For the purpose of this analysis, I define short-term up to 3 months, mid-term up to 6 months and long-term > 6 months.

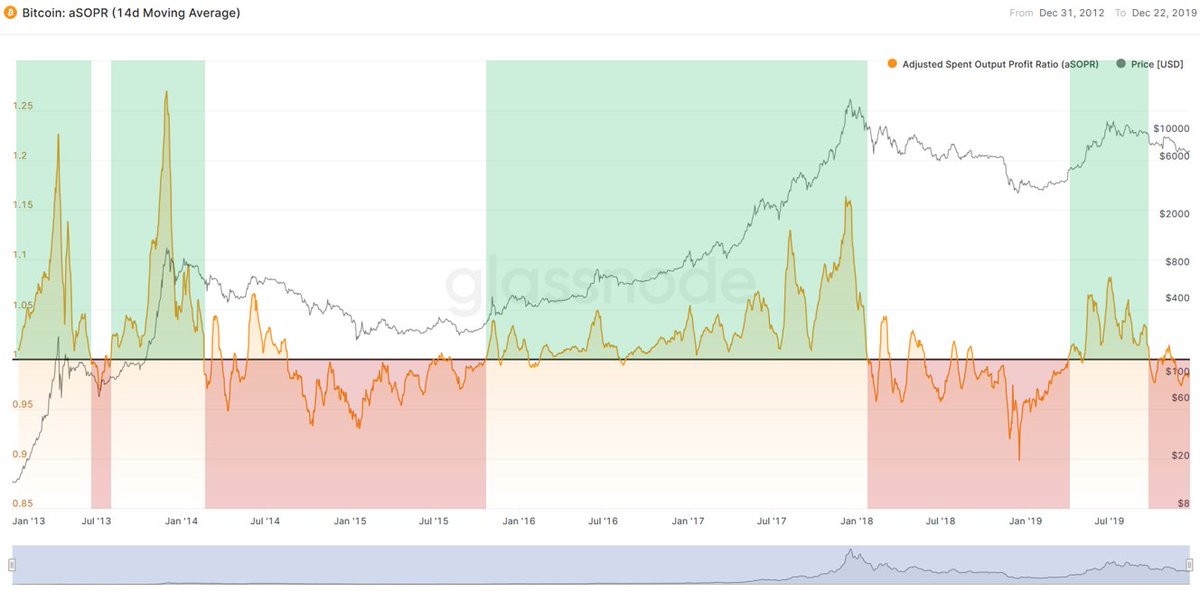

Short-term: Bearish

Medium-Term: Bearish

Long-Term: -

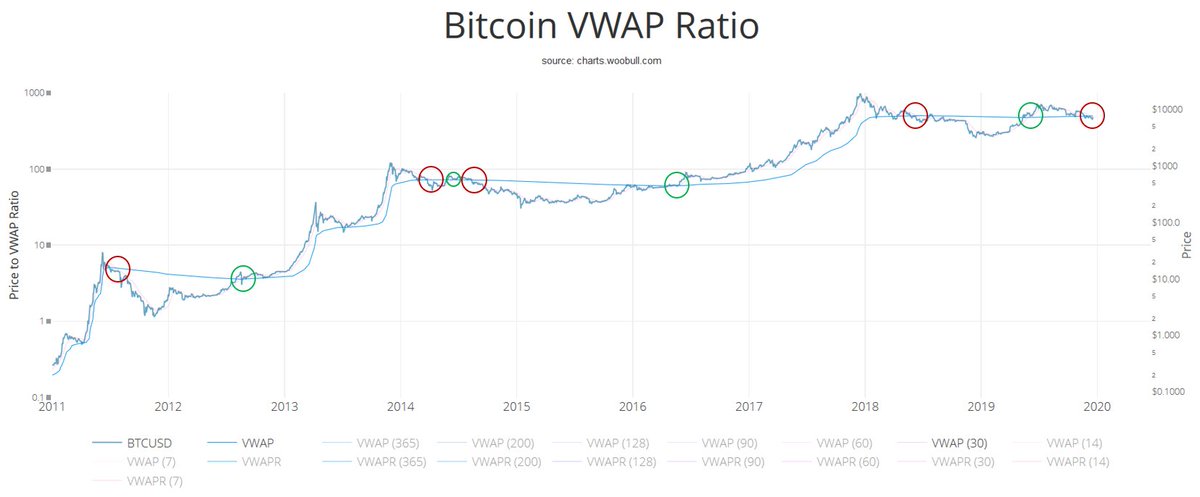

In the past 8 years, whenever the 30D VWAP...

