A thread on why I share our @ucu GS's reaction👇to the recent @USSEmployers proposal to cut our pensions by lowering the DB/DC threshold from £60k to £40k, reducing accrual from 1/75 to 1/85, & capping CPI revaluation at 2.5%. 1/

https://twitter.com/DrJoGrady/status/1379851108026310658

As @jogrady mentions, this proposal is almost identical to the instantly reviled & reject March 2018 ACAS agreement. Here's why it's a provocation for @USSEmployers to try to push this through once again. 2/

On 1 October, @USSpensions contributions are scheduled to rise by 4 percentage points from 30.7% (9.6% member, 21.1% @USSEmployer) to 34.7% (11% member [+1.4], 23.7% employer [+2.6]). This increase was scheduled under the last 2018 valuation. 3/

The 4 point overall increase is owing to deficit recovery contributions (DRCs) rising from 2% to 6% of salaries. 4/

Both before & after 1 October, 28.7% goes to 'future service' = the cost of promising each further year of our current pension promise of 1/75 career average revalued earnings (CARE) DB up to £60k & 20% DC contributions above £60k. 5/

Under the current 2020 valuation, the cost of future service of our current pensions benefits would rise to at least 33.6% (c. +5). 6/

We could let the 1 October rise of the 2018 valuation take effect & live for several month with the +1.4 member & +2.6 employer rises to retain existing benefits, while we carefully explore the best way to resolve the 2020 valuation. 7/

One option involves careful consideration of a potentially promising form of benefit reform known as 'conditional indexation'. See Section 3b👇. 8/

ussemployers.org.uk/sites/default/…

ussemployers.org.uk/sites/default/…

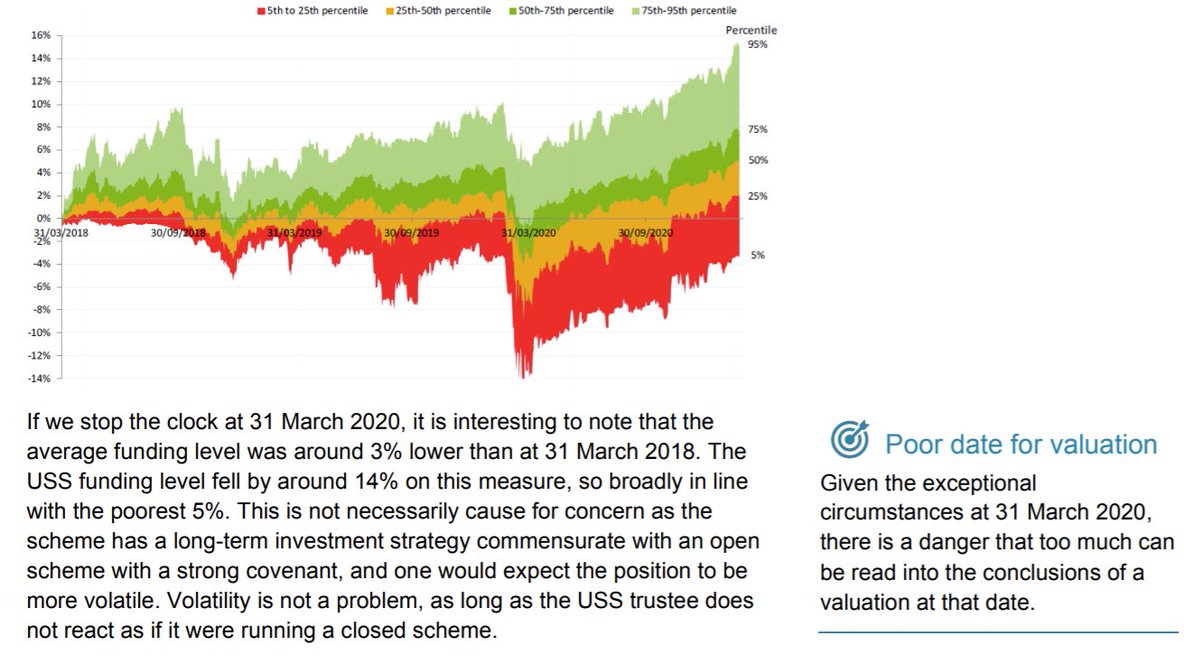

Another (non-exclusive) option involves updating valuation assumptions to 31 March 2021 (11 days ago), on grounds that 31 March 2020 was a "poor date for valuation", given initial Covid spasms👇. 9/

