Reading Zeckhauser and @AnnieDuke is a better preparation for investing in this scenario than the predictions of economists.

Also, focusing on analyzing a single business at a time helps a bit.

Known: 10% dividend, GS converted to bank holding co, "GS is global franchise"

Unknown & unknowable: will $700B bailout pass? What will happen next in credit crisis?

money.cnn.com/2008/09/23/new…

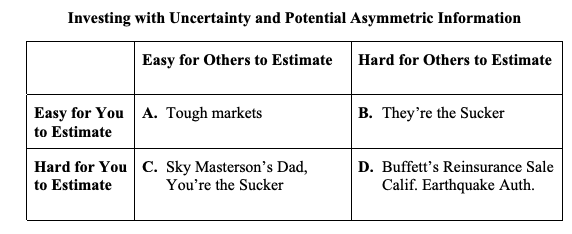

This makes sense when we consider Buffett as investor in unknown and unknowable situations - DCF can't be done there! It's more like horse race handicapping or bridge

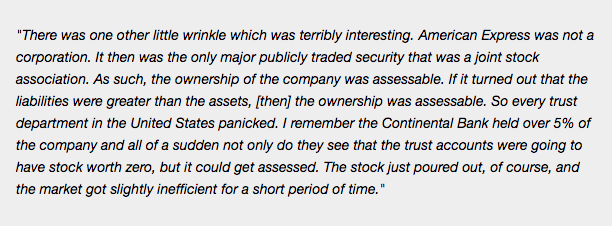

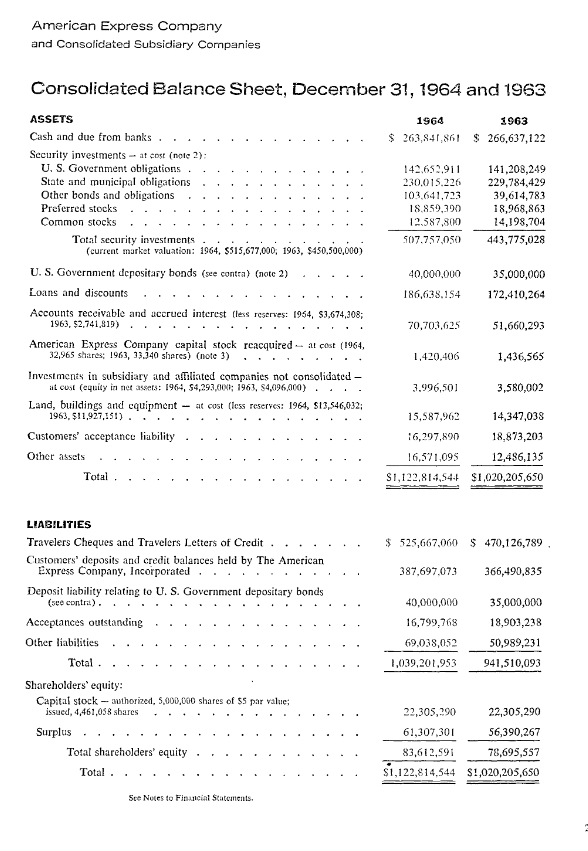

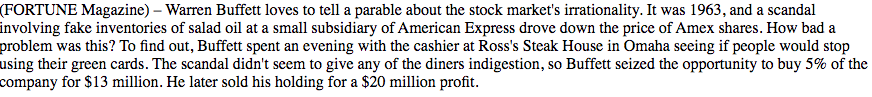

Buffett couldn't have known actual damage number (unknown/unknowable). But he bet big coz price was too low

Buffett talks about using initial yield when investing in farm land. This same story repeats for this investor who bought real estate on Via dei Condotti, near the Spanish steps in Rome, in 1948

Unknown: when would Italy get out of post war recession, will rents go down?

Investor bought 7 buildings on Via dei Condotti in 1948, and was rich when he sold in 1960

(h/t @ThePIBnyc -

privateinvestmentbrief.com/blog/alpha-in-… )