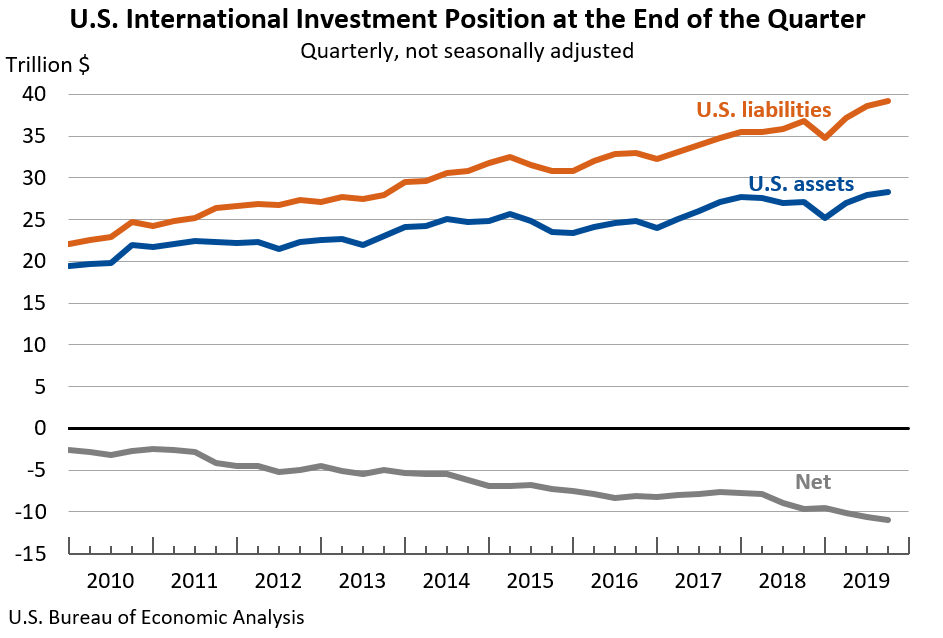

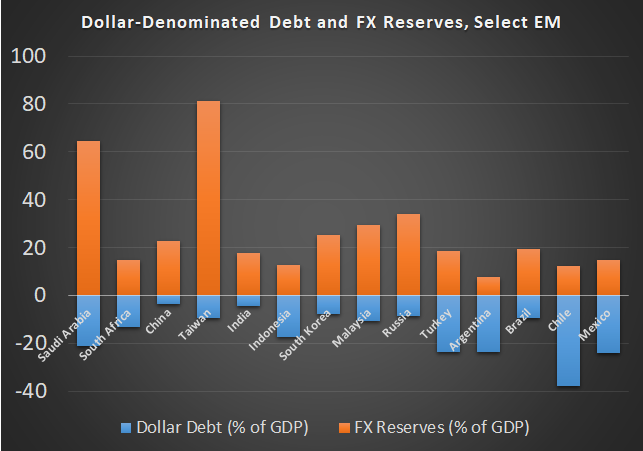

People often ask how dollars can get out of U.S. besides trade. Selling U.S. assets is how. Some of the $39 trillion that foreigners own gross, starting with about $7 trillion in UST.

finance.yahoo.com/news/bank-kore…

The U.S. is the net debtor rather than the net creditor in this scenario. It's our stuff that they would sell.

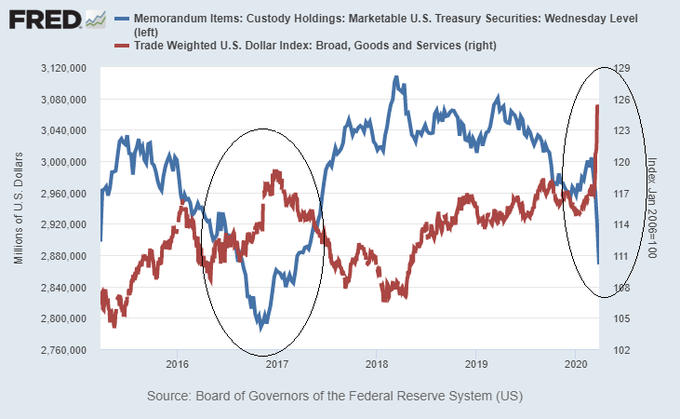

"This facility should help support the smooth functioning of the U.S. Treasury market by providing an alternative temporary source of U.S. dollars other than sales of securities in the open market."

federalreserve.gov/newsevents/pre…