🚨🚨🚨#USS has released their consultation on the 2018 valuation. Headline figure is that the best case scenario they're offering to members is a 3.7% increase in contributions to preserve the DB & DC status quo (minus the 1% match). 1/

ussemployers.org.uk/sites/default/…

ussemployers.org.uk/sites/default/…

This is 0.4% higher than the 3.2% increase that JEP modelled. If split 65:35 between employers and members, that would imply +2.4% employer contributions & +1.3% member contributions. 2/

In order for #USS to accept this best case scenario, they write that "a combination of contingent contributions [automatic triggers] and negative pledges would be the most appropriate means of providing acceptable support" of increased investment risk. 3/

The reasonableness of the automatic triggers will be crucial to the viability of +3.7%. The reference to 'negative pledges' is problematic, since employers have, in the past, been even more adamantly opposed to negative pledges as they have been to automatic triggers. 4/

The following two JEP recommendations are not among those #USS has said they are "prepared to consider":

"Change 6" = 10 yr delay in the 'de-risking' shift of the portfolio to bonds. "Change 7" = smoothing cost of future service contributions over 6 years. 5/

"Change 6" = 10 yr delay in the 'de-risking' shift of the portfolio to bonds. "Change 7" = smoothing cost of future service contributions over 6 years. 5/

#USS is on least defensible ground in their refusal consider any delay in the onset of the shift to bonds. @ucu & @UniversitiesUK should jointly make the case for at least as much of a delay as is needed to bring the overall contribution rise down to JEP-modelled +3.2%. 6/

They are also on shaky ground in their claim that an acceptance of "Change 5" (i.e., increase in Test 1 reliance on covenant at yr 20 from £10 bn to £13 bn) necessitates the adoption of automatic triggers and/or negative asset pledges. 7/

This is because these Test 1 reliance figures all rest on an undefended and indefensible assumption that assets will equal rather than exceed TP liabilities at yr 20. See this blog post. 8/

medium.com/@mikeotsuka/th…

medium.com/@mikeotsuka/th…

It is on account of this undefended and indefensible assumption that #USS's valuations (both this one and their 2017 valuation) significantly overstate the risk of remaining continually invested in the current return-seeking portfolio. 9/

On their own understanding of the underlying rationale for Test 1 (which, tellingly, is not mentioned in the consultation document), the scheme will be within affordable distance at yr 20 of the 'safe harbour' of 'self-sufficiency' even in the absence of any shift to bonds. 10/

🚨I now see that #USS has offered a brief defence of their assumption that assets will not exceed liabilities at yr 20! See highlighted: 11/

The "This ensures..." sentence is saying that USS will not allow the scheme to go into surplus because then we will be overpaying for our benefits. For reasons I will mention below, this is a feeble justification. 12/

The problem is that, by refusing to overpay for benefits by one criterion by going into TP funding surplus, #USS ensures that it is becomes prohibitively expensive to meet a different target, which is specified by Test 1. 13/

Please see this embedded tweet thread for more details. 14/

https://twitter.com/MikeOtsuka/status/1075696288761634816

#USS has claimed (see linked blog post) that the "trustee’s Statement of Funding Principles, which are agreed with participating employers, clearly states that the trustee’s aim is to hold assets equal to the Technical Provisions." 15/

medium.com/@mikeotsuka/th…

medium.com/@mikeotsuka/th…

As I note in this same blog post, this claim re the SFP does not withstand scrutiny. I note here that the consultation document released today contains a new draft SFP, which also nowhere claims that assets must equal, and cannot significantly exceed, TP liabilities. 16/

If #USS were truly acting in the best interest of scheme members & sponsors, they would acknowledge that they made a mistake in assuming that assets would not exceed TP liabilities at yr 20. 17/

They would acknowledge that they therefore overstated the risk of remaining invested in the current return-seeking portfolio. They would not do what they are instead doing, which is to provide a post hoc rationalisation for their undefended & indefensible assumption. 18/

Their refusal to acknowledge their mistake reveals that they place more value on saving face than in funding DB benefits in a rational and cost-effective manner. 19/

The cost to members & employers of saving face for #USS is very high: at least +0.5% contributions, plus onerous automatic triggers & asset pledges. 20/

It is crucial that @UniversitiesUK & @ucu press for a satisfactory explanation from #USS of their assumption that assets will not exceed liabilities at yr 20, before agreeing to +0.5% contributions, plus onerous automatic triggers & asset pledges. 21/21

👆@USSEmployers @ucu @AlistairJarvis @JoanneSegars @SallyBridgeland @Sam_Marsh101 @Flibitygibity @carlomorelliUCU @HershMarion @Dennis_Leech @DaveGuppy @UofGVC @adamtickell @RedActuary @Derek_Benstead @kevinwesbroom @GuyCoughlan @USSbriefs @JosephineCumbo @Wonkhe @stianwestlake

👆Um, I meant to type 0.5% higher: +0.3% for employers (from 2.1% to 2.4%) and +0.2% for members (from 1.1% to 1.3%).