Short-term: Bearish

Medium-Term: Bearish to Neutral

Long-Term: -

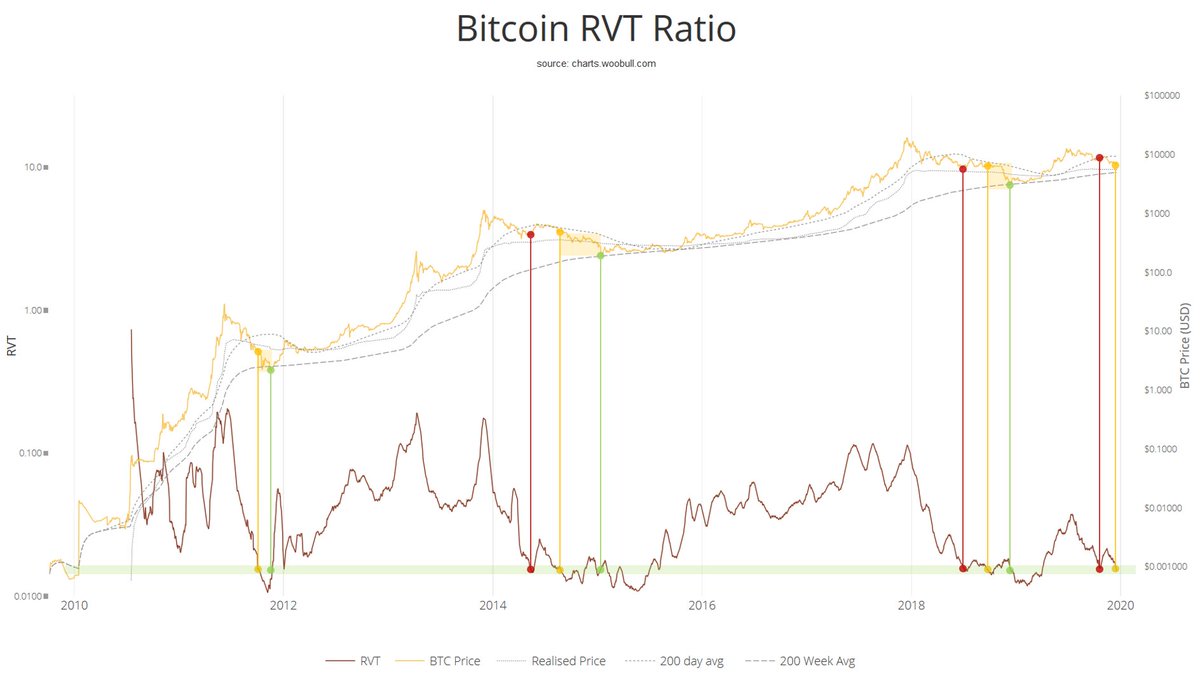

Short-term: Bearish to Neutral

Medium-term: Neutral to Bullish

Long-term: -

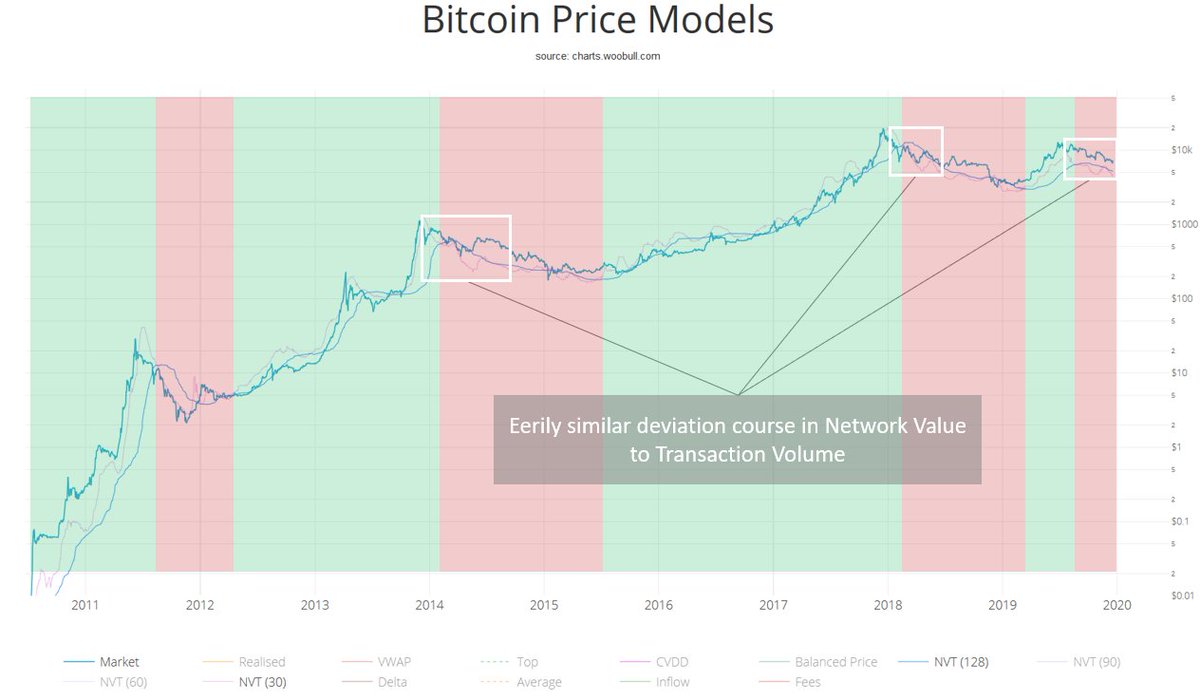

Short-term: -

Mid-term: -

Long-term: Bullish

For fractal lovers: One could infer that the distance between red and orange could be a time indicator for the time distance between orange and green (the bottom). Distance between current red and orange RVT ratio is 1,8 months. This would put a bottom...

