Here’s my reasoning:

1. ‘Avg revenue/user doesn’t stack up’ - As per this news it has 2.4 mill paying customers and a 2019 Revenue of $78 mill (from Wikipedia).

techcrunch.com/2020/05/01/ind…

For ease assume per month registration as straight line = ~3 mill.

And as per news 150% addition in March = 6 mill.

With avg growth at 400% for over 4 years in a row. With schools shuttered the jump should have been 5x min?

Needs a relook.

Clearly shows a large channel + field force led sales approach.

1. Everything has gone digital, even office work is at home

2. Every interaction is online and recorded

3. Even the least techsavvy speaker/teacher is now a producer of digital content by default

(Even I launched WorkLifeTV 😊)

4. Content tsunami is here

6. Subscriptions will get cheaper or be replaced with ad supported models

7. Discretionary & supplementary digital content will be a cognitive overload & shunned

8. Jobs, incomes and spending are all impacted

All of these are headwinds for BYJUs.

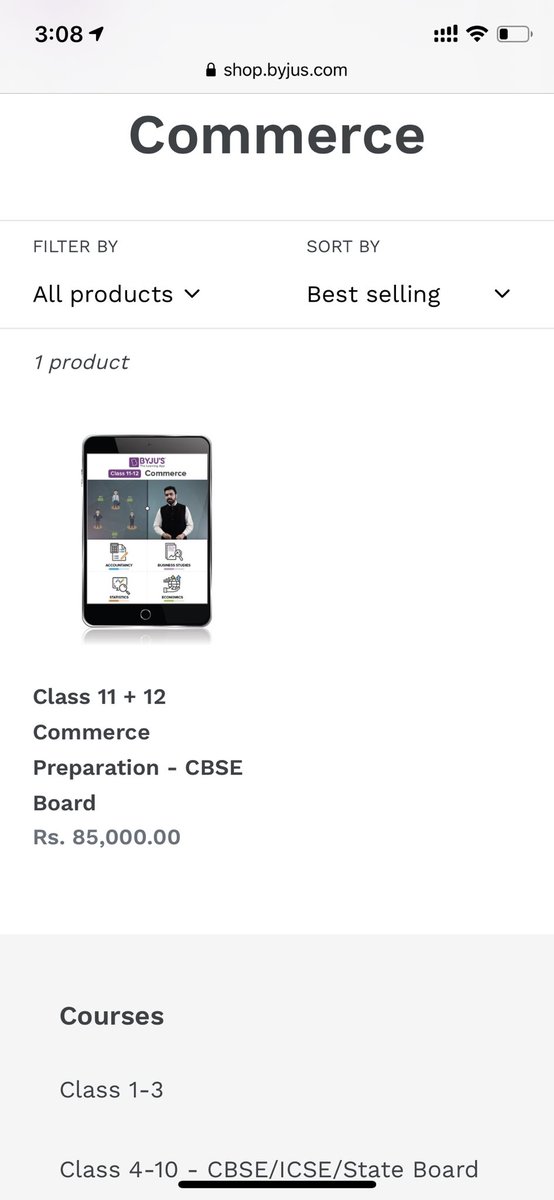

A. BYJUs is a tutor turned Edtech biz offering a substitute to bad teachers in schools

B. Good teachers were confined to the 4walls of good schools or to tution classes - brick & mortar

D. The digital pdt itself is just a format advantage - no new curriculum structures at all

1. The constraints of the 4 walls are gone. Nothing is brick & mortar.

2. Everyone is digital so ‘reach’ advantage is gone

3. There’s hardly a pdt (format)differentiation except quality

1. Zoom calls with students recorded, annotated and converted into explanations (almost zero cost as everything is a sunk cost)

2. Innovators find aggregation opportunities and approach these teachers

I recall @sampad tell me about a tutor in semiurban India who is a superhit.

With all such ‘equilibrium’ the one most impacted is usually the dominant player. In this case BYJUs.

(Pardon any errors)