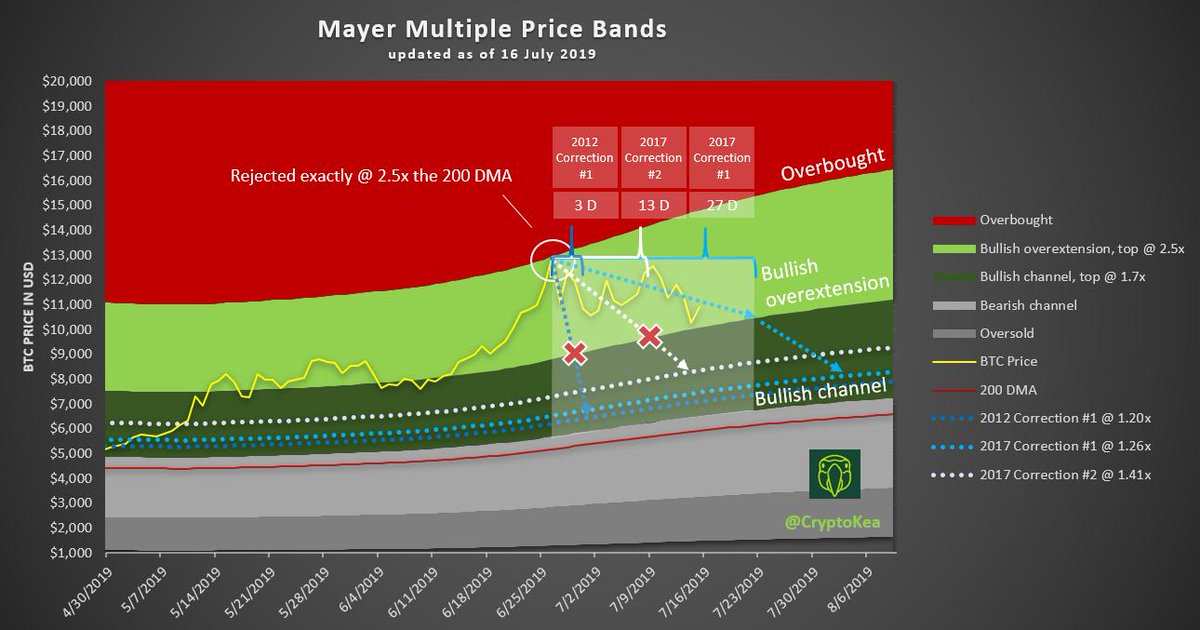

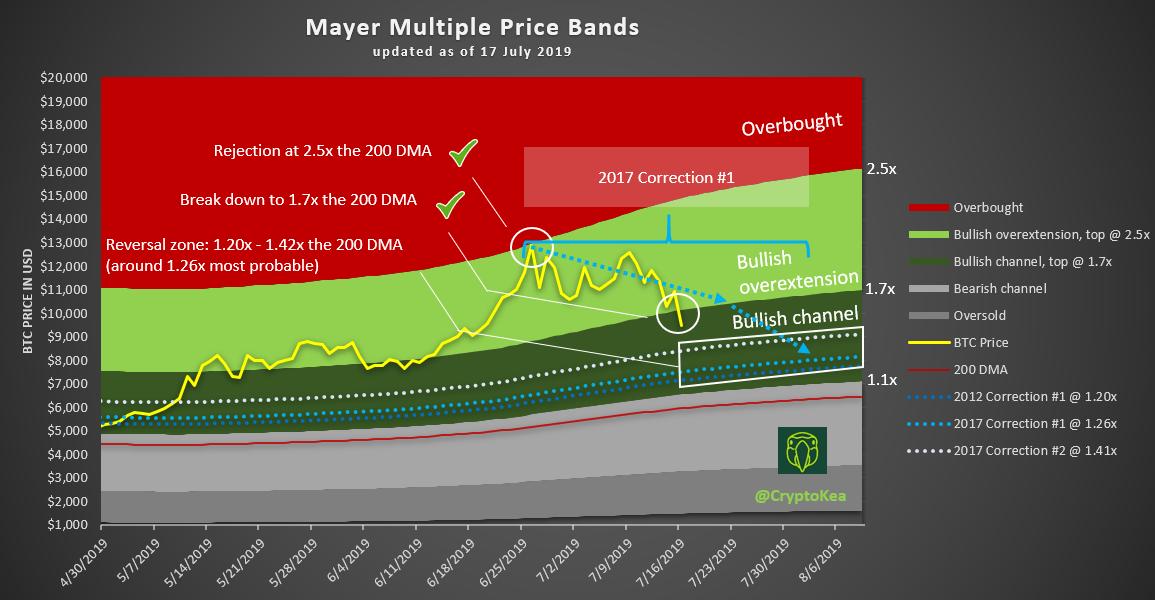

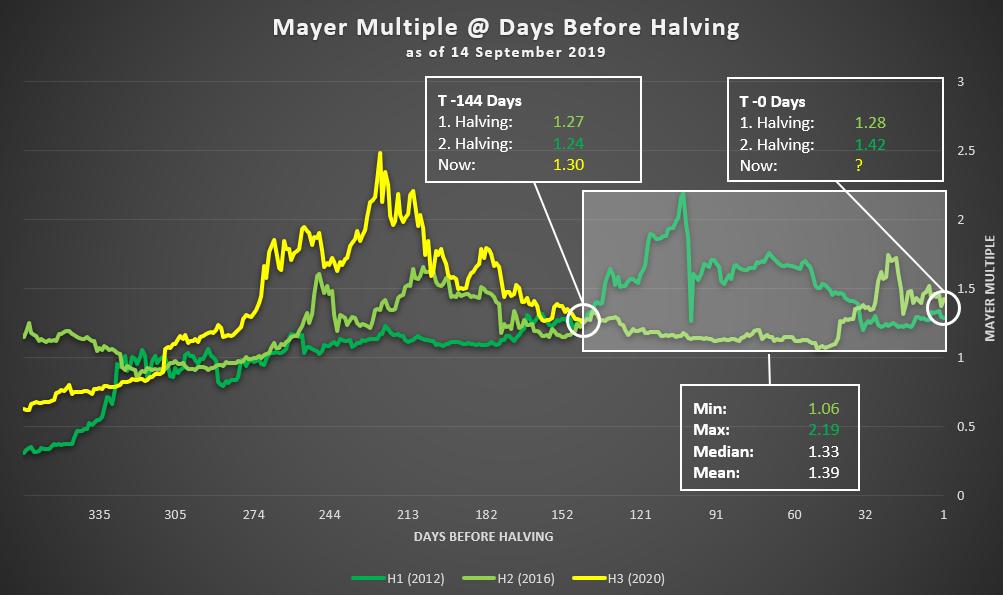

2017 correction #2 target at 1.41x the 200 DMA

2017 correction #1 target at 1.26x the 200 DMA

2012 correction #1 target at 1.20x the 200 DMA

1.41x 200 DMA (2017 correction #2) = $10.197 ✅

1.26x 200 DMA (2017 correction #1) = $9.112 (highest probability)

1.20x 200 DMA (2012 correction #1) = $8.678 (2nd highest probability)