Short-term: Bearish

Medium-Term: Bearish to Neutral

Long-term: -

Short-term: Bearish

Medium-term: Bearish

Long-term: -

Short-term: Bearish

Medium-term: Bearish

Long-term: -

Short-term: -

Medium-term: -

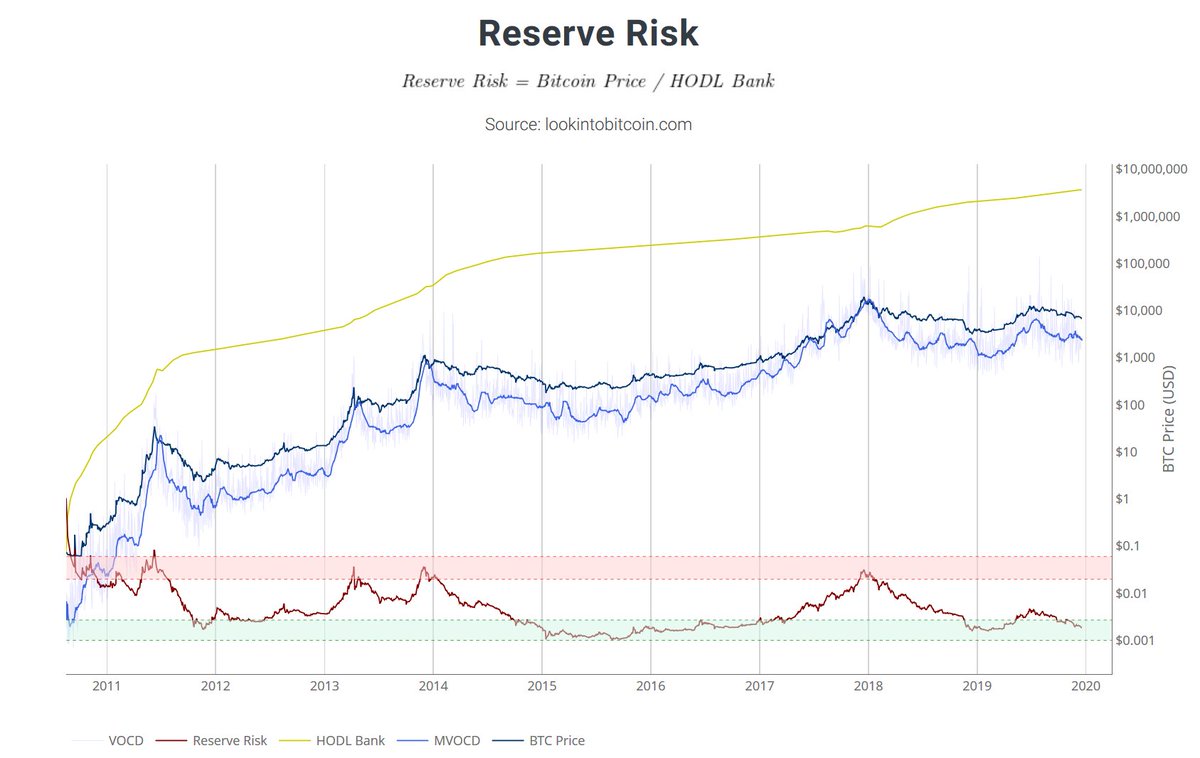

Long-term: Bullish

The model was developed by @100trillionUSD and is probably one of the most famous models in crypto for long-term price projection of Bitcoin today. In very simple terms it describes the relationship between the scarcity of a commodity and the value it...

Short-term: -

Mid-term: -

Long-term: Bullish

First of all, the purpose of this analysis is by no means an exact price prediction as we know that “The inability to predict outliers implies the inability to predict the course of history” (Nassim Nicholas Taleb), meaning no one can..

Now let´s get to the summary:

Short-term Outlook (up to 3 months)

