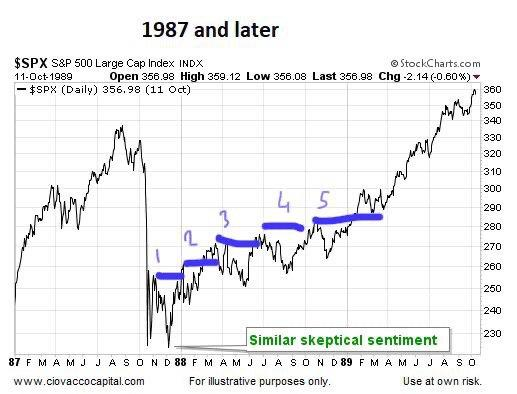

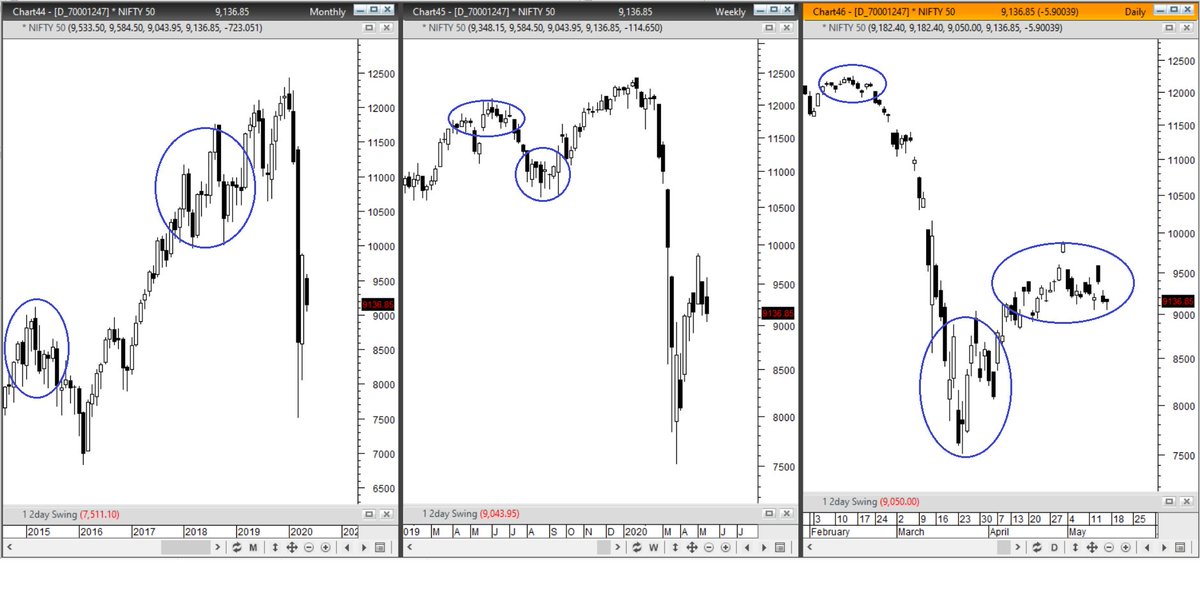

Few observations on #Accumulation pattern in #BHEL

Interesting to see how multiple things add up when price is near inflection point of new breakout. Lets see how it goes.

Interesting to see how multiple things add up when price is near inflection point of new breakout. Lets see how it goes.