NB this #USS webpage 👇contains FAQs on the new valuation, plus links to videos from December institutions meeting by @GuyCoughlan and Ali Tayebbi. (Tagging @USSbriefs)

uss.co.uk/news/all-news/…

uss.co.uk/news/all-news/…

#USS's FAQs include the following question. "Why isn't USS prepared to build up a funding surplus, as has been claimed?" Here is their answer 👇 (on which I will comment in tweets below).

I see from the above explanation that I misread #USS's statement that I posted in /11. I misread them to be saying that if the scheme went into a TP surplus, we would be overpaying for benefits on a TP basis. 1/

Rather, what they appear to be saying is that, even if contributions of 26% invested into the return-seeing portfolio would be 67% likely to generate a substantial surplus by year 20, that level of contributions would involve UNDERPAYMENT for benefits, on an 'economic basis.' 2/

The 'economic basis' involves a discounting of liabilities by the yield on long-dated gilts which they take to match the pensions liabilities. It involves a discount rate of gilts+0% which is even more conservative than the gilts+0.75% rate of a self-sufficiency portfolio. 3/

#USS is saying that not raising contributions above 26% now will make a deficit more likely in the short term and weaken "the ability of the scheme to recover in the long term if things do not go as expected". 4/

The problem with this stance is that, by the same reasoning, USS & employers acted irresponsibly in the past when they went on their CONTRIBUTION HOLIDAY. They impale themselves on the pictured 2nd horn of the dilemma I sketch in this blog post. 5/5

medium.com/@mikeotsuka/a-…

medium.com/@mikeotsuka/a-…

Below I post two of the most significant charts from the valuation document. First, this one, which I think provides the main explanation for why #USS will not accept JEP recommendations in full: 1/

The vertical dotted blue line is roughly the highest c. gilts+1.4 discount rate that the regulator deems acceptable for a covenant they regard to be in the highest category of 'strong'. The blue '2018 including 1-5' bar is the most #USS appears to be prepared to accept. 2/

1-5 consists of 5 of the 7 JEP recommendations that bear on the TP discount rate. #USS is in dispute w/ tPR regarding whether the covenant is 'strong' as opposed to merely 'tending to strong'. USS says they continue to robustly argue for 'strong'. 3/

tPR continues to claim 'tending to strong', in which case even gilts +1.2% of the current, expensive 2017 Rule 76 valuation is beyond tPR's acceptable range. 4/

#USS appears willing to submit a gilts+1.4% valuation, but only if employers agree to automatic triggers & negative asset pledges. This is roughly in line with the linked tPR guidance. 5/

ucu.org.uk/media/9999/TPR…

ucu.org.uk/media/9999/TPR…

Improving on the '2018 including 1-5 valuation' (which involves +3.7% contributions) would involve #USS & their actuary submitting a valuation that tPR has indicated that they would clearly find unacceptable. 6/

JEP made a series of recommendations (i.e., '2018 including 1-7') that @FirstActuarial & @Aon_plc endorsed. But these give rise to a valuation that tPR has indicated they would clearly find unacceptable. 7/

JEP, FA & Aon are right on the merits, and tPR is being overly prudent. #USS & their actuary are willing to resist tPR to some degree, by submitting a gilts+1.4% valuation that implies a covenant stronger than tPR claims the covenant to be. 8/

But #USS & their actuary appear to be unwilling to go any further than that level of resistance to tPR. It's hard to see how @UniversitiesUK & @ucu will be able to shift them further. 9/

Bottom line is that #USS will not accept anything less than +3.7% to continue to fund existing benefits (minus the match). They will also make contributions at that level, rather than higher, conditional on acceptance of automatic triggers & perhaps also negative pledges. 10/

I think the best we'll be able to do, at this point, is to argue for automatic triggers that are as reasonable as possible, along lines I sketch in this linked blog post, as a condition for nothing more than a 3.7% increase. 11/

medium.com/@mikeotsuka/th…

medium.com/@mikeotsuka/th…

.@ucu should also call on @UniversitiesUK to accept the full 3.7% increase, split +2.4% employer, +1.3% member. If UUK insist on cuts to benefits to keep the rise in employer contributions at +2.1%, UCU should insist that such cuts fall first on the most highly paid. 12/