aSOPR: Bearish

VWAP: Bearish

BDR: Bearish to Neutral

RVT Ratio: Bearish

NVT CAPS: Bearish

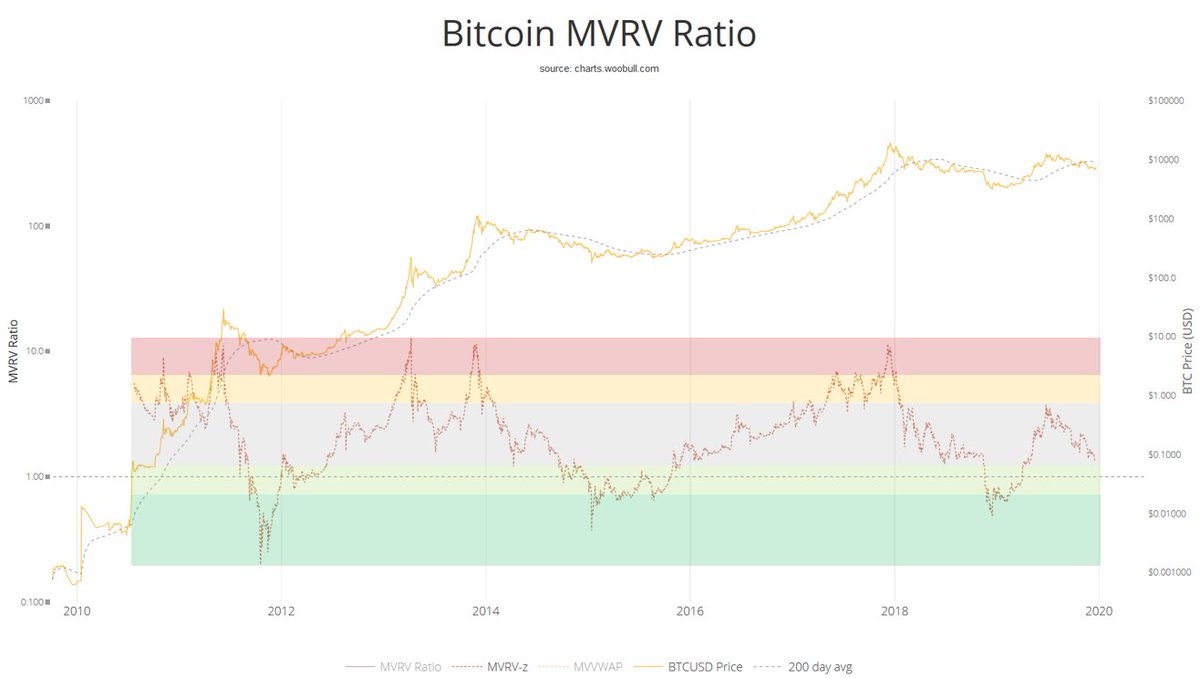

MVRV Ratio: Bearish

Conclusion: Bearish, at least a few more weeks, most likely a few months until bottom

Medium-Term Outlook (up to 6 months)

aSOPR: Bearish

VWAP: Bearish to Neutral

BDAR: Neutral to Bullish

RVT Ratio: Bearish to Neutral

NVT CAPS: Bearish

MVRV Ratio: Bearish