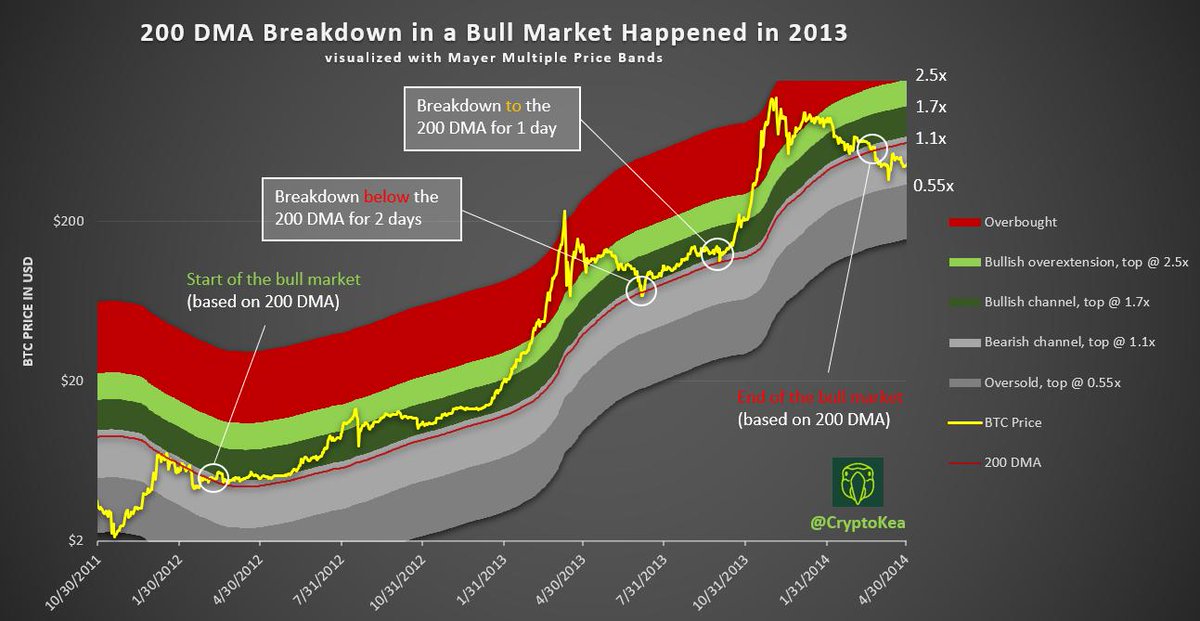

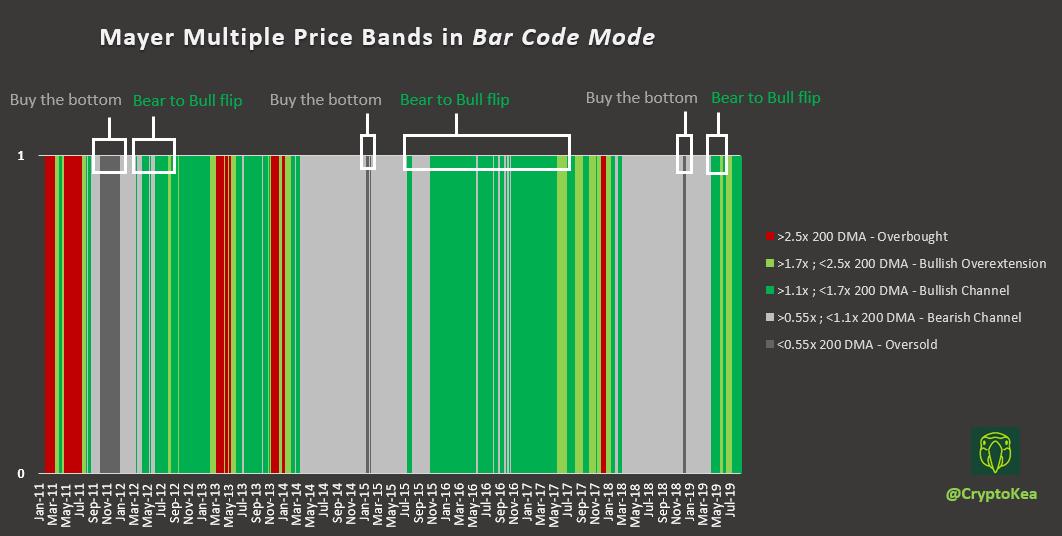

<0.55x the 200 DMA: Oversold

>0.55x and <1.1x the 200 DMA: Bearish Channel

>1.1x and <1.7x the 200 DMA: Bullish Channel

>1.7x and <2.5x the 200 DMA: Bullish Overexentsion