See this Twitter thread on why any cuts should fall first entirely on the highest paid: 13/

https://twitter.com/MikeOtsuka/status/1080931314730192897

The DC section costs 1.2% of payroll (0.8% employer, 0.4% member). Less than 20% of #USS members earn over the £57k salary threshold. The difference between JEP's modelled +3.2% & USS's best case +3.7% is +0.5%. 14/

One should be able to bring costs back down to +3.2% by eliminating DC pension contributions only on earnings so high that they are enjoyed by less than 10% of the scheme's members. Cuts only to the top 10% would be far preferable to any cuts to DB. 15/

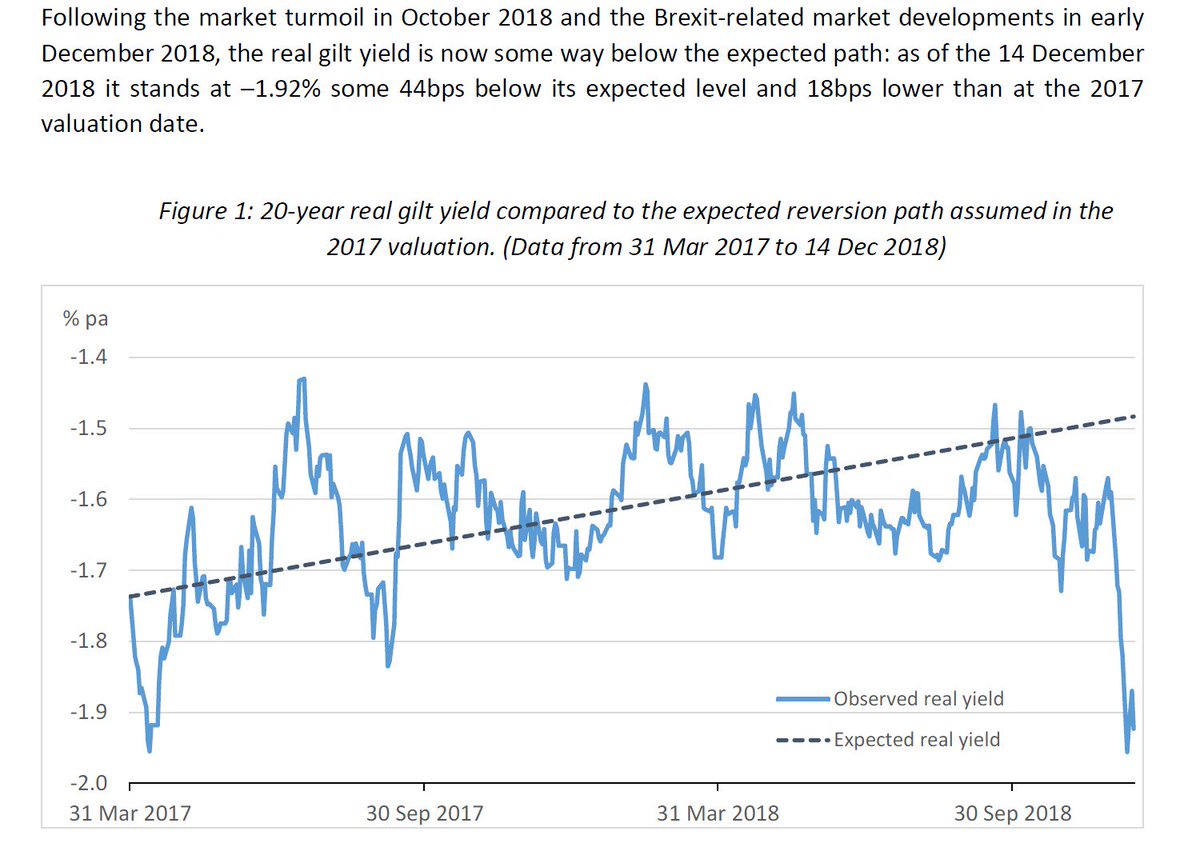

Until about Sept 2018, the gilt yield was reverting above market forecasts along lines of #USS's prediction & assumption. Since then, there has been a significant dip, much of which probably related to the latest Brexit instability. 17/

JEP "Change 7", involving smoothing the cost of future service over the next six years, is based on the assumption that the gilt yield will revert along #USS's predicted path. The recent dip provides USS w/ grounds to resist the smoothing recommendation. 18/

As noted way upthread, I think #USS is on much shakier ground in resisting Change 6, re delay in de-risking, and in placing onerous trigger conditions on acceptance of Change 5, re increase in Test 1 reliance. 19/

.@ucu & @UniversitiesUK need to make the case that #USS's stance w/r/to Changes 5 & 6 involve exaggerated risks, given their erroneous assumption re Test 1 assets, in order to make the case for a mitigation of triggers as condition for acceptance of Change 5. 20/20

• • •

Missing some Tweet in this thread? You can try to

force a refresh