Beginning of this year, @ColeGarner published a great model walk-through and a Tradingview script for the Log Growth Curves became available. As more and more people became aware of it, @phraudsta took a similar approach as

First of all, I am not a mathematician nor statistician. I studied finance and took

Alright, let´s get to it!

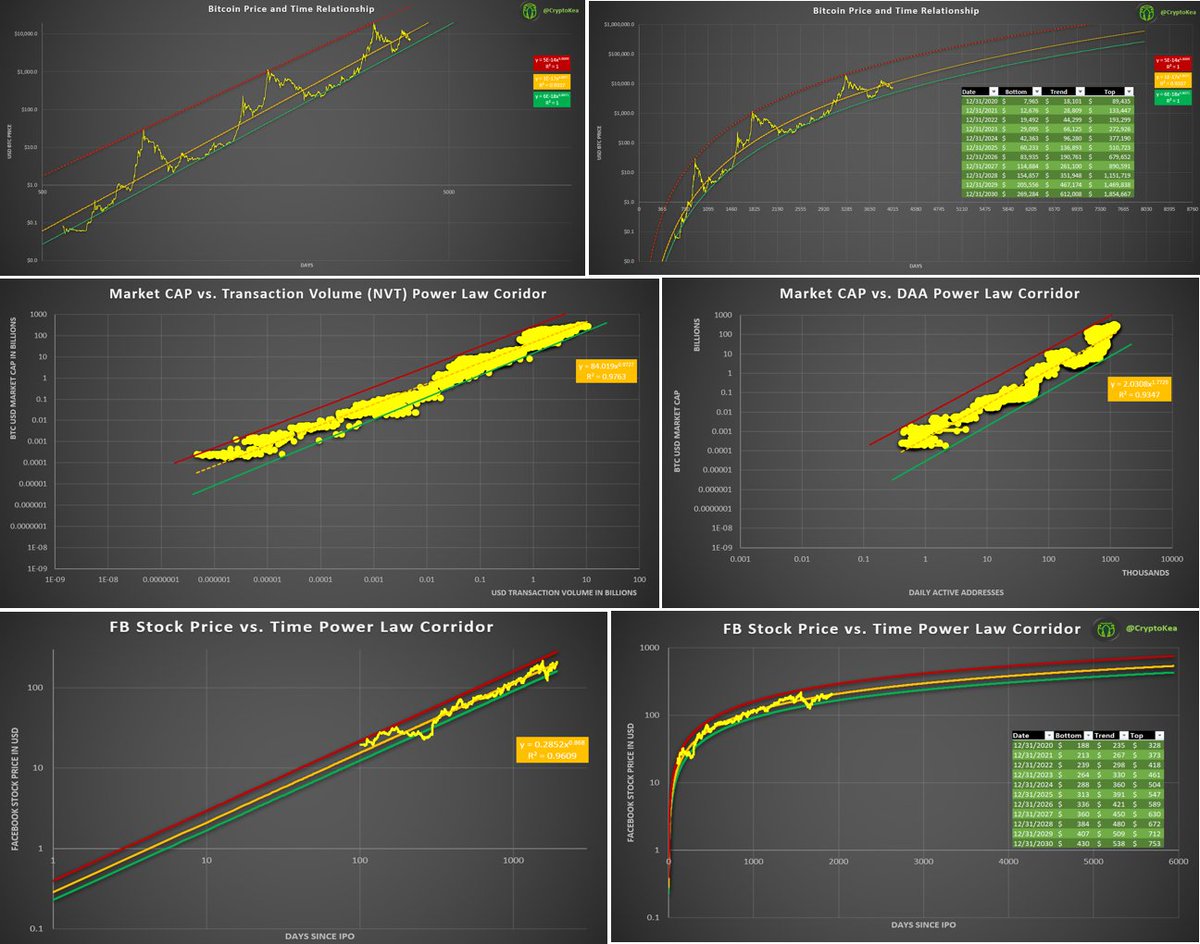

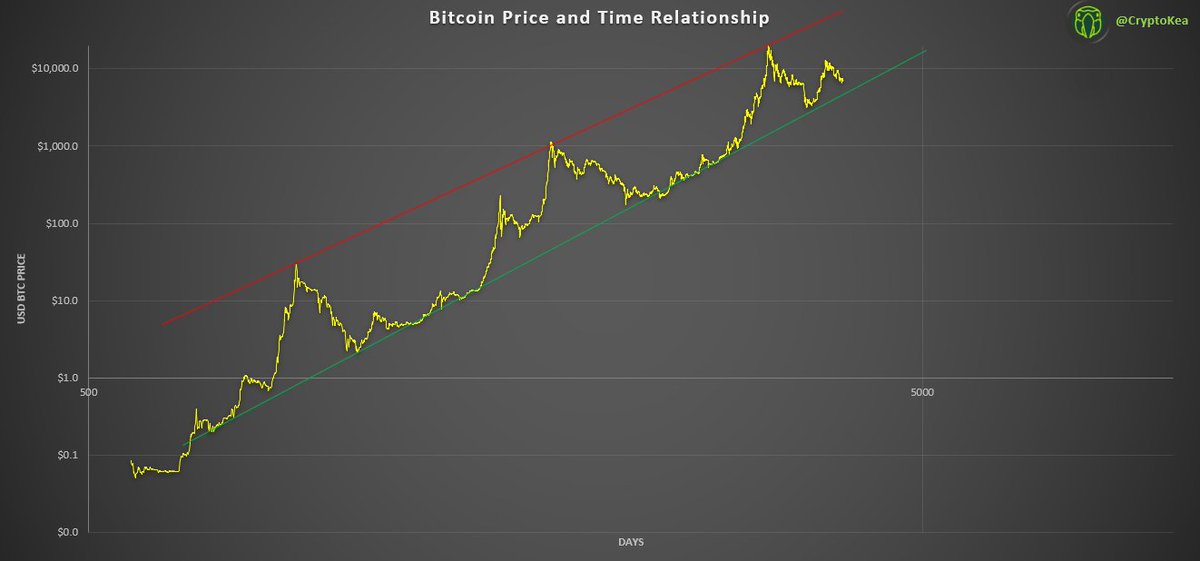

Let´s start from scratch and plot the Bitcoin price first.