>2.5x the 200 DMA: Overbought

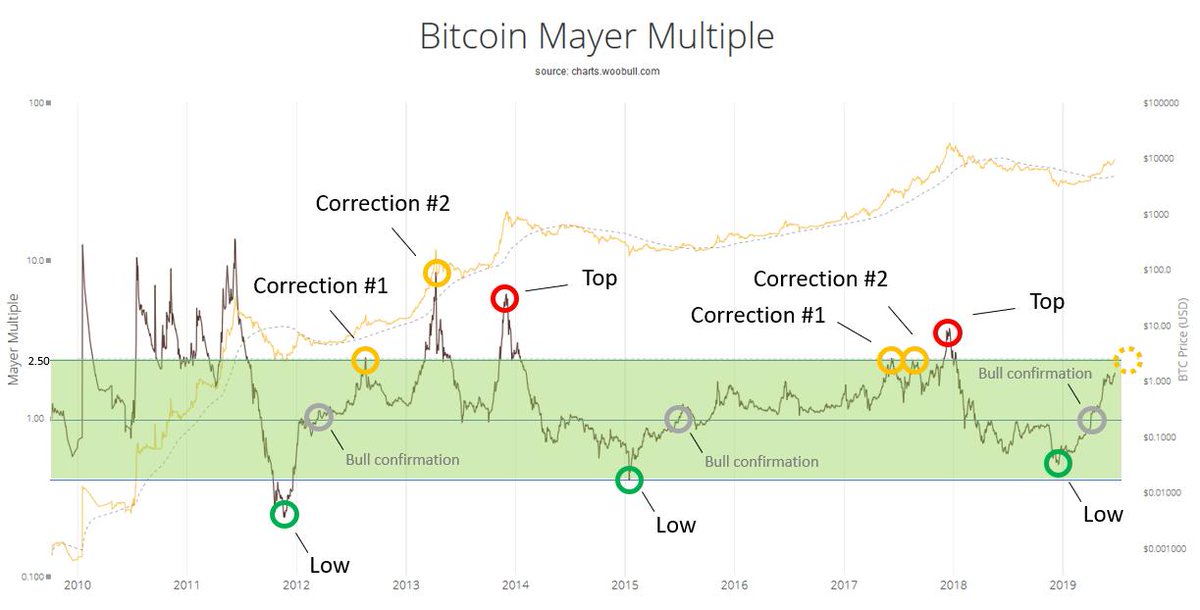

Noteworthy: Whenever #Bitcoin came out of a bear territory (grey), broke through the bullish channel (dark green),

But let´s dig a bit deeper.👇

@TraceMayer

Let´s have a closer look 👇

@TraceMayer

👇