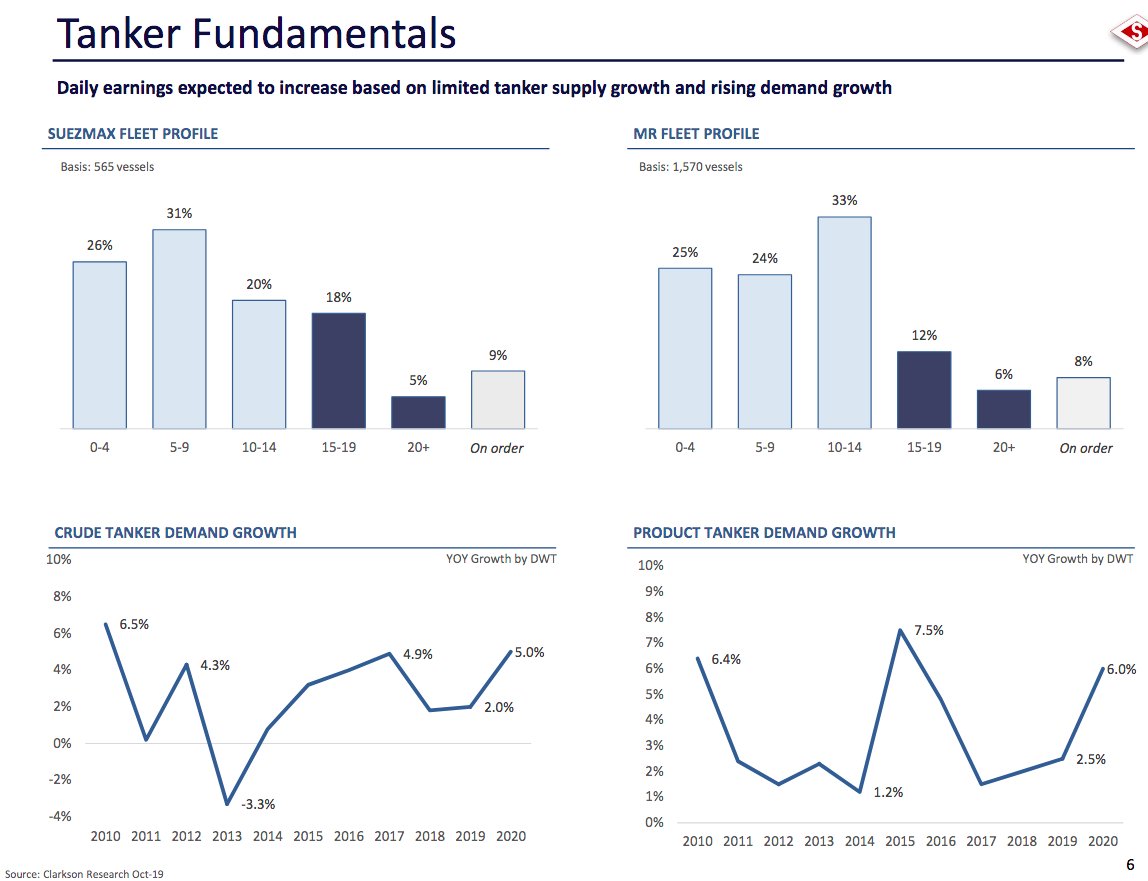

What this all mean? There's inflection now where supply is (finally) constrained

/3

hellenicshippingnews.com/just-4-vlccs-s…

/4

reuters.com/article/us-glo…

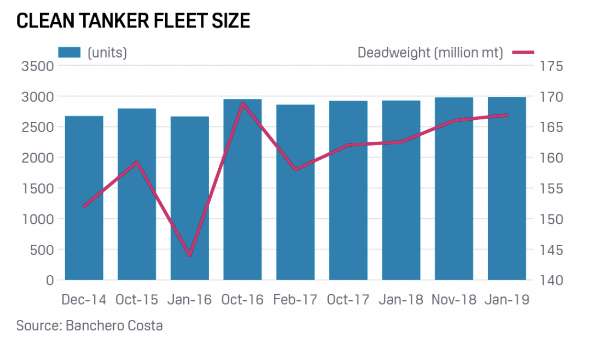

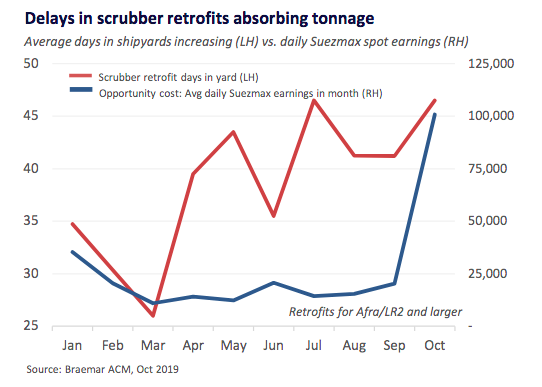

1. Docking for installing scrubber (IMO 2020 related)

2. Ships going from clean to dirty tankers

And demand for clean tankers is up due to transporting LSFO between bunkering ports and refineries

