It's complicated, but has implications for the Eurozone's #COVID19 recovery & the EU itself.

What follows is my attempt to help me (& my students) understand what happened

[THREAD]

socialeurope.eu/europe-under-q…

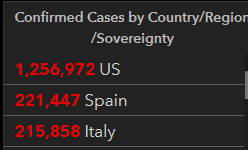

Source: gisanddata.maps.arcgis.com/apps/opsdashbo…

europeaninstitute.org/index.php/ei-b…

socialeurope.eu/corona-bonds-a…

washingtonpost.com/politics/2020/…

duckofminerva.com/2020/04/deja-v…

Without getting into the various acronyms, it's been involved in "quantitative easy" (i.e. pump money by purchasing a wider arrange of financial assets from banks) since 2015

ecb.europa.eu/explainers/sho…

cnbc.com/2020/03/19/ecb…

In a nutshell, the German High Court said that the ECB needed to backoff of "quantitative easing"

politico.eu/article/german…

bloomberg.com/news/articles/…

washingtonpost.com/politics/2020/…

At a broad level, this event illustrates why the euro is simply not ready to be a full competitor to the dollar. The "shared sovereignty" of the eurozone is too fragile of a foundation on which to place a reserve currency

academic.oup.com/isp/article-ab…

bbc.com/news/uk-politi…

Oh, and it also could impact Europe's ability to economically recover from #COVID19, which might be its most important implication.

[END]