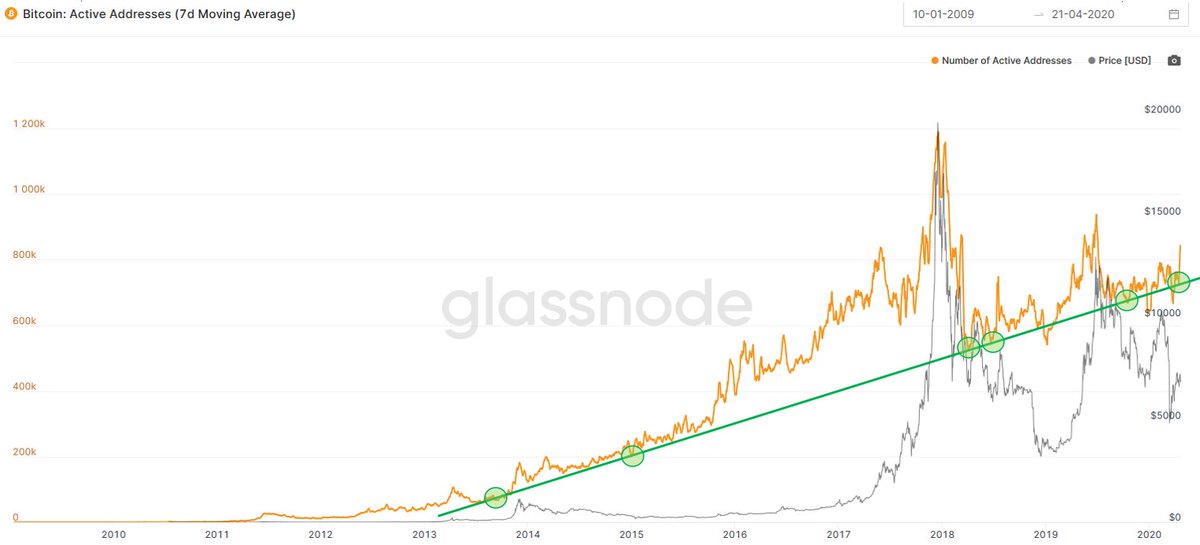

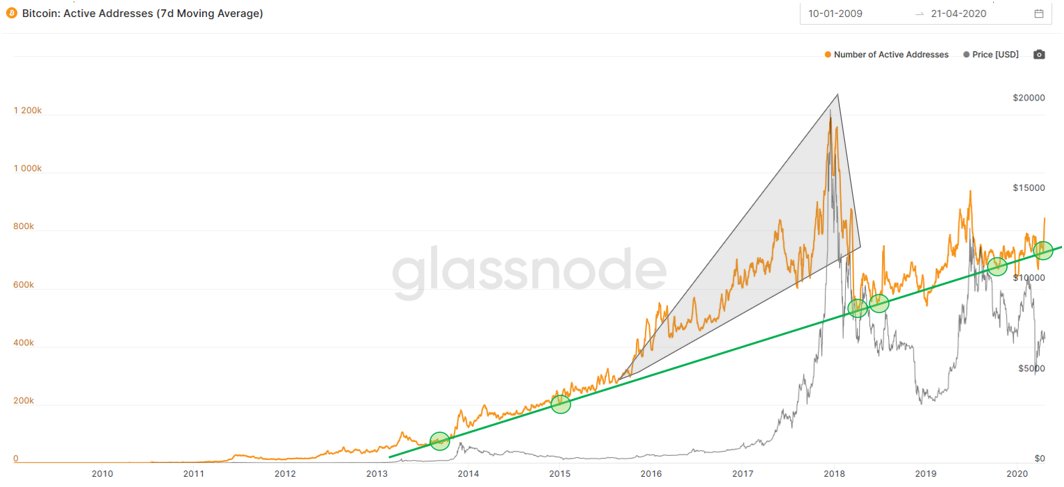

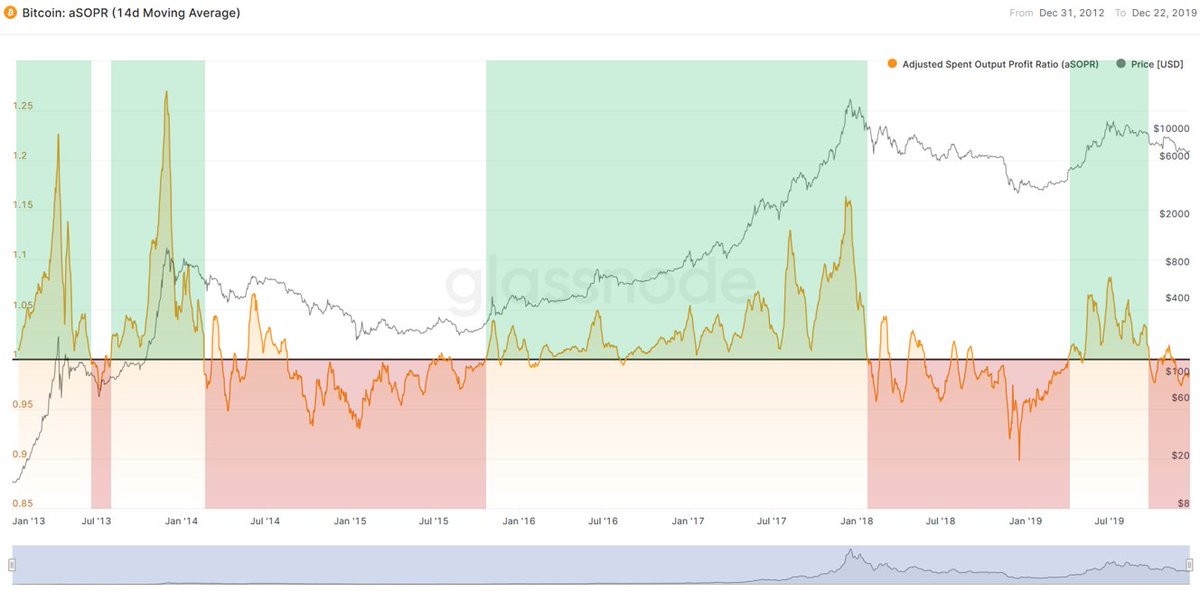

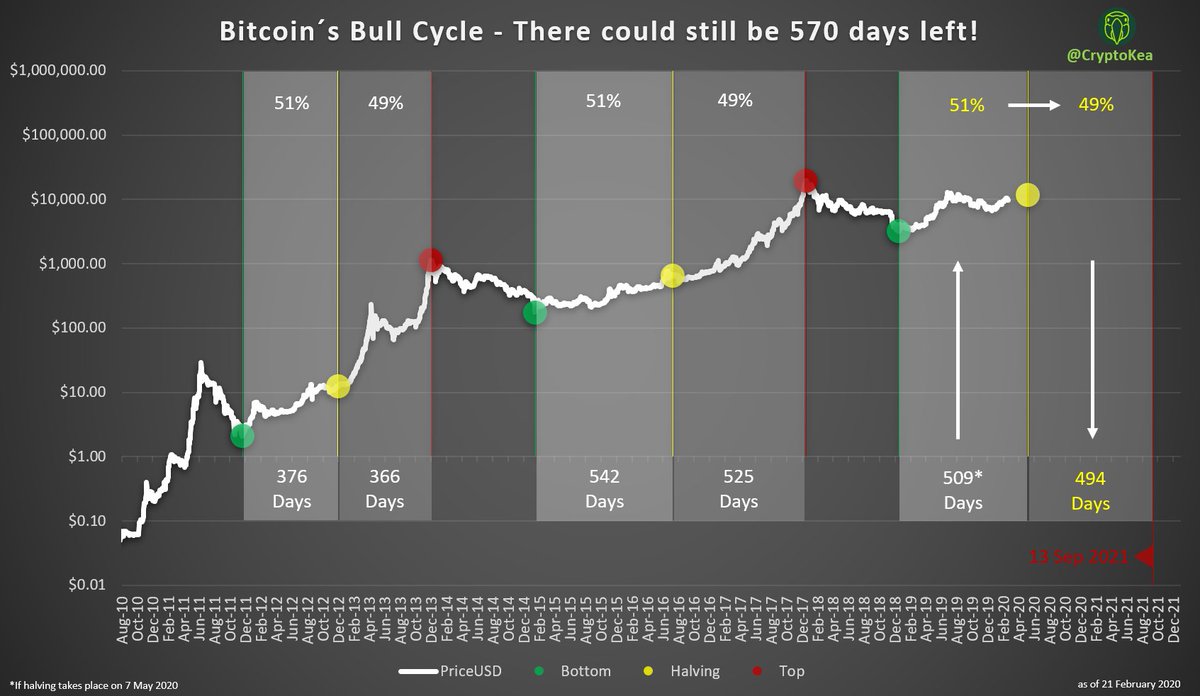

1/ During the last two #Bitcoin bull cycles, price bottoms and tops fluctuated around halving dates in an almost equal ratio. If this relationship were to hold true, we still have more than 570 days of bull market ahead of us, with a cycle top coming in around Sep 2021.