/5

blogs.platts.com/2019/03/04/imo…

/6

benzinga.com/node/15048071

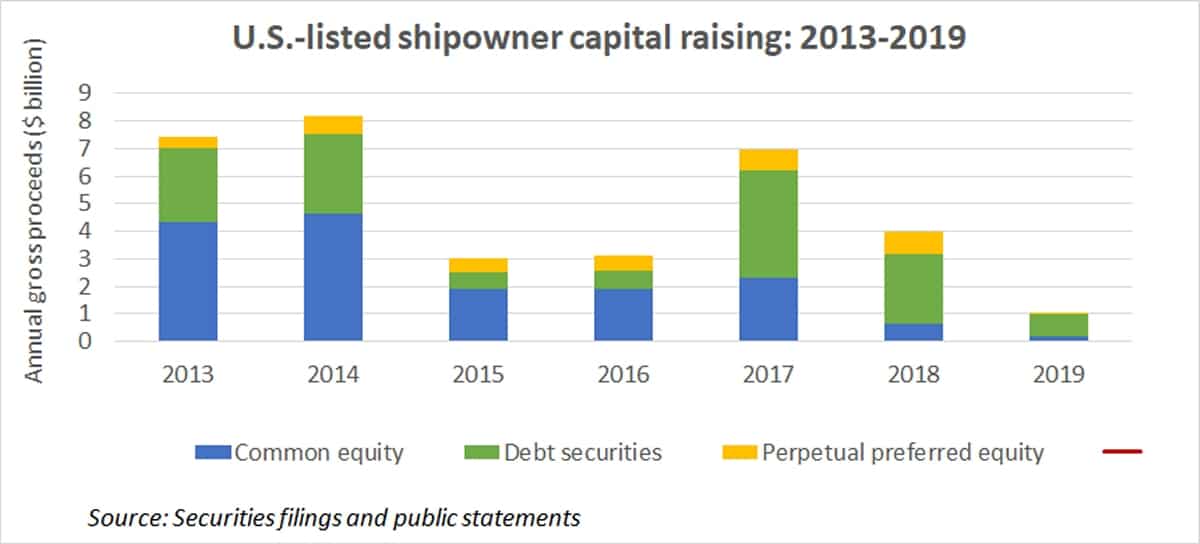

a. Long bear market in spot rates

b. Banks - Financial regulation risk (Basel)

c. Risk: what will IMO 2030 mean?

d. PE funds invested lot in starting 2010, but no IPOs since 2015, and funds nearing maturity

/7

benzinga.com/news/19/12/150…

Christa Volpicelli, Citi: “If you go back and study companies that have announced these [ships-for-shares] transactions, you will see a very strong pattern of stock outperformance."

/8

freightwaves.com/news/stage-is-…

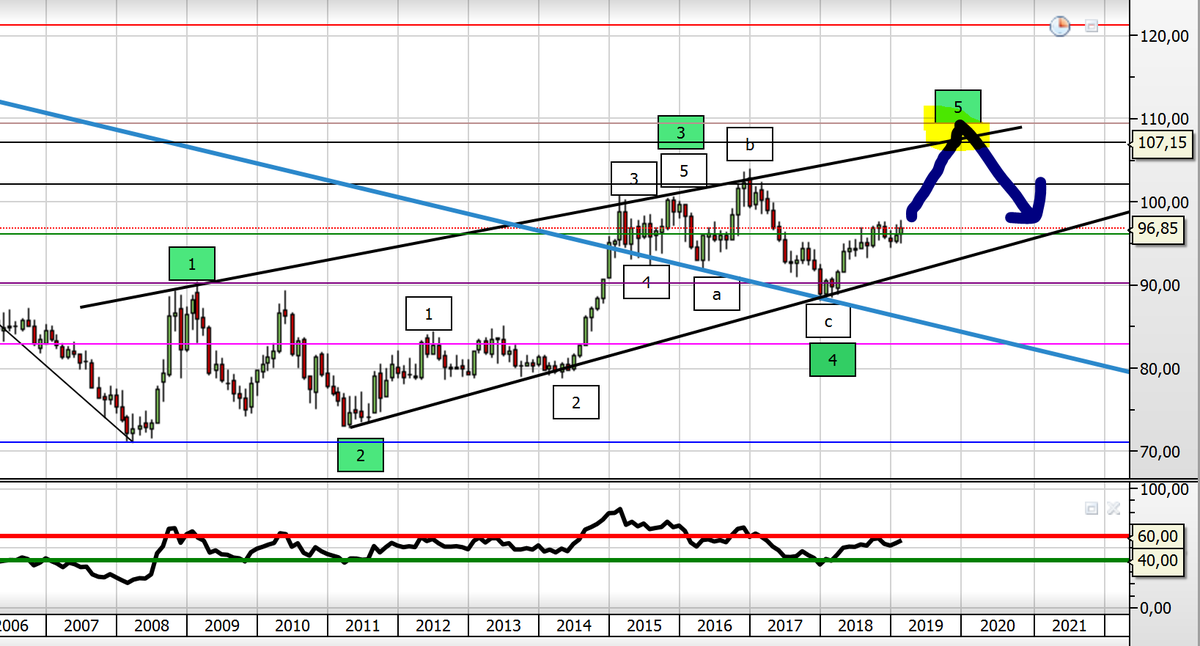

But the odds look really good here.

/10

"probably the best order book that I’ve seen in 25 years",

"fundamentals of exporting of shale oil out of U.S. Gulf on long-haul movements are tremendously accretive"

"Getting compliant fuel all over the place .. going to help rates"

/13

/14