ussemployers.org.uk/sites/default/…

ussemployers.org.uk/sites/default/…

So committed, however, is @USSEmployers to pre-empting the 1 October contribution rise of the 2018 valuation that they are prepared to rush to embrace the higher cost of future service of the 2020 valuation -- 33.6%, which is c. 5 points higher than the current 28.7% rate. 10/

They would then slash what is paid for future service of our pensions down to about 25%, in order to keep their employer contributions from rising from 21.1% to 23.7% on 1 October. 11/

In other words, they would reduce by c. 8.5 percentage points the 33.6% that would need to be paid under the 2020 valuation to retain our existing benefits – i.e., slash the value of our pensions by about 25% -- in order to prevent a 2.6 point rise in employer contributions. 12/

Rushing through such a large cut to our pensions to avoid a 2.6 point rise in employer contributions in October is wholly disproportionate. Now @USSEmployers are the ones who are in the grips of a 'no detriment' ideology. 13/

The 1.4 point October rise in member contributions from 9.6% to 11% would be well worth the cost of retaining status quo benefits under the 2018 valuation while we took the time needed to reach a proper resolution of this crisis. 14/

If @USSEmployers try to push through this 25% slashing of the value of our pensions to save themselves a 2.6 point rise in contributions, & so long as @ucu doesn't overplay its hand in response, I will enthusiastically join a campaign for industrial action in the autumn. 15/15

PS: A prime example of @ucu's overplaying its hand would be passage of this clause in HE10👇. Especially after the lessons of the 22 strike days in 2019-20, I hope reason prevails & this clause is deleted.

ucu.org.uk/circ/html/ucu1…

ucu.org.uk/circ/html/ucu1…

A note on my calculations involved in claiming that the @USSEmployers cuts would "slash the value of our pensions by about 25%"👇. 1/

https://twitter.com/MikeOtsuka/status/1381265108853268480

In the above, my measure of value is simply the price (i.e., contribution rate) that would be charged, under the 2020 valuation, for our existing benefits, in comparison with the price that would be charged for @USSEmployers's proposed reduced level of benefits. 2/

The reduction in price is by c. 25%. It could be argued, however, that the value of our pensions would not go down by quite this much, since @USSEmployers's actuary @AonRetirementUK maintains that pensions could be delivered more efficiently at the lower contribution rate. 3/

When one adds value back on account of the fact that we're getting more pensions bang for buck (pound) at the lower rate, the reduction in value amounts to about 21% (rather than 25%). 4/

Here's a link👇to a spreadsheet, which spells things out in more detail. I used 'Method A', which implies a c. 25% reduction in value. But the alternative 'Method B' implies a c. 21% reduction. 5/5

drive.google.com/file/d/13Li8sk…

drive.google.com/file/d/13Li8sk…

Fn: @USSEmployers confirms that the 21% figure is consistent with @AonRetirementUK's calculation of the approximate overall impact at a scheme-wide level of the UUK proposal.

Bottom line unchanged: If @USSEmployers try to push through this 21% cut in value of future accrual to avoid a 2.6 point rise in their contributions, & so long as @ucu doesn't overplay its hand in reply, I will enthusiastically join a campaign for industrial action in the autumn.

.@AlistairJarvis claims👇that the @USSEmployers proposals are "proportionate & justified". Please explain how a rushed 21% cut in the value of our future pension accrual, to avoid a 2.6 point rise in employer contributions, is "proportionate & justified".

timeshighereducation.com/opinion/attrac…

timeshighereducation.com/opinion/attrac…

• • •

Missing some Tweet in this thread? You can try to

force a refresh