FireCharts, #TradingSignals, #Crypto market data & svcs

CoFounders @Mtrl_Scientist @teamblacknox

$BTC No Financial Advice. Join us https://t.co/jk8qyzpuQg

How to get URL link on X (Twitter) App

2/23 Before we dive into the macro for #Bitcoin, let's look at what's happening this week. It's rare to have a Daily MA #GoldenCross and a Weekly MA #DeathCross happening on the same asset.

2/23 Before we dive into the macro for #Bitcoin, let's look at what's happening this week. It's rare to have a Daily MA #GoldenCross and a Weekly MA #DeathCross happening on the same asset. https://twitter.com/KAProductions/status/1622581106322145281?s=20&t=IDLL6rCKlkY-nm93uR0OVQ

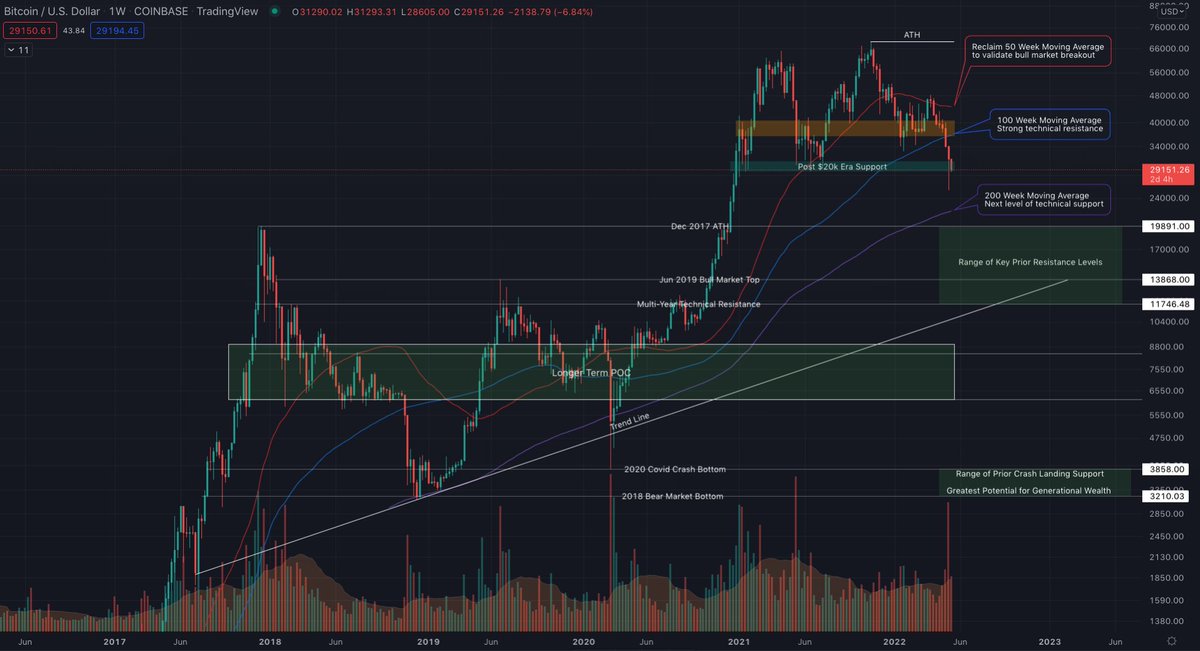

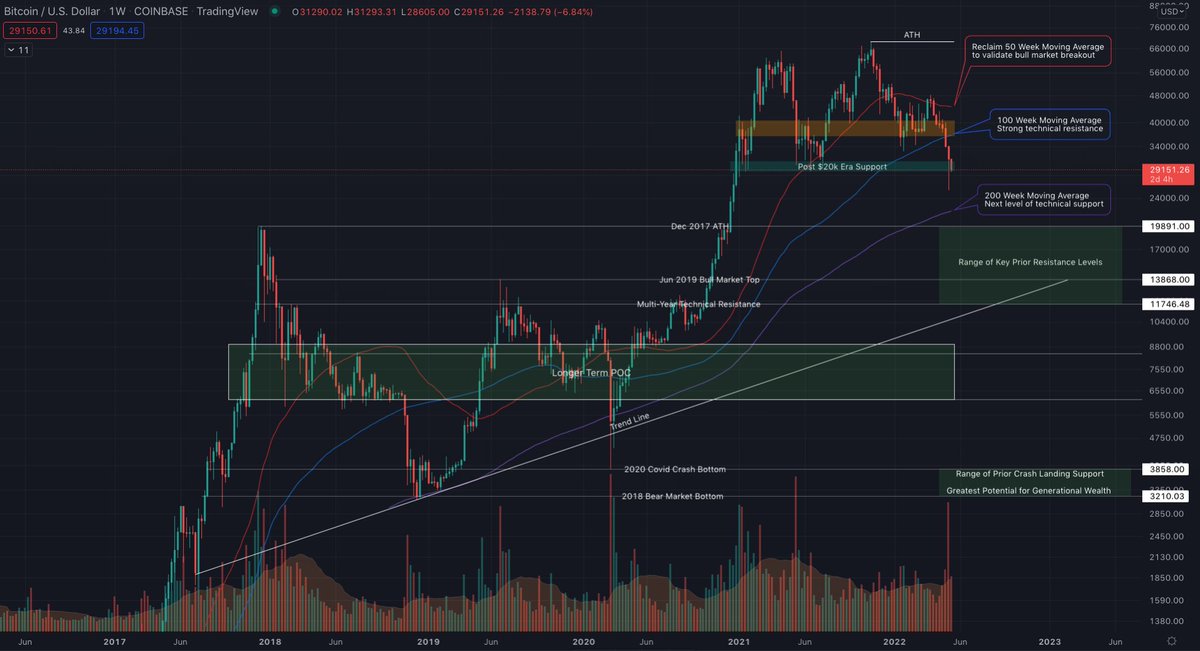

Depending on what exchange you're on, #Bitcoin had a July low of ~$18,763 and closed ~$23,322. A rally to that level would require a 15% move from here. Is that a high probability outcome? Absolutely not. More on that in a bit...

Depending on what exchange you're on, #Bitcoin had a July low of ~$18,763 and closed ~$23,322. A rally to that level would require a 15% move from here. Is that a high probability outcome? Absolutely not. More on that in a bit...

2/11 Yesterday I shared an #ETHUSDT chart showing a tentative short signal from the Trend Precognition A2+ algo. At last night's D close the signal printed and new short signals appeared on both the A2+ algo (arrows) and A1 algo (dots).

2/11 Yesterday I shared an #ETHUSDT chart showing a tentative short signal from the Trend Precognition A2+ algo. At last night's D close the signal printed and new short signals appeared on both the A2+ algo (arrows) and A1 algo (dots).

2/4 Through the cycle, the MTF Mean Reversion indi gave a bunch of #TradingSignals. MTF has an impressive hit rate, but I don't want to create the illusion that these indicators nail it 100% of the time.

2/4 Through the cycle, the MTF Mean Reversion indi gave a bunch of #TradingSignals. MTF has an impressive hit rate, but I don't want to create the illusion that these indicators nail it 100% of the time.

2/In bear markets everyone is looking for a relief rally to exit or add short. Those are good strategies if you can tell the difference between a fakeout and a breakout. #FOMO + failure to identify invalidation levels are why so many people get rekt. #BullTrap #ShortSqueeze

2/In bear markets everyone is looking for a relief rally to exit or add short. Those are good strategies if you can tell the difference between a fakeout and a breakout. #FOMO + failure to identify invalidation levels are why so many people get rekt. #BullTrap #ShortSqueeze