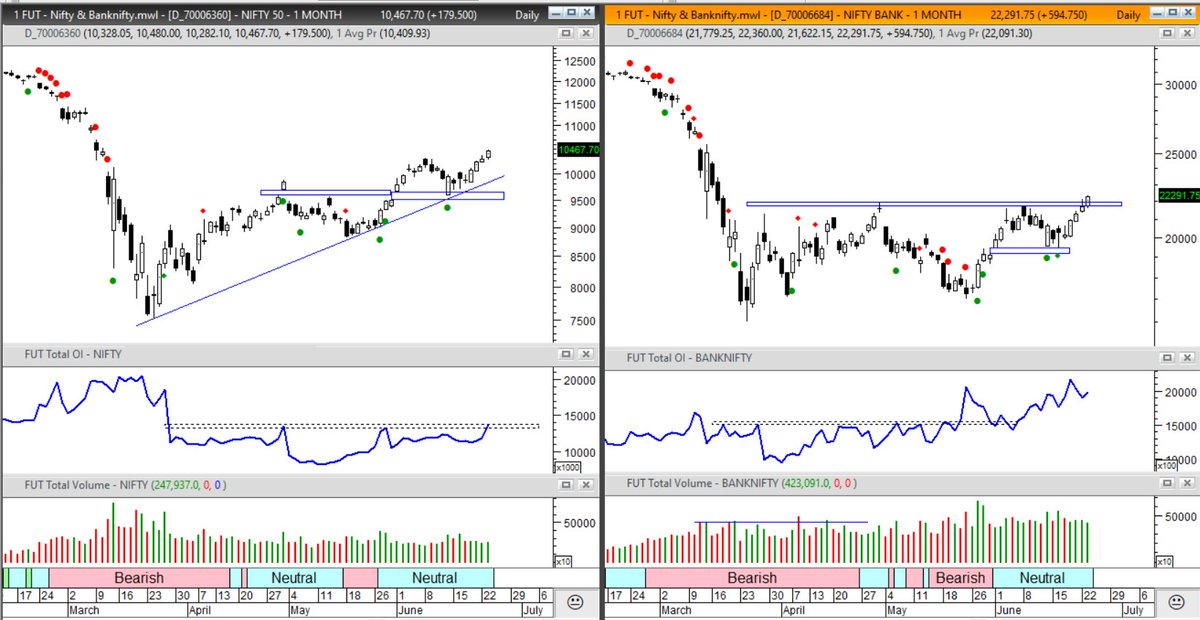

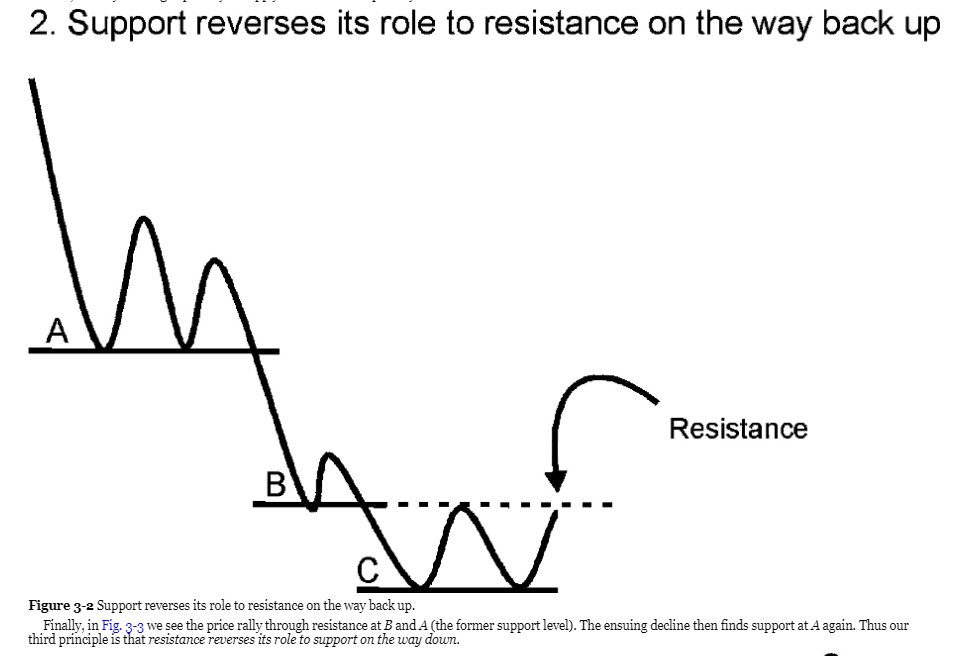

Updated chart of #BHEL .... The current pattern do not look like the one made during Sep-Oct 2019. The current move has much more accumulation signals than before. However, now the negation point is 30 SMA. (in previous upmove stock tested 200 SMA.. that probability is high now)

Updated chart of #BHEL .. stock tests 200 SMA today as highlighted earlier as high probability.

30 SMA was never broken.

#TechnicalAnalysis at work

30 SMA was never broken.

#TechnicalAnalysis at work

• • •

Missing some Tweet in this thread? You can try to

force a refresh