🚀🚀🚀

🚀🚀🚀

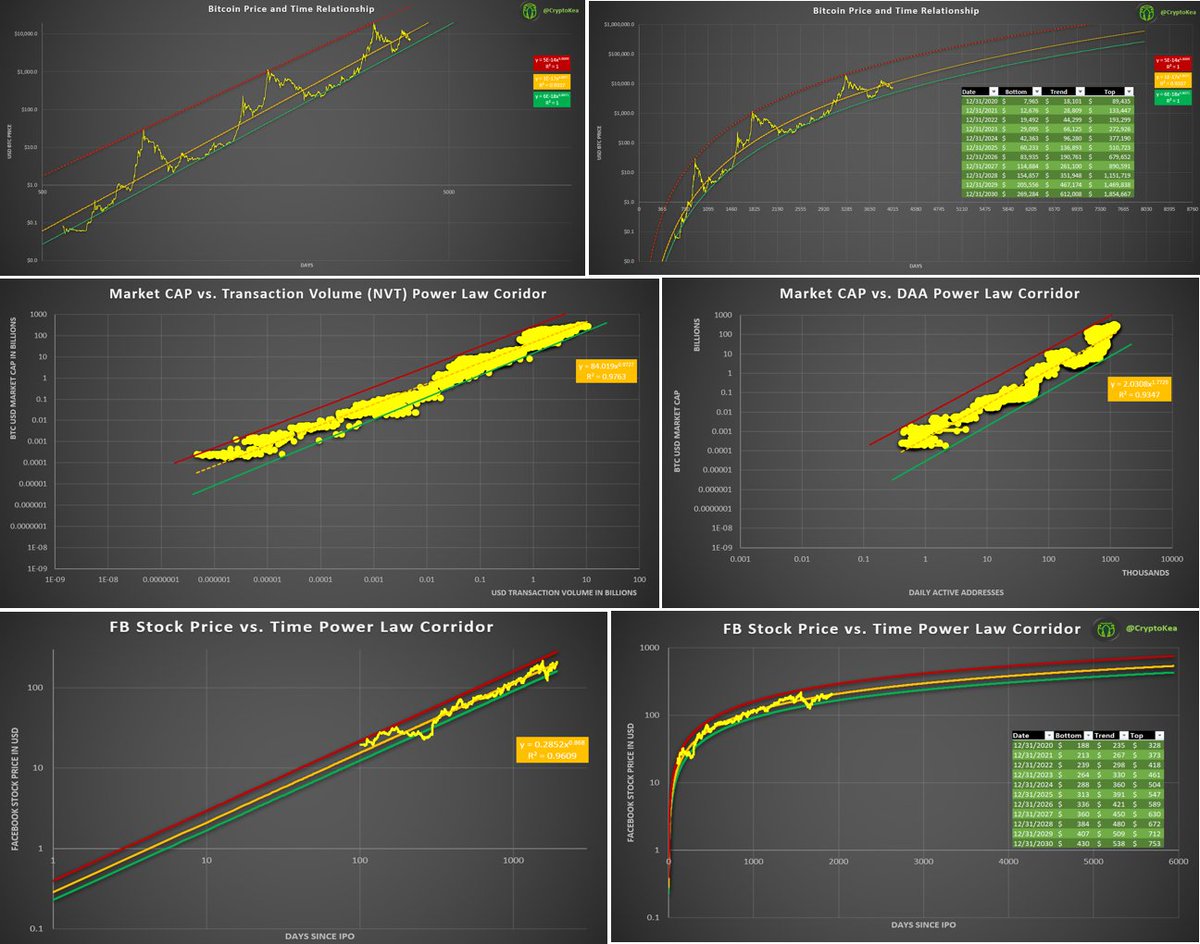

2/ It is still the big question whether Bitcoin´s bull and bear markets take longer each cycle or oscillate around halving cycles. While there are enough good reasons to suggest that cycles are lengthening over time and

3/ likely converge with macro cycles at some point in the future, imo, gravitation around halvings could still be maintained for a while, especially in the early adoption phase of Bitcoin (see #s2f model).

While a sample size of two bull markets is by far too small

While a sample size of two bull markets is by far too small

4/ to make any prediction, this relationship might eventually not be pure coincidence either (e.g. Stock-to-Flow driven hodl behavior could be one out of many reasons).

We all know history never repeats itself …

BUT it often rhymes. 😉

We all know history never repeats itself …

BUT it often rhymes. 😉

• • •

Missing some Tweet in this thread? You can try to

force a refresh