Long-Term Outlook ( > 6 months)

Daily Active Addresses: Bullish

Reserve Risk: Bullish (> 1 year)

Stock-to-Flow Model: Bullish (> 1 year)

Imho, we are likely approaching a market phase in which I personally believe the risk/reward ratio for a...

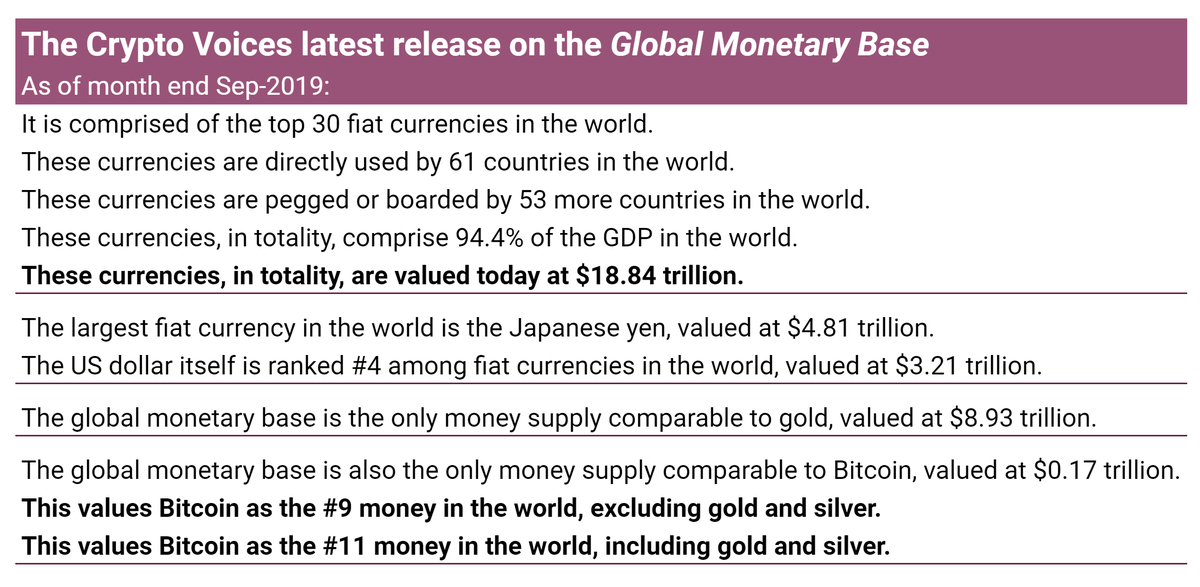

Putting all short-term price movements and craziness in crypto aside, let´s not forget about Satoshi´s...

Merry Xmas to everyone🎄🙏!