$EVI

Quick summary of last QTR results:

GM% down due to initiatives to gain market share

Higher SG&A as they try to modernize their subsidiary operations

CEO called it "short term tradeoff for longer term growth"

/1

Quick summary of last QTR results:

GM% down due to initiatives to gain market share

Higher SG&A as they try to modernize their subsidiary operations

CEO called it "short term tradeoff for longer term growth"

/1

Why can they make these short term tradeoffs?

1. Because the majority owners are insiders

2. Most stock options for employees vest at retirement

Folks on fintwit say they are looking for management with long term focus, but lot of digs at $EVI results

/2

1. Because the majority owners are insiders

2. Most stock options for employees vest at retirement

Folks on fintwit say they are looking for management with long term focus, but lot of digs at $EVI results

/2

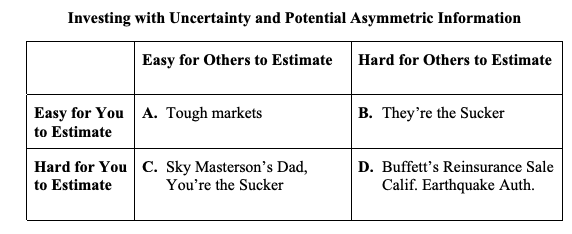

The one legitimate criticism is "Where is the cash flow or EBITDA?"

It's hard to tell with so much "buy" activity.

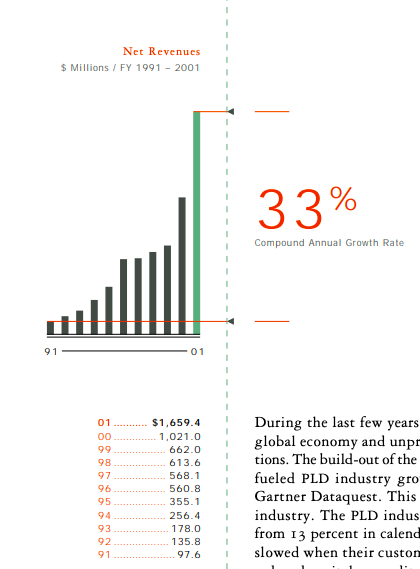

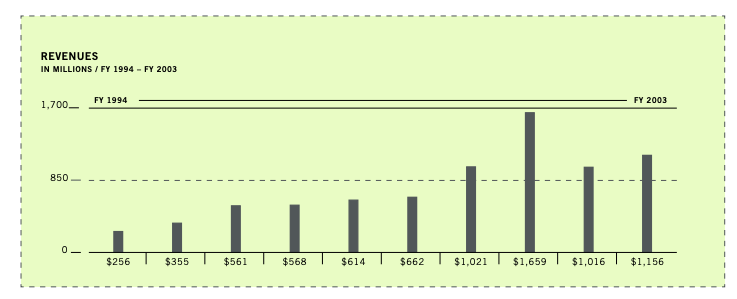

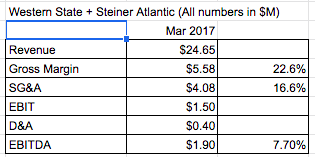

So we have to look back before the buy activity started. Distributors are mid-single digit businesses as seen in Steiner Atlantic statements below

/3

It's hard to tell with so much "buy" activity.

So we have to look back before the buy activity started. Distributors are mid-single digit businesses as seen in Steiner Atlantic statements below

/3

Same case for when they had only two operating businesses - Steiner Atlantic and Western State Designs in March 2017

Note that these two businesses are still close to 40%

/4

Note that these two businesses are still close to 40%

/4

They have acquired maybe around 14 total distributors since 2016. So the other 12 (excluding Steiner and Western State Designs) on average contribute only $3.3M per quarter or 5% of $EVI quarterly revenue

The individual businesses prior to acquisition were ALL subscale.

/5

The individual businesses prior to acquisition were ALL subscale.

/5

Subscale distributors have two problems:

1. High SG&A $ spend compared to revenue

2. Limited number of product lines they can sell

$EVI can change all of that by increasing geographic density, selling more product lines and services, and getting scale

/6

1. High SG&A $ spend compared to revenue

2. Limited number of product lines they can sell

$EVI can change all of that by increasing geographic density, selling more product lines and services, and getting scale

/6

$EVI calls that the "Build" phase. They shared only one piece of data on it - 8% revenue CAGR for distributors owned for more than 2 years. And that's without full addition of new product lines. And they can consolidate regional operations once they get density

/7

/7

How will they gain scale?

a. Combine salesforce across multiple locations in a geographic market

americancoinop.com/articles/aadva…

b. Add more density in a market. Eg: Adding Commercial Laundry Equipment in a market with 3 existing locations

/8

a. Combine salesforce across multiple locations in a geographic market

americancoinop.com/articles/aadva…

b. Add more density in a market. Eg: Adding Commercial Laundry Equipment in a market with 3 existing locations

/8

They get to keep the entrepreneurs and gain scale

"Sellers of laundry businesses took 46% of the consideration in stock, meaning they are not just sellers, but continue to be owners of $EVI"

/9

"Sellers of laundry businesses took 46% of the consideration in stock, meaning they are not just sellers, but continue to be owners of $EVI"

/9

Also, if their average acquisition does $3M per quarter in revenue, what kind of IT systems or CRM are they using? There's efficiency from modernizing systems here.

/10

/10

EVI has same family involved as Watsco. And who did Watsco learn some of this stuff from? Maybe Wayne Huizenga of Autonation and Waste Management? ("track record of building businesses by consolidating fragmented industries")

sun-sentinel.com/news/fl-xpm-19…

sun-sentinel.com/news/fl-xpm-19…

• • •

Missing some Tweet in this thread? You can try to

force a refresh