and abroad.” Indeed, the SEC’s findings paint a much clearer picture of the entire Terra system as a fraud, one just as elaborate and calculated as Sam Bankman-Fried’s FTX,

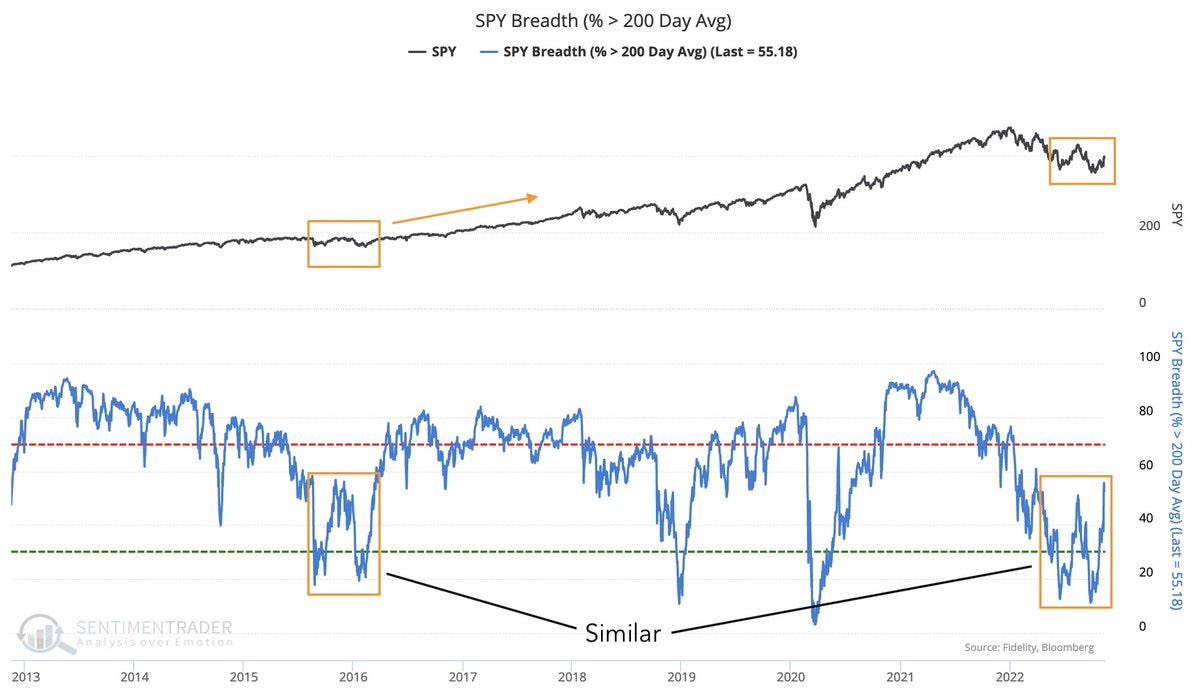

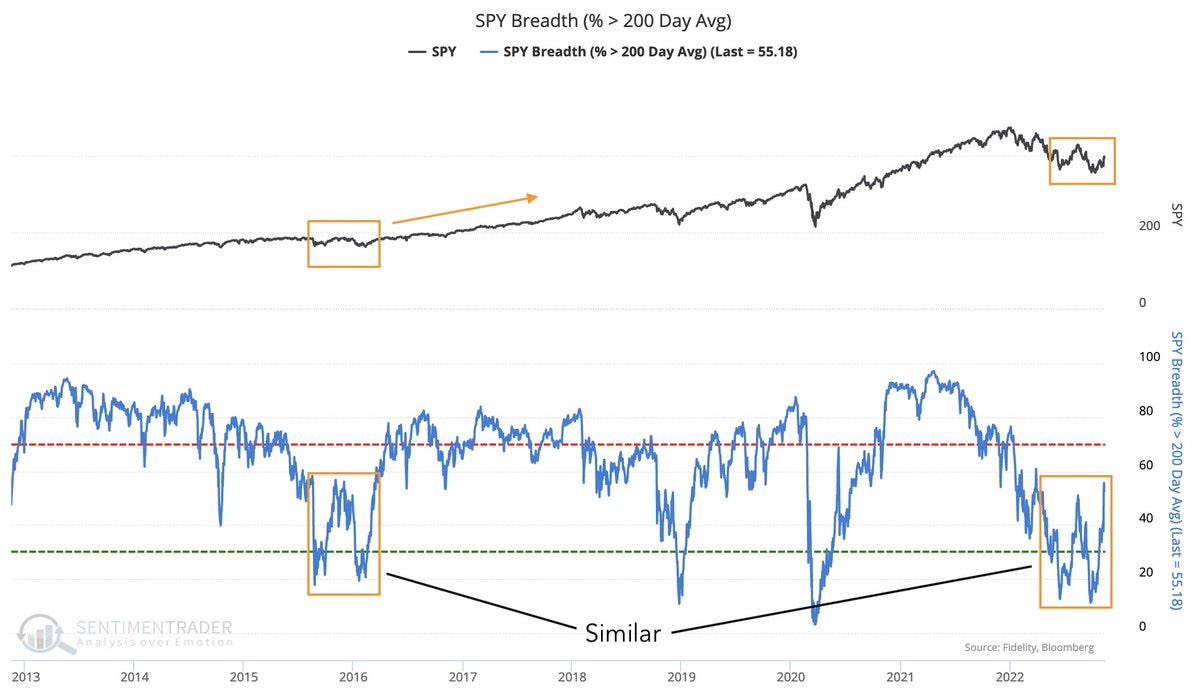

This is very different from what we have now so don’t draw any hasty parallels and stay vigilant. #ES #investing

This is very different from what we have now so don’t draw any hasty parallels and stay vigilant. #ES #investing