How to get URL link on X (Twitter) App

https://twitter.com/pinchedforgrowf/status/1298014912023687168?s=20$U oppty to expand into industrial applications

https://twitter.com/_inpractise/status/1298237598821908481?s=20

New $MAR $EXPE contract as reported by @skift

New $MAR $EXPE contract as reported by @skift

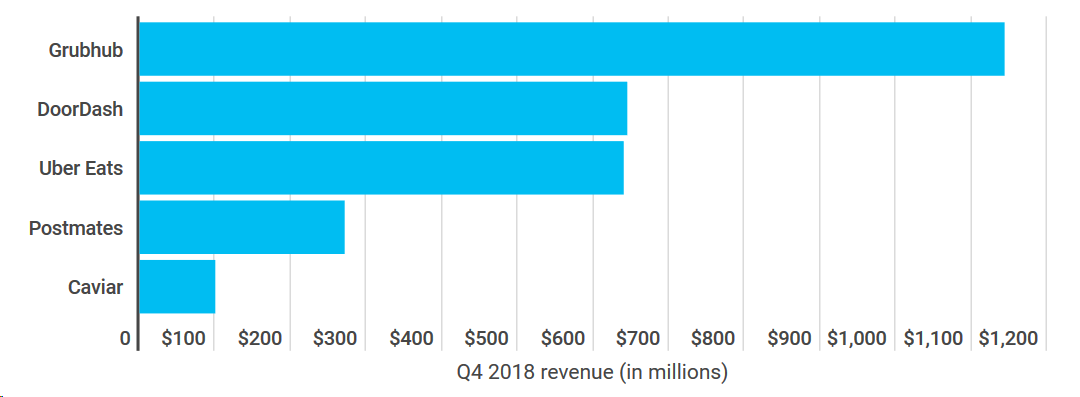

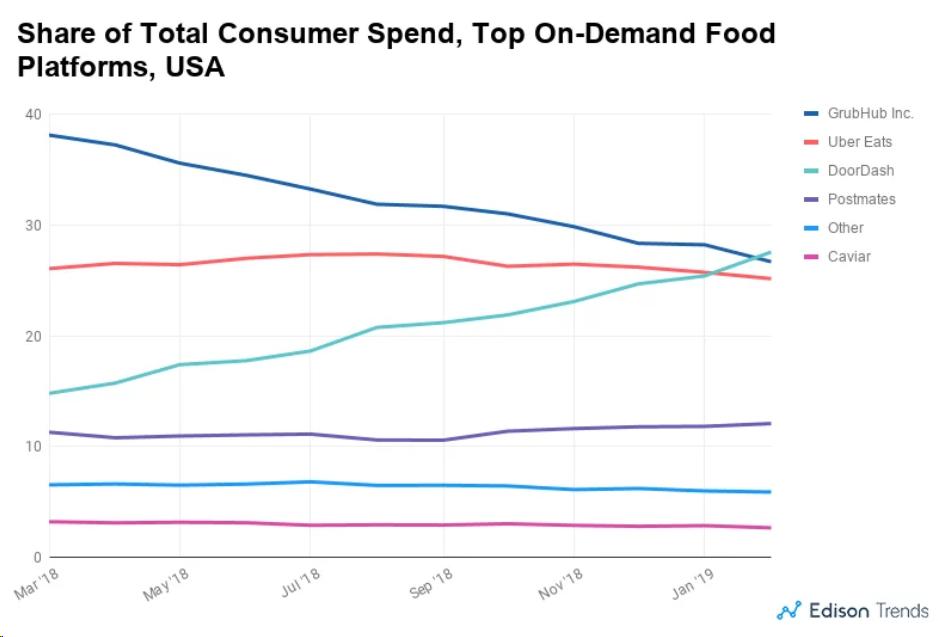

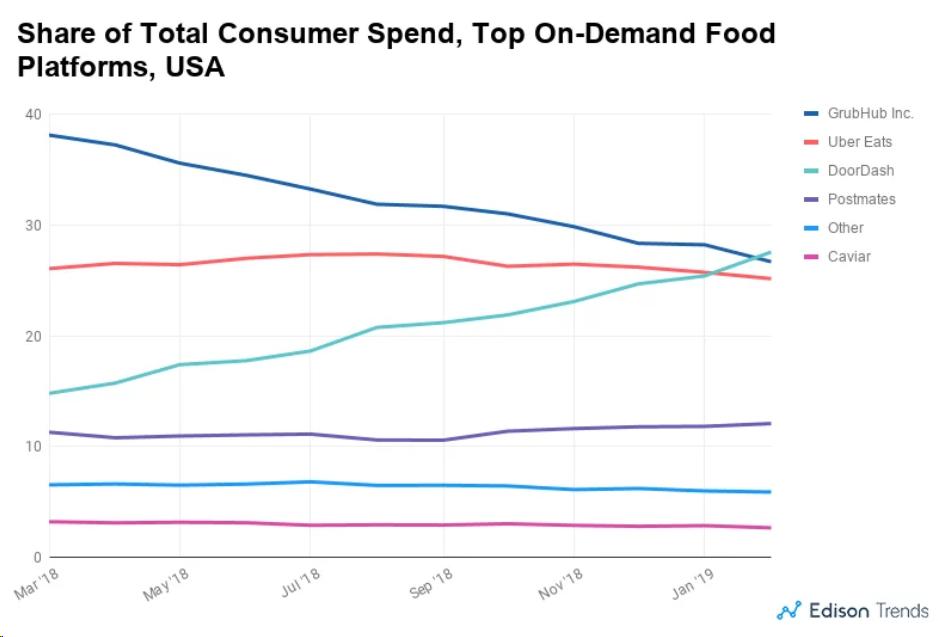

1. According to bit.ly/2WjB5ZY @jonathanmaze, $GRUB is still top

1. According to bit.ly/2WjB5ZY @jonathanmaze, $GRUB is still top