A few takeaways of mine so far:

- Bottom line involves a lot of subjective fitting, using regression doesn't make it fit much better

- While bottom line could be derived from regression line, top line is "just" a best fit based on peaks

- Chart starts at inception date despite missing price data for first 561 days

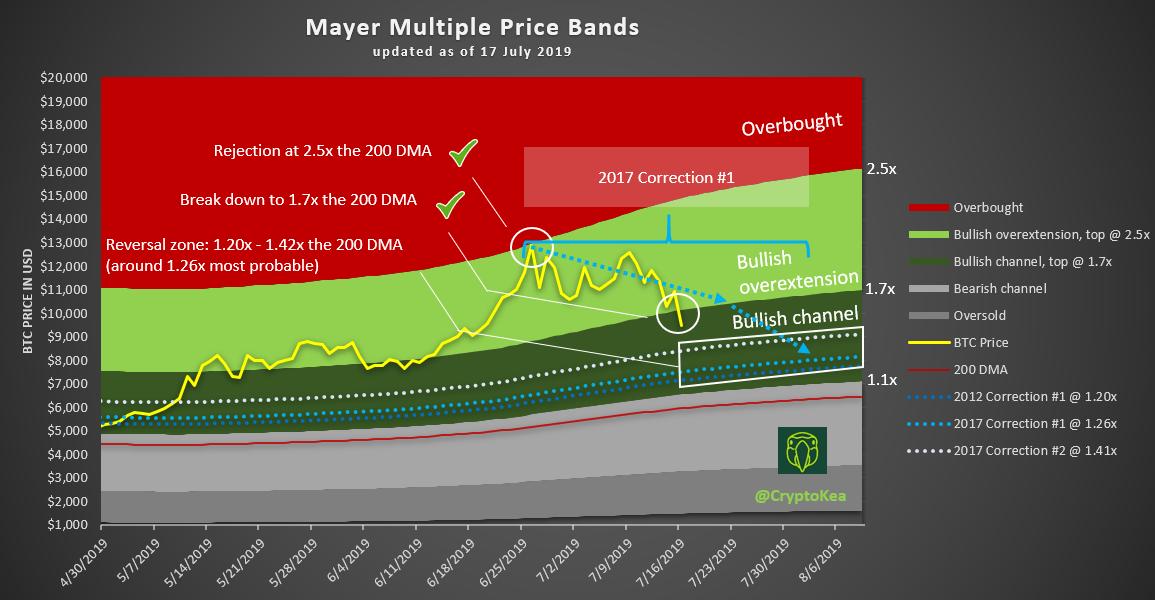

Let´s see how sensitive this model is to subjective changes. Let´s create the same chart

Takeaway:

As time and price are on log scale, a simple

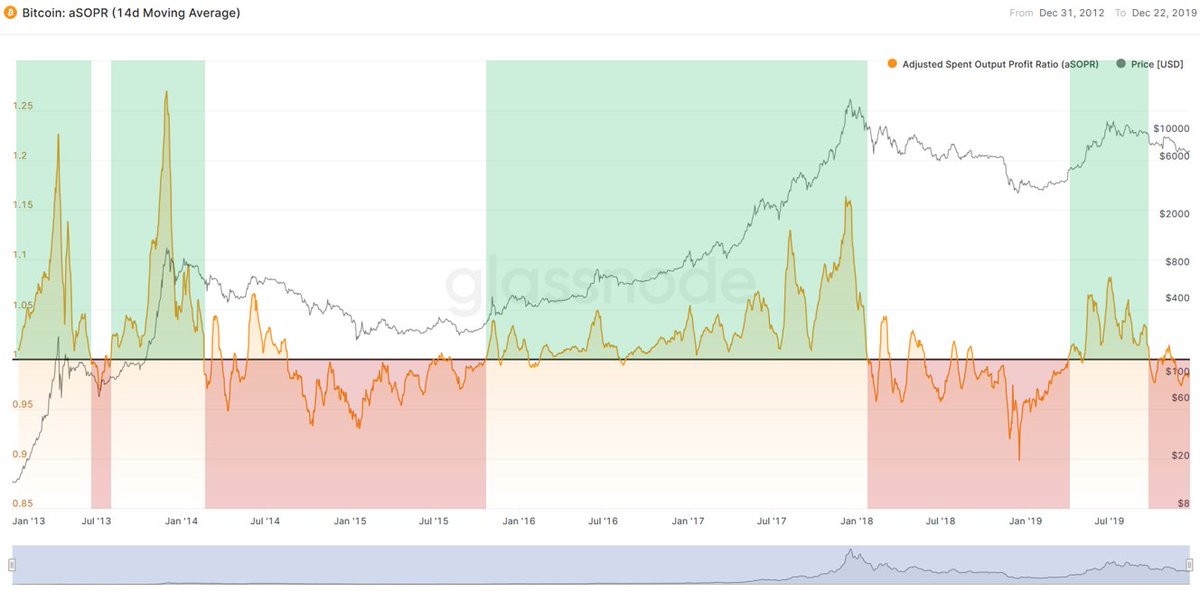

Going back to the power-law corridor starting from Bitcoin´s inception, I was also wondering how rare this coincidence of log time and log price

Hmm, to be honest, it doesn´t look very satisfying yet and the coefficient of determination is not very high. How about we adjust this chart as it was done with the power-law corridor of Bitcoin? Not having a

My overall, personal findings of recreating the Log Growth Curves:

- Bottom line for Bitcoin´s power-law corridor involves a lot of subjective fitting

- While bottom line could be derived from regression line, top line is still "just" a best fit

based on peaks

- As time and price are on log scale, a simple change as changing the starting day can drastically change the power-law corridor and by that the outcome

- Bitcoin´s power-law corridor is by far not rare

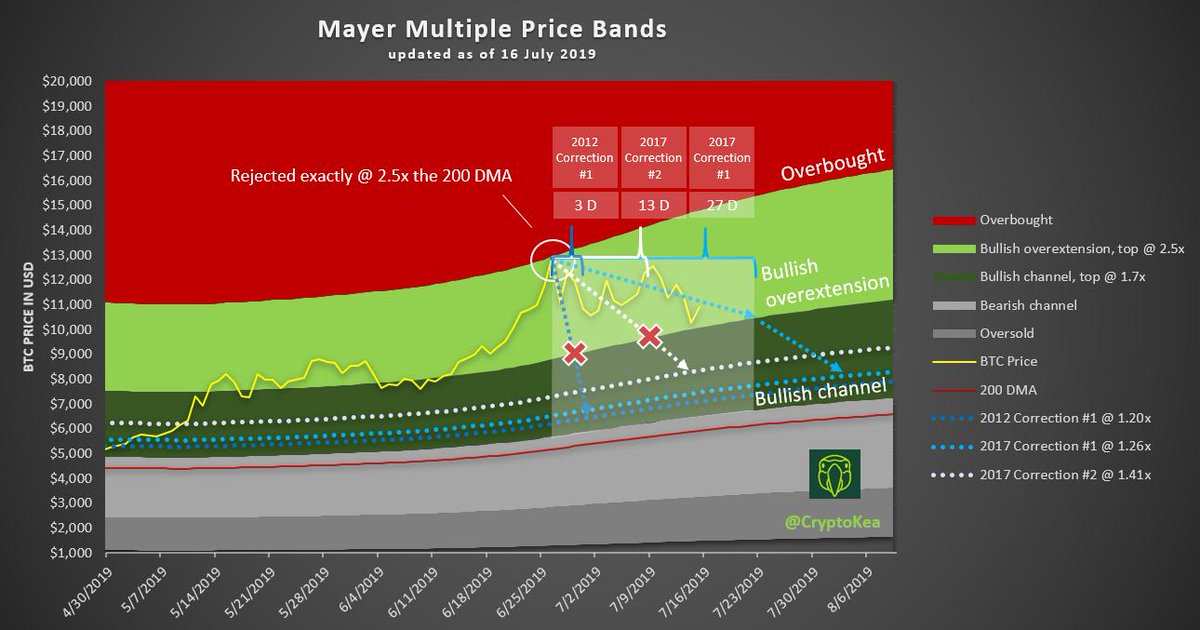

What I found to be interesting though is, that most good-looking power-law corridors outside of Bitcoin were price/time relationships of companies in a

As I do these walk-throughs often just for myself to better understand new models/approaches, I am happy to share more of my personal journeys through the Bitcoin universe

Have a wonderful weekend everyone!